Money Creation

advertisement

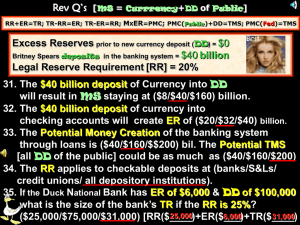

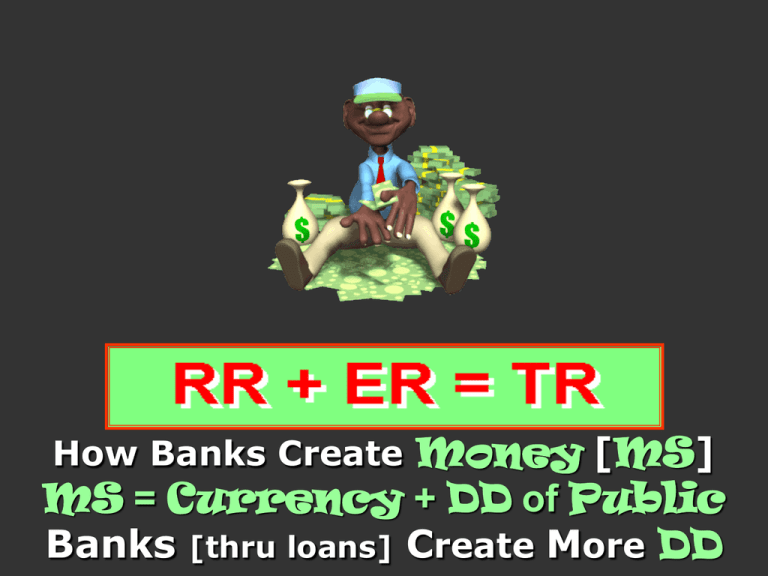

How Banks Create Money [MS] MS = Currency + DD of Public Banks [thru loans] Create More DD 1. Fractional Reserve Banking System – a fraction of DD are kept in reserve(say, 10%) at either the bank’s vault or at the Fed. 2. Vault cash – cash held by a bank (banks rarely keep more than 2% of their in cash) 3. Required Reserve(RR)–specified percentage of DD that banks must keep as RR. 4. Excess reserves – total reserves(TR) – RR. ER is what can be loaned out. 5. 6. Also some ER is used to meet sudden withdrawal demands. Actual(Total) reserves – RR + ER. Deposit Multiplier – one/RR or 1/.10 or $1/10 cents or 10 Multipliers 1/RR[$1/5 cents = 20] 1/5% = 20 1/25% = 4 1/10% = 10 1/33.3%= 3 1/12.5% = 8 1/40 = 2.5 1/20% = 5 1/50% = 2 7. Balance Sheet–statement of assets & liabilities[assets=liabilities]. 8. Discount Rate – when banks borrow from the Fed. [symbolic-emergencies] “wholesale price of money” 9. Federal Funds Rate – banks borrow from other banks for overnight loans. 10. Prime Rate – when a bank’s prime customers [good credit] get loans. “retail price of money” 11. Buying Bonds – “buying” bonds means “bigger ” supply of money and “lower interest rates”. [So, more “C”, “Ig”, and “Xn” ] 12. Selling Bonds – “selling” bonds mea ns “smaller” supply of money and “higher interest rates”. [So, less “C”, “Ig”, and “Xn”] FRACTIONAL RESERVE BANKING YOU deposit $1 with A 10% RR .10 RR 90 cents Excess Reserves Total (Actual) Reserves One Dollar One bank’s loan becomes another bank’s DD. PMC = M x ER, so 10 x .90 =$9 TMS = PMC[$9] + DD[$1] = $10 [MS = Currency + DD of Public] Your Bank Borrows $1 From The Fed [10% RR] Bank Fed 0 One Dollar RR Excess Reserves Total(Actual) Reserves One Dollar PMC = M x ER, so 10 x $1 = $10 TMS [$10] = PMC[$10] [MS = Currency + DD of Public] $1,000 DD [MS=Currency+DD of Public] New Deposits [New Reserves] DD Bank DD Created By New Loans [equal to new ER] New Required Reserves RR=10% A $1,000.00 $100.00 900.00 900.00 B 900.00 $90.00 810.00 C 810.00 $81.00 729.00 D 729.00 $72.90 656.10 PMC = ER[$900] x M[10] DD + PMC $1,000.00 + $9,000.00 = = Dog that can YoYo One year “all u can eat” hot wings at Hooters $729.00 for a “cat bodyguard” PMC = $9,000.00 TMS Smoking cat $10,000.00 MS grows by multiple of 10 $1,000 DD [MS=Currency+DD of Public] New Deposits [New Reserves] DD Bank DD Created By New Loans [equal to new ER] New Required Reserves RR=20% A $1,000.00 $200.00 800.00 B 800.00 $160.00 640.00 C 640.00 $128.00 512.00 D 512.00 $102.40 409.60 PMC = ER[$800 x M[5] DD + PMC $1,000.00 + $4,000.00 = = PMC = $4,000.00 TMS $5,000.00 MS grows by multiple of 5 $1,000 DD [MS=Currency+DD of Public] New Deposits [New Reserves] DD Bank DD Created By New Loans [equal to new ER] New Required Reserves RR=25% A $1,000.00 $250.00 750.00 B 750.00 $188.00 562.00 C 562.00 $140.00 422.00 D 422.00 $105.00 317.00 E 317.00 $80.00 237.00 PMC = ER[$750] x M[4] DD + PMC $1,000.00 + $3,000.00 PMC = $ = 3,000.00 TMS = $4,000.00 MS grows by multiple of 4 MS = DD + Currency of the Public [A DD of $10,000 will increase MS by another $40,000($50,000 MS] RR=20% MS $10,000 $8,000 $6,400 $24,400 MS is $10,000 1. Joe Biker deposits $10,000 in his bank. RR = 20% 4. 