Solutions Guide: Please do not present as your own

advertisement

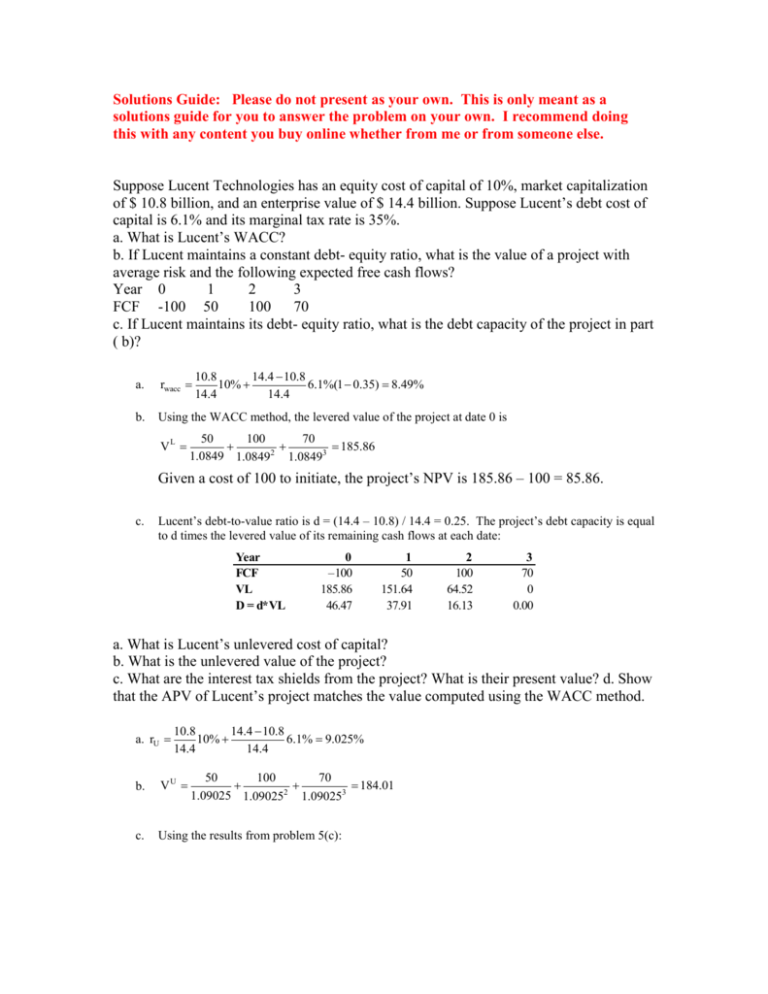

Solutions Guide: Please do not present as your own. This is only meant as a solutions guide for you to answer the problem on your own. I recommend doing this with any content you buy online whether from me or from someone else. Suppose Lucent Technologies has an equity cost of capital of 10%, market capitalization of $ 10.8 billion, and an enterprise value of $ 14.4 billion. Suppose Lucent’s debt cost of capital is 6.1% and its marginal tax rate is 35%. a. What is Lucent’s WACC? b. If Lucent maintains a constant debt- equity ratio, what is the value of a project with average risk and the following expected free cash flows? Year 0 1 2 3 FCF -100 50 100 70 c. If Lucent maintains its debt- equity ratio, what is the debt capacity of the project in part ( b)? 10.8 14.4 10.8 10% 6.1%(1 0.35) 8.49% 14.4 14.4 a. rwacc b. Using the WACC method, the levered value of the project at date 0 is VL 50 100 70 185.86 1.0849 1.08492 1.08493 Given a cost of 100 to initiate, the project’s NPV is 185.86 – 100 = 85.86. c. Lucent’s debt-to-value ratio is d = (14.4 – 10.8) / 14.4 = 0.25. The project’s debt capacity is equal to d times the levered value of its remaining cash flows at each date: Year FCF VL D = d*VL 0 –100 185.86 46.47 1 50 151.64 37.91 2 100 64.52 16.13 3 70 0 0.00 a. What is Lucent’s unlevered cost of capital? b. What is the unlevered value of the project? c. What are the interest tax shields from the project? What is their present value? d. Show that the APV of Lucent’s project matches the value computed using the WACC method. a. rU 10.8 14.4 10.8 10% 6.1% 9.025% 14.4 14.4 50 100 70 184.01 2 1.09025 1.09025 1.090253 b. VU c. Using the results from problem 5(c): Year FCF VL D = d*VL Interest Tax Shield 0 –100 185.86 46.47 1 50 151.64 37.91 2.83 0.99 2 100 64.52 16.13 2.31 0.81 3 70 0 0.00 0.98 0.34 The present value of the interest tax shield is PV(ITS) d. 0.99 0.81 0.34 1.85 1.09025 1.090252 1.090253 VL APV 184.01 1.85 185.86 This matches the answer in problem 5. a. What is the free cash flow to equity for this project? b. What is its NPV computed using the FTE method? How does it compare with the NPV based on the WACC method? a. Using the debt capacity calculated in problem 5, we can compute FCFE by adjusting FCF for aftertax interest expense (D*rD*(1 – tc)) and net increases in debt (Dt – Dt-1): Year D FCF After-tax Interest Exp. Inc. in Debt FCFE b. NPV 53.53 0 46.47 1 37.91 2 16.13 3 0.00 -$100.00 $0.00 $46.47 -$53.53 $50.00 -$1.84 -$8.55 $39.60 $100.00 -$1.50 -$21.78 $76.72 $70.00 -$0.64 -$16.13 $53.23 39.60 76.72 53.23 $85.86 1.10 1.102 1.103