Chapter 5 - Accounting 621

advertisement

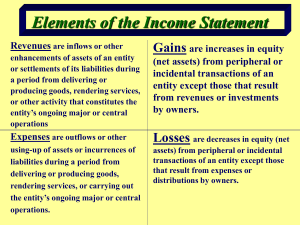

Chapter 5 The Expanded Ledger: Revenue, Expense, and Drawings 1 Expanding the Ledger Through the first four chapters we have looked at the fundamental accounting equation … Assets = Liabilities + Owner’s Equity This resulted in a single account for owner’s equity. By “default”, what types of entries have you charged to owner’s equity? 2 Types of OE Entries? 1. Owner’s investment in the company. 2. Revenues from the sale of goods or by providing a service. 3. Expenses related to the operation of the business and the generation of revenues. 4. Drawings or owner’s withdrawals from the business for personal use. 3 Expanding the Ledger The focus of Chapter 5 is the specific identification and use of accounts to track … REVENUES EXPENSES DRAWINGS 4 Expanding the Ledger The purpose of expanding the ledger is to provide essential information about the progress of the business. This information is needed to assess the ongoing profitability of the company. What do we mean when we say a company is profitable or making a profit? What is meant by loss? 5 Example of Expanding the Ledger What do we know about profitability of this firm in the month of January? Did they make a profit or a loss? 6 Example of Expanding the Ledger How much was spent on advertising? Are the wages fair? Is the rent too high? How much did the owner withdraw from the business? What types of economic events can we “speculate” impacted the owner’s equity account? 7 Example of Expanding the Ledger Now … what can we determine Owner’s Equity about the profitability of this firm? $26,137 8 Income Statement Some of the information from these new accounts will be used to prepare an Income Statement. What do you think an Income Statement is? What accounts do you think we would use to prepare in Income Statement? 9 Sample Income Statement 10 Revenue What is revenue? Selling goods or services produces revenue. What impact does revenue have on equity? Revenue is an increase in equity resulting from the sale of goods or services in the usual course of business. 11 Revenue A company is paid $500 for services rendered. Before using revenue accounts: Dr. Cash Cr. Owner’s Equity $500 $500 Using revenue accounts: Dr. Cash Cr. Revenue $500 $500 12 Revenue How do revenue accounts “behave”? Assets Debit Credit (DR) Normal Balance (CR) = Liabilities Debit Credit (DR) (CR) Normal Balance + Owner’s Equity Debit Credit (DR) (CR) Normal Balance Revenue represents an increase in equity. An increase in equity requires a credit entry. Therefore, to book revenue, credit the revenue account. 13 GAAP - Revenue Recognition The revenue recognition convention states that revenue must be recorded in the accounts (i.e. recognized) at the time the transaction is completed. What does this mean? Revenue is recorded when the bill is sent to the customer. For a cash transaction, revenue is recorded when the sale is complete and 14 the cash is received. Expenses What is expenses? The costs associated with producing revenue. What impact do expenses have on equity? Expenses represent a decrease in equity resulting from the cost of producing revenue. Examples???? 15 Expenses A company pays wages of $250. Before using expense accounts: Dr. Owner’s Equity Cr. Cash $250 $250 Using expense accounts: Dr. Wages Expense Cr. Cash $250 $250 16 Expenses How do expense accounts “behave”? Assets Debit Credit (DR) Normal Balance (CR) = Liabilities Debit Credit (DR) (CR) Normal Balance + Owner’s Equity Debit Credit (DR) (CR) Normal Balance Expenses represent a decrease in equity. A decrease in equity requires a debit entry. Therefore, expense accounts are typically debited. 17 Net Income or Net Loss Using the revenue and expense accounts, a business can determine if they have earned a net income (profit) or a net loss. Net Income is the difference between the total revenues and total expenses, where the revenues are greater than the expenses. A Net Loss is created if expenses are greater than the revenues. 18 Drawings The owner usually looks to the profits of the business to provide a livelihood. In a healthy business, the owner is able to take funds (generated by profits) out of the business. These withdrawals of funds, by the owner, are known as Drawings and decrease equity. 19 Drawings Drawings are NOT expenses. They are not associated with producing revenue. Drawings have nothing to do with the determination of the net income or net loss. Cash is the most common item withdrawn by an owner for personal use. 20 Expanding the Ledger There are four types of accounts in the equity section: 1. Capital – this account will now contain only the equity figure at the beginning of the fiscal period plus new capital from the owner. 2. Revenues – increases in equity resulting from the sale of goods or services. A revenue account normally has a credit balance. 21 Expanding the Ledger 3. Expenses – decreases in equity resulting from the costs of the materials or services used to produce the revenue. An expense account normally has a debit balance. 