Chapter 6 - Florida International University

advertisement

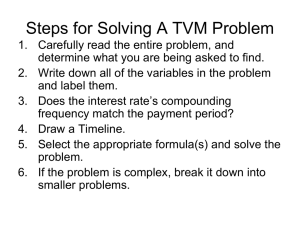

Chapter 6 Discounted Cash Flows and Valuation Learning Objectives 1. Explain why cash flows occurring at different times must be discounted to a common date before they can be compared, and be able to compute the present value and future value for multiple cash flows. 2. Describe how to calculate the present value of an ordinary annuity and how an ordinary annuity differs from an annuity due. 3. Explain what a perpetuity is and how it is used in business, and be able to calculate the value of a perpetuity. 4. Discuss growing annuities and perpetuities, as well as their application in business, and be able to calculate their value. 5. Discuss why the effective annual interest rate (EAR) is the appropriate way to annualize interest rates, and be able to calculate EAR. I. Chapter Outline 6.1 Multiple Cash Flows A. Future Value of Multiple Cash Flows In contrast to Chapter 5, we now consider situations in which there are multiple cash flows. Solving future value problems with multiple cash flows involves a simple process. Prepared by Jim Keys 1 First, draw a time line to make sure that each cash flow is placed in the correct time period. Second, calculate the future value of each cash flow for its time period. Third, add up the future values. ♦ Future Value with Multiple Cash Flows – Use a timeline to illustrate the time period in which cash flows occur. In almost all such calculations, it is implicitly assumed that the cash flows occur at the end of each period. Future Value of Uneven Cash Flow Streams Considering the example above, what is the future value of the cash flows at the end of year three if the interest rate is 6% compounded annually? Note: Treat each cash flow as a lump sum amount and compound for the appropriate number of periods. FVn = PV( 1 + i )n Prepared by Jim Keys 2 FV3 = $100(1.06)2 + $200(1.06)1 + $300 = $100(1.1236) + $200(1.06) + $300 = $624.36 What is the future value of the cash flows if the interest rate is 6% compounded monthly? FVn = PV 1 i/m (m x n) FV3 = $100(1 + .06/12)(12)(2) + $200(1 + .06/12)(12)(1) + $300(12)(0) FV3 = $100(1.12716) + $200(1.061678) + $300 = $625.05 What is the future value of the cash flows at the end of year ten if the interest rate is 6% compounded annually? 0 Period CF 1 2 3 $100 $200 $300 4 5 6 7 8 9 10 FV10 = or FV10 = B. Present Value of Multiple Cash Flows Many situations in business call for computing the present value of a series of expected future cash flows. This could be to determine the market value of a security or business or to decide whether a capital investment should be made. The process is similar to determining the future value of multiple cash flows. First, prepare a time line to identify the magnitude and timing of the cash flows. Next, calculate the present value of each cash flow using Equation 5.4 from the previous chapter. Finally, add up all the present values. The sum of the present values of a stream of future cash flows is their current market price, or value. Prepared by Jim Keys 3 ♦ Present Value with Multiple Cash Flows Present Value of Uneven Cash Flow Streams Considering the example above, what is the present value of the cash flows at time zero (today) if the interest rate is 6% compounded annually? Note: Treat each cash flow as a lump sum amount and discount for the appropriate number of periods. PV = FVn ( 1 + i )-n PV0 = $100(1.06)-1 + $200(1.06)-2 + $300(1.06)-3 PV0 = $100(.943396) + $200(.889996) + $300(.839619) = $524.22 What is the present value of the cash flows if the interest rate is 6% compounded monthly? PV = FVn ( 1 + i/m )-(m x n) PV0 = $100(1 + .06/12)-(12)(1) + $200(1 + .06/12)-(12)(2) + $300(1 + .06/12)-(12)(3) Prepared by Jim Keys 4 PV0 = $100(.941905) + $200(.887186) + $300(.835645) = $522.32 What is the present value of the following cash flows if the interest rate is 6% compounded annually? Period CF 0 1 2 3 4 5 6 7 $100 $200 $300 8 9 10 PV0 = $100( ) + $200( ) + $300( ) = 6.2 Level Cash Flows: Annuities and Perpetuities There are many situations in which both businesses and individuals would be faced with either receiving or paying a constant amount for a length of period. When a firm faces a stream of constant payments on a bank loan for a period of time, we call that stream of cash flows an annuity. Individual investors