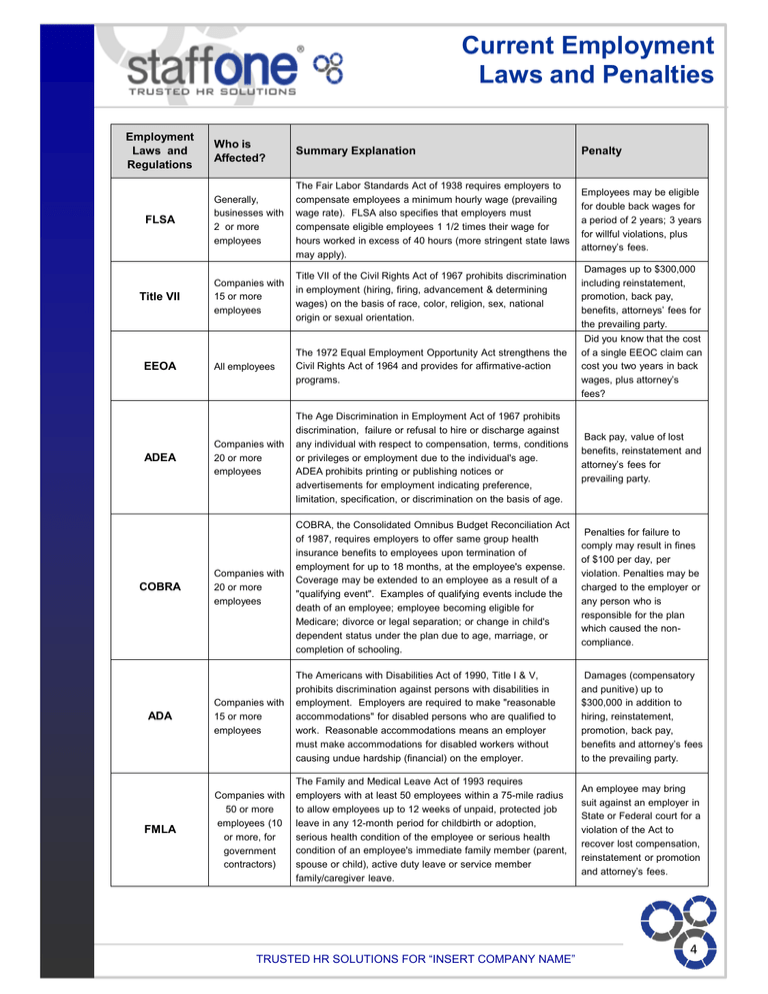

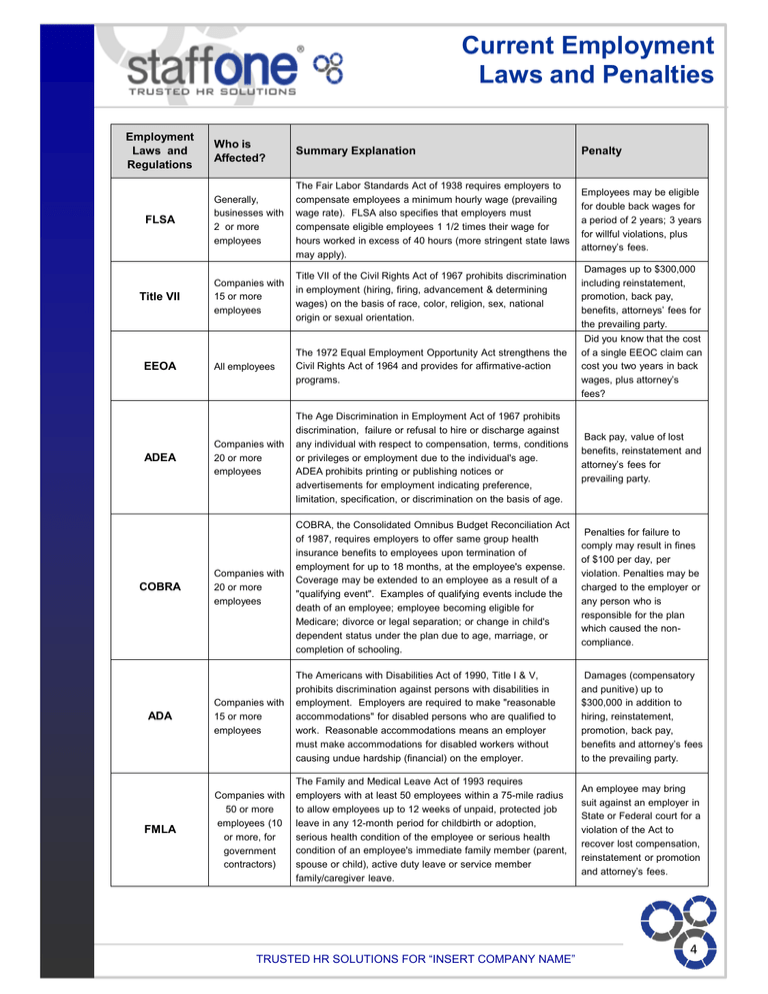

Current Employment

Laws and Penalties

Employment

Laws and

Regulations

Who is

Affected?

Summary Explanation

Penalty

FLSA

Generally,

businesses with

2 or more

employees

The Fair Labor Standards Act of 1938 requires employers to

compensate employees a minimum hourly wage (prevailing

wage rate). FLSA also specifies that employers must

compensate eligible employees 1 1/2 times their wage for

hours worked in excess of 40 hours (more stringent state laws

may apply).

Employees may be eligible

for double back wages for

a period of 2 years; 3 years

for willful violations, plus

attorney’s fees.

Title VII

Companies with

15 or more

employees

Title VII of the Civil Rights Act of 1967 prohibits discrimination

in employment (hiring, firing, advancement & determining

wages) on the basis of race, color, religion, sex, national

origin or sexual orientation.

All employees

The 1972 Equal Employment Opportunity Act strengthens the

Civil Rights Act of 1964 and provides for affirmative-action

programs.

Companies with

20 or more

employees

The Age Discrimination in Employment Act of 1967 prohibits

discrimination, failure or refusal to hire or discharge against

any individual with respect to compensation, terms, conditions

or privileges or employment due to the individual's age.

ADEA prohibits printing or publishing notices or

advertisements for employment indicating preference,

limitation, specification, or discrimination on the basis of age.

Back pay, value of lost

benefits, reinstatement and

attorney’s fees for

prevailing party.

Companies with

20 or more

employees

COBRA, the Consolidated Omnibus Budget Reconciliation Act

of 1987, requires employers to offer same group health

insurance benefits to employees upon termination of

employment for up to 18 months, at the employee's expense.

Coverage may be extended to an employee as a result of a

"qualifying event". Examples of qualifying events include the

