forecast_script02

advertisement

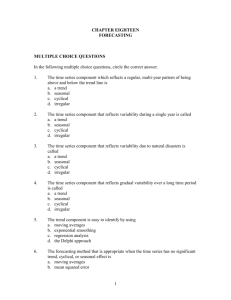

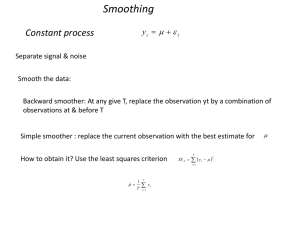

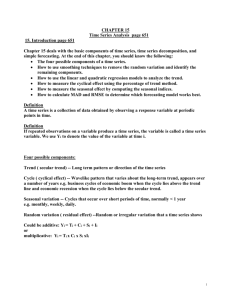

Forecasting –Part Two(text version of audio portion) Slide One: This is the second part of a 3-part series on forecasting. You will learn in detail how to develop and use both the time series and causal models for forecasting. Slide Two: Let us revisit the forecasting techniques that are associated with forecasting the three data patterns in a time series. Simple average, simple moving average, weighted moving average, and exponential smoothing are used to forecast the level component of a time series. Trend adjusted exponential smoothing is for forecasting the trend component of a time series. Finally, seasonal index is for predicting the seasonality pattern in a time series. Slide Three: Recall that a level data pattern means that the data values stay steady over time, indicating that the data values fluctuate around a constant average. The simplest way to define that constant is by taking an average of all data points in the time series. It is the simplest because no other parameters or input data are needed other than the data points in the time series itself. Slide Four: We will use an example to illustrate how to use the simple average method to predict the demand of C&A’s product in July. The previous six months’ demand figures are given here. The forecast for July is simply the mean of these six months’ demand figures, which is 760. Slide Five: The second method to define the constant level in a time series is simple moving average. It is similar to simple average except that an average of only n of the most recent data points is computed. Before you can use simple moving average, you need to be given the number of time periods used in the average (i.e., the parameter n) in addition to n number of data points. Slide Six: Let us use a 3-month moving average to predict the demand for C&A’s product in July. Since n=3, you will compute the average of the three most recent data points (i.e., the actual demand figures of April, May, and June), to give a value of 800 as the forecast demand for July. Slide Seven: The third method that can be used to determine the level pattern of a time series is weighted moving average. It is similar to the simple moving average except that each data point in the n most recent time period is weighted differently. This is to allow for the need to give more weight to recent periods. However, besides the number of time periods used in the average and the time series itself, a third input, which is the choice of weights, will be needed before one can apply the weighted moving average method. Slide Eight: To use the weighted 3-month moving average method to predict the demand for July, we first multiply the weight of June (0.5) with June’s actual demand (700), the weight of May (0.3) with the demand for May (900), and the weight of April (0.2) with the demand for April (800). Then we add these products together to give a value of 780. After that we divide 780 by the sum of the weights (i.e., 0.5+0.3+0.2=1) which yields 780 as the forecast for July. Slide Nine: The last method for level pattern prediction is called exponential smoothing. It is similar to the weighted moving average except that the weight of any one period decreases over time. For example, if the weight given to the most recent period is 0.5, the weights associated with the second, third, fourth, and fifth most recent periods are 0.5x0.5=0.25, 0.5x0.5x0.5=0.125, 0.5 to the 4th power=0.063, and 0.5 to the 5th power=0.031 respectively. Exponential smoothing is easier to use than both the simple and weighted moving average, because it requires minimal supporting data. Unlike the simple and weighted moving average which requires n periods of data points and the weights associated with these data points, exponential smoothing needs only three pieces of input data: the actual, the forecast, and the weight of the most recent period. When the forecasting process is first started, the forecast of the current period can be given the same value as the actual. This further reduces the forecaster’s burden to having to collect enough historical data before initiating the forecasting process. The weight of the most recent period is also called the smoothing constant, alpha, and has a value between 0 and 1. The higher the value of alpha, the more weight is given to recent data. Slide Ten: When we use exponential smoothing to predict the demand for July, we need to be given the actual demand for June (700), the forecast for June (705.2) and alpha (0.1). With these given input data, the forecast for July can be computed as 0.1x700+0.9x705.2, which equals 704.7. Thus far, you have learned four forecasting techniques (simple average, simple moving average, weighted moving average, and exponential smoothing) to define the level pattern of a time series. We will show you how to select the right technique for specific business needs in the next set of slides (part 3). Slide Eleven: When there is a gradual upward or downward movement of the data over time or trend, the level forecasting techniques will not be able to respond to such a pattern. As a result, we need to turn to another method that can predict both the level and trend of a time series. Trend-adjusted exponential smoothing is such a method. It is similar to exponential smoothing except that a trend adjustment is added to an exponentially smoothed forecast. The resulting forecast is called forecast including trend (FIT). Two smoothing constants, one for the level (or alpha), the