may make constant payments on their home or car loans, or invest a fixed amount year after year to save for their retirement. Any financial contract that calls for equally spaced and level cash flows over a finite number of periods is called an annuity. If the cash flow payments continue forever, the contract is called a perpetuity. Constant cash flows that occur at the end of each period are called ordinary annuities. A. Present Value of an Annuity We can calculate the present value of an annuity the same way as we calculated the present value of multiple cash flows. However, if the number of payments were to be very large, then this process will be tedious. Instead we can simplify Equation 5.4 to obtain an annuity factor. This results in Equation 6.1, which can be used to calculate the present value of an annuity. Prepared by Jim Keys 5 1 1 (1 i) n PVA n CF i 1 (1 i) -n CF i In addition to using this annuity equation to solve for the present value of an annuity, financial calculators and spreadsheets may be used. Present value and annuity tables created with the help of Equation 6.1 have limited use outside of a classroom setting. One problem that is widely solved using a financial calculator is finding the monthly payment on a car loan or home loan. ♦ Present Value for Annuity Cash Flows Present Value of an Annuity with Annual Payments or Deposits If you deposit $1,000 at the end of each of the next five years, what is the present value of these deposits if the interest rate is 6%? or Prepared by Jim Keys 6 or 1 - ( 1 + .06 )-5 1 (1 i) -n = $1,000 PVAn CF = $1,000(4.212363786) = $4,212.36 .06 i Note: The cash flow, CF, is defined as the periodic level cash flow. or PVAn = CF(PVIFA 6%,5) = $1,000(4.21236) = $4,212.36 Financial calculator: n N 5 i I/YR 6 PVA PV 4,212.36 CF PMT -1,000 FV FV 0 Present Value of an Annuity with Non-annual Payments or Deposits If you deposit $500 every six months over the next five years, what is the present value of these deposits if the interest rate is 6%? Note: By default, the frequency of the deposits equals the frequency of the compounding/discounting. In this case, there are two cash flows per year, therefore, the discounting frequency is semi-annual. .5 1 1.5 2 2.5 3 3.5 4 4.5 5 Period 0 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 CF 1 - 1 + i/m - (m x n) 1 - 1 + .06/2 - (5)(2) = PVAn = CF $500 = $500(8.530202837) = i/m .06/2 $4,265.10 Financial calculator: n N 5 x 2 = 10 i I/YR 6/2 = 3 PVA PV 4,265.10 CF PMT -500 FV FV 0 Solving for the Annual Payment/Deposit when the Present Value of the Annuity is Given Prepared by Jim Keys 7 You have $10,000 in your bank account earning a 7% rate of interest. You would like to withdraw an equal amount of money at the end of the next eight years. What is the cash flow amount that you can withdraw each year? Note: The loan amount is the present value of an annuity. PVAn CF = Financial calculator: = 1 - ( 1 + i ) i -n n N 8 $10,000 1 - ( 1 + .07 ) .07 -8 i I/YR 7 = $10,000 = $1,674.68 5.971298506 PVA PV -10,000 CF PMT 1,674.68 FV FV 0 Solving for the Non-annual Payment/Deposit when the Present Value of the Annuity is Given If you can obtain a 30-year mortgage at 6.5%, what is your monthly payment on a $250,000 mortgage? CF = PVAn 1 - ( 1 + i/m ) i/m $1,580.17 - (m x n) = $250,000 1 - ( 1 + .065/12 ) .065/12 - (30)(12) = $250,000 = 158.21081957 Financial calculator: n N 30 x 12 i I/YR 6.5/12 PVA PV 250,000 CF PMT -1,580.17 FV FV 0 Total paid over the life of the loan = $1,580.17 x 360 payments = $568,861.20 Interest = $568,861.20 - $250,000 = $318,861.20 If you can obtain a 15-year mortgage at 6.5%, what is your monthly payment on a $250,000 mortgage? CF = PVAn 1 - ( 1 + i/m ) i/m $2,177.77 - (m x n) = $250,000 1 - ( 1 + .065/12 ) .065/12 - (12)(15) = $250,000 = 114.796412038 Financial calculator: Prepared by Jim Keys 8 n N 15 x 12 i I/YR 6.5/12 PVA PV 250,000 CF PMT -2,177.77 FV FV 0 Total paid over the life of the loan = $2,177.77 x 180 payments = $391,998.60 Interest = $391,998.60 - $250,000 = $141,998.60 B. Preparing a Loan Amortization Schedule Amortization refers to the way the borrowed amount (principal) is paid down over the life of the loan. The monthly loan payment is structured so that each month a portion of the principal is paid off and at the time the loan matures, the loan is entirely paid off. With an amortized loan, each loan