Case Study: Intrinsically Linear Models

advertisement

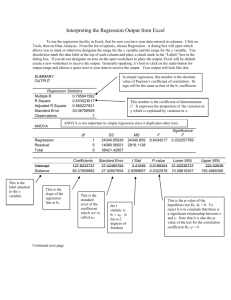

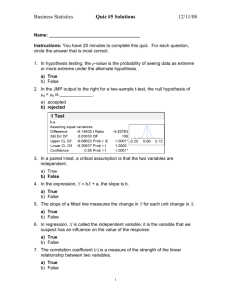

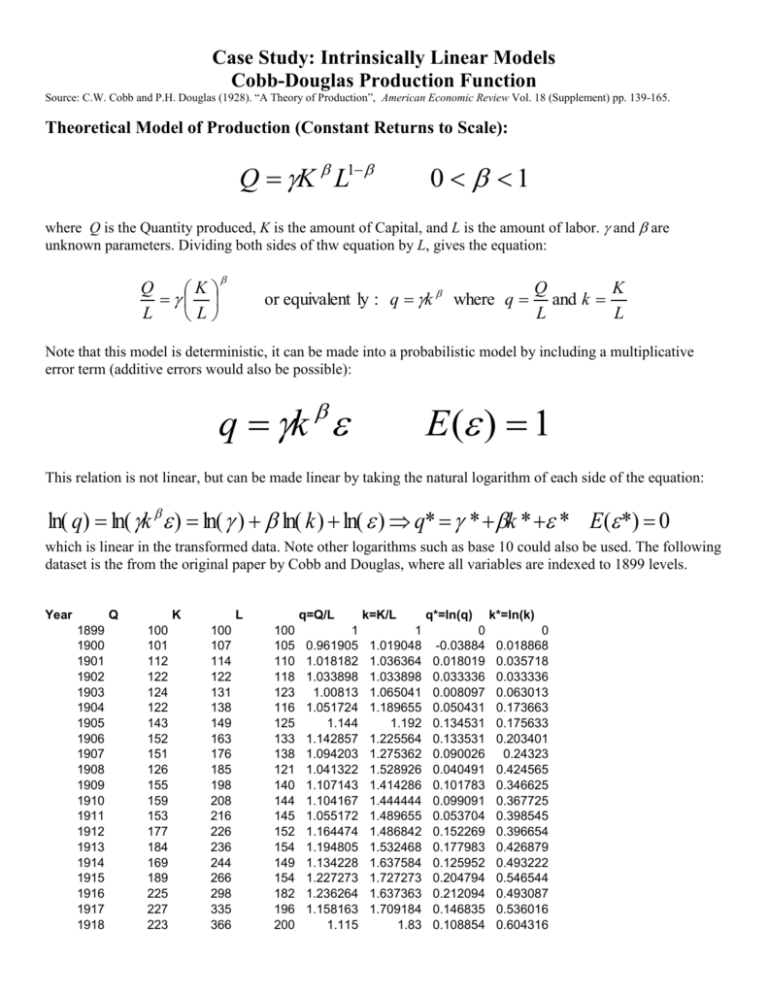

Case Study: Intrinsically Linear Models Cobb-Douglas Production Function Source: C.W. Cobb and P.H. Douglas (1928). “A Theory of Production”, American Economic Review Vol. 18 (Supplement) pp. 139-165. Theoretical Model of Production (Constant Returns to Scale): Q K L1 0 1 where Q is the Quantity produced, K is the amount of Capital, and L is the amount of labor. and are unknown parameters. Dividing both sides of thw equation by L, gives the equation: Q K L L or equivalent ly : q k where q Q K and k L L Note that this model is deterministic, it can be made into a probabilistic model by including a multiplicative error term (additive errors would also be possible): q k E ( ) 1 This relation is not linear, but can be made linear by taking the natural logarithm of each side of the equation: ln( q) ln( k ) ln( ) ln( k ) ln( ) q* * k * * E ( *) 0 which is linear in the transformed data. Note other logarithms such as base 10 could also be used. The following dataset is the from the original paper by Cobb and Douglas, where all variables are indexed to 1899 levels. Year Q 1899 1900 1901 1902 1903 1904 1905 1906 1907 1908 1909 1910 1911 1912 1913 1914 1915 1916 1917 1918 K 100 101 112 122 124 122 143 152 151 126 155 159 153 177 184 169 189 225 227 223 L 100 107 114 122 131 138 149 163 176 185 198 208 216 226 236 244 266 298 335 366 q=Q/L 100 105 110 118 123 116 125 133 138 121 140 144 145 152 154 149 154 182 196 200 1 0.961905 1.018182 1.033898 1.00813 1.051724 1.144 1.142857 1.094203 1.041322 1.107143 1.104167 1.055172 1.164474 1.194805 1.134228 1.227273 1.236264 1.158163 1.115 k=K/L 1 1.019048 1.036364 1.033898 1.065041 1.189655 1.192 1.225564 1.275362 1.528926 1.414286 1.444444 1.489655 1.486842 1.532468 1.637584 1.727273 1.637363 1.709184 1.83 q*=ln(q) 0 -0.03884 0.018019 0.033336 0.008097 0.050431 0.134531 0.133531 0.090026 0.040491 0.101783 0.099091 0.053704 0.152269 0.177983 0.125952 0.204794 0.212094 0.146835 0.108854 k*=ln(k) 0 0.018868 0.035718 0.033336 0.063013 0.173663 0.175633 0.203401 0.24323 0.424565 0.346625 0.367725 0.398545 0.396654 0.426879 0.493222 0.546544 0.493087 0.536016 0.604316 1919 1920 1921 1922 218 231 179 240 387 407 417 431 193 193 147 161 1.129534 1.196891 1.217687 1.490683 2.005181 2.108808 2.836735 2.677019 0.121805 0.179728 0.196953 0.399235 0.695735 0.746123 1.042654 0.984704 Step 1: Fit a simple regression model, regressing q* on k*: Intercept estimates ln(and coefficient of k* estimates : Intercept k*=ln(k) Coefficient Standard t Stat P-value s Error 0.014545 0.019979 0.727985 0.474301 0.254134 0.041224 6.164776 3.32E-06 Step 2: Right out linear equation in transformed q and k: ^ q * 0.014545 0.254134k * Step 3: Back transform the model (exponentiating both sides): ^ q e 0.0145450.254134k * e 0.0145e 0.254ln(k ) 1.0146k 0.254 Plot of data and the function: Q K 1.0146 L L 0.254 Regression Plot 1.6 1.5 Q/L 1.4 1.3 1.2 1.1 1 .9 .8 1 1.2 1.4 1.6 1.8 2 K/L Y = 1.015 * (X^.254) 2.2 2.4 2.6 2.8 3