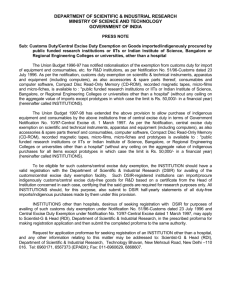

FOR CLAIMING CUSTOMS DUTY EXEMPTION ON EQUIPMENT/SPARE PARTS/ACCESSORORES.

advertisement

FOR CLAIMING CUSTOMS DUTY EXEMPTION ON EQUIPMENT/SPARE PARTS/ACCESSORORES.

CONSUMABLES IMPORTED FOR RESEARCH PURPOSES IN TERMS OF GOVERNMENT NOTIFICATION

NO.10/97 OF CENTRAL EXCISE DATED 01.03.1997 AS AMENDED FROM TIME TO TIME.

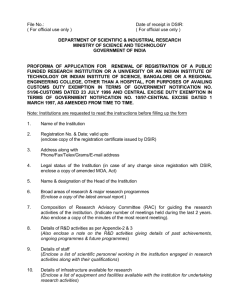

Application No:

Date:

PART A

1.

a. Name of the college with complete

address

b. Is the college affiliated to the

University

If “Yes” enclose copy of letter

:

:

c. Is the college recognised as Ph.D

;

level research Centre in sciences of for

PG level courses in Engineering, Computer

Science

If “yes” give details

2. Brief description of the items along with details of accessories, spare parts,consumables etc being

Imported. Enclose duly authenticated copy of proforma invoice and technical data

Sheets/catalogues/leaflets:

3. Details of approval of the project by the college

a. Date of screening by college’s own purchase :

committee:

b. Date of sanction by competent authority :

c. Total assistance sanctioned

d. Approval expenditure on equipment,

accessories,spare parts and consumables:

4.

a. Scientific Research subjects dealt with :

b. Title of Research project for which the items will be used during the next 2 to 3 years.(attach separate

sheets giving brief details of the scope & duration of the programme and the expected benefits. Also state if

the project is approved by the research Advisory Committee of the college alsong with details thereof.

c. End-use of the items in undertaking the research work, to establish relevance and essentially of the item

to the project :

d. Total value of cumulative imports for the projects so far:

5. Whether the project has been reviewed :

By the Research Advisory Council.

If so, date on which it was reviewed

(Submit an extract of the minutes of the

Meeting of the council)

6. Name & complete address of the manufacturer/supplier and details of purchase order placed

7. a. cost of the items in Indian rupees:

b. Probable date of receipt of items:

Certified that the import of the equipment/accessories/Spare parts/Consumables as stated in clause 2

above is essential for the research programme concerned and that they will be used for such purpose only.

Signature & seal of the Director

Separate application should be

Filed for (a) equipment,(b) Spare Parts

And accessories and (c) Consumables:

PART B

Name of the Universality:

Address

:

Name of the Registrar

:

No.-------------------------Date-------------------------

Certified that:

a. The University is registered with department of Scientific & Industrial Research (DSIR) In

Terms of govt. Notification No.10/97-central excise dated 01.03.1997 (copy of the certificate

Is enclosed herewith).

b. The College__________________________________________ is affiliated to the university.

c. Certified that the import os the equipment/accessories/spare parts/consumables as stated in

Clause 2 above is essential for the research programme concerned and that they will be used for

such purpose only.

Signature of the Registrar with seal

List of documents Requirement from College for avail exeption

Certificate of Custom/Excies

1) Application in for A&B

2) Letter of Affiliation to University

3) Letter of Course grant and from approval AICTE/MCI/DTE and other apex agencies as

Relevant.

4) Letter notifying the college as Research Centre for Ph.D or at least of

M.Tech/M.Sc/M.Pharm/PG course

5) Letter of Undertaking that the instruments will be uliized for teaching/Research only and not for

trainging-no dual purpose as per the guidelines.