2nd Bank lends Sports Shop $6,400. MS $10,000 $8,000 $18,000 2. Suzie Rah Rah borrows $8,000 5. Eventually the MS will be $50,000 Joe 3. Suzie pays $8,000 for a used car. GoNow Auto deposits the $ in 2nd Bank. $10,000+$40,000=$50,000 NOTES: Banks create money by lending ER and destroy money by loan repayment. Purchasing bonds from the public also creates money. MULTIPLE DEPOSIT EXPANSION PROCESS RR= 20% Bank Acquired reserves Required and deposits reserves A $100.00 B 80.00 C 64.00 D 51.20 E 40.96 F 32.77 G 26.22 H 20.98 I 16.78 J 13.42 K 10.74 L 8.59 M 6.87 N 5.50 Other banks 21.97 $20.00 16.00 12.80 10.24 8.19 6.55 5.24 4.20 3.36 2.68 2.15 1.72 1.37 1.10 4.40 P MC in the banking system [MxER] Excess reserves $80.00 64.00 51.20 40.96 32.77 26.22 20.98 16.78 13.42 10.74 8.59 6.87 5.50 4.40 17.57 Amount bank can lend - New money created $80.00 64.00 51.20 1st 40.96 10 32.77 $357 26.22 of 20.98 the 16.78 $400 13.42 10.74 8.59 6.87 5.50 4.40 17.57 $400.00 TMS = $500.00 THE Money [Deposit] MULTIPLIER MM = 1 RR The MM is the reciprocal of the RR. Maximum Potential money checkableCreation in the Bankingdeposit System expansion [PMC] = ER x MM AP Econ [MS = Currrency + DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS Excess Reserves prior to new currency deposit (DD) = $0 Ben Bigbucks deposits in the banking system = $40 million Legal Reserve Requirement [RR] = 20% 1. The $40 million deposit of Currency into DD would result in MS staying at ($8/$40/$160) million. [MS composition changed from currency to DD] 2. The $40 million deposit of currency into checking accounts will create ER of ($20/$32/$40) million. 3. The Potential Money Creation of the banking system through loans is ($40/$160/$$200) mil. The Potential TMS [all DD of the public] could be as much as ($40/$160/$200) mil. 4. The RR applies to checkable deposits at (banks/S&Ls/ credit unions/ all depository institutions). 5. If the Duck National Bank has ER of $6,000 & DD of $100,000 what is the size of the bank’s TR if the RR is 25%? 25,000 6,000 31,000 ($25,000/$75,000/$31,000) [RR($____)+ER($___)+TR($____) [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 6. A stranger deposits $1,000 in a bank that has a RR of 10%. The maximum possible change in the dollar value of the local bank’s loans would 900 be $______. PMC[M X ER] in the banking system is $_____. 9,000 Potential TMS 10,000 could become as high as $_______. 7. Suppose a commercial bank has DD of $100,000 and the RR is 10%. If the bank’s RR & ER are equal, then its TR are ($10,000/$20,000/$30,000). 8. Total Reserves (minus/plus) RR = ER. 9. Suppose the Thunderduck Bank has DD of $500,000 & the RR is 10%. If the institution has ER of $4,000 then its TR are ($46,000/$54,000/$4,000). 10. If ER in a bank are $4,000, DD are $40,000, & the RR is 10%, then TR are ($4,000/$8,000). 11. The main purpose of the RR is to (have funds for emergency withdrawals/ influence the lending ability of commercial banks). 12. If I write you a check for $1 & we both have our checking accts at the Poorman Bank, the bank’s balance sheet will (increase/decrease/be unchanged). 13. Banks (create/destroy) money when they make loans and repaying bank loans (create/destroy) money. 