payment contains some payment of principal and an interest payment. A loan amortization schedule is just a table that shows the loan balance at the beginning and end of each period, the payment made during that period, and how much of that payment represents interest and how much represents repayment of principal. With an amortized loan, a bigger proportion of each month’s payment goes toward interest in the early periods. As the loan gets paid down, a greater proportion of each payment is used to pay down the principal. Prepared by Jim Keys 9 Amortization schedules are best done on a spreadsheet (see Exhibit 6.5) or on the web: http://www.webmath.com/amort.html Suppose a business takes out a $5,000, five-year loan at 9 percent. The loan will be amortized by making equal end-of-year payments. Determine the amount of each payment and create an amortization showing the interest and principal paid for each period. CF = PVAn 1 - ( 1 + i )-n i = $5,000 1 - ( 1 + .09 )-5 .09 = $5,000 = $1,285.46 3.889651263 Prepared by Jim Keys 10 Loan Amortization Using a Spreadsheet - Loan amortization is a very common spreadsheet application. To illustrate, we will set up the problem that we have just examined, a five-year, $5,000, 9 percent loan with constant payments. Our spreadsheet looks like this: C. Finding the Interest Rate The annuity equation can also be used to the find the interest rate or discount rate for an annuity. Prepared by Jim Keys 11 To determine the rate of return for the annuity, we need to solve the equation for the unknown value i. Other than using a trial-and-error approach, it is easier to solve using this with a financial calculator. Solving for Time Periods and Interest Rate in Annuities (Present Value Given) How long will it take you to pay off a $28,000 auto loan if you make yearly payments of $6,000 and the bank is charging you 5.9% interest? Financial calculator: n i N I/YR 5.6178* 5.9 PVA PV 28,000 CF PMT -6,000 FV FV 0 *5.6178 years (5 years, 226 days) How long will it take you to pay off a $28,000 auto loan if you make monthly payments of $500 and the bank is charging you 5.9% interest? n N 65.6613* i I/YR 5.9/12 PVA PV 28,000 CF PMT -500 FV FV 0 *65.6613 months = 65.6613 / 12 = 5.4718 years (5 years, 172 days) You won the Florida Lottery when the advertised prize was $3,000,000. If you choose the “lump sum” option you will be paid $1,500,000 immediately. Instead, you choose to receive thirty annual payments in the amount of $100,000. What is the implied rate of return? n N 30 i I/YR 5.2166 PVA PV -1,500,000 CF PMT 100,000 FV FV 0 If the Lottery Commission agreed to pay you $25,000 each quarter, how would this affect your rate of return? n N 30 x 4 = 120 i I/YR 1.3320* PVA PV -1,500,000 CF PMT 25,000 FV FV 0 *1.3320 is the quarterly (periodic) rate; annual rate = 1.3320 x 4 = 5.288% Prepared by Jim Keys 12 D. Future Value of an Annuity Future value annuity calculations usually involve finding what a savings or an investment activity is worth at some point in the future. This could be saving periodically for a vacation, car, or house, or even retirement. We can derive the future value annuity equation from the present value annuity equation (Equation 6.1). This results in Equation 6.2, as follows. (1 i) n 1 FVA n CF i As with present value annuity calculations, future value calculations are made easier when financial calculators or spreadsheets are used, especially when lengthy investment periods are involved. Future Value of an Annuity with Annual Payments or Deposits If you deposit $2,000 at the end of each of the next five years, what is the future value of these deposits if the interest rate is 10%? Time line for $2,000 per year for five years Future value calculated by compounding forward one period at a time Future value calculated by compounding each cash flow separately Prepared by Jim Keys 13 ( 1 + i ) n 1 ( 1 + .10 )5 1 = FVAn = CF $2,000 = $2,000(6.1051) = $12,210.20 i .10 Note: The cash flow, CF, is defined as the periodic level cash flow. or FVAn = CF(FVIFA 10%,5) = $2,000(6.10510) = $12,210.20 Financial calculator: n N 5 i I/YR 10 PV PV 0 CF PMT -2,000 FVA FV 12,210.20 Future Value of an Annuity with Non-annual Payments or Deposits If you deposit $500 every three months over the next five years, what is the future value of these deposits if the interest rate is 10%? Note: By default, the frequency of