Ch 2

advertisement

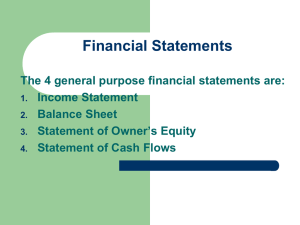

Accounting 100 Chapter 2 Analyzing Business Transactions 1 Objectives Record in equation form the financial effects of a business transaction. Define, identify, and understand the relationship between asset, liability, and owner’s equity account. Analyze the effects of business transactions on a firm’s assets, liabilities, and owner’s equity. 2 Business Transactions A financial event that changes the resources of the firm. May be a purchase, a sale, a receipt, or payment of cash. The effects of each transaction must be studied in order to know what and where to record. 3 Transaction #1 Margery Meadows deposits $50,000 in the bank as the initial investment in her new business, Meadows Accounting. – Cash is increased by $50,000 – Business capital is increased by $50,000 4 Transaction #2 Margery rents facilities for her new business by signing a lease for six months with monthly rent of $1,000 – The rent is paid in advance for the next 6 months in the amount of $6,000 – Cash is decreased by $6,000 5 Transaction #3 Margery purchases a computer and other equipment for $8,000 with a check drawn on the bank. – The equipment increases by $8,000 – The cash decreases by $8,000 6 Current Financial Position Cash + Prepaid Rent + Equipment =Capital +50,000 - 6,000 44,000 - 8,000 36,000 =+ 50,000 +6,000 6,000 6,000 = + 8,000 8,000 50,000 = 50,000 7 Accounting Classifications Assets: property owned by a business Liabilities: debts or obligations of a business Owner’s Equity: financial interest of the owner of a business (also known as proprietorship or net worth) 8 Fundamental Accounting Equation Assets = Liabilities + Owner’s Equity Assets - Liabilities = Owner’s Equity Assets - Owner’s Equity = Liabilities 9 Solving the Equation Assets = Liabilities + Owner’s Equity ? = $ 5,000 + $35,000 $39,000 = ? + $35,000 $42,000 = $ 7,000 + ? 10 Revenue Revenue: inflow of money or other assets (including claims to money) that results from sales of services or goods. Revenue increases owner’s equity. When revenues exceed expenses there is a profit (net income). 11 Expenses Expenses: outflow of money, the use of other assets, or the incurring of a liability. Expenses reduce owner’s equity. When expenses exceed revenues, there is a loss (net loss). 12 Transaction #4 During the month of December, Meadows Accounting Services earned a total of $15,000 in revenue from clients who paid cash. – Cash increased by $15,000 – Owner’s Equity increased by $15,000 • (Fees Earned in the name of the revenue account) 13 Withdrawals Withdrawals are funds taken from a business by the owner to pay personal items (non-business related). Withdrawals reduce owner’s equity, but are not considered a business expense. 14 Financial Statements Preparing accurate and informative financial statements is one of the accountant’s most important jobs. Business people use the financial statements to make decisions. 15 Income Statement A formal report showing the results of the business operations for a specific period of time. Only revenues and expenses are shown on the statement. Revenues - expenses = net income or (loss). 16 Statement of Owner’s Equity A report showing changes that occurred in the owner’s financial interest during a specific period of time. The amount of net income (loss) is the connecting link between the income statement & statement of owner’s equity 17 Balance Sheet A formal report of the firm’s financial position which lists the assets, liabilities, and owner’s equity on a specific date. The link between the balance sheet and the statement of owner’s equity is the revised owner’s investment which is calculated on the Statement of Owner’s Equity. 18 Chapter 2 The End 19