CMS ACO Presentation

advertisement

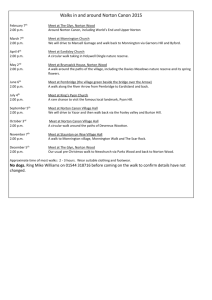

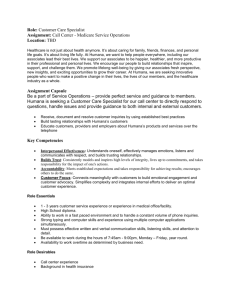

Pilgrimage Healthcare Patients Deserve More Options… Norton Healthcare Integrated Delivery Network of Five Not-for-Profit Hospitals 15 Out-patient Centers 1.6 Million yearly patient encounters $1.7 Billion yearly revenue 12,000 Employees 600 Employed Providers 2,000 Physician Medical Staff 1,857 Licensed Beds 60,000 Admissions/year Who is Accountable for Care? Autonomy versus Paternalism “Flu Shot” ACO Current State • Accountability is an Action… Not an Organization • ACA has pushed organizations to compete on quality and price rather than fee-for-service. • Currently 5% of Medicare Beneficiaries in an “ACO” • 89 initial CMS approved ACOs – only five with both upside and downside risk ACCOUNTABLE CARE ORGANIZATION Components of an ACO Effective Health Management The Players Manage population health Patient attribution Community outreach Training and education Behavior and change management Segmentation and risk factor capabilities Marketing Manage to Quality Standards Effective Health Management Coordinate Items and Services Cost and Efficiencies Employers Patients Hospitals Acute, sub-acute and longterm care providers Ambulatory care centers Pharmaceutical companies Medical device manufacturers Care Givers (physicians, nurses, home health, clinical social worker, clinical psychologist, and other ancillary providers) Payors Federal government Manage to Quality Standards Coordinate Items and Services Quality management (definition by population, not event or episode-driven) Quality standards reporting Disease management Data management and analytics Business intelligence management of clinical, operational and financial data Manage Costs and Efficiencies Risk management Finance and accounting Disease management Measurement of clinical, operational and financial key performance indicators Used with Permission KPMG HEALTHCARE Preventive care Medical management Telemedicine Funding administration Supply chain Participation in Health Information Exchanges (HIEs) Journey for Accountable Care • Initiated as part of Brookings – Dartmouth Commercial Pilot in 2009 • Future plans for other manage care providers as model develops. • Patient population – 1.24 million in community • Current included groups: NHC employees/Humana employees – 10,000 • Approximately 300 physicians included — Primary Care and Specialists • Consideration to expand into other reimbursement partnerships — Bundled Payment — Shared Risk (smaller employers) Strategy for Success • Accountability is an Action • Manage the Patient Through the Care Continuum • Patient and Community Engagement and Accountability • Transparency • Data Infrastructure Management and EMR • Patient, Provider, Payer, and Employer Partnerships • Change is Hard • Decrease Variation – Increase Personalization Evolution of Analytics WHAT WILL happen and WHEN? WHY it happened? WHAT happened? Learning Improving Predicting Norton Healthcare – Humana Accountability Pilot Year 1 Financial Data Norton Year 2 1.7% Reduction below target PMPM Humana Year 2 14.9% Reduction below target PMPM Clinical Results: Aggregated Commercial ACO-Utilization/Quality/Overuse Metrics Inpatient days/1000 Down 29% ER visits/1000 Down 46% Physician visit within 7 days discharge Up 14.6% Diabetes A1c testing Up 6.1% Cholesterol Management - Diabetes Up 8.6% Appropriate Imaging – Low Back Pain Up 13.9% Avoidance of Antibiotics w/Acute Bronchitis Up 32% Norton Healthcare Accountability Pilot Dartmouth – Brookings ACO Pilot Performance Measurement 2009 HEDIS PPO Norton Baseline Norton Year 1 Change Diabetes – A1c Management (testing) 83.3% 87.7% 93.4% 5.6% Diabetes – Cholesterol Management (testing) 78.6% 83.9% 91.8% 7.9% Use of Appropriate Medications for People with Asthma 92.8% 96.2% 82.8% -13.4% Cholesterol Management for Patient with Cardiovascular Conditions (testing) 80.2% 88.9% 89.5% 0.6% Use of Imaging Studies for Low Back Pain 72.7% 65.2% 56.3% -8.8% Avoidance of Antibiotic Treatment for Adults with Bronchitis 22.6% 12.2% 16.7% 4.5% Persistence of Beta Blocker Treatment After Heart Attack 69.6% Cervical Cancer Screening 74.6% 77.9% 78.2% 0.3% Breast Cancer Screening 67.1% 79.9% 81.6% 1.7% Annual Monitoring for Patients on Persistent Medications 77.0% 83.7% 88.6% 4.9%15 Quality Measure (for all, higher %s represent better performance) Too few eligible cases. Anti-Infective Purchasing/QTR/Patient Day 1 1 0.98 Miscellaneous BetaLactams 0.90 0.86 Macrolides 0.73 0.75 Miscellaneous Dollars Per Patient Day 0.68 Aminoglycosides Antivirals Quinolones Antifungals Tetracyclines Anti-Pseudomonal Beta-Lactams Anti-MRSA Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Clinical Effectiveness Total Joint Replacement (Per Case) Absolute Impact % Impact Direct Variable Cost ($665) -8.0% Length of Stay (0.27) -9.5% COPD Initiative (Per Case) Absolute Impact % Impact Direct Variable Cost ($400) -13.1% Length of Stay (0.37) -7.5% CHF Initiative (Per Case) Absolute Impact % Impact Direct Variable Cost ($243) -6.8% Length of Stay (0.01) -0.2% ESRD Initiative (Per Case) Absolute Impact % Impact Direct Variable Cost ($1094) -9.4% Length of Stay (0.75) -8.7% The Future of Clinical Re-Engineering • Improved care coordination and communication • Improved access – physician extenders – email – phone call etc. • Prevention and early diagnosis • ED and Immediate Care Center visits • Increase generic medication utilization • Hospital re-admissions and multiple ED visits • Improved management of complex patients – Manage the Top 100 – Care Coordination and High Resource Utilizers Evidence or Bias? Disruptive Innovation Future of Healthcare Think Differently – Treat Differently Future of Healthcare *The Volume-To-Value Revolution. Oliver Wyman Resource Management Questions Steve.Hester@NortonHealthcare.org