other for the trend (or beta) are required. In addition, three pieces of input data, namely, the actual and forecast figures for the previous period (At-1, Ft-1), and the exponentially smoothed trend for the previous period (Tt-1) are needed before one can use the trend-adjusted exponential smoothing. Slide Twelve: Let us compute the demand for C&A’s product in July using trend-adjusted exponential smoothing. We are given the two smoothing coefficients (alpha is 0.1 and beta is 0.2), June’s forecast (705.2), June’s trend (175), and June’s actual (700). We will compute the exponentially smoothed forecast for July (F7) which is equal to alpha x June’s actual + (1-alpha) x (June’s forecast – June’s trend) or 0.1x700+0.9x(705.2-175), giving us a value of 862.2. Next we need to compute the exponentially smoothed trend for July (T7) which is equal to beta x (July’s forecast – June’s forecast) + (1-beta) x June’s trend or 0.2x(862.2+171.4)+0.8x175, giving us a value of 171.4. The forecast including trend for July is then found by adding F7 and T7 or 862.2+171.4, giving us a value of 1033.6. Slide Thirteen: Seasonality in a time series is exhibited as regular up and down movements in series values that can be related to recurring events such as weather or holidays. There are two models of seasonality: additive and multiplicative. In the additive model, seasonality is incorporated by adding or subtracting a quantity to the series average. In the multiplicative model, seasonality is expressed as a percentage of the series average which is used to multiply the value of a series to incorporate seasonality. The seasonal percentage is called a seasonal index. Slide Fourteen: Let us use an example to illustrate seasonality forecasting. C&A Ski Resort has an average of 1,000 visitors each year. With a major expansion under way, C&A is planning to accommodate 1,500 visitors next year. However, since C&A’s business is highly seasonal, an estimate on seasonal demand will be more useful for their needs than an annual one. We are given seasonal demand data for the past two years to derive the seasonal demand estimates. First we need to figure out the seasonal indexes for each season, which are computed by dividing the actual seasonal demand by the average demand per season. Since we have two years of data, we can compute each season’s indexes for each year. Slide Fifteen: First we need to figure out the seasonal index for each season, which is computed by dividing the actual seasonal demand by the average demand per season. Given that the annual average demand is 1000, the average demand per season is a quarter of 1000, which is 250. Since we are given two years’ seasonal data on actual demand, the actual demand per season can be an average of those 2 years’ figures, yielding a value of 290, 160, 225, 325 for spring, summer, fall, and winter respectively. By dividing each of these four figures by 250, the seasonal index for spring, summer, fall, and winter is found to be 1.16, 0.64, 0.9, and 1.30 accordingly. Slide Sixteen: Next we can compute year 2003’s seasonal demand estimates. The projected seasonal demand for year 2003 is a quarter of 1500, which is 375. The seasonal demand estimates for year 2003 are found by multiplying 375 with that season’s index. Thus, the demand estimates for spring, summer, fall, and winter should be 435, 240, 337.5, and 487.5 respectively. Slide Seventeen: Recall in part 1 that causal models are used to discover the cause-and-effect relationship between a set of causal factors (or independent variables) and the factor to be forecasted (or dependent variable). If the underlying relationship is linear, a causal model called linear regression can produce a best fitted linear equation to relate the dependent variable to the independent variables. Slide Eighteen: The simplest form of linear regression assumes that the dependent variable is related to only one independent variable. In this case, the relationship between the independent variable (Y) and dependent variable (X) can be described by an equation of a straight line (i.e., Y=a+bX, where a is the intercept, and b is the slope of the line). Slide Nineteen: Linear regression finds a value for parameters a and b that minimizes the sum of the squared deviations of the actual data points from the fitted points. The resulting straight line is also called the best fitted or least squares line. The formulas for computing a and b are given on the slide. Slide Twenty: We will use an example to demonstrate how to use linear regression to predict a student’s test score if test score is related to the number of studying hours. We have data on six pairs of studying hours (X) and test scores (Y). In order to compute the intercept and slope of the best fitted line, we compute the values of XY and X2 for each data point as shown in the slide. Slide Twenty-One: The parameters a and b are both found to be 10. Therefore, the equation of the regression line is Y=10+10X. If a student spends 9 hours studying (X=9), his test score will be 10+10*9=100. Slide Twenty-Two: When the dependent variable changes as a result of time, time can be treated as an independent variable. In this case, linear regression is also a viable approach to compute trend for a time series, as shown here in this example where profit is related to the month of the year. Slide Twenty-Three Using the formulas for parameters a and b, the best fitted line is found to be Y=39.6-2.7X. We can use the regression line to predict profits for any month of the year. For example, profit in October can be computed by substituting X by 10 to yield a value of 39.6-27=12.6.