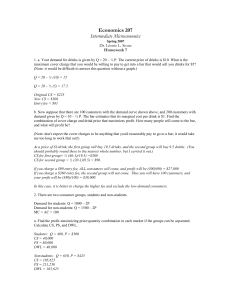

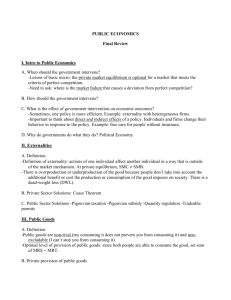

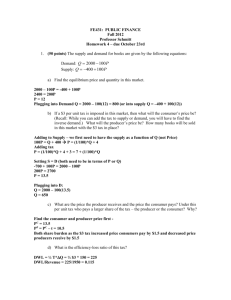

Problem Set 1 - the University of California, Davis

advertisement

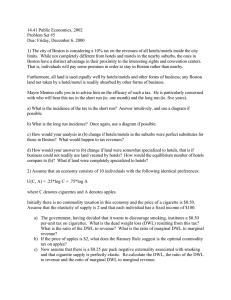

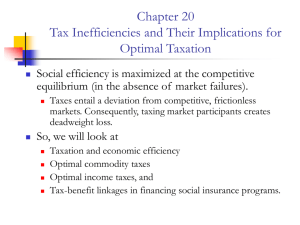

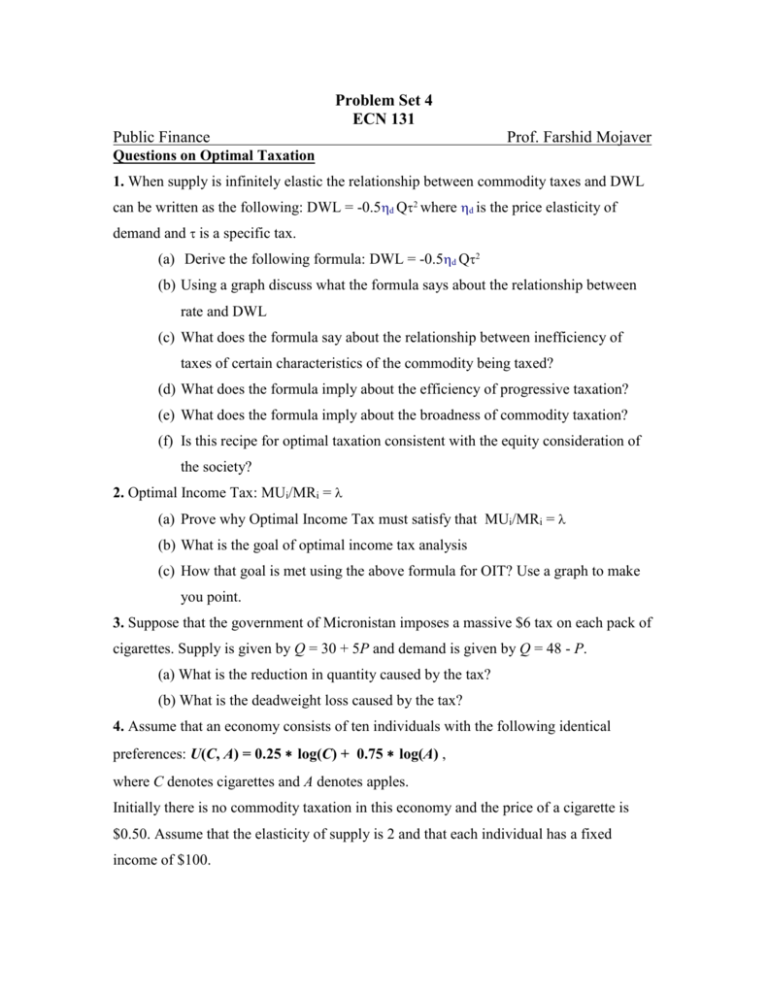

Problem Set 4 ECN 131 Public Finance Prof. Farshid Mojaver Questions on Optimal Taxation 1. When supply is infinitely elastic the relationship between commodity taxes and DWL can be written as the following: DWL = -0.5d Q2 where d is the price elasticity of demand and is a specific tax. (a) Derive the following formula: DWL = -0.5d Q2 (b) Using a graph discuss what the formula says about the relationship between rate and DWL (c) What does the formula say about the relationship between inefficiency of taxes of certain characteristics of the commodity being taxed? (d) What does the formula imply about the efficiency of progressive taxation? (e) What does the formula imply about the broadness of commodity taxation? (f) Is this recipe for optimal taxation consistent with the equity consideration of the society? 2. Optimal Income Tax: MUi/MRi = (a) Prove why Optimal Income Tax must satisfy that MUi/MRi = (b) What is the goal of optimal income tax analysis (c) How that goal is met using the above formula for OIT? Use a graph to make you point. 3. Suppose that the government of Micronistan imposes a massive $6 tax on each pack of cigarettes. Supply is given by Q = 30 + 5P and demand is given by Q = 48 - P. (a) What is the reduction in quantity caused by the tax? (b) What is the deadweight loss caused by the tax? 4. Assume that an economy consists of ten individuals with the following identical preferences: U(C, A) = 0.25 * log(C) + 0.75 * log(A) , where C denotes cigarettes and A denotes apples. Initially there is no commodity taxation in this economy and the price of a cigarette is $0.50. Assume that the elasticity of supply is 2 and that each individual has a fixed income of $100. (Note that in Cobb-Douglas utility functions, demand for each good is only a function its own price and income. i.e., the price of other good is irrelevant to its own demand.) (a) The government, having decided that it wants to discourage smoking, institutes a $0.50 per-unit tax on cigarettes. What is the deadweight loss (DWL) resulting from this tax? What is the ratio of the DWL to revenue? What is the ratio of marginal DWL to marginal revenue? (b) If the price of apples is $2, what does the Ramsey Rule suggest is the optimal commodity tax on apples? (c) Now assume that there is a $0.25 per pack negative externality associated with smoking and that cigarette supply is perfectly elastic. Recalculate the DWL, the ratio of the DWL to revenue, and the ratio of marginal DWL to marginal revenue. 