Problem Set 1 - the University of California, Davis

advertisement

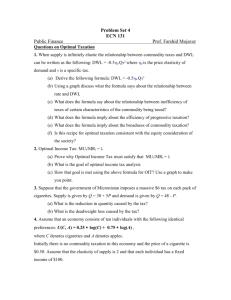

Problem Set 5 Solution ECN 131 Public Finance Prof. Farshid Mojaver Questions on Optimal taxation (Ch20) 1. When supply is infinitely elastic the relationship between commodity taxes and DWL can be written as the following: DWL = -0.5d Q2 where d is the price elasticity of demand and is a specific tax. (a) Derive the above-mentioned formula for DWL. (b) What does the formula says about the relationship between tax rate t and DWL. Use a graph to make your point. (c) What does the formula say about the relationship between inefficiency of taxes and the characteristics of the commodity being taxed? (d) What does the formula imply about the efficiency of progressive taxation? (e) What does the formula imply about the broadness of commodity taxation? (f) To avoid inefficiency and reduce DWL what kinds of goods should be taxed most and what is the implication of that policy on equity? Ans) a. See the appendix (Chap.20) in the text book. b. The formula illustrates that DWL increase exponentially with tax rate. P P P DWL S t P P DWL Or D Q t c. The magnitude of DWL is directly related to the demand elasticity of the commodity in q uestion. The higher the elasticity the higher the DWL. d. The formula implies that progressive taxation is not efficient. e. Since DWL increases exponentially with tax rate for given revenue target it is better to ha ve low tax rates on many goods than very high taxes on a few. f. The formula implies that commodities with low demand elasticities should be taxed most. But some of these good might be necessity goods consumed by low-income families. Su ch policy would be inconsistent with equity considerations. 2. Optimal Income Tax: MUi/MRi = (a) Prove why Optimal Income Tax must satisfy that MUi/MRi = (b) What is the goal of optimal income tax analysis (c) How that goal is met using the above formula for OIT? Use a graph to make you point. Ans) a. See the appendix (Chap.20) in the text book. b. Here the goal is to maximize social well being (measured by a social welfare function) subject to a revenue target. This goal implicitly reconciles both efficiency and equity concerns of the society. c. The OIT rule implies different tax rates for different groups. The groups might differ in their income and the elasticity of their labor supply. This implies progressive taxation (for MU/MR to be equal across the rich and the poor tax rate on the rich must be higher). MUi MU/MR MUi Poor MUi Rich MUMU/MRpoor = MU/MRRich MU P R MUiTax Rate 3. Suppose that the government of Micronistan imposes a massive $6 tax on each pack of cigarettes. Supply is given by Q = 30 + 5P and demand is given by Q = 48 - P. (a) What is the reduction in quantity caused by the tax? (b) What is the deadweight loss caused by the tax? Ans) a. 5 packs (Note that whether tax is levied on consumer or producer does not matter to the solution i n this question) From 30+5P=48-P, P*=3 & Q*=45 (before tax equilibrium) From 30+5(Pc-6)=48-Pc, Pc**=8 (Ps**=2) & Q**=40 (after tax equilibrium) b. $15 because 1/2*6*5=15 4. Assume that an economy consists of ten individuals with the following identical preferences: U(C, A) = .25 log(C) + .75 log(A), where C denotes cigarettes and A denotes apples. Initially there is no commodity taxation in this economy and the price of a cigarette is $0.50. Assume that the elasticity of supply is 2 and that each individual has a fixed income of $100. a. The government, having decided that it wants to discourage smoking, institutes a $0.50 per-unit tax on cigarettes. (i) What is the deadweight loss (DWL) resulting from this tax? (ii) What is the ratio of the DWL to revenue? (iii) What is the ratio of marginal DWL to marginal revenue? Calculating deadweight loss for this problem requires you to determine the optimal quantity demanded before the tax and the price elasticity of demand. The utility function can be written as U = C0.25A0.75, a standard Cobb-Douglas form. Quantity demanded (For this utility function) Q d = .25M/P (the exponent on the commodity income)/the price of the commodity) Pre-tax Q Q d = (0.25 100)/0.5 = 50 (per person), or 500 for the whole economy. Now we need to solve for price elasticity of demand. Here the difficulty is that the formulas in the textbook are defined for Hicksian elasticity of demand. The relation between the Marshalian price elasticity and Hiksian elasticity of good X is given in the following Slutsky equation: DX Marshallian = DX Hicksian - Income Share of Income Spent on X Or DX Hicksian = DX Marshallian + Income Share of Income Spent on X In Cobb-Douglas utility functions Price elasticity of demand DX Marshallian Income elasticity of demand Income = = dQ/dp*p/Q = (-.25/p2)p/[.25M/p]= –1 dQ/dM*M/Q =.25/P * M/(.25M/P) = 1 Share of Income Spent on X = p*X/M = p*[.25M/p]/M = .25 So DX Hicksian = - + * 0.25 = -0.75 (i) The text gives the formula for deadweight loss as DWL = – (1/2)sd sd) Q/P d = -0.075 s = 2 sd sd) = 0.078 DWL = -(1/2)*( 0.078)*(.5) *50*10/.5= -9.75 (ii) DWL/TR = ? DWL= – (1/2)sd sd) Q’/P, Tax Revenue = tQ’ DWL/TR = – (1/2)sd sd) /P = – (1/2)*0.078*(.5)/.5 = -0.039 (iii) MDWL/MR =sd sd) Q/P] / Q =sd sd) /P] = 0.078*(.5)/.5 = 0.078 b. If the price of apples is $2, what