death of an employee; employee becoming eligible for

Medicare; divorce or legal separation; or change in child's

dependent status under the plan due to age, marriage, or

completion of schooling.

Penalties for failure to

comply may result in fines

of $100 per day, per

violation. Penalties may be

charged to the employer or

any person who is

responsible for the plan

which caused the noncompliance.

ADA

Companies with

15 or more

employees

The Americans with Disabilities Act of 1990, Title I & V,

prohibits discrimination against persons with disabilities in

employment. Employers are required to make "reasonable

accommodations" for disabled persons who are qualified to

work. Reasonable accommodations means an employer

must make accommodations for disabled workers without

causing undue hardship (financial) on the employer.

Damages (compensatory

and punitive) up to

$300,000 in addition to

hiring, reinstatement,

promotion, back pay,

benefits and attorney’s fees

to the prevailing party.

FMLA

Companies with

50 or more

employees (10

or more, for

government

contractors)

The Family and Medical Leave Act of 1993 requires

employers with at least 50 employees within a 75-mile radius

to allow employees up to 12 weeks of unpaid, protected job

leave in any 12-month period for childbirth or adoption,

serious health condition of the employee or serious health

condition of an employee's immediate family member (parent,

spouse or child), active duty leave or service member

family/caregiver leave.

An employee may bring

suit against an employer in

State or Federal court for a

violation of the Act to

recover lost compensation,

reinstatement or promotion

and attorney’s fees.

EEOA

ADEA

COBRA

TRUSTED HR SOLUTIONS FOR “INSERT COMPANY NAME”

Damages up to $300,000

including reinstatement,

promotion, back pay,

benefits, attorneys’ fees for

the prevailing party.

Did you know that the cost

of a single EEOC claim can

cost you two years in back

wages, plus attorney’s

fees?

4