the deposits equals the frequency of the compounding/discounting. In this case, there are four cash flows per year, therefore, the compounding frequency is quarterly. .50 .75 1 4 4.25 4.50 4.75 5 Period 0 .25 … … … $500 $500 $500 $500 … … … $500 $500 $500 $500 $500 CF 1 + i/m (m x n) - 1 1 + .10/4 (4)(5) - 1 = FVAn = CF $500 = $500(25.54465761) = i/m .10/4 $12,772.33 Prepared by Jim Keys 14 Financial calculator: n N 5x4 i I/YR 10/4 PV PV 0 CF PMT -500 FVA FV 12,772.33 Solving for the Annual Payment/Deposit when the Future Value of the Annuity is Given You wish to have $2,500,000 in your investment account forty years from now when you retire. You plan to accumulate this sum by making end-of-year deposits into a mutual fund. If the fund earns a rate of return of 12%, how much must you contribute each year? FVAn CF = Financial calculator: ( 1 + i )n 1 i n N 40 = $2,500,000 ( 1 + .12 )40 1 .12 i I/YR 12 $2,500,000 = $3,259.06 767.0914203 = PV PV 0 CF PMT -3,259.06 FVA FV 2,500,000 Solving for the Non-annual Payment/Deposit when the Future Value of the Annuity is Given If you make weekly deposits to the retirement fund mentioned above, how much must you contribute each week? CF = FVAn ( 1 + i/m ) i/m per week (m x n) 1 = $2,500,000 ( 1 + .12/52 ) .12/52 (52)(40) 1 = $2,500,000 = $48.14 51,930.8076686 Financial calculator: n N 40 x 52 = 2080 i I/YR 12/52 = .230769231… PV PV CF PMT FVA FV 0 -48.14* 2,500,000 *$48.14 per week totals $2,503.33 per year Solving for Time Periods and Interest Rate in Annuities (Future Value Given) Prepared by Jim Keys 15 How long will it take you to save for a $20,000 down payment on a home if you make yearly deposits of $7,500 and the bank is paying you 5% interest? Financial calculator: n N 2.5653* i I/YR 5 PV PV 0 CF PMT -7,500 FVA FV 20,000 *2.5653 years (2 years, 206 days) How long will it take you to save for a $20,000 down payment on a home if you make three deposits a year of $2,500 and the bank is paying you 5% interest? n N 7.5722* i I/YR 5/3 PV PV 0 CF PMT -2,500 FVA FV 20,000 *7.5722 four month periods = 7.5722 / 3 = 2.5241 years (2 years, 191 days) You contributed $3,000 per year to your Roth IRA account over the past twenty-five years. The balance in your account is now $500,000. What compound annual rate of return have you achieved? n N 25 i I/YR 13.4409 PV PV 0 CF PMT -3,000 FVA FV 500,000 What would your rate of return have been if you made quarterly deposits of $750? n N 25 x 4 = 100 i I/YR 3.1344* PV PV 0 CF PMT -750 FVA FV 500,000 *3.1344% per quarter = 3.1344 x 4 = 12.5377% per year E. Perpetuities A perpetuity is a constant stream of cash flows that goes on for an infinite period. In the stock markets, preferred stock issues are considered to be perpetuities, with the issuer paying a constant dividend to holders. Prepared by Jim Keys 16 The equation for the present value of a perpetuity can be derived from the present value of an annuity equation with n tending to infinity. PVA CF Present va lue factor for anannuity 1 1 (1 i ) CF i CF i (1 0) CF i One thing that should be emphasized in the relationship between the present value of an annuity and a perpetuity is that just as a perpetuity equation was derived from the present value annuity equation, we could also derive the present value of an annuity from the equation for a perpetuity. ♦ Perpetuities - a level stream of cash flows that occur at equal intervals for an infinite period of time. Present Value of a Perpetuity The University wishes to establish an endowment fund that will generate $50,000 per year in scholarships. If they can earn a rate of return of 5.5%, how much will they have to raise? PVA PVperpetuity CF $50,000 = $909,090.91 i .055 How much would they have to raise if they could earn a rate of return of 5.5% compounded daily? PVA PVperpetuity F. $50,000 CF $50,000 = $884,388.54 n 365 .056536237 [(1 i/m) 1] [(1 .055/365) 1] Annuity Due When you have an annuity with the payment being incurred at the beginning of each period rather than at the end, the annuity is called an annuity due. Prepared by Jim Keys 17 Rent or lease payments are typically made at the beginning of each period rather than at the end of each period. The annuity transformation method (Equation 6.4) shows the relationship between the ordinary annuity and the annuity due. Each period’s cash flow thus earns an extra period of interest compared to an ordinary