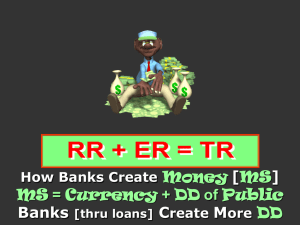

RR+ER=TR

advertisement

Rev Q’s [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS Excess Reserves prior to new currency deposit (DD) = $0 Britney Spears deposits in the banking system = $40 billion Legal Reserve Requirement [RR] = 20% 31. The $40 billion deposit of Currency into DD will result in MS staying at ($8/$40/$160) billion. 32. The $40 billion deposit of currency into checking accounts will create ER of ($20/$32/$40) billion. 33. The Potential Money Creation of the banking system through loans is ($40/$160/$$200) bil. The Potential TMS [all DD of the public] could be as much as ($40/$160/$200) 34. The RR applies to checkable deposits at (banks/S&Ls/ credit unions/ all depository institutions). 35. If the Duck National Bank has ER of $6,000 & DD of $100,000 what is the size of the bank’s TR if the RR is 25%? 25,000 6,000 31,000 ($25,000/$75,000/$31,000) [RR($____)+ER($___)+TR($____) Rev Q’s [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 36. A stranger deposits $1,000 in a bank that has a RR of 10%. The maximum possible change in the dollar value of the local bank’s loans would 900 be $______. PMC[M X ER] in the banking system is $_____. 9,000 Potential TMS 10,000 could become as high as $_______. 37. Suppose a commercial bank has DD of $100,000 and the RR is 10%. If the bank’s RR & ER are equal, then its TR are ($10,000/$20,000/$30,000). 38. Total Reserves (minus/plus) RR = ER. 39. Suppose the Thunderduck Bank has DD of $500,000 & the RR is 10%. If the institution has ER of $4,000 then its TR are ($46,000/$54,000/$4,000). 40. If ER in a bank are $4,000, DD are $40,000, & the RR is 10%, then TR are ($4,000/$8,000). 41. The main purpose of the RR is to (have funds for emergency withdrawals/ influence the lending ability of commercial banks). 42. If I write you a check for $1 & we both have our checking accts at the Poorman Bank, the bank’s balance sheet will (increase/decrease/be unchanged). 43. Banks (create/destroy) money when they make loans and repaying bank loans (create/destroy) money. 44. When a bank loan is repaid the MS is (increased/decreased). 45. The Fed Funds rate is a loan by one bank (to another bank/from the Fed). Rev. Q’s [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 46. If the RR was lowered [say, from 50% to 10%], the size of the monetary multiplier [MM] would (increase/decrease). Leakages(limitations) of the Money Creating Process 1. Cash leakages [taking part of loan in cash] 2. ER (banks don’t loan it or we don’t borrow] 47. If borrowers take a portion of their loans as cash, the maximum amount by which the banking system increases the MS by lending will (increase/decrease).