MJK_ch4a

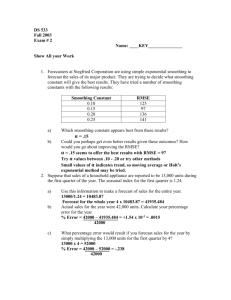

advertisement

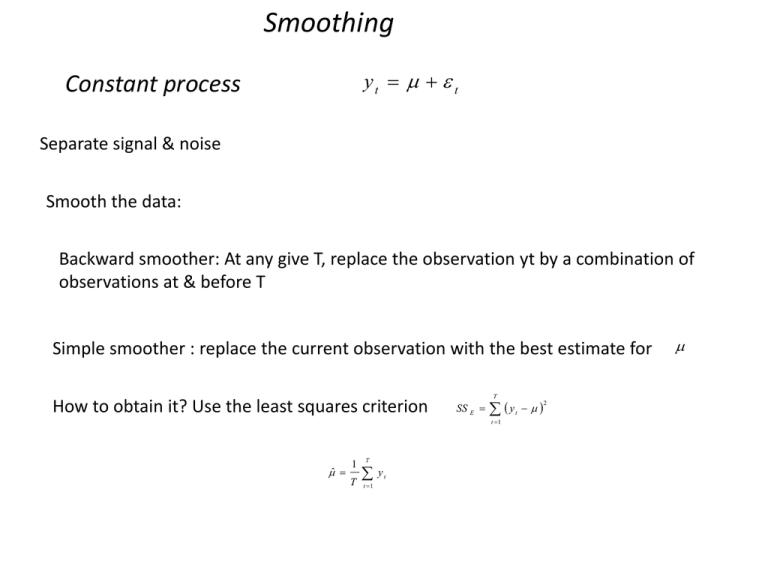

Smoothing

yt t

Constant process

Separate signal & noise

Smooth the data:

Backward smoother: At any give T, replace the observation yt by a combination of

observations at & before T

Simple smoother : replace the current observation with the best estimate for

How to obtain it? Use the least squares criterion

T

SS E

y

t 1

ˆ

1

T

T

t 1

yt

t

2

Not Constant process

Can we use ?

ˆ

1

T

T

yt

t 1

this smoother accumulates more and more data points and gains some sort of inertia

So it cannot react to the change

Obviously, if the process change, earlier data do not carry the information about the it

Use a smoother that disregards the old values and reacts faster to the change

Simple moving average

Simple moving average

MT

y T y T 1 y T N 1

N

Var ( M T )

1

N

N

yt

t T N 1

2

N

Choice of span N:

-If N small :reacts faster to the change

- large N:constant process

The moving averages will be autocorrelated since 2 successive moving averages contain the

same N-1 observations

k

1 N , k N

k 0, k N

First order exponential smoothing

Obtain a smoother that reacts faster to the change

Idea: give geometrically decreasing weights to the past observations

T 1

t

y T 1 y T y T 1 y T 2

2

T 1

y1

t0

However,

T 1

t

t0

1

T

1

Adjust the smoother , by multiplying

~

y T 1

(1 )

1

T

T 1

t y T t

t0

1

y T

y T 1 y T 2

2

T 1

y1

Simple or first order

exponential smoother

2

T 1

~

y T 1 y T 1 T y T 1 y T 1 y T 2

y1

1

1

y

y

T

1

T

~

y T 1

y T 1

yT 2

T 2

y1

First-order exponential smoothing:

linear combination of the current observation & the smoothed observation at the

previous time unit

~

y t 1 y T ~

y T 1

~

y t y T (1 ) ~

y T 1

Discount factor : weight on the last observation

(1 ) : weight on the smoothed value of the previous observations

The initial value

The initial value

2 commonly used estimates of

~

y 0 y1

~

y0 y

~

y0

~

y0

If the changes in the process are expected to occur early & fast

If the process at the beginning is constant

The value of

As gets closer to 1, & more emphasis is given in the last observations : the

smoothed values follow the original values more closely

0:

~

yT ~

y0

1 : ~y T y T

0 .1 0 .4

The smoothed values equal to a constant

The least smoothed version of the original time series

Values recommended

Choice of the smoothing constant:

1

Subjective: depending of willingness to have fast adaptivity or more

rigidity.