annuity. Thus, the present value or future value of an annuity due is always higher than that of ordinary annuity. Annuity due value = Ordinary annuity value × (1 + i) 6.3 Cash Flows That Grow at a Constant Rate In addition to constant cash flow streams, one may have to deal with cash flows that grow at a constant rate over time. These cash flow streams are called growing annuities or growing perpetuities. A. Growing Annuity Business may need to compute the value of multiyear product or service contracts with cash flows that increase each year at a constant rate. These are called growing annuities. An example of a growing annuity could be the valuation of a growing business whose cash flows are increasing every year at a constant rate. This equation to evaluate the present value of a growing annuity (Equation 6.5) can be used when the growth rate is less than the discount rate. → Use this form of the equation if the next period’s cash flow (CF1) is given. Prepared by Jim Keys 18 PVAgrowing (n) n CF1 1 g 1 (i g) 1 i → Use this form of the equation if the current period’s cash flow (CF0) is given. PVAgrowing (n) n CF0 (1 g) 1 g 1 (i g) 1 i Example: Modern Energy Company owns several gas stations. Management is looking to open a new station in the western suburbs of Baltimore. One possibility they are evaluating is to take over a station located at a site that has been leased from the county. The lease, originally for 99 years, currently has 73 years before expiration. The gas station generated a net cash flow of $92,500 last year, and the current owners expect an annual growth rate of 6.3 percent. If Modern Energy uses a discount rate of 14.5 percent to evaluate such Prepared by Jim Keys 19 businesses, what is the present value of this growing annuity? Time for lease to expire = n = 73 years Last year’s net cash flow = CF0 = $92,500 Expected annual growth rate = g = 6.3% (constant) Firm’s required rate of return = i = 14.5% Expected cash flow next year = CF1 = $92,500(1 + g) = $92,500(1.063) = $98,327.50 Present value of growing annuity = PVAgrowing (n) n 1.063 73 CF1 1 g $98,327.50 PVA n 1 1 (i g) 1 i (0.145 0.063) 1.145 $1,199,115.85 0.9955931549 $1,193,831.53 B. Growing Perpetuity When the cash flow stream features a constant growing annuity forever, it is called a growing perpetuity. This can be derived from Equation 6.5 when n tends to infinity and results in Equation 6.6. → Use this form of the equation if the next period’s cash flow (CF1) is given. PVA CF1 (i g) → Use this form of the equation if the current period’s cash flow (CF0) is given. PVA CF0 (1 g) (i g) Prepared by Jim Keys 20 Example: You are offered an investment that will pay perpetual cash flows. The first cash flow of $12,000, beginning one year from today, will increase at a constant rate of 3.5%. What are you willing to pay for this investment if your required rate of return is 7.25%? Term of the cash flows = n = ∞ Next year’s net cash flow = CF1 = $12,000 Expected annual growth rate = g = 3.5% (constant) Your required rate of return = i = 7.25% Present value of growing perpetuity = PVAgrowing (∞) PVA CF1 $12,000 $12,000 $320,000 (i g) (.0725 .035) .0375 What is the value of the cash flow to be received in year 2? CF2 = CF1(1 + g) = $12,000(1.035) = $12,420 6.4 The Effective Annual Interest Rate Interest rates can be quoted in the financial markets in a variety of ways. The most common quote, especially for a loan, is the annual percentage rate (APR). The APR is a rate that represents the simple interest accrued on a loan or an investment in a single period. This is annualized over a year by multiplying it by the appropriate number of periods in a year. A. Calculating the Effective Annual Interest Rate (EAR) The correct way to compute an annualized rate is to reflect the compounding that occurs. This involves calculating the effective annual rate (EAR). Prepared by Jim Keys 21 The effective annual interest rate (EAR) is defined as the annual growth rate that takes compounding into account. Equation 6.7 shows how the EAR is computed. EAR = (1 + Quoted rate/m)m – 1, where, m is the number of compounding periods during a year. The EAR conversion formula accounts for the number of compounding periods and, thus, effectively adjusts the annualized interest rate for the time value of money. The EAR is the true cost of borrowing and lending. Example: Your credit