Final Exam (0900-1200hr, January 29, 2003)

advertisement

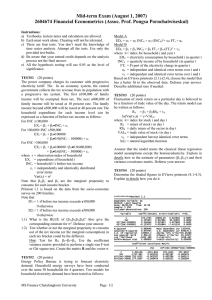

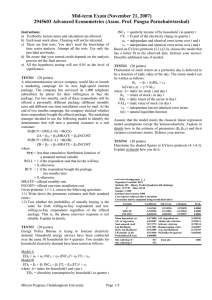

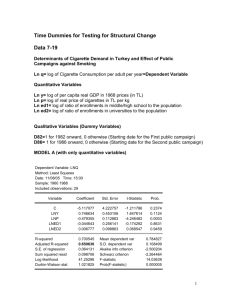

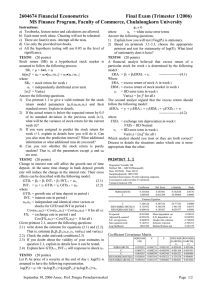

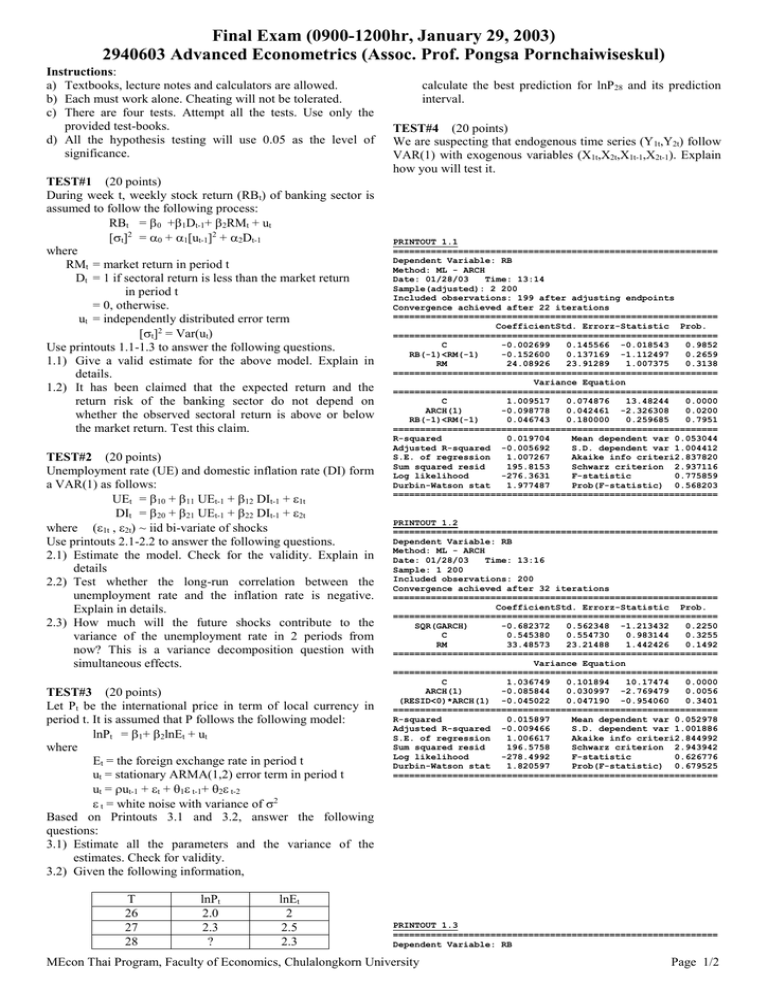

Final Exam (0900-1200hr, January 29, 2003) 2940603 Advanced Econometrics (Assoc. Prof. Pongsa Pornchaiwiseskul) Instructions: a) Textbooks, lecture notes and calculators are allowed. b) Each must work alone. Cheating will not be tolerated. c) There are four tests. Attempt all the tests. Use only the provided test-books. d) All the hypothesis testing will use 0.05 as the level of significance. TEST#1 (20 points) During week t, weekly stock return (RB t) of banking sector is assumed to follow the following process: RBt = 0 +1Dt-1+2RMt + ut [t]2 = 0 + 1[ut-1]2 + 2Dt-1 where RMt = market return in period t Dt = 1 if sectoral return is less than the market return in period t = 0, otherwise. ut = independently distributed error term [t]2 = Var(ut) Use printouts 1.1-1.3 to answer the following questions. 1.1) Give a valid estimate for the above model. Explain in details. 1.2) It has been claimed that the expected return and the return risk of the banking sector do not depend on whether the observed sectoral return is above or below the market return. Test this claim. TEST#2 (20 points) Unemployment rate (UE) and domestic inflation rate (DI) form a VAR(1) as follows: UEt = 10 + 11 UEt-1 + 12 DIt-1 + 1t DIt = 20 + 21 UEt-1 + 22 DIt-1 + 2t where (1t , 2t) ~ iid bi-variate of shocks Use printouts 2.1-2.2 to answer the following questions. 2.1) Estimate the model. Check for the validity. Explain in details 2.2) Test whether the long-run correlation between the unemployment rate and the inflation rate is negative. Explain in details. 2.3) How much will the future shocks contribute to the variance of the unemployment rate in 2 periods from now? This is a variance decomposition question with simultaneous effects. TEST#3 (20 points) Let Pt be the international price in term of local currency in period t. It is assumed that P follows the following model: lnPt = 1+ 2lnEt + ut where Et = the foreign exchange rate in period t ut = stationary ARMA(1,2) error term in period t ut = ut-1 + t + 1 t-1+ 2 t-2 t = white noise with variance of 2 Based on Printouts 3.1 and 3.2, answer the following questions: 3.1) Estimate all the parameters and the variance of the estimates. Check for validity. 3.2) Given the following information, T 26 27 28 lnPt 2.0 2.3 ? lnEt 2 2.5 2.3 calculate the best prediction for lnP28 and its prediction interval. TEST#4 (20 points) We are suspecting that endogenous time series (Y1t,Y2t) follow VAR(1) with exogenous variables (X1t,X2t,X1t-1,X2t-1). Explain how you will test it. PRINTOUT 1.1 ============================================================ Dependent Variable: RB Method: ML - ARCH Date: 01/28/03 Time: 13:14 Sample(adjusted): 2 200 Included observations: 199 after adjusting endpoints Convergence achieved after 22 iterations ============================================================ CoefficientStd. Errorz-Statistic Prob. ============================================================ C -0.002699 0.145566 -0.018543 0.9852 RB(-1)<RM(-1) -0.152600 0.137169 -1.112497 0.2659 RM 24.08926 23.91289 1.007375 0.3138 ============================================================ Variance Equation ============================================================ C 1.009517 0.074876 13.48244 0.0000 ARCH(1) -0.098778 