Safety stock - Kellogg School of Management

advertisement

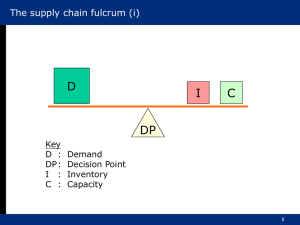

Supply Chain Management Managing the Supply Chain Key to matching demand with supply Cost and Benefits of inventory Economies of Scale Inventory management of a retailer: EOQ + ROP Levers for improvement Safety Stock Hedging against uncertainty Role of lead time Improving Performance Centralization & Pooling efficiencies Postponement Accurate Response What is a Supply Chain? The Procurement or supply system Raw Material supply points Movement/ Transport The Operating System Raw Material Movement/ Storage Transport The Distribution System Manufacturing PLANT 1 PLANT 2 PLANT 3 Movement/ Transport Finished Goods Movement/ Storage Transport WAREHOUSE WAREHOUSE WAREHOUSE A B C MARKETS What makes a “good” Supply Chain? Corporate Finance CISCO SELECTRON Current Assets BS/ 2000 BS/2000 Cash & Equivalents 4,234 1,475.5 Short-term investments 1,291 958.6 AR 2,299 2,146.3 Inventories 1,232 Deferred Income 2,054 260.5 Total Current Assets 11,110 8,628.2 %11 3,787.3 %44 Inventories represent about %34 of current assets for a typical company in the US; %90 of working capital. For each dollar of GNP in the trade and manufacturing sector, about 40cents worth of inventory was held. Average logistics cost = 21c/dollar = %10.5 of GNP. Another example of financial flows at the corporate level: Mobile Handsets Data: – End of quarter inventory position from 10Q statements – Sales from income statement (smooth 9month avg.) How can financial flows help explain the difference in performance during the downturn? Nokia ($M) Inventory Sales per month (9 month avg) Time (months) Ericson ($M) Inventory Sales per month (9 month avg) Time (months) Motorola ($M) Inventory Sales per month (9 month avg) Time (months) 1999 12/31/99 $ 1,786 $ 1,437 1.24 $ 3,016 $ 486 6.20 $ 3,707 $ 1,088 3.41 3/31/00 $ 1,925 $ 1,437 1.34 $ 4,031 $ 486 8.29 $ 4,688 $ 1,088 4.31 2000 6/30/00 9/30/00 $ 2,290 $ 2,062 $ 1,437 $ 1,437 1.59 1.43 $ 4,612 $ 4,984 $ 486 $ 486 9.48 10.25 $ 5,446 $ 5,557 $ 1,088 $ 1,088 5.01 5.11 12/31/00 $ 2,014 $ 1,437 1.40 $ 4,671 $ 486 9.60 $ 5,242 $ 1,088 4.82 3/31/01 $ 1,985 $ 1,692 1.17 $ 4,667 $ 245 19.02 $ 4,533 $ 830 5.46 2001 6/30/01 $ 1,622 $ 1,692 0.96 $ 2,947 $ 245 12.01 $ 3,842 $ 830 4.63 9/30/01 $ 1,774 $ 1,692 1.05 $ 2,647 $ 245 10.79 $ 3,250 $ 830 3.91 4 Mobile Handsets: How explain the difference in performance? $6B Inventory Flow Time 20wks 18 $5B 16 Motorola $4B 14 Ericson 12 Ericson $3B 10 8 $2B Motorola 6 $1B Nokia 4 2 $- Nokia 0 8/28/99 12/6/99 3/15/00 6/23/00 10/1/00 1/9/01 4/19/01 7/28/01 11/5/01 8/28/99 12/6/99 3/15/00 6/23/00 10/1/00 1/9/01 4/19/01 7/28/01 11/5/01 5 Solectron’s executive officer compensation plan • Base compensation • Bonuses – “The Bonus Plan provides for incentive compensation ... based on certain worldwide, site and individual performance measures. Worldwide and site performance are measured based on targets w.r.t. profit before taxes, inventory turns, days sales outstanding and return on assets. The Compensation Committee believes that these factors are indicative of overall corporate performance and shareholder value.” [compensation committee report FY 96] • Long Term Incentive Compensation Supply Chain Metrics Costs of not Matching Supply and Demand • Cost of overstocking – liquidation – obsolescence – holding • Cost of under-stocking – lost sales and customer goodwill – lost margin Why hold Inventory? • Economies of scale – Fixed costs of ordering/manufacturing – Quantity discounts – Trade Promotions Cycle/Batch stock • Uncertainty – Information Uncertainty – Supply/demand uncertainty • Seasonal Variability • Strategic – Flooding, availability Safety stock Seasonal stock Strategic stock Cost of Inventory • Physical holding cost (out-of-pocket) • Financial holding cost (opportunity cost) • Low responsiveness – to demand/market changes – to supply/quality changes Holding cost (H) Costs Associated with Batches • Ordering costs (S) – Changeover of production line (Set-up) – Transportation (Delivery) – Receiving • Holding costs (H = r C) – Physical holding cost – Cost of capital (r) – Cost of obsolescence Palü Gear: Retail Inventory Management Annual jacket revenues at a Palü Gear retail store are roughly $1M. Palü jackets sell at an average retail price of $325, which represents a mark-up of 30% above what Palü Gear paid its manufacturer. Being a profit center, each store made its own inventory decisions and was supplied directly from the manufacturer by truck. For each order up to 5000 jackets, the manufacturer charges a flat fee of $2,200 for delivery. To exploit economies of scale, stores typically orders 1500 jackets each time it places an order. (Palü’s cost of capital is approximately 20%.) What order size would you recommend for a Palü store in current supply network? Palü Gear: Evaluation of current policy of ordering 1500 units each time 1. What is average inventory I? I= Annual cost to hold one unit H = Annual cost to hold I = 2. How often do we order? Annual throughput R = # of orders per year = Annual order cost = 3. What is total cost? TC = Can we do better ? Find the most economical order quantity Method 1 : Enumerate Number of units Number of per order/batch Batches per Q Year: R/Q 50 62 100 31 150 21 200 15 250 12 300 10 350 9 400 8 450 7 500 6 510 6 520 6 530 6 540 6 550 6 600 5 650 5 700 4 750 4 800 4 850 4 900 3 1000 3 Annual Setup Cost $ 135,385 $ 67,692 $ 45,128 $ 33,846 $ 27,077 $ 22,564 $ 19,341 $ 16,923 $ 15,043 $ 13,538 $ 13,273 $ 13,018 $ 12,772 $ 12,536 $ 12,308 $ 11,282 $ 10,414 $ 9,670 $ 9,026 $ 8,462 $ 7,964 $ 7,521 $ 6,769 Annual Holding Cost $ 1,250 $ 2,500 $ 3,750 $ 5,000 $ 6,250 $ 7,500 $ 8,750 $ 10,000 $ 11,250 $ 12,500 $ 12,750 $ 13,000 $ 13,250 $ 13,500 $ 13,750 $ 15,000 $ 16,250 $ 17,500 $ 18,750 $ 20,000 $ 21,250 $ 22,500 $ 25,000 Annual Total Cost $ 136,635 $ 70,192 $ 48,878 $ 38,846 $ 33,327 $ 30,064 $ 28,091 $ 26,923 $ 26,293 $ 26,038 $ 26,023 $ 26,018 $ 26,022 $ 26,036 $ 26,058 $ 26,282 $ 26,664 $ 27,170 $ 27,776 $ 28,462 $ 29,214 $ 30,021 $ 31,769 $160,000 Setup Cost $140,000 Holding Cost $120,000 Total Cost $100,000 $80,000 $60,000 $40,000 $20,000 $0 100 200 300 400 500 600 700 800 900 1000 Order (batch) size Q Economies of Scale: Inventory Build-Up Diagram R: Annual demand rate (units/yr), Q: Number of jackets per replenishment order • Number of orders per year = R/Q. • Average number of jackets in inventory = Q/2 . Inventory T = Q/R Q R = Demand rate T time between orders Order placed, Order placed, arrives immediately Lead time=0 arrives immediately Lead time=0 Time t Economic Order Quantity EOQ R S H Q : Demand per year, : Setup or Order Cost ($/setup; $/order), : Marginal annual holding cost ($/per unit per year), H : Order quantity. 2SR QEOQ H C r : Cost per unit ($/unit), : Cost of capital (% / yr), =rC Total annual costs 2 SRH H Q/2: Annual holding cost S R /Q:Annual setup cost QEOQ Batch Size Q What do we learn from the EOQ formula ? How does the ordering policy change if … The product is a success and the demand picks up, now we are selling 4 times the original demand… The interest rates double up, so does our unit inventory holding costs … After investing in IT, we manage to reduce our fixed ordering cost by half … Optimal Economies of Scale: For a Palü Gear retailer R = 3077 