card company charges you 18.99%, but requires you to make monthly payments. What is the effective annual rate you are paying? EAR = (1 i/m) m - 1 = (1 .1899/12)12 - 1 = .207332 = 20.73% ♦ Calculating and Comparing Effective Annual Rates You have compiled the following information on 1-year CD rates from three local banks. Which bank will you choose to deposit your money? Bank A B C APR 4.10% 4.08% 4.06% m Annual Quarterly Continuously EAR 1 EARA = (1 .041/1) - 1 = EARB = (1 .0408/4) 4 - 1 = EARC = ei - 1 = (2.71828).0406 -1 = Financial calculator: Your credit card company charges you 18.99%, but requires you to make monthly payments. What is the effective annual rate you are paying? m P/YR 12 APR NOM% 18.99 Prepared by Jim Keys EAR EFF% 20.7332 22 Spreadsheet: EFFECT(nominal_rate,npery) B. Consumer Protection Acts and Interest Rate Disclosure Congress passed the Truth-in-Lending Act in 1968 to ensure that the true cost of credit was disclosed to consumers so that they could make sound financial decisions. Similarly, another piece of legislation called the Truth-in-Savings Act was passed to provide consumers with an accurate estimate of the return they would earn on an investment. These two pieces of legislation require by law that the APR be disclosed on all consumer loans and savings plans and that it be prominently displayed on advertising and contractual documents. It is important to note that the EAR, not the APR, is the appropriate rate to use in present and future value calculations. Prepared by Jim Keys 23 Chapter 6 Sample Questions Multiple Choice Identify the choice that best completes the statement or answers the question. 1. FV of multiple cash flows: Chandler Corp. is expecting a new project to start producing cash flows, beginning at the end of this year. They expect cash flows to be as follows: 1 $458,357 2 $527,111 3 $585,093 4 $672,857 5 $787,243 If they can reinvest these cash flows to earn a return of 5.2 percent, what is the future value of this cash flow stream at the end of five years? a. b. c. d. $3,616,289.15 $3,052,280.75 $3,317,696.47 $4,379,359.34 2. PV of multiple cash flows: Ferris, Inc., has borrowed from their bank at a rate of 7 percent and will repay the loan with interest over the next five years. Their scheduled payments, starting at the end of the year are as follows—$550,000, $640,000, $730,000, $840,000, and $960,000. What is the present value of these payments? a. b. c. d. $2,425,314.67 $3,113,984.26 $2,994,215.64 $2,814,562.70 3. Present value of an annuity: Lorraine Jackson won a lottery. She will have a choice of receiving $50,000 at the end of each year for the next 40 years, or a lump sum today. If she can earn a return of 4 percent on any investment she makes, what is the minimum amount she should be willing to accept today as a lump-sum payment? a. b. c. d. $870,882.05 $989,638.69 $1,345,908.62 $1,296,426.69 4. Future value of an annuity: Jayadev Athreya has started on his first job. He plans to start saving for retirement early. He will invest $3,500 at the end of each year for the next 40 years in a fund that will earn a return of 9 percent. How much will Jayadev have at the end of 40 years? a. b. c. d. $1,076,155.59 $1,182,588.56 $969,722.62 $1,620,146.32 Prepared by Jim Keys 24 5. Computing annuity payment: Maricela Sanchez needs to have $34,000 in three years. If she can earn 5 percent on any investment, what is the amount that she will have to invest at the end of every year for the next three years? a. b. c. d. $14,452.02 $9,922.28 $12,187.15 $10,785.09 6. Computing annuity payment: Jackson Electricals has borrowed $39,150 from its bank at an annual rate of 5.2 percent. It plans to repay the loan in three equal installments, beginning at the end of next year. What is its annual loan payment? a. b. c. d. $12,554.21 $14,430.12 $16,883.24 $17,604.75 7. Computing annuity payment: Trevor Smith wants to have $2,750,000 at retirement, which is 31 years away. He already has $200,000 in an IRA earning 5 percent annually. How much does he need to save each year, beginning at the end of this year, to reach his target? Assume he could earn 5 percent on any investment he makes. a. b. c. d. $26,036.91 $23,172.85 $18,486.20 $34,108.35 8. Perpetuity: Roger Barkley wants to set up a scholarship at his alma mater. He is willing to invest $100,000 in an account earning 9.25 percent. What will