File

advertisement

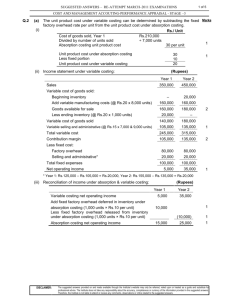

Chapter 5 Job Order Costing Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of large, unique, high-cost items. Built to order rather than mass produced. Many costs can be directly traced to each job. Basic Cost Accounting Procedures Process Costing Job Order Costing Typical job order cost applications: Special-order printing Building construction Also used in service industry Hospitals Law firms Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of small, identical, low-cost items. Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Basic Cost Accounting Procedures Process Costing Job Order Costing Typical process cost applications: Petrochemical refinery Paint manufacturer Paper mill Job Order Costing Manufacturing overhead (OH) Applied to each job using a predetermined rate (POHR) Direct materials THE JOB Direct labor Job Order Costing The primary document for tracking the costs associated with a given job is the job cost sheet. Let’s investigate The Job Cost Sheet RoseCo Job Cost Sheet Job Number A - 143 Department B3 Item Wooden cargo crate Date Initiated 3-4-X9 Date Completed Units Completed Direct Materials Direct Labor Manufacturing Overhead Req. No. Amount Ticket Hours Amount Hours Rate Amount Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit Cost Units Shipped Date Number Balance The Job Cost Sheet RoseCo Job Cost Sheet Job Number A - 143 Department B3 Item Wooden cargo crate Date Initiated 3-4-X9 Date Completed Units Completed Direct Materials Direct Labor Manufacturing Overhead Req. No. Amount Ticket Hours Amount Hours Rate Amount X7-6890 $ 116 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit Cost $ 116 Units Shipped Date Number Balance The Job Cost Sheet RoseCo Job Cost Sheet Job Number A - 143 Department B3 Item Wooden cargo crate Date Initiated 3-4-X9 Accumulate direct Date Completed labor costs by Units Completed means of a work record, such as a Direct Materials Direct Labor Manufacturing Overhead time ticket, for each Req. No. Amount Ticket Hours Amount Hours Rate Amount employee. X7-6890 $ 116 36 8 $ 88 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit Cost $ $ 116 88 Units Shipped Date Number Balance The Job Cost Sheet RoseCo Job Cost Sheet Apply manufacturing overhead to jobs using a Job Number A - 143 Date Initiated 3-4-X9 predetermined overhead rate (POHR) based on direct labor Date Completed 3-5-X9 hours (DLH). Department B3 Item Wooden cargo crate Units Completed 2 Direct Materials Direct Labor Manufacturing Overhead Req. No. Amount Ticket Hours Amount Hours Rate Amount X7-6890 $ 116 36 8 $ 88 8 $ 4 $ 32 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit Cost $ $ $ $ $ 116 88 32 236 118 Units Shipped Date Number Balance questions Exercise No.01 Classify these industries into Job order costing and process costing industries: a. Meat c. Pianos e. Breakfast cereals g. Wood furniture i. Coke k. Leather m. Tyres and tubes. b. sugar d. steel f. paper boxes h. toys j. cooking utensils l. paint n. locomotives Exercise No.02 Forge Machine works collects it cost data by the job order costing system. For job 642, the following data are available: Direct Material used: 14/9 issued $1,200 20/9 issued $ 668 22/9 issued $ 480 Direct Labour: 20/9 180 hours @$6.2/hr 26/9 140 hours@$7.3/hr Factory overhead is applied at the rate of $3.5 per direct labour hour. Required: 1. The appropriate information entered on job cost sheet. 2. The estimated sales price if markup is 40% of cost. Exercise No.03 TedySung company produces special machines made to customers specifications. The following data pertain to job 1106: Customer: Markem machine shop Dated started: 4/11/19--Dated finished: 18/11/19— Sales price: $20,425 Materials used Direct labour rate in dept 1 Labour hour s used in Dept 1 Dated: October 27 Customers order No. C696 Description: 18 drilling machines 11/11 $2400 $8.2 per hour 300 18/11 $1300 $8.2 per hour 200 Direct labour rate in dept 2 $8.00 per $8.00 per hour hour Labour hour s used in Dept 2 150 70 Machine Hours in Dept 2. 200 120 Applied FOH in Dept 1 $4.00 per $4.00 per direct lab hour direct lab hour Applied FOH in Dept 2 $1.80 per $1.80 per machine hour machine hour Marketing and admin expenses are charged to each order at a rate of 25% of the cost to manufacture. Required: Prepare a Job Cost Sheet for order number 1106. Exercise No.04 Cambridge Company uses job order costing. At the beginning of May, two jobs were in process: Job No.369 Job No.372 Materials $2,000 $700 Direct labour $1,000 $300 Applied factory overhead $1,500 $450 During the month the following expenditures incurred on these jobs to complete them. Materials $10,000 $5,000 Direct labour $15,000 $3,500 Facto jry overhead $12,000 $2,300 Markup 20% 30% Required: calculate the: 1. Total production cost of each job. 2. Sales price of each job.