units/ year r = 0.20/year C = $ 250 / unit S = $ 2,200 / order Unit annual holding cost = H = $50/unit-yr Optimal order quantity = EOQ = 520 units Number of orders per year = R/Q = 3077/520 = 5.91 Time between orders = Q/R = 8.78 weeks Annual order cost = (R/Q)S = $13,018/yr Average inventory I = Q/2 = 260 units Annual holding cost = (Q/2)H = $13,018/yr Take-Aways I Batching & Economies of Scale • Increasing batch size of production (or purchase) increases average inventories (and thus cycle times). • Average inventory for a batch size of Q is Q/2. • The optimal batch size trades off setup cost and holding cost. • To reduce batch size, one has to reduce setup cost (time). • Square-root relationship between Q and (R, S): – If demand increases by a factor of 4, it is optimal to increase batch size by a factor of 2 and produce (order) twice as often. – To reduce batch size by a factor of 2, setup cost has to be reduced by a factor of 4. Role of Supply Leadtime L: Palü Gear cont. • The lead time from when a Palü Gear retailer places an order to when the order is received is two weeks. If demand is stable as before, when should the retailer place an order? • I-Diagram: ROP Order 2wks placed ROP = Order arrives Two Key Decisions of Inventory Management 1. How much to order ? Answer: EOQ 2. When to place an order ? Answer: ROP Reorder Point represents the amount of inventory on hand when we place a new order . Delivery Lead Time = 0 (Instantaneous Delivery) then ROP = ……. Delivery Lead Time > 0 then ROP = ……. ROP is driven by: Delivery Lead Time Demand Uncertainty Customer Service Level A Key to Matching Supply and Demand When would you rather place your bet? A A: B: C: D: B A month before start of Derby The Monday before start of Derby The morning of start of Derby The winner is an inch from the finish line C D Demand uncertainty and forecasting Year • 1 • 2 • 3 • 4 • 5 • 6 Demand 323 258 303 304 284 285 Forecast Error Demand uncertainty and forecasting • Forecasts depend on – historical data – “market intelligence” • Forecasts are usually (always?) wrong. • A good forecast has at least 2 numbers (includes a measure of forecast error, e.g., standard deviation). • The forecast horizon must at least be as large as the lead time. The longer the forecast horizon, the less accurate the forecast. • Aggregate forecasts tend to be more accurate. Palü Gear: Service levels & Inventory management • In reality, a Palü Gear store’s demand fluctuates from week to week. In fact, weekly demand at each store had a standard deviation of about 30 jackets assume normally distributed. Recall that average weekly demand was about 60 jackets; the order lead time is 2 weeks; fixed order costs are $2,200/order and it costs $50 to hold one jacket in inventory during one year. • Questions: 1. If the retailer uses the ordering policy discussed before (ROP =120), what will the probability of running out of stock in a given cycle be? 2. The Palü retailer would like the stock-out probability to be smaller. How can she accomplish this? 3. Specifically, how does it get the service level up to 95%? Example: say we increase ROP to 140 (and keep order size at Q = 520) 1. On average, what is the stock level when the replenishment arrives? 2. What is the probability that we run out of stock before a delivery arrives? 