be the annual scholarship that can be given from this investment? a. b. c. d. $9,750 $1,081,081 $6,750 $9,250 9. Perpetuity: Chris Collinge has funded a retirement investment with $250,000 earning a return of 5.75 percent. What is the value of the payment that he can receive in perpetuity? (Round to the nearest dollar.) a. $12,150 b. $15,250 c. $14,375 d. $14,900 Prepared by Jim Keys 25 10. Growing perpetuity: Jack Benny is planning to invest in an insurance company product. The product will pay $10,000 at the end of this year. Thereafter, the payments will grow annually at a 3 percent rate forever. Jack will be able to invest his cash flows at a rate of 6.5 percent. What is the present value of this investment cash flow stream? (Round to the nearest dollar.) a. $326,908 b. $312,766 c. $285,714 d. $258,133 11. Growing annuity: Hill Enterprises is expecting tremendous growth from its newest boutique store. Next year the store is expected to bring in net cash flows of $675,000. The company expects its earnings to grow annually at a rate of 13 percent for the next 15 years. What is the present value of this growing annuity if the firm uses a discount rate of 18 percent on its investments? (Round to the nearest dollar.) a. $6,448,519 b. $6,750,000 c. $7,115,449 d. $5,478,320 12. Effective annual rate: Desire Cosmetics borrowed $152,300 from a bank for three years. If the quoted rate (APR) is 11.75 percent, and the compounding is daily, what is the effective annual rate (EAR)? (Round to one decimal place.) a. 11.75% b. 14.3% c. 12.5% d. 11.6% 13. The condominium at the beach that you want to buy costs $249,500. You plan to make a cash down payment of 20 percent and finance the balance over 10 years at 6.75 percent. What will be the amount of your monthly mortgage payment? a. b. c. d. $2,291.89 $2,809.10 $3,287.46 $3,412.67 Prepared by Jim Keys 26 Chapter 6 Sample Questions Answer Section MULTIPLE CHOICE 1. ANS: C Learning Objective: LO 1 Level of Difficulty: Medium Feedback: 0 1 $458,357 2 $527,111 n = 5; 3 $585,093 i = 5.2% 4 $672,857 5 $787,243 FV5 = $458,357(1.052)4 + $527,111(1.052)3 + $585,093(1.052)2 + $672,857(1.052)1 + $787,243(1.052)0 FV5 = $561,392.79 + $613,690.36 + $647,524.76 + $707,845.56 + $787,243.00 FV5 = $3,317,696.47 PTS: 1 2. ANS: C MSC: JDK Learning Objective: LO 1 Level of Difficulty: Medium Feedback: 0 1 $550,000 2 $640,000 n = 5; 3 $730,000 i = 7% 4 $840,000 5 $960,000 PV = $550,000(1.07)-1 + $640,000(1.07)-2 + $730,000(1.07)-3 + $840,000(1.07)-4 + $960,000(1.07)-5 PV = $514,018.69 + $559,000.79 + $595,897.45 + $640,831.98 + $684,466.73 PV = $2,994,215.64 PTS: 1 3. ANS: B MSC: JDK Learning Objective: LO 2 Level of Difficulty: Medium Feedback: 0 1 $50,000 2 3 $50,000 $50,000 n = 40; i = 4% ... ... Prepared by Jim Keys 39 $50,000 40 $50,000 27 = $989,638.69 Key: Enter: Solve For: n N 40 i I/YR 4 PVA PV CF PMT 50,000 FV FV 0 -989,638.69 PTS: 1 4. ANS: B MSC: JDK Learning Objective: LO 2 Level of Difficulty: Medium Feedback: 0 1 $3,500 2 $3,500 3 $3,500 n = 40; i = 9% ... ... 39 $3,500 40 $3,500 = $1,182,588.56 Key: Enter: Solve For: n N 40 i I/YR 9 PV PV 0 CF PMT -3,500 FVA FV 1,182,588.56 PTS: 1 5. ANS: D MSC: JDK Learning Objective: LO 2 Level of Difficulty: Medium Feedback: 0 1 $CF 2 $CF n = 3; 3 $CF i = 5% 4 $0 5 $0 = $10,785.09 Key: Enter: Solve For: n N 3 i I/YR 5 PV PV 0 CF PMT FVA FV 34,000 -10,785.09 Prepared by Jim Keys 28 PTS: 1 6. ANS: B MSC: JDK Learning Objective: LO 2 Level of Difficulty: Medium Feedback: 0 1 $CF 2 $CF 3 $CF 4 $0 n = 3; 5 $0 i = 5.2% 6 $0 7 $0 8 $0 9 $0 = $14,430.12 Key: Enter: Solve For: n N 3 i I/YR 5.2 PV PV 39,150 CF PMT FVA FV 0 -14,430.12 Each payment made by Jackson Electricals will be $14,430.12, starting at the end of next year. PTS: 1 7. ANS: A MSC: JDK Learning Objective: LO 2 Level of Difficulty: Medium Feedback: Retirement investment target in 31 years = $2,750,000 Amount invested in IRA account now = PV = $200,000 Return earned by investment = i = 5% Value of current investment in 31 years = FV31 = $200,000(1 + .05)31 = $907,607.90 Balance of money needed = $2,750,000 - $907,607.90 = $1,842,392.10 = FVA Payment needed to reach target = CF = PMT = $26,036.91 Key: Enter: Solve For: PTS: 1 8. ANS: D n N 31 i I/YR 5 PV PV -200,000 CF PMT FVA FV 2,750,000 -26,036.91 MSC: JDK Learning Objective: LO 3 Level of Difficulty: Medium Prepared by Jim Keys 29 Feedback: Annual payment