Valuation methods

advertisement

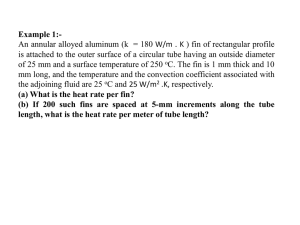

FIN Valuation methods An overview For details, see “Finance for Strategic Decision Making,” by M. P. Narayanan & Vikram Nanda, Published by Jossey-Bass ©2006 M. P. Narayanan Methodologies FIN Comparable multiples P/E multiple Market to Book multiple Price to Revenue multiple Enterprise value to EBITDA multiple Discounted Cash Flow (DCF) NPV, IRR, or EVA based methods WACC method CF to Equity method ©2006 M. P. Narayanan 2 Understanding Value FIN In the context of valuing companies, it is important to understand what we mean by value. From an economic perspective, value is the present value of future free cash flows (FCF) expected to be produced by the company, discounted at the weighted average cost of capital (WACC) that reflects the risk of the cash flows. For a definition of free cash flow, see cash flow template later For an understanding of the WACC, see conceptual diagram later ©2006 M. P. Narayanan 3 Understanding Value FIN This value, is often called the “Economic Value” or “Market Value” of the company. Let us first clearly understand the differences between Economic value of the company Accounting or book value of the company ©2006 M. P. Narayanan 4 Understanding Value: Book Value FIN Consider a company whose balance sheet is shown on the next page. The important points to note are: Fixed assets represent the investment in property, plant and equipment, minus the depreciation Cash is cash on hand Accounts receivable is the amount due from customers. It is an interest free loan to customers. Accounts payable is the amount owed to suppliers. It is an interest free loan from suppliers. Accrued expenses are amounts owed to employees, government, etc. It is also an interest free loan. Financial investments include holdings in other companies. ©2006 M. P. Narayanan 5 FIN Understanding Value: Book Value Accounting Balance Sheet Fixed assets $1500 Current assets Cash Marketable securities & financial investments Current liabilities Short-term debt $150 $200 Payable $320 $150 Accrued expenses Inventory $350 Noncurrent liabilities Receivable $400 Long-term debt Equity $2600 ©2006 M. P. Narayanan $80 $1000 $1050 $2600 6 Understanding Value: Book Value FIN Finally the Shareholder funds in an accounting balance sheet (called the book value of equity) is the amount of equity capital invested in the company. This includes The original equity capital invested when the company was started. Additional equity invested in the company through subsequent external equity financings minus any equity repurchases. Profits reinvested in the company. It is important to understand that the value of equity in the accounting balance sheet is NOT what the shareholders can obtain if they sold the company and paid off all the debt. ©2006 M. P. Narayanan 7 Understanding Value: Book Value FIN Before we relate the accounting balance sheet to economic values, we slightly reconfigure the accounting balance sheet. The cash on hand is decomposed into “operating cash” and “excess cash”. Operating cash is the cash required for working capital purposes. It is determined by the company’s cash budgeting process. “Excess cash” is cash that is not required for working capital purposes. It is presumably kept for strategic reasons In this example, we assume that $25 cash is required for operating purposes. Remaining cash ($175) is “Excess cash.” ©2006 M. P. Narayanan 8 FIN Understanding Value: Book Value Marketable securities and financial investments are taken out of current assets which is now re-labeled as “current operating assets.” If there are any interest-bearing current liabilities, they are left on the sources side of the balance sheet. Remaining items are re-labeled as “current operating liabilities.” ©2006 M. P. Narayanan 9 Understanding Value: Book Value FIN Accounting Balance Sheet: Reconfigured Sources Uses Fixed assets $1500 Excess Cash $175 Marketable securities & financial investments $150 Working capital Current operating assets Operating cash 25 Inventory $350 Receivable $400 Current operating liabilities Payable Accrued expenses ($320) ($80) $2200 ©2006 M. P. Narayanan Short-term debt $150 Long-term debt $1000 Equity $1050 $2200 10 Understanding Value: Book Value FIN The total capital (on which a return must be provided) raised by the company is $2200: Short-term debt = $150 Long-term debt = $1000 Equity = $1050 Note that accounts payable and accrued expenses are not included as they are not interest-bearing liabilities. ©2006 M. P. Narayanan 11 FIN Understanding Value: Book Value This capital is used to Acquire fixed assets = $1500 Invest in working capital = $375 Acquire financial holdings in other companies and invest in excess cash and marketable securities (possibly for future investment needs) = $325 Note that working capital is the difference between current operating assets and current operating liabilities. ©2006 M. P. Narayanan 12 FIN Understanding Value: Economic Value Using the reconfigured accounting balance sheet as a model, we can now create an economic balance sheet. The main difference is that Values in the accounting balance sheet represent what has been invested. Values in the economic balance sheet represent the current value of what has been invested. The goal of companies is to ensure that the economic value exceeds the accounting value!! ©2006 M. P. Narayanan 13 FIN