The amount of money earned after the costs of operating a business

advertisement

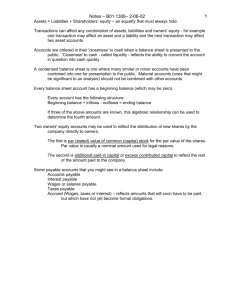

Accounting I Semester Exam Review An entry level job performing one or two accounting tasks is called a(n) a. b. c. d. accounting clerk entrepreneur internship staff accountant 5 An entry level job performing one or two accounting tasks is called a(n) a. b. c. d. accounting clerk entrepreneur internship staff accountant 5 To find information about a career in accounting a. look for information on accounting careers in the library b. research career information on the internet c. talk to someone who works in the accounting field d. all of the above 3 To find information about a career in accounting a. look for information on accounting careers in the library b. research career information on the internet c. talk to someone who works in the accounting field d. all of the above 3 • The most common form of business organization is a a. b. c. d. corporation lemonade stand partnership sole proprietorship 10 • The most common form of business organization is a a. b. c. d. corporation lemonade stand partnership sole proprietorship 10 A merchandising business a. buys raw materials and transforms them into finished products b. buys finished products and resells them c. provides a service for a fee d. all of the above 6 A merchandising business a. buys raw materials and transforms them into finished products b. buys finished products and resells them c. provides a service for a fee d. all of the above 6 A business that operates to support a cause or interest is known as a a. b. c. d. career goal not-for-profit organization private entity sports franchise 4 A business that operates to support a cause or interest is known as a a. b. c. d. career goal not-for-profit organization private entity sports franchise 4 A corporation is a business organization that is recognized by law to a. b. c. d. have a life of its own have an active social life have at least 3 owners pay no tax 8 A corporation is a business organization that is recognized by law to a. b. c. d. have a life of its own have an active social life have at least 3 owners pay no tax 8 Accounting is often called the "language of business" because a. accountants in many companies share financial information b. all business owners have a good understanding of accounting principles c. it is easy to understand d. it is fundamental to the communication of financial information 15 Accounting is often called the "language of business" because a. accountants in many companies share financial information b. all business owners have a good understanding of accounting principles c. it is easy to understand d. it is fundamental to the communication of financial information 15 Money supplied by investors, banks, or owners of a business is called a. b. c. d. capital incurred expenses secondary alignment pin money 7 Money supplied by investors, banks, or owners of a business is called a. b. c. d. capital incurred expenses secondary alignment pin money 7 The amount of money earned after the costs of operating a business are paid is _______. capital b. expense c. profit d. revenue a. 1 The amount of money earned after the costs of operating a business are paid is _______. capital b. expense c. profit d. revenue a. 1 A free enterprise system allows businesses to a. have their government choose their products b. produce the goods and services they choose c. buy goods at a discount d. operate at a profit 9 A free enterprise system allows businesses to a. have their government choose their products b. produce the goods and services they choose c. buy goods at a discount d. operate at a profit 9 Those who transform ideas for products or services into real-world businesses are known as a. b. c. d. accountants entrepreneurs organizers profit takers 11 Those who transform ideas for products or services into real-world businesses are known as a. b. c. d. accountants entrepreneurs organizers profit takers 11 One of the disadvantages of a sole proprietorship is a. all the profits go to the owner b. it is easy to set up c. the owner has all the risks d. there are few regulations to follow 13 One of the disadvantages of a sole proprietorship is a. all the profits go to the owner b. it is easy to set up c. the owner has all the risks d. there are few regulations to follow 13 One example of an accounting assumption is a. b. c. d. business entity financial accounting financial reports management accounting 17 One example of an accounting assumption is a. b. c. d. business entity financial accounting financial reports management accounting 17 A business owned by two or more people is called a. b. c. d. a corporation a partnership looking for trouble venture capital 12 A business owned by two or more people is called a. b. c. d. a corporation a partnership looking for trouble venture capital 12 The total revenue for the period is $25,496, the total expenses are $13,387, and the withdrawals account has an ending balance of $2,500. The capital account increased by ____________. a. b. c. d. $9,609 $12,109 $14,609 $27,996 23 The total revenue for the period is $25,496, the total expenses are $13,387, and the withdrawals account has an ending balance of $2,500. The capital account increased by ____________. a. b. c. d. $9,609 $12,109 $14,609 $27,996 23 Closing entries close the net income or net loss into the . a. b. c. d. revenue account expense account capital account cash in bank account 20 Closing entries close the net income or net loss into the . a. b. c. d. revenue account expense account capital account cash in bank account 20 GAAP stands for a. a clothing store b. generally accepted accounting period c.generally accepted accounting principles d. generally allowed accounting principles 16. GAAP stands for a. a clothing store b. generally accepted accounting period c.generally accepted accounting principles d. generally allowed accounting principles 16. When accounting information is processed by hand it is called a. b. c. d. a financial reporting system a manual accounting system an in-house system open accounting 14. When accounting information is processed by hand it is called a. b. c. d. a financial reporting system a manual accounting system an in-house system open accounting 14. The source of information for the closing entries is the ________. a. b. c. d. balance sheet income statement work sheet all the above 22. The source of information for the closing entries is the ________. a. b. c. d. balance sheet income statement work sheet all the above 22. The word equities