A) Education/Trainging-Invalid

B) Research/Trainging-Invalid

C) Education/Research-Valid

6) Letter of Undertaking Showing the availability of the said equipment with location not to be

mobilized elsewhere.

7) Letter of Undertaking not to sale out prior permission of University.

8) Six/Three monthly report of its very exixence in the same deptt., accessible to inspect by the

officials of Excise & Customs and University’s administration.

9) Letter of constitution of Research Academic Council for the College and its approval to such

programme proposals and requirement of the equipment.

10) Purchase order copy.

11) Lknj

dsysys loZ nLrk,sot lk{kakfdr dsysys vlkos rlsp loZ dkxni=s 10 izrhr lknj

dsysyh vlkoh

GOVERNMENT OF INDIA

MINISTRY OF SCIENCE & TECHNONOGY

Dept. Of science * Industrial Research

Technology Bhawan, New Mehrauli Road,

NEW DELHI – 110016

Telegram: SCIENCETEH

Telephone: 667373,662135 (PABX)

Fax: 6960629,661682,6863847

6862418

No.TU/V/RG-CDE/96

Date 28th October, 1998

To,

The vice-Chancellor,

Nagpur University,

Near Maharajbagh

Nagpur (Maharashtra)

Dear Sir,

As you are aware the Govt. Of India has been giving several fiscal incentives for scientific and

industrial research. One such incentive is exemption from customs and central excise duty for equipment,

accessories,spare parts and consumables needed for research purposes only by the following

organizations:

a) Public funded research institutions or a university or an Indian Institute of technology or Indian

Institute of Science, Bangalore or a Regional Engineering college other than a hospital.

b) Non-commercial research institutions other than a hospital

2. The customs and excise duty exemption has been extended vide notification No.51/96 Customs and

10/97-central Excise respectively, a copy each of which is enclosed for your reference.

3. While DSIR has been issuing certificates to essentiality of the equipment, spares. Accessories,

consumables needed for research by non-commercial research institutions on case to case basis, the

Public funded research institution or a University or an Indian Institute of technology or Indian Institute of

Science, Bangalore or a Regional Engineering College listed at (a) above have been given registration by

DSIR, which empowers the head of intuitions to issue essentiality certificate to obtain Customs Duty/Excise

Duty exemption on equipment, spare, accessories, consumable needed for research purposes only.

4. The notification has defined the tern ”University” for the purpose of customs and excise exemption

on equipment, spare, accessories, consumable needed for research purposes. This definition reads as

follows:

“(b) University means a university established or incorporated by or under a Central, State or Provincial Act

and included(i)

(ii)

(iii)

An institution declared under section 3 of the University Grants Commission Act, 1956 (3 of 1956)

to be a deemed university for the purposes of that Act.

An institution declared by Parliament by law to be an institution of national importance

A college maintained by or affiliated to, a University”

5. DSIR has registered a number of universities under the provisions of the above Notification, which

empowers the registrars of universities to issue essentiality, certificates. Similarly Govt. Owned colleges or

colleges which are fully funded by the central/state Govt. And which are having recognition from university

for research at Ph.D. level or at PH level at Engineering, Medicine or Computer Science, Post doctoral

research by faculty/scholars, or colleges undertaking research sponsored by industry/government or other

organization have also been registered by DSIR, which empower the Principal or Director to issue the

essentiality certificate for equipment,spares,accessories,consumables needed for research purposes.

There is no change in the procedure for universities and Govt. owned colleges.

6. As regards privately funded/managed colleges which are affiliated,it has Been decided with the

approval of Hon’ble Minister (HRD and S&T) that universities to which these colleges are affiliated will

issue essentiality certificates on case to case basis (for each item) to these colleges for

equipment,spares,accessories,consumables excusively required for research proposes only provided:

The colleges are recongnised as Ph.D level research centre in natural,applied and /or social

sciences or for PG level courses in agricultural sciences,engineering and/or computer science by

universities to which they are affiliated.