needed = PMT = CF Present value of investment = PVA = $100,000 Investment rate of return = i = 9.25% Term of payment = Perpetuity PMT = CF = PVperpetuity x i = $100,000 x .0925 = $9,250 PTS: 1 9. ANS: C MSC: JDK Learning Objective: LO 3 Level of Difficulty: Medium Feedback: Annual payment needed = PMT Present value of investment = PVA = $250,000 Investment rate of return = i = 5.75% Term of payment = Perpetuity PTS: 1 10. ANS: C Learning Objective: LO 4 Level of Difficulty: Medium Feedback: Cash flow at t=1 = CF1 = $10,000 Annual growth rate = g = 3% Discount rate = i = 6.5% Present value of growing perpetuity = PVA¥ PTS: 1 11. ANS: A Learning Objective: LO 4 Level of Difficulty: Medium Feedback: Time of growth = n = 15 years Next year's expected net cash flow = CF1 = $675,000 Expected annual growth rate = g = 13% Firm's required rate of return = i = 18% Present value of growing annuity = PVAn Prepared by Jim Keys 30 PTS: 1 12. ANS: C Learning Objective: LO 5 Level of Difficulty: Medium Feedback: Loan amount = PV = $152,300 Interest rate on loan = i = 11.75% Frequency of compounding = m = 365 Effective annual rate = EAR PTS: 1 13. ANS: A PTS: 1 MSC: JDK Prepared by Jim Keys 31 Chapter 6 (Additional Problems) 1. You are given the following cash flow information. The discount rate is 11.15 percent and the payments are received at the end of each year. Year 1–5 6–10 Amount $3,000 $9,000 What would you be willing to pay right now to receive the income stream above? a. $30,579.40 b. $13,760.73 c. $17,124.46 d. $42,199.57 e. $49,844.42 2. You make deposits to your investment account as shown in the table below. Your rate of return is 11.10 percent and the deposits are made at the end of each year. Year 1–5 6–10 Amount $3,000 $7,000 What is the value of your account at the end of Year 10? a. $75,369.05 b. $108,531.43 c. $145,462.27 d. $110,792.51 e. $104,009.29 3. You have just taken out a 30-year, $100,000 mortgage on your new home. This mortgage is to be repaid in equal end-of-month installments. If the nominal interest rate on the mortgage is 5.43 percent, what is the amount of each monthly payment? a. $277.78 b. $563.40 c. $642.28 d. $794.40 e. $997.23 4. You have just taken out a 15-year, $375,000 mortgage on your new home. This mortgage is to be repaid in equal end-of-month installments. If the nominal interest rate on the mortgage is 9.52 percent, what is the total amount of interest you will pay over the life of the mortgage? a. $330,666.50 b. $419,946.45 c. $426,559.78 d. $380,266.47 e. $410,026.46 Prepared by Jim Keys 32 5. Growing perpetuity: Jack Benny is planning to invest in an insurance company product. The product will pay $2,750 at the end of this year. Thereafter, the payments will grow annually at a 2 percent rate forever. Jack will be able to invest his cash flows at a rate of 7.1 percent. What is the present value of this investment cash flow stream? a. b. c. d. $61,200.98 $53,921.57 $69,990.20 $44,053.92 6. Growing annuity: Hill Enterprises is expecting tremendous growth from its newest boutique store. Next year the store is expected to bring in net cash flows of $625,000. The company expects its earnings to grow annually at a rate of 9 percent for the next 5 years. What is the present value of this growing annuity if the firm uses a discount rate of 10 percent on its investments? a. b. c. d. $2,789,723.64 $3,540,159.30 $3,442,518.97 $3,063,116.56 Prepared by Jim Keys 33 Chapter 6 (Additional Problems) Answer Section MULTIPLE CHOICE 1. ANS: TOP: 2. ANS: TOP: 3. ANS: TOP: 4. ANS: TOP: 5. ANS: A PTS: 1 DIF: PV of an uneven CF stream A PTS: 1 DIF: FV of an uneven CF stream B PTS: 1 DIF: Mortgage Payment A PTS: 1 DIF: Total Interest Paid Over Life of Mortgage B Medium OBJ: TYPE: Problem Medium OBJ: TYPE: Problem Medium OBJ: TYPE: Financial Calculator Medium OBJ: TYPE: Financial Calculator Learning Objective: LO 4 Level of Difficulty: Medium Feedback: Cash flow at t = 1 = CF1 = $2,750 Annual growth rate = g = 2% Discount rate = i = 7.1% Present value of growing perpetuity = PVA(Growing perpetuity) PTS: 1 6. ANS: A MSC: JDK Learning Objective: LO 4 Level of Difficulty: Medium Feedback: Time for lease to expire = n = 5 years Next year's net cash flow = CF1 = $625,000 Expected annual growth rate = g = 9% Firm's required rate of return = i = 10% Present value of growing annuity = PVA(Growing annuity) PTS: 1 MSC: JDK 34