Leverage and Capital Budgeting

advertisement

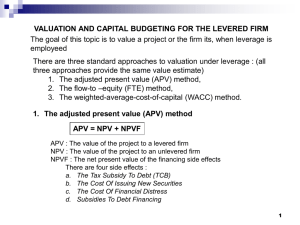

Valuation and Capital Budgeting for the Levered Firm Key Concepts and Skills Understand the effects of leverage on project value Value levered projects using Adjusted Present Value (APV) Flows to Equity (FTE) WACC 2 Leverage and Project Value Why might leverage affect the value of a project? What will/should happen to the value of the project as more debt is used to finance the project? 3 Adjusted Present Value Approach Project value = No debt (NPV) plus PV of financing (NPVF) APV = NPV + NPVF 4 APV Example Consider a project with perpetual cash flows of $140,000 per year. If the tax rate is 34%, should the firm take the project if it costs $475,000? 0 1 2 The unlevered cost of equity is rE = 20%: PV = NPV = 5 APV Example Now, assume the firm uses 126,229.50 of debt to help finance the project, the cost of debt is 10% We can adjust the unlevered firms NPV by adding the tax shied to find the levered value of the project APV = NPV + PV(Tax Shield) 6 Flow to Equity Approach Discount cash flows to equity holders of the levered firm at the cost of levered equity capital, rE 1. Calculate the levered cash flows to equity (LCFs) 2. Calculate rE 3. Value the LCFs at rE 7 First Find Re of the Levered Firm D RE RU (1 tC )( RU RD ) E D = 126,229.50 V= E= 8 Calculating LCF The project makes $140,000 per year What do the equity holders get? 9 Alternative LCF Calculation The only difference between the unlevered firm’s cash flow to equity and the levered firm’s is the after tax interest payment Unlevered: 92,400 After Tax Interest Payment: Cash flow to equity : 10 Flow to Equity NPV Eq. PV = Eq. NPV = 11 WACC Method rWACC E D RE rD (1 tC ) DE ED Discount the unlevered cash flows at the levered WACC D = 126,229.50; V = 504,918; E = 378,688.5 12 WACC Valuation Unlevered Cash flows = 92,400 WACC = 18.3% NPV = 13 Notes on APV, FTE, & WACC WACC or FTE if the firm’s target debt-to-value ratio applies to the project over the life of the project. Use the APV if the project’s level of debt is known over the life of the project. Use 14 WACC is the most widely used in practice. Summary: APV, FTE, and WACC APV WACC FTE Initial Investment Cash Flows Discount Rates 15 All UCF rU All UCF rWACC Equity Portion LCF rE Summary 16 1. The APV formula can be written as: 2. The FTE formula can be written as: 3. The WACC formula can be written as