14. When a bank loan is repaid the MS is (increased/decreased). 15. The Fed Funds rate is a loan by one bank (to another bank/from the Fed). [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 16. If the RR was lowered [say, from 50% to 10%], the size of the monetary multiplier [MM] would (increase/decrease). Leakages (limitations) of the Money Creating Process 1. Cash leakages [taking part of loan in cash] 2. ER (banks don’t loan it or we don’t borrow] 17. If borrowers take a portion of their loans as cash, the maximum amount by which the banking system increases the MS by lending will (increase/decrease). Money Supply = DD + Currency of the Public ER “PMC” Loans $100[10% RR] [1st Bank] [1st Bank] Banks/Public DD [$100] $90 $90 Fed /Public/Banks DD[$100] $90 $90 “PMC” Crea. In “TMS” “Potential” System Total MS $900 $1,000 $900 $1,000 [*Fed buys bonds from public who put the money in their DD] Banks/Fed Fed Loan[$100] $100 [or sells bonds to Fed] ER $100 “PMC” Loans $1,000 $100 [20% RR] [1st Bank] [1st Bank] Banks/Public DD [$100] $80 $80 Fed/Public/Banks DD [$100] $80 $80 “PMC” Crea. In $1,000 “TMS” “Potential” System Total MS $400 $500 $400 $500 [*Fed buys bonds from public who put the money in their DD] Banks/Fed Fed Loan[$100] $100 [or sells bonds to Fed] $100 $500 $500 Banks and the Fed [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of Public [Money borrowed from the Fed [or gained thru bond sales] is ER & can be loaned out] 9. RR is 25%; Econ Bank borrows $25,000 from the Fed; its ER are increased by 25,000 Potential Money Creation in the system is $_______. $______. 100,000 100,000 Potential TMS is $_______. 10. RR is 50%; a bank borrows $20,000 from the Fed; this one bank’s ER are increased 40,000 40,000 Potential TMS is $______ by $_____. 20,000 Potential Money Creation in the system is $______. 11. RR is 20%; the Duck Bank sells $10 M of bonds to the Fed; Duck Bank’s ER are increased by $___million. PMC in the system is $__________. 50 million 50 million TMS is $__________. 10 12. RR is 20%; Fed buys $50,000 of securities from Keynes Bank. Its ER are increased by $___________. Potential Money Creation in the banking system is 50,000 $______________. Potential TMS is $___________. 250,000 250,000 13. 25% RR; Fed buys $400 million of bonds from the Friar Bank. This one 400 bank’s ER are increased by $_____million. 14. RR is 50%; the Fed sells $200 million of bonds to a bank; its ER are (increased/decreased) by $_______. 200 M Potential Money Creation in the 400 M banking system is (increased/decreased) by $________. 15. RR is 10%; a bank borrows $10 million from the Fed; this one bank’s ER are increased by $_______ million. PMC in the banking system is 10 $_______million. Potential TMS is $_______million. 100 100 Banks and the Public RR+ER=TR; TR-RR=ER; TR-ER=RR; M x ER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS MS = currency + DD of Public Banks & Public (all DD of Public are subject to the RR; rest is ER & can be loaned out) 1. No ER & RR is 20%; DD of $10 M is made in the Thunder Bank. MS is $___million. ER increase by $___million. Potential Money Creation in the 10 8 banking system is $_____M. Potential TMS is $____million. 40 50 2. There are no ER & RR is 25% & $16,000 is deposited in the Duck Bank. MS is $_______. 