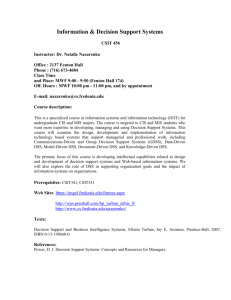

Decision Support Systems (DSS)

advertisement

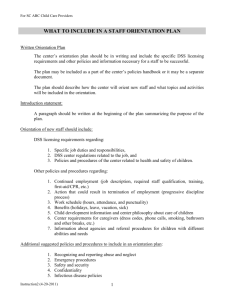

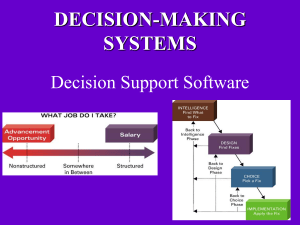

Decision Support Systems (DSS) 1 Decision Making and Problem Solving • Problem solving is a critical activity for any business organization. • Once a problem has been identified, the problem-solving process begins with decision making. • A well-known model developed by Herbert Simon divides the decision-making phase of the problem-solving process into three stages: intelligence, design, and choice. • This model was later incorporated by George Huber into the following expanded model – see next slide. 2 How Decision Making Relates to Problem Solving 3 st 1 stage: Intelligence • Potential problems or opportunities must be identified and defined. • This is the most important step because if the wrong problem is identified and defined, the entire effort of problem solving is wasted. • Symptoms are not problems. • To distinguish symptoms and real problems, we need to gather data describing the problem. 4 Gather data about the problem • Environmental resources and constraints are investigated during the 1st stage (Intelligence) to gain understanding of the problem. • Study the environment which may include suppliers, customers and competitors (from market research) etc. • Competitors: sell at prices 10% to 15% lower. • Suppliers: increase costs of goods sold to 30% or more because of recent oil price hike. • Customers: complain about product’s defects which affect human’s health seriously. 5 Decision Support System (DSS) • A DSS may be expressed as a mathematical program, with some symbolic representations to represent real world objects, quantities and meanings, to solve business decision problems, e.g. shared resource allocation problems (see Tutorial D or case 18 of “Advanced Cases in MIS”). 6 Shared resource allocation problems • They have resource allocation limits which can be expressed using mathematical constraints. • e.g. maximum available cotton (C) in stock for Tshirt production in a factory is 10 tons. This limit can be expressed as a constraint: C <= 10 tons. • Some constraints may conflict with another, and thus finding solutions or the best solution is a difficult mathematical problem called optimization or linear programming problem. 7 Programmed Decisions • Easy to computerize using rules, procedures, quantitative methods or mathematical formulae. E.g. • Simple financial model: Profit = Revenue - Cost • Simple Present-value cash flow model: P = F / (1+i)n where P = present value, F = future single payment ($), i = interest rate, n = number of years. • Problems/decisions solved by operational or transactional processing systems (TPS) are easily programmed, they are structured problems. • Routine, summary reports produced by MIS are also structured problems. 8 Nonprogrammed Decisions • Nonprogrammed decisions – Rules and relationships not well defined – Problem is not routine, exceptional cases – Not easily quantifiable – Determining an appropriate training program for new employees is an example of unstructured problem. – E.g. interviewing new employees is also a nonprogrammed or unstructured decision. 9 Optimization (using Solver) • finds the best solution out of many combinations of possibilities • E.g. find the appropriate number of products a factory should produce to meet a profit goal, given certain constraints and assumptions. E.g. • E.g. of a problem constraint: there is a limit on the number of working hours per day (X) for each machine in the factory: X <= 8 hours. • E.g. minimum number of basketballs to produce in a factory per month (Y): Y >= 40000 balls 10 Heuristics • They are “rules of thumb”, guesses or estimates based on vast experience, or commonly accepted guidelines. • E.g. when the inventory level for a certain item drops below 20 units, an experienced manager would order 4 month’s supply as a good guess to avoid out of stock without too much excess inventory. • Heuristics are used in optimization for efficiency especially when there are many complicated problem constraints, changing cells and decision variables. 11 Excel Solver’s optimizing routines 12 DSS: What-if (sensitivity) analysis • Makes several forecasts for different possible economic situations (or scenarios) which could be good, bad or stable by using varying estimates of inputs such as growth rate, oil price, labour change, salaries etc. • The varying estimates of inputs reflect uncertainties of real economy. • In Supply/Demand, elasticity can be done using what-if analysis. 13 Decision Support Systems (DSS) • A CBIS that focuses on decision-making effectiveness for various decision-making levels: mostly for mid and top levels of management, less for bottom level management. 14 Characteristics of DSS • Predictive nature – output information is for future events rather than descriptive of past events, should help reduce risks in future. E.g. forecasts of future economic conditions, projections of new product sales, forecasts of changing target customer groups. • Summary form – output information is not detailed, but concerned with global data. E.g. managers are not interested in the details of customer’s invoices but more interested in the overall buying trend in the summaries of sales groups. 15 Characteristics of DSS • Ad hoc basis – strategic planning information is produced irregularly but with a specific purpose. E.g. Managers may request marketing analysis information about a new set of stores (or a new product) when they are considering adding new stores in the region. • Unexpected information – economic forecast for the economy and for the industry may often find surprises to managers. E.g. marketing survey in above may produce store locations that had not been expected. 16 Characteristics of DSS • External data – most of the inputs into DSS are from sources external to the firm. Information such as investment opportunities, rates of borrowed capital, census data, economic conditions must be obtained from databases outside the firm e.g. government databases. • Subjectivity - input data into DSS are usually highly subjective (personal opinions based on experiences) and their accuracy may be a suspect. E.g. rumors about future stock market trends reported by brokers. 17