Chapter 17

Chapter 17

Job Costing and

Overhead Allocation

(omit pp. 21-32)

1

Job-Order versus Process Costing Systems

• Objective of both systems is to compute unit costs.

• The choice between the two types of systems is dictated by the type of product/service being provided or manufactured.

• Job costing - distinct, identifiable unit of a product or service (custom production). Costs accumulated by job.

• Process costing - masses of similar product or service units (homogeneous production). Costs accumulated by process or department.

• Process costing used for large quantities of likeitems (ex: mass manufacturing).

• Job order used for unique services or manufacturing jobs (ex: veterinary and medical services, custom machine shops).

2

Other Characteristics of Job Costing Systems

• Costs are accumulated by job.

• There is a subsidiary account, or job cost record, for each job The costs of each inventory control account (e.g., WIP, FG) equals the sum of the costs accumulated for each job in that inventory.

• Widely used in construction companies, certain types of manufacturers, service providers, and nonprofit organizations.

3

Direct Material and Direct Labor

• Direct Material (DM) - material costs directly traceable to the product. Include cost to purchase material, as well as shipping costs, sales tax, and other costs (like insurance during shipping).

• Direct Labor (DL) - labor costs directly traceable to product or service. Include wage rates, as well as fringe benefits ( including insurance, retirement benefits, employer portion of social security, and employer payments for state and federal unemployment taxes). Note that some portion of DL may be fixed (ex: insurance) or may not vary with productive activity (unemployment taxes). We will not deal with fringe benefits in this

Module.

4

Manufacturing and Service Overhead Costs

• Manufacturing overhead includes all other manufacturing costs (except DM and DL), and would include:

– indirect materials and supplies.

– indirect labor (ex.: maintenance, supervisor).

– rent/depreciation on manufacturing plant and equipment.

– insurance on manufacturing plant.

– maintenance costs on plant and equipment.

– utilities on manufacturing plant.

• Note MOH is accumulated in a separate, temporary account, then applied to WIPI using a predetermined rate (more on Slide 10)

• For service organizations, the overhead allocation is similar (ex.: hospitals and the $10 aspirin.)

5

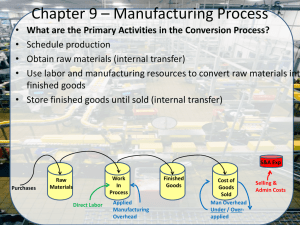

Cost Flows and the Production Process

• Manufacturing inventories:

– Raw Materials Inventory (RM)

– Work-in-process Inventory (WIP)

– Finished Goods Inventory (FG)

• Cost flows (see Exhibit 17.4, page 17-11)

– purchase raw materials (debit RMI)

– use raw materials (credit RMI, debit WIPI)

– use direct labor (debit WIPI)

– recognize actual OH (debit MOH)

– apply OH (credit MOH, debit (WIPI)

– when completed, transfer from WIPI to FGI

– when sold, transfer from FGI to COGS

6

Basic Inventory Equations

(See Exhibit 18.6 for Statement Format)

From T-Accounts:

Beg. RM Inv. + Purchases - End. RM Inv. = RM Used (or DM)

Beg. WIP Inv. + DM + DL + OH - End. WIP Inv. = COGM

Beg. FG Inv. + COGM - End. FG Inv. = COGS

DM = Direct Materials = Raw Materials Used

DL = Direct Labor

OH = Manufacturing Overhead

COGM = Cost of Goods Manufactured

COGS = Cost of Goods Sold

RM = Raw Materials

WIP = Work in Process

FG = Finished Goods

7

Attaching Costs to Jobs

1. Trace the DM and DL to the jobs.

2. Allocate the indirect (overhead) costs to the job using an appropriate allocation base

(cost driver).

3. Companies may develop a single plantwide overhead rate, or use different departmental overhead rates.

4. Other overhead allocation techniques will be examined in Module 18, Activity-Based

Costing.

