Chapter Eight

advertisement

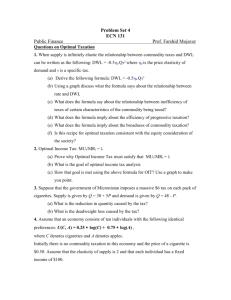

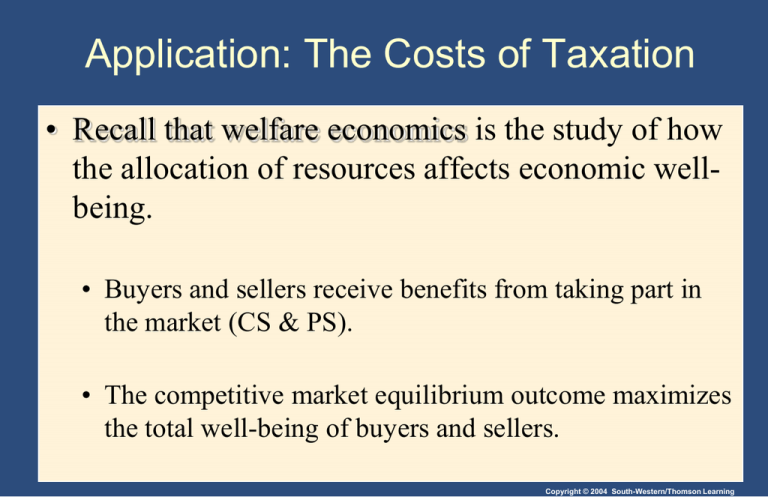

Application: The Costs of Taxation • Recall that welfare economics is the study of how the allocation of resources affects economic wellbeing. • Buyers and sellers receive benefits from taking part in the market (CS & PS). • The competitive market equilibrium outcome maximizes the total well-being of buyers and sellers. Copyright © 2004 South-Western/Thomson Learning THE DEADWEIGHT LOSS OF TAXATION • How do taxes affect the economic well-being of market participants? • When a tax is levied in a market…. • The price paid by buyers rises and the price received by sellers falls. Copyright © 2004 South-Western/Thomson Learning How a Tax Affects Market Participants • A tax places a wedge between the price buyers pay and the price sellers receive. • Because of this tax wedge, the quantity of units bought and sold falls below the amount that would be bought and sold without a tax (equilibrium). • The size of the market for the taxed good shrinks. Copyright © 2004 South-Western/Thomson Learning How a Tax Affects Market Participants • The change in total welfare includes: • • • • The change in consumer surplus and producer surplus The tax revenue. Loss in CS and PS exceeds the tax revenue raised. This drop in net well-being to society is called deadweight loss (DWL). • DWL arises because buyers and sellers no longer realize some of the gains from trade compared to the competitive market equilibrium outcome (some units are no longer traded). Copyright © 2004 South-Western/Thomson Learning Figure 4 The Deadweight Loss Price Lost gains from trade PB Supply Size of tax Price without tax PS Cost to sellers Value to buyers 0 Q2 Demand Quantity Q1 Reduction in quantity due to the tax Copyright © 2004 South-Western DETERMINANTS OF THE DEADWEIGHT LOSS • What determines whether the DWL and the tax revenue from a tax are large or small? • The amounts of DWL and tax revenue depend on how much the quantity supplied and quantity demanded respond to changes in the price. • In other words, the amounts of DWL and tax revenue depend on the price elasticities of supply and demand. Copyright © 2004 South-Western/Thomson Learning DETERMINANTS OF THE DEADWEIGHT LOSS • More elastic demand and supply results in… • Larger decline in equilibrium quantity. • Greater DWL. • Smaller tax revenue. Copyright © 2004 South-Western/Thomson Learning Summary • A tax on a good reduces the well-being of buyers and sellers of the good. • The reduction in consumer surplus and producer surplus usually exceeds the tax revenue raised. • This drop in net well-being is referred to as the deadweight loss (DWL) of the tax. Copyright © 2004 South-Western/Thomson Learning Summary • Taxes generally have a DWL because they cause buyers to consume less and sellers to produce less. • This change in behavior shrinks the size of the market below the competitive market equilibrium outcome which maximizes total well-being. Copyright © 2004 South-Western/Thomson Learning Summary • DWL is the cost of raising revenue from taxing a particular good or service (no free lunch). • It is more efficient to raise revenue by taxing markets with inelastic demand and/or supply. • You should always ask: What does policy success require and what does reality look like? Copyright © 2004 South-Western/Thomson Learning