The colleges have research/academic council of their own to screen and review the research

programmes or their research programmes are screened by the universities.

7. Medical colleges are not eligible for issuance of the essentiality vertificates by universities for

customs/excise dulty exemption under above mentioned notification.

8. DSIR has prepared a set of guidelines for registrar of the Universities for purposes of issuing essentiality

certificates to the affiliated private colleges (on case to case basis for each item of imports of indigenous

purchases) for equipment,spares,accessories,consumables for exclusively needed for research purposes.

The guidelines are enclosed herewith for your kind retention and compliance.

9. Henceforth,the privately funded/managed colleges will not be given registration by DSIR and if any

college holds such registration it, ceases to be valid beyond 31-08-1998.

10. The Universities,while submitting the half-yearly returns of imports/indigenous purchases to DSIR

should include the details of duty free imports/indigenous purchases availed by the private colleges for

which essentility certificates have neen issued by the University.

This issue with the approval of Hon’ble Minister (HRD and S&T).

Yours faithfully

Sd/(JAGDISH SINGH)

Joint Advisor

Copy to:-

All Colleges registered with DSIR in terms of Notification No.51/96-Customs and 10/97-Central

Excise

All Collectors of Customs and Collectors of Central Excise

DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH

SUBJECT: Guidelines for issuance of essentiality certificate to colleges for availing customs duty

exemption in terms of Government Notification No.51/96-Customs dated 23-07096 and Central

excise duty exemption in terms of Government Notification No.10/97-Central

Excise dated 01-03097

As per the above notification a Public Funded Research Institution or a University or an Indian

Institute of Technology or Indian Institute of Science, Bangalore or a Regional Engineering College other

than a hospital are required to obtain registration from DSIR for purposes of availing customs duty

exemption on imports and central excise duty exemption on domestic purchases of

equipment/consumables needed for research purposes. Copies of notifications are enclosed herewith.

2. The definition of the University in the above notification is as follows:

“University means a University established or incorporated by or under a central,state or provincial Act and

includesI)

An institution declared under section 3 of the University Grants Commission Act,1953(3 of

1956) to be a University for the purposes of that Act.

II)

An institution declared by Parliament by law to be an institution of national importance.

III)

A college maintained by, or affiliated to ,a University”

3. Privately funded/managed colleges shall be eligible for issuance of essentiality certificates for

customs/Central excise duty exemption on equipment ,accessories, spare parts and consumables needed

exclusively for research, if these colleges satisfy the following criteria:

The college which is being issued the essentiality certificate by the university should be affiliated to

the University.

The college should be recognized as Ph.D level research centre in natural/applied/social science

or for PG level courses in engineering, computer science, agricultural science by universities to

which it is affiliated.

The college should have a research/academic council of its own to screen and approve the

research programmes and /or the research programs should be screened and approved by the

University.

4. The equipment, accessories, spare parts and consumables for which customs and central Excise duty

exemption is sought should be exclusively meant for research purposes only. The equipment required for

education/training or dual use such as research and training are not eligible.

5. Medical colleges are not eligible for issuance of the essentiality certificates b universities for

customs/excise duty exemption under above mentioned notifications.

6. The application for Essentiality certificates for itme needed exclusively for research should be submitted

in the enclosed proforma and the essentiality certificate should be signed by the Registrar of the university

concerned, in Part B of the application.

7. The University should constitute a multidisciplinary committee of Academicians/ Professors,which will

meet periodically and consider all application for customs and central excise duty exemption for items

needed exclusively for research along with the research programs and will submit its recommendations to

the Registrar of the university. The committee may have members form faculty of the

University,Govt.owned colleges,eminent scientists from other Univeristy, National laboratories etc.