3. How do we get that stock-out probability down to 5%? Lead Time Demand Consider the lead time between the placement of an order and the arrival of the order. L=2 weeks. Demand per week, R ~ (60, 30) The mean demand during the lead time = 2*60 = 120 Standard deviation of demand during lead time = = (30)2 + (30)2 30 2 D lead time ~ N (120, 30 2 ) IF ROP=120 Probability of stock out (i.e., Probability that the demand during lead time is greater than 120 ) = ? Lead time demand distribution 120 Mean Demand During Lead Time SAFETY STOCK Safety stock increase with the service level. Increase reorder point above average demand during lead time, lower the probability of stockout! BETTER SERVICE LEVEL! e.g., % 95 ROP Less demand variability Small variance / SD %95 ROP 120 Safety stock increases with the variance (SD) of lead time demand Higher Variability Larger SD/ variance %95 120 ROP Safety Stock I s z*R L Safety stock increases (decreases) with an increase (decrease) in: • demand variability or forecast error, • delivery lead time for the same level of service, • delivery lead time variability for the same level of service. Palü Gear: Determining the required Reorder Point for 95% service DATA: R = 60 jackets/ week H = $50 / jacket, year S = $ 2,200 / order R = 30 jackets/ week standard deviation of weekly demand L = 2 weeks QUESTION: What should safety stock be to insure a desired cycle service level of 95%? ANSWER: 1. Determine lead time demand = 42.42 2. Required # of standard deviations z* = 1.64 3. Reorder Point = 120+1.64*42.42= 190 jackets 4. Safety stock Is = 1.64*42.42=70 jackets Review of Probability The standard normal distribution F(z) • Transform X = N(m,) to z = N(0,1) z = (X - m) / . F(z) = Prob ( N (0,1) < z) F(z) 0 • Transform z back, knowing z*: X* = m + z*. z 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 3.0 3.1 3.2 3.3 0.00 0.5000 0.5398 0.5793 0.6179 0.6554 0.6915 0.7257 0.7580 0.7881 0.8159 0.8413 0.8643 0.8849 0.9032 0.9192 0.9332 0.9452 0.9554 0.9641 0.9713 0.9772 0.9821 0.9861 0.9893 0.9918 0.9938 0.9953 0.9965 0.9974 0.9981 0.9987 0.9990 0.9993 0.9995 0.01 0.5040 0.5438 0.5832 0.6217 0.6591 0.6950 0.7291 0.7611 0.7910 0.8186 0.8438 0.8665 0.8869 0.9049 0.9207 0.9345 0.9463 0.9564 0.9649 0.9719 0.9778 0.9826 0.9864 0.9896 0.9920 0.9940 0.9955 0.9966 0.9975 0.9982 0.9987 0.9991 0.9993 0.9995 0.02 0.5080 0.5478 0.5871 0.6255 0.6628 0.6985 0.7324 0.7642 0.7939 0.8212 0.8461 0.8686 0.8888 0.9066 0.9222 0.9357 0.9474 0.9573 0.9656 0.9726 0.9783 0.9830 0.9868 0.9898 0.9922 0.9941 0.9956 0.9967 0.9976 0.9982 0.9987 0.9991 0.9994 0.9995 0.03 0.5120 0.5517 0.5910 0.6293 0.6664 0.7019 0.7357 0.7673 0.7967 0.8238 0.8485 0.8708 0.8907 0.9082 0.9236 0.9370 0.9484 0.9582 0.9664 0.9732 0.9788 0.9834 0.9871 0.9901 0.9925 0.9943 0.9957 0.9968 0.9977 0.9983 0.9988 0.9991 0.9994 0.9996 0.04 0.5160 0.5557 0.5948 0.6331 0.6700 0.7054 0.7389 0.7704 0.7995 0.8264 0.8508 0.8729 0.8925 0.9099 0.9251 0.9382 0.9495 0.9591 0.9671 0.9738 0.9793 0.9838 0.9875 0.9904 0.9927 0.9945 0.9959 0.9969 0.9977 0.9984 0.9988 0.9992 0.9994 0.9996 0.05 0.5199 0.5596 0.5987 0.6368 0.6736 0.7088 0.7422 0.7734 0.8023 0.8289 0.8531 0.8749 0.8944 0.9115 0.9265 0.9394 0.9505 0.9599 0.9678 0.9744 0.9798 0.9842 0.9878 0.9906 0.9929 0.9946 0.9960 0.9970 0.9978 0.9984 0.9989 0.9992 0.9994 0.9996 0.06 0.5239 0.5636 0.6026 0.6406 0.6772 0.7123 0.7454 0.7764 0.8051 0.8315 0.8554 0.8770 0.8962 0.9131 0.9279 0.9406 0.9515 0.9608 0.9686 0.9750 0.9803 0.9846 0.9881 0.9909 0.9931 0.9948 0.9961 0.9971 0.9979 0.9985 0.9989 0.9992 0.9994 0.9996 0.07 0.5279 0.5675 0.6064 0.6443 0.6808 0.7157 0.7486 0.7794 0.8078 0.8340 0.8577 0.8790 0.8980 0.9147 0.9292 0.9418 0.9525 0.9616 0.9693 0.9756 0.9808 0.9850 0.9884 0.9911 0.9932 0.9949 0.9962 0.9972 0.9979 0.9985 0.9989 0.9992 0.9995 0.9996 0.08 0.5319 0.5714 0.6103 0.6480 0.6844 0.7190 0.7517 0.7823 0.8106 0.8365 0.8599 0.8810 0.8997 0.9162 0.9306 0.9429 0.9535 0.9625 0.9699 0.9761 0.9812 0.9854 0.9887 0.9913 0.9934 0.9951 0.9963 0.9973 0.9980 0.9986 0.9990 0.9993 