12 - JustAnswer

12. Earl Company’s direct labor costs for the month of January are as follows:

Actual direct labor hours

Standard direct labor hours

Direct labor rate variance-unfavorable

18,000

19,000

$2,160

Total Payroll $117,000

What was Earl’s direct labor efficiency variance?

A. $1,200 favorable

B. $1,800 favorable

C. $6,380 favorable

D. $6,400 favorable

Labor efficiency variance = (actual number of labor hours worked - standard number of labor hours allowed) x standard labor rate per hour

Labor efficiency variance = (18,000 - 19,000) x $6.40*

Labor efficiency variance = 1,000 x 6.40 = $6,400 F (standard exceeded actual)

* The standard labor rate must be calculated prior to calculating the variance above by using the labor rate variance as follows:

Labor rate variance = (actual labor rate per hour - standard labor rate per hour) x actual number of hours worked

$1,800 U = (6.50** - standard labor rate per hour) x 18,000

1,800 U / 18,000 = .10

.10 = 6.50 - standard labor rate per hour

6.40 = standard labor rate per hour (since variance is unfavorable, the standard rate is less than the actual rate)

**Total payroll / actual labor hours worked = actual labor rate per hour

$117,000 / 18,000 = $6.50

13. The data below relate to the month of April for Monroe, Inc., which uses a standard cost system:

Actual total direct labor

Actual hours used

$54,200

16,500

Standard hours allowed for good output

Direct labor rate variance-debit

A. $187.50 favorable

B. $187.50 unfavorable

C. $437.50 favorable

D. $437.50 unfavorable

Actual total overhead

Budgeted fixed overhead

“Normal” activity in hours

Total overhead application rate per standard direct labor hour

What was Monroe’s volume variance for April?

16,250

$1,400

$53,100

$12,000

16,000

$3.25

Standard overhead budgeted for actual level of production - applied overhead at standard = volume variance

Variable overhead application rate per hour

Standard hours allowed

Variable overhead costs budgeted

Budget $40,625 (variable cost) + $12,000 (fixed cost)

Overhead applied: 16,250 hours

Favorable volume variance

$3.25

$ 2.50 x 16,250

$ 40,625

$52,625.00

52,812.50

$ 187.50

14. The standard direct material to produce one unit of Product A is four yards of material at $2.50 per yard. During June, 4, 200 yards of material costing $10,080 are purchased and used to produce 1,000 units of Product A. What was the material price variance for June?

A. $400 favorable

B. $420 unfavorable

C. $80 unfavorable

D. $480 unfavorable

15. Which one of the following standard cost variances would be least controllable by a production supervisor:

A. Overhead variance

B. Overhead controllable

C. Labor efficiency

D. Material Usage

16. The material price variance, in a standard cost system, is obtained by multiplying the

A. actual price by the difference between actual quantity purchased and standard quantity used.

B. actual quantity by the difference between actual price and standard price.

C. standard price by the difference between standard quantity purchased and standard quantity used.

D. standard quantity by the difference between actual price and standard pricw.

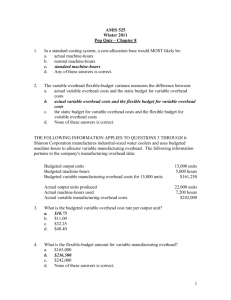

17. Flexible budgeting is a reporting system in which the

A. statements included in the budget report vary from period to period

B. budget standards may be adjusted at will.

C. reporting dates vary according to the levels of activity reported upon

D. planned level of activity is adjusted to the actual level of activity before the budget comparison report is prepared.

18. If a company uses a predetermined rate for absorbing manufacturing overhead, the volume variance is the

A. under applied or over applied variable cost element of overhead.

B . under applied of over applied fixed cost element of overhead .

C. difference in budgeted cost and actual costs of fixed overhead items.

D. difference in budgeted costs and actual costs of variable overhead items.

19. Elgin Company’s budgeted fixed factory overhead costs are $50,000 per month, plus a variable factory overhead rate of $4.00 per direct labor hour. The standard direct labor hours allowed for October production were 20,000. An analysis of the factory overhead indicates that in October Elgin had an

unacceptable budget (controllable) variance of $1,500 and a favorable volume variance of $500. Elgin uses a two-variance analysis of overhead variances.

What is Elgin’s applied factory overhead for October?

A. $128,000

B. $129,500

C. $130,000

D. $130,500

Volume variance = Standard overhead budgeted for actual production - Applied overhead at standard

$500 F = $130,000* - Applied overhead at standard

$130,500 = Applied overhead at standard (Favorable variance indicates that applied overhead exceeds budgeted amount.)

* Standard direct labor hours

Variable overhead rate per hour

Variable overhead budgeted

Fixed overhead budgeted

Total overhead budgeted

20,000 x $4.00

$ 80,000

50,000

$130,000

20. Why might it be misleading to view an unfavorable variance on a performance report as indicative of inferior performance?

A. Actual results are beyond the control of the manager being evaluated.

B. The unfavorable variance may be the result of the company’s having used attainable standards rather than ideal standard’s.

C. The standard may need to be updated.

D. Variance analysis is for purposes of income determination, not performance evaluation.