2

Choice advocated by Brown (inventor of the method): λ = 0.7

3

Objective: constant chosen to minimize the sum of squared forecast

errors

Use exponential smoothers for model estimation

General class of models

y t f t ; t

yt 0 t

e.g. constant process

T

SS E

y

t

2

t 1

If not all observations have equal influence on the sum : introduce weights that geometrically

decrease in time

T 1

SS

*

E

y

T

T t

0

2

t0

Take the derivative

The solution

For large T

dSS

*

E

d 0

ˆ 0

T 1

2

y

T t

ˆ 0

t0

1

1

T

T 1

T

t

yT t

t0

T 1

t

ˆ 0 (1 ) y T t ~y T

t0

0

Second order exponential smoothing

Linear trend model

y t 0 1t t

t

Uncorrelated with mean 0 & constant variance

2

Use single exponential smoothing: underestimate the actual values

Why?

t

E ~

y T E 1 y T t

t0

1 E ( y T t )

t

t0

Given

E y t 0 1t

t

E ~

y T 1 0 1 (T t )

t0

0 1T 1 1 1 t

t

t

t0

t0

1

E ~

y T 0 1T

1

E yT

1

1

bias

Simple exponential smoother:biased

estimate for the linear trend model

Solutions:

a) Use a large value

1:

1

0

Smoothed values very close to the observed: fails to

satisfactorily smooth the data

b) Use a method based on adaptive updating of the

discount factor

c) Use second order exponential smoothing

Second order exponential smoothing

Apply simple exponential smoothing on

~y

T

(2)

(1 )

(2)

~

y T ~

y T (1 ) ~

y T 1

(1 )

(2)

yˆ T 2 ~

yT ~

yT

Unbiased estimate of yT

2 main issues: choice of initial values for the smoothers& the discount factors

Initial values

1 ˆ

(1 )

~

y 0 ˆ 0 , 0

1, 0

1 ˆ

2

~

y 0 ˆ 0 , 0 2

1, 0

Estimate parameters

through least squares

Holt’s Method

Divide time series into Level and Trend

Lt =λyt +(1−α)(Lt−1+Tt−1)

Tt =β(Lt +Lt-1 )+(1−β)Tt-1

Ft+1=Lt+Tt

yt = actual value in time t

λ = constant-process smoothing constant

β = trend-smoothing constant

Lt = smoothed constant-process value for period t

Tt = smoothed trend value for period t

F

= forecast value for period t + 1

t = current time period

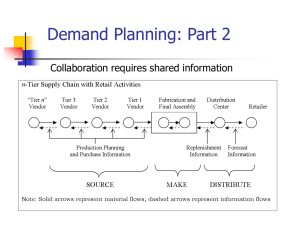

Use exponential smoothers for forecasting

At time T, we wish to forecast observation at time T+1, or at time

yˆ T T

T +t

step ahead forecast

Constant Process

yt 0 t

Can be estimated by the first-order exponential

smoother

yˆ T (T ) ~

yT

Forecast :

At time T+1

0

yˆ T 1 y T 1 1 ~

yT

yˆ T 1 y T 1 1 yˆ T (T )

yˆ T 1 (T ) yˆ T (1) y T 1 yˆ T 1

yˆ T (1) eT (1)

e T (1) y T 1 yˆ T 1 (T )

One-step-ahead forecast error

yˆ T 1 (T ) yˆ T (1) y T 1 yˆ T 1

yˆ T (1) eT (1)

Our forecast for the next observation is our previous forecast for the

current observation plus a fraction of the forecast error we made in

forecasting the current observation

Choice of

Sum of the squared one-step-ahead forecast errors

SS E

T

e 1

2

t 1

t 1

Calculate for various values of

Pick the one that gives the smallest sum of squared forecast errors

Prediction Intervals

Constant process

~

y T Z a ˆ e

2

first-order exponential smoother

~y

T

Za

2

ˆ e

100(1-a/2) percentile of the standard normal distribution

Estimate of the standard deviation of the forecast errors

Linear Trend Process

yˆ T T

step ahead forecast

yˆ T T ˆ 0 ,T ˆ1 ,T T

ˆ 0 ,T ˆ1,T T ˆ1,T

yˆ T ˆ1 ,T

In terms of the exponential smoothers

(1 )

(2)

yˆ T 2 ~y T ~y T

1

~y

(1 )

T

2 ~y T

(2)

(1 )

(2)