8. The University should maintain record of cumulative imports/indigenous purchases by each private

college and whils submitting half yearly returns to DSIR, the details or imports/indigenous purchases by

each college based on the essentiality certificate issued by university should be given

****************

CUSTOMS & EXCISE NOTIFICATION

NOTIFICATION

New Delhi,dated the 23rd July,1996

1 Shravana,1918 (Saka)

No.51/96-CUSTOMS

G.S.R. (E) – In exercise of the powers conferred by sub-section 25 of the Customs Act, 1962 (52 of

1962), the Central Government, being satisfied that it is necessary in the public interest so to do,

hereby, exempts goods falling within the Frist Schedule to the Customs Tariff Act 1975 (51 of

1975) and specified in column (3) of the table hereto annexed,from the whole of the duty of

customs leviable thereon which is specified in the said first Schedule and from the whole of the

additional duty leviable thereon lunder section 3 of the said Customs Tariff Act, when imported into

India, by imjporters specified in column (2) of the said table, sujet ot the conditions specified in the

corresponding entry in column (4) of the said Table.

2. This notification shall come into force with effect from the 1 st day of September, 1996.

TABLE

S.No.

(1)

1.

Name of the importer

(2)

Description of goods

(3)

Public funded research institution (a) Scientific and technical

university or an Indian Inst. Instruments,apparatus,equipment

Of technology or Indian Institute (including computer)

Of Science,Bangalore or a Regional

Engineering College,other than

(b) accessories,spare parts and

a hospital

consumables thereof,

(c) Computer software,compact

Disc-Read only Memory (CD-ROM)

Recorded magnetic tapes,

Microfilms, microfiches.

2. Non-commercial research

Institutions,other than a

Hospital

(a) scientific and technical

instruments,apparatus,equipment

(including computer);

(b) accessories,spare parts and

Consumables thereof,

(c) computer software,compact

Disk-Read (CD-Rom), recorded

Magnetic tapes,microfilms,

Microfiches

Conditions

(4)

If, the importer-(i) it Or a

registered with the Govt

of Indian in the Dept of

Scientific & Industrial

Research.

(ii) produces,at the time of

importation,a certificate from

the Head of the institution in

Each case certifying that the

Said goods are required for

Research purposed only.

(i) The importer is

registered with the Govt.of

India in the Dept. of

Scientific and Industrial

Research.

(ii) an officer not below the rank

of a Deputy Secretary to the

Govt.of India in the said Dept.

certified,in each case that the

Importer is not engaged in any

Commercial activity and that

The said goods are required for

Research purpose only

(iii) the goods are covered by a

Pass –Book issued by the said

Department

(iv) the aggregate C.I.F.value

Of imports under this

Exemption does not exceed

Rupees two crores in the case

Of consumables and rupees

Five crores in other cases,in

a financial year

Explanation: For the purposes of this notification, the expression

(a) “Public funded research institution” means a research institution in the case of which not less

than fifty per cent of the recurring expenditure is met by the central government of any State or

the administration of any Union territory.

(b) “University” means a university established or incorportated by or under a Central,State of

provincial Act and includes(i)

(ii)

(iii)

An institution declared under sectopm 3 of the University Grants commission Act,.1956 (3

of 1956) to be a university for the purposes of that Act;

An institution declared by Parliament by law to be a institution of national importance;

A college maintained by, or affiliated to, a University;

(c) “Head” means –

I)

In relation to an institution, the director thereof (by whatever name called);

II)

In relation to a University, the Registrar thereof (by whatever name called);

III)

In relation to a college, the Principal thereof (by whatever name called);

(d) “Hospital” includes any Institution, Centre, Trust,Society,Assiociation,Laboratory,clinic or

Maternity Home which renders medical,surgical or diagnostic treatment.