does the Ramsey Rule suggest is the optimal commodity tax on apples? The Ramsey Rule for optimal commodity taxation is that all commodities should be taxed so that MDWL/MR equal across commodities. In order for this to hold, it must be true that t = (1/ d) MDWL/MR. MDWL/MR for cigarette = 0.078 d = -1 t = (1/ d) 0.078= 0.078 c. Now assume that there is a $0.25 per pack negative externality associated with smoking and that cigarette supply is perfectly elastic. Recalculate the (i) DWL, (ii) the ratio of the DWL to revenue, and (iii) the ratio of marginal DWL to marginal revenue. (i) DWL = – (1/2)sd sd) Q/P sd sd) = 0.078 DWL = -(1/2)*( 0.078)*(.25) *500/0.50= -2.437 (ii) DWL/TR = – (1/2)sd sd)/P, = -(1/2)*( 0.078)*(.25)/0.50 = -0.0195 (iii) MDWL/MR =sd sd)/P] = 0.039 4. Which of the following is likely to impose a large excess burden? (a) A tax on land (b) A tax of 24 percent on the use of cellular phones.(This is the approximate sum of federal and state tax rates in California, New York and Florida) (c) A subsidy for investment in “high-tech” companies (d) A tax on economic profits (e) A 10 percent tax on all computer software (f) A 10 percent tax only on the Excel spreadsheet program Ans) For a , we know that the elasticity of supply of land is zero(i.e., perfect inelastic), so there is no DWL. Similarly, we can see there is no excess burden on a tax on economic profits since in this case, tax doesn’t make any distortion. On the other hand, b and f is the very elastic cases, so there would be huge DWL. In particular, compare the case of e and f. It is trivial that the elasticity of demand of the Excel program is much higher than the elasticity of demand of all computer software. 5. Some countries rely relatively heavily on taxes that distort economic behavior, and others do not. A recent econometric study found that countries in the latter category tend to grow faster than countries in the former (Kneller, Bleaney, and Norman, 1999). Explain this phenomenon. Ans) Higher tax rates increase DWL and discourage economic activity and foreign investment leading to lower economic growth. 7. How does the extent to which there is competition in the market affect the size of the deadweight loss caused by a tax imposed on producers? Explain. Ans) The reason the extent of competition in a market affects the deadweight loss of a tax relates to the fact that producer and consumer surplus is the smallest for the units that are produced close to the competitive equilibrium. In a competitive market, a tax that reduced the quantity sold by one unit would have almost no effect on consumer surplus because consumers value the good at approximately its price. Similarly, the same tax in the same market would not affect producer surplus much if at all because the marginal cost of producing that unit is roughly equal to its price. However, if the market is monopoly, then there is already underproduction. Consequently, the consumer and producer surpluses associated with producing the last good could be quite large and would be lost to the extent that a tax causes fewer of the goods to be sold. 8. Discuss the equity implications of the Ramsey rule for optimal commodity taxation. How can these equity issues be addressed, if at all? Ans) The Ramsey rule states that commodities with low elasticities of demand should be taxed at higher rates than commodities with high elasticities of demand. However, low-income people might spend a higher proportion of their incomes on commodities with low elasticities of demand (food, clothing, and so on) than might high-income people. Consequently, following the Ramsey rule may result in a regressive taxation scheme society may view as inequitable. The equity issue could be addressed by reducing commodity taxes on goods consumed disproportionately by low-income groups below that implied by the inverse elasticity rule. However, while doing so would increase equity, it would reduce efficiency. Consequently, the extent to which society would want to reweight the optimal commodity taxes depends on how much society wants to trade off efficiency to gain equity. 9. How is it possible for marginal tax rates to decline as income increases while average tax rates rise with income? How does the optimal tax system simulated by Gruber and Saez (2000) represent an optimal trade-off between equity and efficiency concerns? A taxpayer’s marginal tax rate is the rate paid on the last dollar of income; the average rate is calculated based on the taxpayer’s entire income. As long as marginal rates are above average rates, average rates will be increasing. The higher marginal, or last, rate will bring the average up. This is analogous to the behavior of cost functions, grade point averages, and all other phenomena for which both marginal and average functions are calculated. When the marginal unit is below the average, it brings the average down. When the marginal unit exceeds the average, it brings the average up. In the example given by Gruber and Saez (2000), it is true that marginal rates decline with income, but those rates are still greater than the average tax rate, and so must bring the average tax rate up. In the case of taxes, the marginal rate has the greatest effect on decision making: a rational worker will choose to