refers to claims against the assets of a business by a. b. c. d. . creditors only owners only customers only both creditors and owners 25 The word equities refers to claims against the assets of a business by a. b. c. d. . creditors only owners only customers only both creditors and owners 25 If the trial balance section of the work sheet is out of balance, the first thing you should do is . a. check the ledger accounts against the work sheet b. add the columns again c. recopy the accounts and balances to a new work sheet d. look in the ledger for the amount of the difference 19. If the trial balance section of the work sheet is out of balance, the first thing you should do is . a. check the ledger accounts against the work sheet b. add the columns again c. recopy the accounts and balances to a new work sheet d. look in the ledger for the amount of the difference 19. Each of the following is a business expense except a payment for _____ . a. b. c. d. advertising equipment monthly rent utilities bills 24 Each of the following is a business expense except a payment for _____ . a. b. c. d. advertising equipment monthly rent utilities bills 24 Accounting is often called the "language of business" because a. b. c. d. asset accounts liability accounts permanent accounts temporary accounts 18 Accounting is often called the "language of business" because a. b. c. d. asset accounts liability accounts permanent accounts temporary accounts 18 A business that operates to earn money for its owners is called a(n) a. career b. for-profit business c. owner financed business d. professional organization 2 A business that operates to earn money for its owners is called a(n) a. career b. for-profit business c. owner financed business d. professional organization 2 When closing the withdrawals account, transfer the balance in this account to the __________ account. a. b. c. d. capital expense income summary revenue 21 When closing the withdrawals account, transfer the balance in this account to the __________ account. a. b. c. d. capital expense income summary revenue 21 True or False Corporations often start out as sole proprietorship or partnerships. True or False Corporations often start out as sole proprietorship or partnerships. True or False Accounts Receivable is a liability account. True or False Accounts Receivable is a liability account. True or False The corporation is the easiest form of business to organize. True or False The corporation is the easiest form of business to organize. True or False Every transaction affects two or more accounts and is recorded by equal amounts of debits and credits. True or False Every transaction affects two or more accounts and is recorded by equal amounts of debits and credits. True or False An owner’s equity account is increased on the debit side and normally has a debit balance. True or False An owner’s equity account is increased on the debit side and normally has a debit balance. True or False An increase in revenue is recorded as a credit. True or False An increase in revenue is recorded as a credit. True or False A credit to an account always increases it; a debit to an account always decreases it. True or False A credit to an account always increases it; a debit to an account always decreases it. True or False The debit and credit parts of an entry must be equal for the accounting equation to remain in balance. True or False The debit and credit parts of an entry must be equal for the accounting equation to remain in balance. True or False Only businesses that earn a profit will have the economic resources to continue to operate. True or False Only businesses that earn a profit will have the economic resources to continue to operate. True or False When revenue accounts are closed, the Income Summary account is debited. True or False When revenue accounts are closed, the Income Summary account is debited. True or False Withdrawals is a permanent account. True or False Withdrawals is a permanent account. True or False Increases in expenses are recorded as debits. True or False Increases in expenses are recorded as debits. True or False The balance sheet should be prepared before the statement of changes in owner’s equity. True or False The balance sheet should be prepared before the statement of changes in owner’s equity. True or False A work sheet is normally prepared in pencil on standard multicolumn accounting paper. True or False A work sheet is normally prepared in pencil on standard multicolumn accounting paper. True or False A net loss occurs when the revenue is greater than the expenses. True or False A net loss occurs when the revenue is greater than the expenses. True or False After each transaction, the basic accounting equation should remain in balance. True or False After each transaction, the basic accounting equation should remain in balance. True or False Assets + Liabilities = Owner’s Equity is another way to express the basic accounting equation. True or False Assets + Liabilities = Owner’s Equity is another way to express the basic accounting equation. True or False The difference between the debit and credit amounts in an account is the account balance. True or False The difference between the debit and credit amounts in an account is the account balance. True or False Temporary capital accounts are extensions of the owner’s capital account. True or False Temporary capital accounts are extensions of the owner’s capital account. True or False A journal is like a diary of a business because it is the only place where complete details of a transaction are recorded. True or False A journal is like a diary of a business because it is the only place where complete details of a transaction are recorded. True or False A creditor has a financial claim to the assets of a business. True or False A creditor has a financial claim to the assets of a business. True or False The total financial claims do not have to equal the total cost of the property. True or False The total financial claims do not have to equal the total cost of the property. True or False Expenses decrease owner’s equity and are recorded as debits. True or False Expenses decrease owner’s equity and are recorded as debits. True or False A fiscal period may be one month, three months, six months, or even one year, but usually it is one year. True or False A fiscal period may be one month, three months, six months, or even one year, but usually it is one year. True or False A trial balance is prepared after posting is completed. True or False A trial balance is prepared after posting is completed. True or False