0.9995 0.9996 0.09 0.5359 0.5753 0.6141 0.6517 0.6879 0.7224 0.7549 0.7852 0.8133 0.8389 0.8621 0.8830 0.9015 0.9177 0.9319 0.9441 0.9545 0.9633 0.9706 0.9767 0.9817 0.9857 0.9890 0.9916 0.9936 0.9952 0.9964 0.9974 0.9981 0.9986 0.9990 0.9993 0.9995 0.9997 Safety Stocks Inventory on hand I(t) EOQ EOQ order order order ROP R mean demand during supply lead time: m=RL Is I safety stock s 0 Time t L L L Comprehensive Financial Evaluation: Inventory Costs of Palü Gear 1. Cycle Stock (Economies of Scale) 1.1 Optimal order quantity 1.2 # of orders/year = = 1.3 Annual ordering cost per store = $13,009 1.4 Annual cycle stock holding cost. = $13,009 2. Safety Stock (Uncertainty hedge) 2.1 Safety stock per store = 70 2.2 Annual safety stock holding cost = $3,500 3. Total Costs for 5 stores = 5 (13,009 + 13,009 + 3,500) = 5 x $29,500 = $147.5K. How to find service level (given ROP)? How to find re-order point (given SL)? • • • 1. 2. L = Supply lead time, D =N(R, R) = Demand per unit time is normally distributed with mean R and standard deviation R DL =N(m, ) = Demand during the lead time is normally distributed with mean m = RL and standard deviations R L Given ROP, find SL = Cycle service level = P(stock out) = P(demand during lead time >ROP) = 1-F(z*= (ROP- m)/) [use table] = 1- NORMDIST(ROP, m, , True) [or Excel] Given SL, find ROP = m + Is = m + z* [use table to get z* ] = NORMINV(1-SL, m, ) [or Excel] Safety stock Is = z* Reorder point ROP = m + Is Take-Aways II Demand Uncertainty & Inventory Management Cycle Cost : EOQ: How much to order? Balance the fixed costs of ordering with the average inventory holding cost. Total Cycle Cost are quiet robust to misestimating the parameters Growth brings scale economies, adjust operating policies as markets conditions change. Safety Stock Cost: Reorder Point : When to place an order? Uncertainty is nothing but forecasting error. Determined by the Service Level P(D(lead time)>ROP) ROP=RxL+Safety Stock Improving The Supply Chain How can we reduce supply chain costs without sacrificing customer service? How can we improve customer service without increasing supply chain costs? Distribution Centralization Product Postponement (HP) Process Postponement (Benetton) Capacity Analysis (Benetton) Improving Supply Chain Performance: 1. The Effect of Pooling/Centralization Decentralized Distribution Is=100 Centralization Distribution Is=100 Is=400 Is= 400 Is=100 Is=100 Centralized vs. Decentralized Distribution Pros Cons Palü Gear’s Internet restructuring: Centralized inventory management Weekly demand per store = 60 jackets/ week with standard deviation = 30 / week H = $ 50 / jacket, year S = $ 2,200 / order Supply lead time L = 2 weeks Service level : 95% availability. Palü Gear now is considering restructuring to an Internet store. So 5 local stores will be closed and a National DC will be opened to distribute direct to customers. Compare the safety stock in the decentralized and centralized systems Decentralized Demand R per week for each store ms60 s30 Demand during Supplier lead time (L=2) mltd ltd Safety Stock for each store (%95 availability) Centralized – 5 stores Demand R per week for the centralized warehouse mc c Demand During Supplier Lead Time (L=2) mltd ltd Safety Stock for the centralized warehouse (%95 availability) Total Safety Stock Palü Gear’s Internet restructuring: comprehensive financial inventory evaluation 1. Cycle Stock (Economies of Scale) 1.1 Optimal order quantity 1.2 # of orders/year = = 1.3 Annual ordering cost of e-store = $29,089 1.4 Annual cycle stock holding cost = $29,089 2. Safety Stock (Uncertainty hedge) 2.1 Safety stock for e-store = 2.2 Annual safety stock holding cost = $7,800. 