(RAJIV TALWAR)

UNDER SECRETARY TO THE GOVERNMENT OF INDIA

NOTIFICATION

New Delhi,the 1st March,1997

10 Phalguna, 1918 (Saka)

No.10/97 – CENTRAL EXCISE

G.S.R. (E) – In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise Act,

1944 (1 of 1944), the Central Government, being satisfied that it isnecessary in the public interest so to do,

hereby exempts goods specified in column (3) of the Table below and falling under the Schedule to the

Central Excise Tariff act, 1985, (5 of 1986) from the whole of the duty of excise leviable thereon which is

specified in the said Schedule,when supplied to the institutions specified in the corresponding entry in

column (2) of the said Table, subject to the conditions specified in the corresponding entry in column (4) of

the said Table.

TABLE

S.No. Name of the Institution

Description of the goods

Conditions

---------------------------------------------------------------------------------------------------------------------------------------------(1)

(2)

(3)

(4)

(1)

Public funded research

Institution or a University

Or an Indian Institute of

Technology or Indian

Institution of Science

Bangalore or a Regional

Engineering college,

Other than hospital.

(a) scientific and technical

instruments,apparatus,equipment

(including computers);

(b) accessories and spare parts of

goods specified in (a) above and

consumables;

(c) computer software,Compact

Disc-Read only Memory

(CD-ROM), recorded magnetic

Tapes,microfilms,microfiches;

(d)Prototypes

(i) If the institution(a) is a public funded research

institution under the administrative

control of the Dept. of Space or

Dept of Atomic Energy or the

Defence Research Development

Organization of the Govt of India

and produces a certificate to that

effect form an officer not below

the rank of a Deputy Secretary to

The Govt of India in the concerned

Dept to the manufacturer at the

Time of clearance of the specified

goods; or

(b) is registered with the Govt. of

India in the Dept. of Scientific &

Industrial Research and the

Manufacturer produces at the time

of clearance, a certificate from the

Head of the institution in each case

Certifying that the said goods are

required for research purposes only

(ii) The aggregate value of

prototypes does not exceed fifty

thousand rupees.

(2) Non- commercial

Research institutions,

Other than a hospital

(a) Scientific and Technical

instruments,apparatus,equipment

(including computers);

(i) the institution is registered

with the Govt of India in the Dept.

of Scientific & Industrial Research

(b) accessories and spare parts

There of and comsumables;

(c) computer software, Compac

Disc-read only Memory

(CD-ROM),recorded magnetic

Tapes,microfilm,microfiches;

(i) an officer not below the rank of

a Deputy Secretary to the Govt of

India in the said Dept certifies in

each case that the institution is not

engaged in any commercial activity

and that the said goods are required

For research purposes only;

(d)Prototyes.

(iii) the goods are covered by a passBook issued by the said Dept.

(iv) the aggredate value of goods

Received under this exemption by

An institution does not exceed

rupees two crores in the case of

consumables. Rupees fifty thousand

in the case of prototypes and rupees

five crores in other cases,in a financial

year.

Explanation:- For the purpose of this notification, the expression(a) “ Public funded research institution” means a research institution in the case of which not less than

fifty percent of the recurring expenditure is met by the Central Government or the Government of

any State or the administration of any Union territory;

(b) “University” means a university establish or incorporated by or under a Central, State or Provincial

Act and includesi)

ii)

iii)

An institution declared under section 3 of the University Grants Commission Act, 1956 (3

of 1956) to be deemed university for the purposes of that Act;

An institution decleared by Parliament by law to be an institution of national importance;

A college maintained by, or affiliated to, a University;

(c) “Head” meansi)

In relation to an institution, the Director thereof (by whatever name called);

ii)

In relation to a University, the Registrar thereof (by whatever name called);

iii)

In relation a college, the Principal thereof (by whatever name called);

(d) “Hospital” includes any Institution, Centre, Trust, Society, Association, Laboratory, Clinic or

Maternity Home which renders medical,surgival or diagnostic treatment.

(NAVNEET GOEL)

UNDER SECRETARY TO THE GOVERNMENT OF INDIA