2

~y T 1

~y T

1

1

Parameter Estimates

æ

ö

è

ø

b0,T +1 = l (1+ l ) yT +1 + (1- l ) ç b0,T + b1,T ÷

2

b1,T +1 =

l

(b

2-l

0,T +1

)

- b0,T +

2 (1- l )

b1,T

(2 - l )

100(1-α/2) prediction intervals for any lead time τ

æ

ö

æ

ö

l

l

c

t ÷ yT(1) - ç1+

t ÷ yT(2) ± Za /2 t s e

ç2 +

è

è 1- l ø

1- l ø

c1

ci2 = 1+

l é

10 -14 l + 5l 2 ) + 2il ( 4 - 3l ) + 2i 2 l 2 ùû

3 ë(

(2 - l )

Estimation of the variance of the forecast errors, σe2

Assumptions: model correct & constant in time

Apply the model to the historic data & obtain the forecast errors

1 T 2

s = å et (1)

T t=1

2

e

=

2

1 T

yt+1 - yt+1 ( t ))

(

å

T t=1

Update the variance of the forecast errors when have more data

2

s e,T+1

=

2

s e,T+1

=

1

2

Ts e,T

+ eT2+1 (1))

(

T +1

T

1

eTt2 (t ))

å

(

T - t +1 t=t

Define mean absolute deviation Δ

(

D = E e - E ( e)

)

Assuming that the model is correct

DT = d eT (1) + (1- d ) DT -1

s e,T = 1.25DT

Model assessment

Check if the forecast errors are uncorrelated

Sample autocorrelation function of the forecast errors

T -1

åéëe (1) - e ùûéëe (1) - e ùû

t

rk =

t=k

t-k

T -1

åéëe (1) - e ùû

2

t

t=0

Exponential Smoothing for Seasonal data

Seasonal Time Series

Additive Seasonal Model

yt = Lt + St + et

Lt = b0 + b1t

St = St+s = St+2 s =…

Lt: linear trend component

St: seasonal adjustment

s: the period of the length of cycles

εt: uncorrelated with mean zero & constant variance σε2

s

Constraint: å S

t

t=1

=0

Forecasting

- Start from current observation yT

- Update the estimate LT

- Update the estimate of β1

- Update the estimate of St

- τ- step-ahead foreceast

(

)

(

)

LT = l1 yt - ST-s + (1- l1 ) LT-1 + b1,T-1 , 0 < l1 <1

b1,T = l2 ( LT - LT-1 ) + (1- l2 ) b1,T-1, 0 < l2 <1

(

)

ST = l3 yT - LT + (1- l3 ) ST-s , 0 < l3 <1

yT+t (T ) = LT + b1,T t + ST (t - s)

Estimate the initial values of the smoother

Use least-squares

s-1

yt = b 0 + b1t + åg i ( I t,i - I t,s ) + et

i=1

I t,i = {

1, t=i,i+s,i+2s

0, otherwise

b0,0 = L0 = b 0

b1,0 = b1

S j-s = g j ,1 £ j £ s -1

s-1

S0 = -åg j

j=1

Exponential Smoothing for Seasonal data

Seasonal Time Series

Multiplicative Seasonal Model

yt = Lt St + et

Lt = b0 + b1t

St = St+s = St+2 s =…

Lt: linear trend component

St: seasonal adjustment

s: the period of the length of cycles

εt: uncorrelated with mean zero & constant variance σε2

s

Constraint: å S

t

t=1

=0

Forecasting

- Start from current observation yT

- Update the estimate LT

- Update the estimate of β1

- Update the estimate of St

- τ- step-ahead foreceast

(

)

(

)

LT = l1 yt / ST-s + (1- l1 ) LT-1 + b1,T-1 , 0 < l1 <1

b1,T = l2 ( LT - LT-1 ) + (1- l2 ) b1,T-1, 0 < l2 <1

(

)

ST = l3 yT / LT + (1- l3 ) ST-s , 0 < l3 <1

yT+t (T ) = LT + b1,T t + ST (t - s)

Estimate the initial values of the smoother

From the historical data, obtain the initial values

b0,0 = L0 =

yn - y1

1 is

, yi =

å yt

(n -1)s

s t=(i-1)2+1

s

2

S *j

b1,0 = y1 - b 0,0

S j-s = s

s

åS

,1 £ j £ s

*

i

i=1

S 0* =

n

y(t-1)s+ j

1

å

n t=1 yt - ((s +1) / 2 - j)b 0