16,000 This one bank can increase its loans by a maximum of 48,000 $_______. 12,000 Potential Money Creation in the banking system is $_______. 64,000 Potential Total Money Supply could be $__________. 3. Econ Bank has ER of $5,000; DD are $100,000; RR is 25%. TR are $_______. 30,000 4. DD are $10,000; ER are $1,000; TR are $3,000; RR are $2,000 _________. [TR-ER=RR]. $50,000 5. Nomics Bank has ER of $10,000; DD of $100,000; RR of 40%. TR are _________. With ER above, Potential Money Creation in the banking system is $__________. 25,000 6. Friar Bank has DD of $100,000; RR is 20%; RR & ER are equal. TR are $________. 40,000 7. If ER in a bank are $10,000; DD are $200,000, & the RR are 10%. TR are $_______. 30,000 100,000 This single bank can 8. No ER & RR is 25%. DD of $100,000 is made. MS is $_______. 75,000 PMC in the system is $________. increase its loans by $_______. 300,000 TMS is $________. 400,000 Fed and the Public [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of the Public [When Fed buys securities from Public, they will put the money in their DD] 16. RR is 50%; Fed buys $10 M of bonds from the Public. MS is increased by _______. $10 M $20 M ER are increased by $5 ____. _______. M PMC in the system is $10 M Potential TMS is _______. 17. RR is 25%; Fed buys $100 M of bonds from the Public. The MS is increased _______. $100 M ER are increased by ______. _______. ________. $75 M PMC in the system is $300 M Potential TMS is $400 M 18. RR is 50%; Fed sells $200 M of bonds to the Public. The MS is (incr/decr) by $100 M PMC in the banking system is __________. $200 M ER are (incr/decr) by _________. M (increased/decreased) by $200 _______. __________. M Potential TMS is (incr/decr) by $400 19. RR is 20%; Fed buys $5 million of securities from the Public. The MS $5 M ER are increased by _______. is increased by _______. $4 M Potential Money $25 M M Potential TMS is _________. Creation in the banking system is$20 _______. 20. RR is 10%; Fed buys $50 million of bonds from the Public. The MS is $50 M ER are increased by _______. $45 M PMC in the banking increased by _______. $500 M $450 M Potential Total Money Supply is __________. system is __________. 1. The RR is 20% & Joe Smith deposits $10,000 in the Econ Bank that he has been saving in a coffee can in a tree. The impact of this transaction on the ER of the Econ Bank & the potential increase in the money supply would be: [Remember: MS = Currency + DD of public] (A) ER would increase by $10,000 & the maximum increase in TMS would be $50,000. (B) ER would increase by $8,000 & the maximum increase in TMS would be $50,000 (C) ER would increase by $8,000 & the maximum increase in MS would be $40,000 (D) ER would increase by $10,000 & the maximum increase in MS would be $40,000. (E) ER would increase by $40,000 & the maximum increase in MS would be $50,000. The MS [Cash or DD of the public] was $10,000 cash. When he deposited the $10,000, the Econ Bank could loan out ER of $8,000. The $8,000 x MM of 5 became $40,000 for TMS of $50,000. So, $10,000 MS of cash increased MS by $40,000 to get the total money supply of $50,000. 