0.042461 -2.326308 0.0200 RB(-1)<RM(-1) 0.046743 0.180000 0.259685 0.7951 ============================================================ R-squared 0.019704 Mean dependent var 0.053044 Adjusted R-squared -0.005692 S.D. dependent var 1.004412 S.E. of regression 1.007267 Akaike info criteri2.837820 Sum squared resid 195.8153 Schwarz criterion 2.937116 Log likelihood -276.3631 F-statistic 0.775859 Durbin-Watson stat 1.977487 Prob(F-statistic) 0.568203 ============================================================ PRINTOUT 1.2 ============================================================ Dependent Variable: RB Method: ML - ARCH Date: 01/28/03 Time: 13:16 Sample: 1 200 Included observations: 200 Convergence achieved after 32 iterations ============================================================ CoefficientStd. Errorz-Statistic Prob. ============================================================ SQR(GARCH) -0.682372 0.562348 -1.213432 0.2250 C 0.545380 0.554730 0.983144 0.3255 RM 33.48573 23.21488 1.442426 0.1492 ============================================================ Variance Equation ============================================================ C 1.036749 0.101894 10.17474 0.0000 ARCH(1) -0.085844 0.030997 -2.769479 0.0056 (RESID<0)*ARCH(1) -0.045022 0.047190 -0.954060 0.3401 ============================================================ R-squared 0.015897 Mean dependent var 0.052978 Adjusted R-squared -0.009466 S.D. dependent var 1.001886 S.E. of regression 1.006617 Akaike info criteri2.844992 Sum squared resid 196.5758 Schwarz criterion 2.943942 Log likelihood -278.4992 F-statistic 0.626776 Durbin-Watson stat 1.820597 Prob(F-statistic) 0.679525 ============================================================ PRINTOUT 1.3 ============================================================ Dependent Variable: RB MEcon Thai Program, Faculty of Economics, Chulalongkorn University Page 1/2 Final Exam (0900-1200hr, January 29, 2003) 2940603 Advanced Econometrics (Assoc. Prof. Pongsa Pornchaiwiseskul) Method: ML - ARCH Date: 01/29/03 Time: 13:16 Sample: 1 200 Included observations: 200 Convergence achieved after 26 iterations ============================================================ CoefficientStd. Errorz-Statistic Prob. ============================================================ C -0.033348 0.138380 -0.240988 0.8096 RM 22.53198 23.51115 0.958353 0.3379 ============================================================ Variance Equation ============================================================ C 1.037565 0.102964 10.07699 0.0000 ARCH(1) -0.098655 0.010456 -9.435508 0.0000 ============================================================ R-squared 0.007892 Mean dependent var 0.052978 Adjusted R-squared -0.007293 S.D. dependent var 1.001886 S.E. of regression 1.005533 Akaike info criteri2.839077 Sum squared resid 198.1748 Schwarz criterion 2.905044 Log likelihood -279.9077 F-statistic 0.519739 Durbin-Watson stat 1.861711 Prob(F-statistic) 0.669179 ============================================================ Lags interval: 1 to 1 ============================================================ Likelihood 5 Percent 1 Percent Hypothesized Eigenvalue Ratio Critical ValuCritical ValuNo. of CE(s) ============================================================ 0.389833 34.99342 15.41 20.04 None 0.103549 6.340073 3.76 6.65 At most 1 ============================================================ *(**) denotes rejection of the hypothesis at 5%(1%) significance level Unnormalized Cointegrating Coefficients: ============================================================ UE DI 0.075458 0.138147 0.090885 -0.039561 ============================================================ PRINTOUT 2.1 Vector Autoregression Estimates ======================================== Date: 01/28/03 Time: 13:22 Sample(adjusted): 2 60 Included observations: 59 after adjusting endpoints Standard errors & t-statistics in parentheses ======================================== UE DI ======================================== UE(-1) 0.484077 -0.186778 (0.10345) (0.08903) (4.67931) (-2.09803) Log likelihood-165.0593 ============================================================ DI(-1) -0.312070 (0.10708) (-2.91425) 0.335431 (0.09215) (3.63996) C 0.542541 0.227590 (0.18083) (0.15561) (3.00031) (1.46253) ======================================== R-squared 0.382675 0.263981 Adj. R-squared 0.360627 0.237694 Sum sq. resids 67.11876 49.70590 S.E. equation 1.094783 0.942128 F-statistic 17.35697 10.04248 Log likelihood -87.52069 -78.66066 Akaike AIC 3.068498 2.768158 Schwarz SC 3.174136 2.873796 Mean dependent 0.973097 0.106559 S.D. dependent 1.369150 1.079059 ======================================== Determinant Residual Covaria 0.950494 Log Likelihood -165.9369 Akaike Information Criteria 5.828370 Schwarz Criteria 6.039645 ======================================== Normalized Cointegrating Coefficients: 1 Cointegrating Equation(s) ============================================================ UE DI C 1.000000 1.830790 -1.172253 (0.44837) PRINTOUT 3.1 ============================================================ Dependent Variable: LOG(P) Method: Least Squares Date: 01/28/03 Time: 13:39 Sample(adjusted): 2 27 Included observations: 26 after adjusting endpoints Convergence achieved after 19 iterations Backcast: 0 1 ============================================================ Variable CoefficientStd. Errort-Statistic Prob. ============================================================ C 0.556897 0.167547 3.323828 0.0032 LOG(E) -0.404976 0.073326 -5.522935 0.0000 AR(1) 0.578664 0.301539 1.919035 0.0687 MA(1) -0.977222 0.497775 -1.963178 0.0630 MA(2) -0.011509 0.362611 -0.031740 0.9750 ============================================================ R-squared 0.637016 Mean dependent var 0.423882 Adjusted R-squared 0.567876 S.D. dependent var 0.283021 S.E. of regression 0.186047 Akaike info criter-0.354592 Sum squared resid 0.726884 Schwarz criterion -0.112650 Log likelihood 9.609693 F-statistic 9.213453 Durbin-Watson stat 2.015074 Prob(F-statistic) 0.000184 ============================================================ Inverted AR Roots .58 Inverted MA Roots .99 -.01 ============================================================ PRINTOUT 3.2 Coefficient Covariance Matrix ============================================================ C LOG(E) AR(1) MA(1) MA(2) ============================================================ C 0.028072 -3.90E-05 0.030094 -0.064432 0.033179 LOG(E) -3.90E-05 0.005377 -0.000615 -0.005995 0.003812 AR(1) 0.030094 -0.000615 0.090926 -0.134770 0.099009 MA(1) -0.064432 -0.005995 -0.134770 0.247780 -0.171672 MA(2) 0.033179 0.003812 0.099009 -0.171672 0.131487 ============================================================ End of Exam PRINTOUT 2.2 Johansen Cointegration Test ============================================================ Date: 01/28/03 Time: 13:28 Sample: 1 60 Included observations: 58 Test assumption: Linear deterministic trend in the data Series: UE DI MEcon Thai Program, Faculty of Economics, Chulalongkorn University Page 2/2