3. Total Costs for consolidated e-store = 29,089 + 29,089 + 7,800 = $65,980 Learning Objectives: centralization/pooling Different methods to achieve pooling efficiencies: – – – – Physical centralization Information centralization Specialization Raw material commonality (postponement/late customization) Cost savings are sqrt(# of locations pooled). Improving Supply Chain Performance: 2. Postponement & Commonality (HP Laserjet) Generic Power Production Unique Power Production Transportation Europe Process I: Unique Power Supply N. America Europe Process II: Universal Power Supply Make-to-Stock N. America Push-Pull Boundary Make-to-Order Benetton’s Production and Distribution Network Tailored Inventories: Postponement • Simple solution – Produce all garments as Greige goods (Production cost is 10% higher) • Tailored solution – Base load manufactured from colored thread (cheaper but long lead time sourcing) – Safety stock held as Greige goods and manufactured on demand (10% more expensive but short lead times) Process Postponement Dyeing 2 wks Knitting 2 wks Make to Stock Dyeing 2 wks Dye to Order Postponement and Re-assortment: The Advantage to Forecasting Actual total sales 4000 4000 4000 3500 3500 3500 3000 3000 3000 2500 2500 2500 2000 2000 2000 1500 1500 1500 1000 1000 1000 500 500 500 0 0 0 0 500 1000 1500 2000 2500 3000 3500 4000 Initial Forecast 0 500 1000 1500 2000 2500 3000 3500 4000 0 Updated Forecast after observing 20% of sales Each data point represents the forecast and the actual season sales for a particular item (at the style-color level). 500 1000 1500 2000 2500 3000 3500 4000 after 80% Benetton: Two types of Production Capacities Speculative Capacity Long Lead Time cheap Commit before observing the demand Gamble! Reactive Capacity Short Lead Time - expensive Commit after observing the early sales data How do we decide on the size of the speculative capacity? Optimal Service Level and Accurate Response to Demand Uncertainty when you can order only once: • Palü Gear’s is planning to offer a special line of winter jackets, especially designed as gifts for the Christmas season. Each Christma-jacket costs the company $250 and sells for $450. Any stock left over after Christmas would be disposed of at a deep discount of $195. Marketing had forecasted a demand of 2000 Christmas-jackets with a forecast error (standard deviation of 500) How many jacketsDemand should Palü Gear’s order? forecast for Christmas jackets 18% 16% 16% 14% 16% 13% 12% 13% 10% 10% 10% 8% 6% 6% 6% 4% 2% 3% 3% 1% 1% 0% 800 1000 1% 1200 1400 1600 1800 2000 2200 2400 2600 2800 3000 1% 3200 Optimal Service Level and Accurate Response: with Excel (1) Performance for a given order Q, say Q = 2000 Stock: 2000 Demand Probability of Demand units sold 800 1000 1200 1400 1600 1800 2000 2200 2400 2600 2800 3000 3200 1% 1% 3% 6% 10% 13% 16% 16% 13% 10% 6% 3% 1% 800 1000 1200 1400 1600 1800 2000 2000 2000 2000 2000 2000 2000 1825.6 Expected: units units overstock understock 1200 1000 800 600 400 200 0 0 0 0 0 0 0 141.6 0 0 0 0 0 0 0 200 400 600 800 1000 1200 240.0 Profit 94000 145000 196000 247000 298000 349000 400000 400000 400000 400000 400000 400000 400000 357331 Optimal Service Level and Accurate Response : with Excel (2) Performance for all possible Q Order size Q Probability Demand = Q 1000 1001 1200 1400 1600 1800 2000 2200 2400 2600 2800 2999 3000 2% 2% 3% 6% 10% 13% 16% 16% 13% 10% 6% 5% 12% 21% 34% 50% 66% 79% 88% 95% 3% 98% Cumulative Expected Expected Expected P (Demand < Q ) units sold units overstock units understock = F(Q) 983.6 984.6 1177.4 1364.8 1540.2 1696.2 1825.6 1924.0 1991.2 2032.0 2053.3 2062.6 2062.7 0.0 0.0 2.9 12.2 33.6 