1. RR is 20% & Econ Bank borrows $10,000 from the Fed. The impact of this loan on the bank’s ER and then TMS are: [Remember again: MS = Currency + DD of public] (A) ER would increase by $10,000 & the maximum increase in TMS would be $50,000. (B) ER would increase by $8,000 & the maximum increase in TMS would be $50,000 (C) ER would increase by $8,000 & the maximum increase in MS would be $40,000 (D) ER would increase by $10,000 & the maximum increase in MS would be $40,000. (E) ER would increase by $40,000 & the maximum increase in MS would be $50,000. All of the $10,000 loan would be ER. Econ Bank could loan it all out so it could result in a PMC and TMS of $50,000. [MM of 10 x $10,000 = $50,000] Money Creation Problems from the 2005 Macro MC Exam (87%) 40. Under a fractional reserve banking system, banks are required to a. keep part of their demand deposits as reserves b. expand the money supply when requested by the central bank c. insure their deposits against losses and bank runs d. pay a fraction of their interest income in taxes e. charge the same interest rate on all their loans (72%) 41. If a commercial bank has no ER and the RR is 10%, what is the value of new loans this single bank can issue if a new customer deposits $10,000? a. $100,000 b. $90,333 c. $10,000 d. $9,000 e. $1,000 The TR: $15,000, Securities: $70,000, and Liabilities Loan: $15,000 total up to the $100,000 DD. DD: $100,000 This bank would have to keep $12,000 of their $100,000 in RR. With TR of $15,000, they have $3,000 in ER to loan. Assets Total Reserves: $15,000 Securities: $70,000 Loan: $15,000 (37%) 42. A commercial bank is facing the conditions given above. If the RR is 12% and the bank does not sell any of its securities, the maximum amount of additional lending this bank can undertake is a. $15,000 b. $12,000 c. $3,000 d. $1,800 e. 0 (53%) 43. Assume the RR is 20%, but banks voluntarily keep some excess reserves. A $1 million increase in new reserves will result in They could increase M, but a. an increase in the MS of $5 million c. decrease in MSMS of by $1 $5 million they keeping in ER, somillion MS b. an increase in the MS of less than $5 million d. are decrease insome the MS of $5 will increase by less than $5 million. e. a decrease in the MS of more than $5 million THE Total DEMAND FOR MONEY Transactions Demand, Dt + Asset Demand, Da Nominal Interest Rate M1 10 7.5 5 2.5 Dt Independent of the interest rate Dt Rate of interest, i (percent) “Walking around” money 10 7.5 5 = Total demand for money, Dm Da [M2] – store of value money Money that we don’t need for daily, weekly, or monthly transactions. We will invest more of it the higher the interest rate. We will hold less because the opportunity cost increases. 10% Da Interest Rate 2.5 CDs or 8% Da 0 0 50 100 150 200 250 300 0 50 100 150 200 250 Opportunity Cost 0 Amount of money demanded (billions) Amount of money demanded (billions) Da [hold less] Interest Rate Da varies inversely Opportunity Cost with the interest rate. Da [hold more] 6% 5% 4% 2% 1% 0 0 50 100 150 200 MS 7.5 5 2.5 Dt = Total demand for money, Dm MS2 MS1 0 50 100 150 200 250 300 Amount of money demanded [billions] Asset Demand, Da 10 7.5 5 2.5 Da Rate of interest, i (percent) 10 + Rate of interest, i (percent) Nominal Interest Rate Transactions Demand, Dt 10 7.5 55 E 2.5 Dm 0 0 50 100 150 200 250 300 0 50 100 150 200 250 300 Amount of money demanded [billions] Money market 1. At equilibrium 5% I.R., the amount of money demanded for transactions is (0/50/100) and the amount demanded as an asset is (0/50/100). 