change labor time on the basis of his marginal net wage, not his average wage. Thus, the marginal tax rate has important efficiency implications. If it is too high, it will discourage work. The work deterrence of an income tax is highest for high-income workers, as their marginal utility from additional income is low (by the concept of diminishing marginal utility of income). Thus, falling marginal tax rates for high-income earners reduces the efficiency loss of work deterrence. On the other hand, the fairness, or equity, concerns of a tax system would indicate lower average tax rates for poorer taxpayers. The system simulated by Gruber and Saez (2000) accomplishes that. Higherincome taxpayers face higher average tax rates than do lower-income taxpayers. Questions on Ch21 1. Suppose that you can earn $16 per hour before taxes and can work up to 80 hours per week. Consider two income tax rates, 10% and 20%. (a) On the same diagram, draw the two weekly consumption-leisure budget constraints reflecting the two different tax rates. (b) Draw a set of representative indifference curves such that the income effect of the tax increase outweighs the substitution effect. (c) Draw a set of representative indifference curves such that the substitution effect of the tax increase outweighs the income effect. (a) The maximum weekly consumption, in dollars, without a tax is 80 x $16 = $1,280. A 10% tax reduces that amount to 0.9* 0.8* $1,024. These give the y-intercepts of the budget constraints. The x-intercept, measuring leisure, is always 80 hours. (b) When the income effect outweighs the substitution effect, a lower tax leads to more leisure because a higher income allows a person to acquire more of a normal good, in this case leisure: (c) When the substitution effect outweighs the income effect, a lower tax leads to less leisure because leisure now has a higher opportunity cost (the higher after-tax wage): 2. Suppose that you estimate the following female labor supply relationship: Labor supply Li = –320 + 85∙Wi + 320∙Gi –120∙Mi where labor supply is measured in annual hours worked and wages are expressed in hourly wages. Wi : after-tax wage Gi : dummy variable (college graduate) Mi : dummy variable (married) (a) Interpret the coefficient on after-tax wages. What does this coefficient imply about the effect of increasing wages from $6 to $10 per hour on labor supply? (b) What can we learn from this estimate about the income and substitution effects of wages on labor supply? (c) How might this coefficient estimate be biased? Explain. (a) The coefficient on after-tax wages is positive, indicating that a higher after-tax wage increases labor supply. The magnitude of the effect is 85: for each dollar increase in aftertax wage, all else equal, a female will work 85 more hours per year. For a $4 increase (from $6 to $10), that translates to 4 *85 = 340 hours. (b) This particular estimate does not explicitly include a measure of nonlabor income. The approach described in the text subtracted the nonwage income effect from the wage effect to isolate the substitution effect of wages on labor supply. That cannot be done here. The most we could confidently state is that the total of income and substitution effects is positive, and so any negative effect on labor supply arising from the income effect is more than offset by the substitution effect. The substitution effect, which induces more work as leisure becomes more expensive, must be greater than the income effect, which induces less work as income increases. There is a hint in the estimation that the income effect matters, though. Being married enters as a negative number, indicating that having another possible income in the household reduces labor supply. (c) This estimate holds marital status and having a college degree constant. Given those controls, the coefficient of interest is +85, indicating that women who earn a higher wage work more hours. A number of other explanatory variables would have to be included to avoid bias. There is no control for family size or presence of children, and it may be the case that mothers are more likely to work part-time and to accept a lower hourly wage in exchange for work hour flexibility. It is also possible that the women who are earning the highest wages and working the longest hours are somehow different from other women, not just in presence of children but in chosen careers, in attitudes about working, or in ambition. Thus, there are a number of competing explanations for the observed correlation between wages and hours that this crosssectional estimate cannot distinguish. 