8

Methods of Assigning Costs to Jobs

• Actual costing – a costing method that assigns actual overhead costs to jobs; a proportional allocation can be done only at the end of the period after all overhead costs are accumulated

(should not be used in most circumstances).

• Normal costing – assigns overhead costs to jobs using an estimated, predetermined overhead application rate to apply overhead to each job as it is completed (used in this chapter).

• Budgeted (or standard) costing - a costing method that assigns both direct and indirect costs to jobs using predetermined or budgeted rates (more on this in Module 21).

9

Why Use Predetermined Overhead Rates?

Predetermined rates have certain advantages over the use of actual rates:

• They reduce variability inherent in actual overhead rates.

• Managers do not have to wait until the end of an accounting period to get job cost reports.

• They require manufacturing personnel to engage in planning (budgets and standard costs).

• They set performance expectations.

10

Computing/Using Predetermined OH Rates

• Identify the indirect costs to be allocated.

• Estimate the amount of these costs expected to be incurred during the period, based on the estimated level of operations.

• Select an appropriate cost allocation base.

• Estimate the level of allocation base expected to be consumed, based on the estimated level of operations.

• Compute the predetermined overhead (MOH) rate:

MOH Rate = Est. annual MOH costs

Est. level of allocation base

• During the period, measure the actual amount of the allocation base consumed by a given job.

• Allocate overhead to that job by multiplying the predetermined rate by the actual amount of the allocation base consumed by the job:

Estimated MOH rate x actual level of activity =

Overhead Applied to production

11

Accounting for Actual and Applied MOH Costs

• Actual and applied costs of manufacturing overhead are typically accumulated in an account called

Manufacturing Overhead.

• Actual costs of overhead items are debited (added) to this account.

• Allocation of overhead is accounted for independently of the incurrence of overhead.

• Work-In-Process Inventory is debited (increased) for applied (allocated) overhead and Manufacturing

Overhead is credited (reduced) with the amount of the allocation.

• We will use T-accounts to represent activity in the

MOH account.

• Note that this is a temporary account, and must be eliminated before any financials are prepared.

12

T-Account for Manufacturing Overhead

Manufacturing OH

Actual OH costs incurred are accumulated here.

Applied OH costs are transferred out of MOH to WIP Inv.

The balance - debit or credit - is closed to other related accounts at the end of the period.

13

Manufacturing Overhead Variances

• The difference between the actual manufacturing overhead incurred and the amount allocated to jobs represents the manufacturing overhead variance .

• Assume that the actual manufacturing overhead totaled $14,200, while the allocated

(applied) overhead was $14,000. There is a debit balance of $200.

• This debit amount would be transferred to

COGS if the amount is immaterial, or proportionally allocated to WIP Inv., FG Inv., and COGS if the amount was material.

14

Journal Entry to Transfer MOH Balance

• If the amount is immaterial (small), the entire amount may be transferred to COGS. Using the amount on the previous slide:

COGS 200

MOH 200

(now MOH has a balance of zero, and all of the additional cost has been transferred to

COGS.)

15

Journal Entry to Transfer MOH Balance

• If the amount is material (large), the amount must be allocated proportionately to WIP Inv.,

FG Inv., and COGS (based on ending balances before allocation). To allocate the same $200 debit balance in MOH (assuming balances for WIP, FG, and COGS are 10%,

20%, and 70% proportionately:

WIP Inv.

FG Inv.

COGS

MOH

20

40

140

200

16

Manufacturing Overhead Variances

• If the variance has a debit balance, actual manufacturing overhead exceeded allocated (or applied) overhead. Work-In-Process Inventory,

Finished Goods Inventory, and Cost of Goods

Sold are all understated .

• If the variance has a credit balance, allocated (or applied) manufacturing overhead exceeded actual overhead. Work-In-Process Inventory,

Finished Goods Inventory, and Cost of Goods

Sold are all overstated .

• In either case, the final adjustment to the MOH account takes the accounts back to actual costs before financial statements are prepared.

17