2. If the interest rate were 10%, the amount of money demanded for Dt would be (0/50/100) & the amount demanded as an asset would be (0/50/100). 3. Da slopes down because lower in. rates (incr/decr) the cost of holding money. [at “E”, money supplied ($200) = money demanded ($200)] Nominal Interest Rate The Dm curve represents the quantity of money people are willing to hold at various interest rates. DmMS 7.5 E 5 2.5 0 50 100 150 200 250 300 Money Market Due to a recession, suppose the money supply is increased from $200 billion to $250 billion. S2 S1 P2 P1 # of Bonds A temporary surplus of MS1MS2 $50 billion beyond which the people wish to hold, 10 Nominal Interest Rate Price of Bonds [at “E”, money supplied ($200) = money demanded ($200)] Dm 7.5 E 5 E 2.5 0 50 100 They react by buying bonds [pushing bond prices up] to meet the desired level of liquidity. 150 200 250 300 Money Market AD AD PL YD GDP Nominal Interest Rate LRAS SRAS MS1 MS2 Dm E 1% 0 Money Market 500 Liquidity Trap – in a stagnant economy with interest rates near or at zero, an increase in MS fails to stimulate AD, so recession or depression gets worse. With low returns expected on financial investments, people hoard their money. Banks are unwilling to lend in a slack economy. Fiscal policy is needed here. [at “E”, money supplied ($200) = money demanded ($200)] Due to inflation, suppose the money supply is decreased from $200 billion to $150 billion. Nominal Interest Rate Dm MS 7.5 E 5 2.5 0 50 100 150 200 Money Market 250 300 P1 P2 # of T-bills Nominal Interest Rate Price of Bonds A temporary shortage of money will require the sale of some assets [bonds-which will make their price fall] to meet the money shortage need. DmMS2 MS1 S1 S2 10 7.5 E 5 0 50 100 150 200 250 300 Money Market 1. [3 pts] Assume that declining stock market prices in the U.S. cause many U.S. financial investors to sell their stocks and increase their money holdings. investors sell off stocks when market prices begin to decline. These new money holdings will increase the asset [speculative] demand for money. In the volatile market, investors will hold more money while determining future needs. [2 pts: 1 pt for correct graph and 1 pt for Dm shifting right.] Nominal Interest Rate (a) Draw a correctly labeled graph of the money market and show the impact of the financial investors’ actions on each of the following. (i) Demand for money (ii) Nominal interest rate DMMS DM2 Answers for 1. (a) (i) [2 points] 1 r 2 1. (a) (i) In an effort to preserve wealth, r1 M Quantity of Money Tutorial: These will shift the real Dm curve. 1. Changes in real aggregate spending, 2. Advances in banking technology. [ATMs available 24/7 decrease the need for cash (Dm)] 3. Changes in institutions [ability to get interest on checking accounts lead to an increase in Dm], 4. Riskiness of alternative stores of value [stocks]. Dm increases when stocks are not appealing. Answers for 1. (a) (ii) [1 point for saying the interest rate increases] 1. (a) (ii) The nominal interest rate would increase because the demand for money increases as the DM curve shifts up, as shown above.