3. You graduate from UC Davis and take a job as a research assistant with a wage of $25 per hour. Your job is extremely flexible: you can choose any number of hours from 0 to 2000 per year. Suppose there is a income tax of the following form: Income up to $10,000: no tax Income from $10,000 - $30,000: 20% tax rate Income from $30,000 up: 30% tax rate (a) Draw a graph in [hours, consumption] space showing your opportunity set with and without the tax system. (b) Say you choose to work 1500 hours per year. What is your marginal tax rate? What is your average tax rate? Do these rates differ? Why or why not? (c) Suppose that the tax rates in the second and third brackets are increased to 25% and 50%. What is the likely effect on the labor supply of men? What is the likely effect on the labor supply of married women? Explain how the responses might differ between these groups, both in terms of underlying economic effects, and in terms of the empirical evidence on labor supply responses. (d) Suppose that the government replaces the current tax system with a lump-sum tax: each person pays $10,000 per year in taxes regardless of what they earn. Discuss this tax change on equity and efficiency grounds. Draw a new graph in [hours, consumption] space as part of your answer. (e) Instead, suppose that the government replaces the current tax system with a negative income tax: you receive $5,000 from the government and pay a tax of 25% on all income you earn. Discuss this tax change on equity and efficiency grounds. Explain the likely effects in terms of the empirical evidence on labor supply responses. Draw a new graph in [hours, consumption] space as part of your answer. a) Draw non-linear BC with slope of –25 from 0 to 400 hours, slope of -.8*25 from 400 to 1200 hours, and slope of -.7*25 from 1200 to 2000 hours (intercept at income = $40,000). Non-taxed BC is line with slope of –25 and intercept at income of $50,000. C 50,000 40,000 26,000 10,000 800 1,600 2,000 Leisure b) Marginal tax rate = 30%. Average tax rate = (0%*10,000) + (20%*(30,000-10,000)) + (30%*(37,500-30,000) / 37,500 = 16.67%. Average is less than marginal because most of your income is taxed at a lower rate than your marginal rate. c) Two theoretical effects, net effect is ambiguous. Substitution effect: higher taxes mean leisure is relatively cheaper, choose more leisure. Income effect: higher taxes mean you are poorer, choose less leisure. For men, the empirical research shows that taxes have little net effect; the two effects offset. Empirical research shows that women are much more likely to decrease labor supply because there’s a large substitution effect (presumably, women have more outside options). Key is that non-market labor, which women are more likely to engage in, is not taxed, so women are more likely choose to work at home. C 50,000 35,000 25,000 10,000 800 1,600 2,000 Leisure d) The new BC has a slope of –25; the income at 2000 hours is $40,000 and the income at 0 hours is -$10,000. This tax is good on efficiency grounds, because there is no DWL; you have to pay the tax regardless of how much you work, so it can’t distort your decision to work. On the other hand, this system is regressive; now the poor pay a much larger percentage of their income in taxes than the rich. C 50,000 40,000 0 1,600 2,000 Leisure -1000 e) The new BC has a slope of -.75*25; the income at 2000 hours is $42,500 ($5,000 plus 2000 * .75 * 25) and the income at 0 hours is $5,000. This tax may distort labor supply and generate DWL relative to the lump-sum tax, since workers keep only 75 cents of every dollar they earn and because of the income effect of the $5,000 guarantee. However, this system is preferable on equity grounds to the lump-sum tax; the tax rate is flat, so it’s neither a progressive or regressive system, while the lump-sum tax was regressive. The first tax was more progressive than this tax, but this tax provides a safety net for the very needy, so relative to the first tax the equity effects are ambiguous. Relative to the first tax, this tax has a broader base, but it’s not clear how many people have lower rates and how many have higher rates, so the efficiency effects are also ambiguous. C 50,000 42500 5000 2,000 Leisure 4. Describe the EITC program using a graph a. Theoretically speaking what kind of effects do we expect to see on the labor supply of the EITC recipients and why? b. What are the empirical findings: i. On the effect of the program on the labor supply of single mothers not in the labor force? ii. What about the people that are already in the labor force iii. What is the impact of the program on the labor supply of married women Ans) a. The Earned Income Tax Credit is a federal income tax policy that subsidizes the wages of low-income earners. The EITC presents a 40% wage-subsidy, by offering a refundable tax credit, and when earnings are sufficiently high, the credit is reduced at a tax rate of 21% . b. The figure shows four distinct groups: - For those out of the labor force, located at point A, the EITC unambiguously increases labor force participation through the substitution effect. - For those at points like B, the subsidy creates ambiguous effects on hours of work. The substitution effect increase work, while the income effect decreases it. - For those at points like C, the subsidy decreases hours of work because of the income effect. There is no substitution effect. - For those at points like D, the phase-out region, the income and substitution effects both decrease labor supply. c. The conclusions from a number of quasi-experimental studies about the EITC show that: - Labor force participation increased for single mothers. - Conditional on work, the EITC does not seem to much affect hours of work. - Since the EITC is computed based on family income, married couples are likely to fall into the phaseout range. Eissa and Hoynes (1998) find a modest reduction in labor supply among married women in response to the EITC.