Understanding Value: Economic Value Economic Balance Sheet Free CF @ WACC $2500 Short-term debt 150 Excess Cash $175 Long-term debt $1000 Marketable securities & financial investments $150 Equity $1675 $2825 $2825 Enterprise value ©2006 M. P. Narayanan 14 FIN Understanding Value: Economic Value Fixed assets and working capital in the accounting balance sheet have been replaced by the present value of the free cash flow they are expected to generate in the future ($2500). This figure is just an assumed number. This is the economic value of the operations of the company and is often called Enterprise Value. Excess cash and marketable securities are usually valued the same as in the accounting balance sheet as their values are unlikely to be different. Financial investments should be valued at market It is assumed in this example that the market and book values are the same. ©2006 M. P. Narayanan 15 FIN Understanding Value: Economic Value The total value of the company is: Enterprise Value + Excess cash + Marketable securities + Financial investments In this example it is assumed the economic value of the debt is the same as in the accounting balance sheet. This is more likely to be true for short-term debt. The value of the long-term debt is more sensitive to changes in interest rates. If the interest rates had increases since their issue, their value would decrease from the face value. ©2006 M. P. Narayanan 16 FIN Understanding Value: Economic Value In general, liabilities also include, in addition to debt, obligations to other parties such as Legal and environmental liabilities Liabilities to employees such as pension The value of equity is the difference between the total value of the company and all its liabilities. It is also called the market capitalization and is equal to the share price times the number of shares outstanding. This is the current value of the equity, i.e., what the shareholder will receive if they were to sell the company off at its current value and payoff all the liabilities. ©2006 M. P. Narayanan 17 Constructing Economic Value Balance Sheet FIN If a company is publicly traded, it is easy to construct the right side of the balance sheet: Debt values can be obtained from the accounting balance sheet Equity value can be calculated by multiplying the share price by the number of outstanding shares. Value of items such as excess cash, marketable securities, and financial investments can be obtained from the accounting balance sheet and market prices of these items. The enterprise value can then be calculated as the residual. ©2006 M. P. Narayanan 18 Multiples: P/E FIN If valuation is being done for an IPO or a takeover, Value of firm = Average Transaction P/E multiple EPS of firm Average Transaction multiple is the average multiple of recent transactions (IPO or takeover as the case may be) If valuation is being done to estimate firm value Value of firm = Average P/E multiple in industry EPS of firm This method can be used when firms in the industry are profitable (have positive earnings) firms in the industry have similar growth (more likely for “mature” industries) firms in the industry have similar capital structure See next page ©2006 M. P. Narayanan 19 P/E and leverage FIN Gordon growth model: P0 = D1/(re − g) P0 = Stock price today D1 = Expected next-year dividend per share re = Cost of equity g = Expected dividend growth rate Assume constant payout ratio K = Payout ratio = D1/ EPS1 P0 = K × EPS1/(re − g) Simple algebra yields P0/EPS1 = K /(re − g) As leverage increases, re increases, decreasing P/E multiple ©2006 M. P. Narayanan 20 Multiples: Price to book FIN The application of this method is similar to that of the P/E multiple method. Since the book value of equity is essentially the amount of equity capital invested in the firm, this method measures the market value of each dollar of equity invested. This method can be used for companies in the manufacturing sector which have significant capital requirements. companies which are not in technical default (negative book value of equity) ©2006 M. P. Narayanan 21 FIN Multiples: Enterprise Value to EBITDA This multiple measures the enterprise value, that is the value of the business operations (as opposed to the value of the equity). In calculating enterprise value, only the operational value of the business is included. Value from investment activities, such as investment in treasury bills or bonds, or investment in stocks of other companies, is excluded. ©2006 M. P. Narayanan 22 Value to EBITDA multiple: Example FIN Suppose you wish to value a target company using the following data: Revenue = $800 million COGS = $500 million SG&A = $150 million All from continuing operations only Excludes any non-operating income such as interest and dividend income Excludes interest expenses Depreciation (from CF statement) = $50 million Cash in hand = $25 million Marketable securities = $45 million Sum of long-term and short-term debt held by target = $750 million ©2006 M. P. Narayanan 23 Value to EBITDA multiple: Example FIN You collect the following data about a recent takeover in the same industry Selling price = $40 a share (40 shares) Cash on hand = $50 million (all assumed “Excess Cash”) Marketable securities = $200 million Market value of financial investments = $120 million Short-term debt = $200 million Long-term debt = $1100 million From continuing operations Revenue = $1000 million COGS = $650 million SG&A = $120 million Depreciation = $70 million ©2006 M. P. Narayanan 24 Value to EBITDA multiple: Example FIN First compute enterprise value at which this comparable company sold. Equity value = 40 × 40 = $1600 million Enterprise value = 1600 + 1100 + 200 − 250 − 120 = $2530 million Economic Balance Sheet Enterprise value Excess Cash & marketable securities Market value of financial investments $2530 Short-term debt 200 $250 Long-term debt $1100 $120 Equity $1600 $2900 ©2006 M. P. Narayanan $2900 25 Value to EBITDA multiple: Example FIN Next compute the EBITDA of the comparable company from continuing operations EBITDA = Revenue − COGS − SG&A + Depreciation EBITDA = 1000 − 650 − 120 + 70 = $300 million Compute the Enterprise value/EBITDA multiple at which the comparable firm sold Enterprise value/EBITDA = 2530/300 = 8.43 Compute EBITDA of your target company EBITDA of target = 800 − 500 − 150 + 50 = $200 million Compute enterprise value of the target Enterprise value of target = 200 × 8.43 = $1686 million ©2006 M. P. Narayanan 26 FIN Value to EBITDA multiple: Example Compute equity value of target company Equity value = 1686 + 70 − 750 = $1006 million Finally, if there are acquisition costs (Investment banking, legal) and financing costs (bank fees, transaction costs) subtract from equity value (not done in this example). Economic Balance Sheet Enterprise value Excess Cash & marketable securities $1686 $70 $1756 ©2006 M. P. Narayanan Total debt Equity $750 $1006 $1756 27 Valuation: Value to EBITDA multiple FIN Since this method measures enterprise value it accounts for different capital structures cash and security holdings By evaluating cash flows prior to discretionary capital investments, this method provides a better estimate of value. Appropriate for valuing companies with large debt burden: while earnings might be negative, EBIT is likely to be positive. Gives a measure of cash flows that can be used to support debt payments in leveraged companies. ©2006 M. P. Narayanan 28 Mutiples methods: drawbacks FIN While Multiples methods are simple, all of them share several common disadvantages: They do not accurately reflect the synergies that may be generated in a takeover. They assume that the market valuations are accurate. For example, in an overvalued market, we might overvalue the firm under consideration. They assume that the firm being valued is similar to the median or average firm in the industry. They require that firms use uniform accounting practices. ©2006 M. P. Narayanan 29 Valuation: DCF method FIN This is similar to the technique we used in capital budgeting: Estimate expected free cash flows of the target including any synergies resulting from the takeover Discount it at the appropriate cost of capital This yields enterprise value After calculating enterprise value, equity value of target is calculated using the same process as before. ©2006 M. P. Narayanan 30 Valuation: DCF method FIN DCF methods impose stricter discipline on the acquiring company They need to specify the value drivers of the takeover They need to provide estimates of the value created and their sources Allows for post-audit of the takeover based on these benchmarks ©2006 M. P. Narayanan 31 FIN DCF methods: Starting data Free Cash Flow (FCF) of the firm WACC ©2006 M. P. Narayanan 32 Template for Free Cash Flow FIN Revenue Operating Income Statement Less Costs Less Depreciation Profits from asset sale Taxable income Less Tax NOPAT Add back Depreciation Less Profits from asset sale Operating cash flow Less increase in working capital Less capital expenditure Cash from asset sale Free cash flow (or unlevered CF) ©2006 M. P. Narayanan 33 Template for Free Cash Flow FIN The goal of the template is to estimate cash flows, not profits. Template is made up of three parts. An Operating Income Statement Adjustments for non-cash items included in the Operating Income Statement to calculate taxes Capital items, such as capital expenditures, working capital, cash from asset sales, etc. The Operating Income Statement portion differs from the usual income statement because it ignores interest. This is because, interest, the cost of debt, is included in the cost of capital and including it in the cash flow would be double counting. ©2006 M. P. Narayanan 34 Template for Free Cash Flow FIN There are four categories of items in our Operating Income Statement. While the first three items occur most of the time, the last one is likely to be less frequent. Revenue items Cost items Depreciation items Profit from asset sales Cash from asset sale − Book value of asset Book value of asset = Initial investment − Accumulated depreciation Adjustments for non-cash items is to simply add all non-cash items subtracted earlier (e.g. depreciation) and subtract all noncash items added earlier (e.g. Profit from asset sale). ©2006 M. P. Narayanan 35 Template for Free Cash Flow FIN There are two type of capital items Fixed capital (also called Capital Expenditure (Cap-Ex), or Property, Plant, and Equipment (PP&E)) Working capital We need to include only additions to capital (both fixed and working) since the capital originally invested is still employed in the project. It is important to recover both types of capital at the end of a finite-lived project. Recover the market value property plant and equipment Cash from asset sale Recover the working capital left in the