4. Drawings – decreases in equity resulting from the owner’s personal withdrawals. A drawings account normally has a debit balance. Drawings are NOT a factor in calculating net 22 income or loss. Complete each statement with a DR or CR a) b) c) d) e) f) g) The Bank account normally has a ____ balance. A Revenue account normally has a ____ balance. An Expense account normally has a ____ balance. Paying a creditor involves a ____ entry to the creditor’s account. The Drawings account receives a ____ entry when the owner withdraws money for personal use. A lawyer gives a cash refund to a customer. The Bank account will receive a ____ entry and the Revenue account will receive a ____ entry. Supplies are bought on credit. The Supplies account will receive a ____ entry and the supplier’s account payable will receive a ____ entry. 23 Complete each statement with a DR or CR h) i) j) k) l) The Drawings account will not normally receive ____ entries. An increase in equity can be thought of as a ____ to the Capital account. Net Income can be thought of as a ____ to the Capital account. Net Loss can be thought of as a ____ to the Capital account. The owner takes a computer from the business for his personal (permanent) use. The Drawings account will receive a ____ entry. 24 The Income Statement The income statement tells the owners and the managers how the business is doing. By definition, an income statement is a financial statement that summarizes the items of revenue and expense, and shows the net income or net loss of a business for a given period of time. 25 The word “expense” is not always required. Why? Date? In what order are The accounting expenses listed? period for which the figures have been accumulated A company can have more than one source of Net Income is not revenue. cash. It is the difference between total revenues and total expenses. 26 The Income Statement Who uses the Income Statement? 1. Owners and Managers Shows if the business is making profit. Used for setting goals and policy. When compared to previous years, it provides a trend … highlighting potential problems. 2. Bankers Supports loan decisions. Past profitability is one indicator of future 27 potential. The Income Statement Who uses the Income Statement? 3. Income Tax Authorities Every business is required by law to prepare an income statement. The net income figure of a proprietorship must be included on the owner’s income tax return. Corporations must file their own tax returns. The income statement must be sent to the government along with the tax returns.28 Fiscal Period Net income is measured over a specific length of time, known as the fiscal period. The formal fiscal period is typically one year. The fiscal year does not have to be the calendar year … it just has to run for 12 consecutive months (or in some cases, 52 consecutive weeks) 29 Accounting Period The text indicates that the fiscal period is sometimes referred to as the accounting period. Companies prepare financial statements periodically in order to assess their financial condition and operating results. Accounting periods are typically one month, one quarter, or one year. If a company uses a one year accounting period (i.e. they only prepare financial statements at year end) it is referred to 30 as their fiscal period or fiscal year. GAAP The Time Period Concept The time period concept provides that accounting will take place over specific time periods known as fiscal periods. What does this mean? Companies must use fiscal periods of equal length when measuring financial progress. 31 GAAP The Matching Principle The matching principle states that each expense item related to revenue earned must be recorded in the same period as the revenue it helped earn. What does this mean? Expenses must be recorded in the period in which the revenue is recognized. To do this, accountants make a number of mathematical adjustments in the accounts at the end of a fiscal year. 32 (we cover this in detail in Chapter 9) Chart of Accounts To help organize the expanded ledger, it is customary to number the accounts in the ledger. These numbers are used for identification and reference, particularly in computer systems. We will be using a computer system, Simply Accounting, later in the semester. The chart of accounts used by Simply Accounting is: Assets Liabilities Capital & Drawings Revenue Expenses 1000 – 1999 2000 – 2999 3000 – 3999 4000 – 4999 5000 – 5999 33 Expanded Basis Equation and Debit / Credit Rules Assets Assets Dr. Cr. = = Liabilities Liabilities Dr. Cr. Owner’s Equity + + Owner’s Capital Dr. + - Cr. Dr. Revenues Dr. Owner’s Drawings Cr. - Cr. Expenses Dr. Cr. 34 p. 134, Exercise 1: 1) 2) Identify the errors. Prepare corrected income statement. 35 Class / Homework p. 134, Exercise 2: A. Prepare a trial balance. B. Prepare a chart of accounts based on the Simply Accounting numbering system in this lesson. C. Prepare an income statement. p. 135, Exercise 5: Do all parts of this question … including the questions about GAAP. 36 Equity Relationship and the Balance Sheet Created by D. Gilroy Heart Lake Secondary School 37 Beginning Capital $21,878 Drawings $3,950 Ending Capital $26,137 (Beg + Inc) Total Income $23,660 Increase in Equity $4,259 (NI – Drawings) Net Income $8,209 (Rev – Exp) Total Expenses $15,451 Beginning Net Net Ending Drawings Capital + Income -- Loss -= Capital 38 $21,878 $8,209 $n/a $26,137 $3,950 39