74.3 141.6 240.0 369.4 525.4 700.8 887.2 888.2 1082.0 1081.0 888.2 700.8 525.4 369.4 240.0 141.6 74.3 33.6 12.2 3.0 2.9 Expected Profit $ $ $ $ $ $ $ $ $ $ $ $ $ 196,721 196,914 235,323 272,291 306,184 335,142 357,331 371,593 377,929 377,496 372,126 363,726 363,683 200 -55 Towards the newsboy model Suppose you placed an order of 2000 units but you are not sure about whether you should have ordered one more unit. What is the contribution of ordering an additional unit? Marginal Benefit Earn a margin (p-c) = B with propability (1-p)= P(D>2000) P = .. Marginal Cost Incur an overage cost of (c-s) = C with probability p = P(D<=2000) P = ….. Expected contribution of an additional unit E(P) = ……………….. So? ... Order more? Accurate Response: The newsboy model In general: at the optimal Q E(P) <= 0 – no incentives to order more (1-p)B = Sell pC Do not sell Equivalently, choose the smallest Q such that p = P(D<Q) = F(Q) >= B / Example: • Critical fractile B / (B+C) = 230 220 (B+C) 210 o 200 Expected 190 Profit ($k) 180 170 160 150 140 130 u Order/Stock 120 Quantity Q 10001200140016001800200022002400260028003000 • Find Q by rounding up! Q= - C = - 55 + 200 = C Accurate response: Find optimal Q from newsboy model Cost of overstocking by one unit = C – the out-of-pocket cost per unit stocked but not demanded – “Say demand is one unit below my stock level. How much did the one unit overstocking cost me?” E.g.: purchase price - salvage price. Cost of understocking by one unit = B – The opportunity cost per unit demanded in excess of the stock level provided – “Say demand is one unit above my stock level. How much could I have saved (or gained) if I had stocked one unit more?” E.g.: retail price - purchase price. Given an order quantity Q, increase it by one unit if and only if the expected benefit of being able to sell it exceeds the expected cost of having that unit left over. Marginal Analysis: Order more as long as F(Q) < B / (B + C) = smallest Q such that service level F(Q) > critical fractile B / (B + C) Where else do you find newsboys? Benefits: Flexible Spending Account decision ATM Perishable Products (Newspaper, Medical Supplies, Fashion Goods) Weddings, Conferences… SUPPLY CHAIN MANGEMENT Implications: Economies of Scale Goal of a Supply Chain Match Demand with Supply It is hard … Why? Manage the trade-off between Ordering cost and Inventory Holding Cost Q*= 2 SR H •Growth brings economies of scale, hence should reflect that into ordering decisions. •To reduce the order size n times, One has to cut the fixed cost per order by n2 times (the square root formula!) Hard to Anticipate Demand Forecasts are wrong… why? There is lead time… why there is lead time? Lead time (flow time) = Activity time+ Waiting Time Because there is waiting time.. Why there is waiting time? There is inventory in the SC (Little’s Law) • As long as you are in the flat region you are doing fine. ROP & Rules of Forecasting Uncertainty~ Probability Distribution (Mean, SD) Demand Uncertainty During Lead Time (L) Shorter Horizon less Uncertainty Aggregate Forecasts, less uncertain Why do we hold inventory? Uncertainty Forecast Error Safety Stock Is= zR L How do we deal with uncertainty? Implications: Is z (service level appropriate) Balance overstocking and understocking Newsboy Problem … Critical Fractile = 1- P(stockout) Reduce Lead time Reduce R How do we deal with it? Customer Demand Uncertainty Normal Variations… Where does R come from? Bullwhip Effect Causes •Demand Signaling •Rationing •Batching •Promotions Aggregation •Physical •Information •Specialization •Component Commonality •Postponement How do we deal with it? •Make the SC more visible •Align Incentives