5. Which of the following is likely to impose a large excess burden? (a) A tax on land (b) A tax of 24 percent on the use of cellular phones.(This is the approximate sum of federal and state tax rates in California, New York and Florida) (c) A subsidy for investment in “high-tech” companies (d) A tax on economic profits (e) A 10 percent tax on all computer software (f) A 10 percent tax only on the Excel spreadsheet program 6. Some countries rely relatively heavily on taxes that distort economic behavior, and others do not. A recent econometric study found that countries in the latter category tend to grow faster than countries in the former (Kneller, Bleaney, and Norman, 1999). Explain this phenomenon. 7. How does the extent to which there is competition in the market affect the size of the deadweight loss caused by a tax imposed on producers? Explain. 8. Discuss the equity implications of the Ramsey rule for optimal commodity taxation. How can these equity issues be addressed, if at all? 9. How is it possible for marginal tax rates to decline as income increases while average tax rates rise with income? How does the optimal tax system simulated by Gruber and Saez (2000) represent an optimal trade-off between equity and efficiency concerns? Questions on Ch21 1. Suppose that you can earn $16 per hour before taxes and can work up to 80 hours per week. Consider two income tax rates, 10% and 20%. (a) On the same diagram, draw the two weekly consumption-leisure budget constraints reflecting the two different tax rates. (b) Draw a set of representative indifference curves such that the income effect of the tax increase outweighs the substitution effect. (c) Draw a set of representative indifference curves such that the substitution effect of the tax increase outweighs the income effect. 2. Suppose that you estimate the following female labor supply relationship: Labor supply Li = –320 + 85∙Wi + 320∙Gi –120∙Mi where labor supply is measured in annual hours worked and wages are expressed in hourly wages. Wi : after-tax wage Gi : dummy variable (college graduate) Mi : dummy variable (married) (a) Interpret the coefficient on after-tax wages. What does this coefficient imply about the effect of increasing wages from $6 to $10 per hour on labor supply? (b) What can we learn from this estimate about the income and substitution effects of wages on labor supply? (c) How might this coefficient estimate be biased? Explain. 5. Describe the EITC program using a graph a. Theoretically speaking what kind of effects do we expect to see on the labor supply of the EITC recipients and why? b. What are the empirical findings: i. On the effect of the program on the labor supply of single mothers not in the labor force? ii. What about the people that are already in the labor force iii. What is the impact of the program on the labor supply of married women