Examine Quantity Theory of Money

advertisement

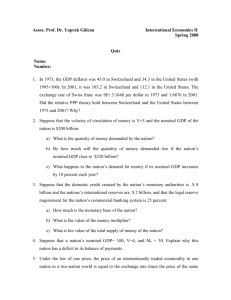

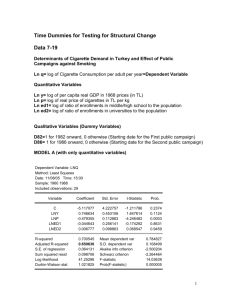

Examine Quantity Theory of Money Structural Change by 1973 Oil Crisis Part A Examining the Quantity Theory of Money Part B Test Whether 1973 Oil Crisis cause a structural change About Quantity Theory of Money The Quantity Theory was first developed by Irving Fisher in the inter-war years as is a basic theoretical explanation for the link between money and the general price level. Roughly speaking, the Quantity Theory try to explain the cause of inflation. The Theory is argue that the inflation is caused by the growth of Money Supply Cause of inflation 1) The Quantity Theory 2) Neo-Keynesian Cost push inflation Demand pull inflation Built-in inflation Methodology Fisher identity or equation of exchange MV = PY M is the money supply V is the velocity of circulation of money P is the general price level Y is the real value of national output (i.e. real GDP) Fisher identity or equation of exchange MV = PY lnM + lnV = lnP + lnY To test the cause of growth of price level (inflation), we yield lnP = lnM + lnV - lnY To simplify our examining, we hold the growth rate of the velocity of circulation of money (V) being constant (β0 ). Thus, we yield the regression like this: lnP = β0 + β1lnM + β2 lnY Sample Country: United States Period: 1959Q1 to 2010Q3 Data: M is M2 P is the GDP Deflator Y is the real GDP Result We run a OLS estimation on the regression: lnP = β0 + β1lnM + β2 lnY The result is: lnP = 2.918171 + 0.893281 lnM - 0.650627 lnY (0.33306 ) (0.028347 ) R-squared = 0.992265 (0.061715 ) RSS = 0.603807 We can conclude that the Quantity Theory of Money significantly explain the cause of inflation Test Whether 1973 Oil Crisis cause a structural change 1973 Oil Crisis lead the GDP growth of US decreased by 4.7% It shows that 1973 Oil Crisis is a serious economic shock for US It is worth to test that whether 1973 Oil Crisis bring a structural change (in term of the effect of the growth of money supply and output to the inflation.) Methodology The Chow test is used to do the test. Separate the whole period to two sub-periods: 1959Q1 to 1973Q3 1973Q4 to 2010Q3 Establish the Hypothesis: H0: No structural change, Var(1)=Var(2) =σ2 H1 :Yes, there is a structural change, Var(1)≠Var(2)≠σ2 • Run OLS on two sub-sample groups separately and obtain the RSS1, and RSS2, (RSS1+RSS2=RSSUR) Run OLS on the whole sample (N) and obtain the restricted RSSR Compute: F* = [(RSSR - RSS1 RSS2)/k+1]/ (RSS1 +RSS2)/N-2k-2 If F* > Fc , k+1, N-2k-2 ==> reject H0 RSSR (Whole Period)= 0.603807 RSS1 (1959Q1 to 1973Q3) = 0.029737 RSS2 (1973Q4 to 2010Q3)= 0.445407 By computation: F*= 18.14275 , where Fc =3.9491 Where α=0.01 Since F*= 18.14275 , Fc =3.9491 F* > Fc , k+1, N-2k-2 ==> reject H0 There is a structural change, Var(1)≠Var(2)≠σ2 We can conclude that the effects of the growth of money supply and output to the inflation have had a structural change after 1973 oil crisis!