project (assume full recovery) ©2006 M. P. Narayanan 36 Template for Free Cash Flow FIN What is the FCF template actually doing? See table on the right The template is longer because of tax calculations Items on the right are the value drivers You may view this as a conceptual template ©2006 M. P. Narayanan Revenue Less Costs Less Tax Less increase in working capital Less capital expenditure Cash from asset sale Free cash flow (or unlevered CF) 37 Estimating Horizon FIN For a finite stream, it is usually either the life of the product or the life of the equipment used to manufacture it. Since a company is assumed to have infinite life: Estimate FCF on a yearly basis for about 5 years. After that, calculate a “Terminal Value”, which is the ongoing value of the firm. ©2006 M. P. Narayanan 38 Terminal Value FIN Terminal value can be calculated several ways: Use the constant growth perpetuity model with a long-term growth closer to economy growth rates. Estimate a two- or three-stage model, Works for mature industries Higher growth rate(s) in the initial stage(s) (for about 10 years) A lower long-term growth for the final stage Use a Enterprise value to EBITDA multiple based on industry averages to estimate terminal value ©2006 M. P. Narayanan 39 WACC FIN One of the issues in the valuation of companies for acquisition is what WACC to use. Should we use the target company’s WACC or the acquirer’s WACC? Or something else? As always, the answer is “it depends.” If a conglomerate is buying a target company, it is appropriate to use the target company’s WACC. There is likely to be very little interaction between the target company’s operations and that of the acquirer. If it is a horizontal merger, the WACC of acquirer and target are likely to be close. A weighted average WACC may be appropriate (weights based on the enterprise values of the two parties) ©2006 M. P. Narayanan 40 WACC FIN The idea is that if the integration of the target with the acquirer is minimal, the target’s WACC is appropriate. If there is substantial integration, but companies are not in the same industry, it becomes more difficult to figure out a precise WACC to value the target. The issue has to be dealt on a case by case basis. ©2006 M. P. Narayanan 41 Valuation of private companies FIN Private company stocks are very illiquid Similar to small firms with less liquid stocks, private company stocks also will sell at a discount. The liquidity issue much more severe with private companies. Private company owners are likely to be less diversified. Therefore, they bear both the market risk and the company-specific risk, increasing their cost of capital and decreasing the value of the firm to them. If you own only GM stock you are bearing the risk of the auto industry as well risk that is GM-specific (a strike at GM). If you own all the auto company stocks (GM, Ford, Toyota, Nissan, Volkswagen, Diamler-Chrysler), you bear only the auto industry risk. ©2006 M. P. Narayanan 42 Valuation of private companies FIN The typical method of valuing a private company is to value it as if it is a public company and then apply a discount for the reasons stated earlier. Find a pure-play and use its WACC to discount the cash flows of the private company Pure-play is a public company that has the same business risk as the private company Or, use the multiples of a public company The trick is to compute this discount. There are ways to get some handle on this discount. The discounts are in the 20-40% range ©2006 M. P. Narayanan 43 Weighted average cost of capital: Overview Required rate = 8% Required rate = 12% Equity capital $60 Total capital $100 Annual return $9.28 Total return = $10.40 Rate of return on capital required to payoff the debt and minimally satisfy stockholders, i.e., WACC ©2006 M. P. Narayanan Annual return $7.20 Stockholders Annual return $3.20 Lenders Debt capital $40 Annual tax saving from interest deduction = $1.12 (35% of 3.20) FIN Operations Required rate = 9.28% 44 Costs of debt and equity FIN Cost of debt can be approximated by the yield to maturity of the debt. If the yield is not directly available, check the bond rating of the company and find the YTM of similar rated bonds. Cost of equity CAPM Find be and calculate required re. Use Gordon-growth model and find expected re. Under the assumption that market is efficient, this is the required re. You need an estimate of future dividend growth rate to do this. Therefore, works better for firms with a history of dividend payments ©2006 M. P. Narayanan 45 Valuation: CF to Equity method FIN In the WACC method, we compute Enterprise value by discounting the free cash flows at WACC Add value of any financial investments Subtract value of debt to obtain equity value In CF to Equity method, we Compute CF that are available to equity-holders This is Free Cash Flow less principal and after-tax interest payments Discount this at cost of equity and directly compute equity value ©2006 M. P. Narayanan 46 Equity value: WACC method FIN Value from Operations Enterprise value Value from investments Value generated Value of Debt Equity value All are values: CF discounted at appropriate cost of capital ©2006 M. P. Narayanan 47 FIN Equity value: CF to Equity method FCF from Operations CF from investments Total CF generated CF to Debt (Principal, after-tax interest) All are CF CF to Equity Equity value = CF to Equity @ re ©2006 M. P. Narayanan 48