Account Titles Presentation

advertisement

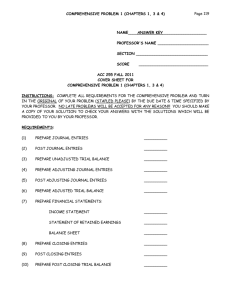

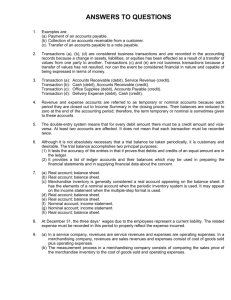

A. Activity Proper B. Abstraction C. Application/Seatwork D. QUIZ E. Assignment Answer the following question with your group mates in ¼ pad paper. 1. It is the amount of collectible from customers or clients. Notes Receivables b) Cash c) Accounts Receivables a) 2. Heavy metallic and movable items that are capable of performing certain functions or used to perform certain function. Merchandise Inventory b) Machinery and Equipment c) Tools a) 3. Obligations to suppliers for items bought and are not supported by promissory notes. a) Expense Payable b) Accounts Payable c) Notes Payable 4. This account title is used for withdrawal made by the owner. a) Accounts Payable b) Owner’s Capital c) Owner’s Drawing 5. The amounts of rentals incurred based on occupancy of space or usage of property and equipment. a) Service Income b) Rent Expense c) Tools Expense Account Titles – are the terms used to identify the specific element of accounting to be used in the recording process. Proper identification is necessary right at the recording phase they are brought forward to accounting reports. Cash – currency (bills and coins), checks postal money orders and treasury warrants received by the business. Accounts Receivable (AR) – amounts collectible from the customers or clients (for goods sold and services rendered) in this account is not supported by promissory notes so that it is often referred to as arising from sales “open account” Merchandise Inventory (MI) – goods acquired for sale and are still unsold. Notes Receivable (NR) – Amounts collectible that are covered by promissory notes. Prepaid Expense – expenses to be incurred yet in the future but are already paid. Example: Prepaid rent, Prepaid Interest, and Prepaid Insurance. Unused Supplies – supplies that are still unused as of the end of an accounting period. Land – land acquired by the business for its use. Building – structures of edifices acquired for use of the business. Machinery and Equipment – Heavy metallic and movable items that are capable of performing certain functions or used to perform certain functions. Examples: Sewing Machine, Cutting Machines a computers. Delivery Equipments – wheeled items used in making deliveries to customers or clients. Example: Van and trucks Furniture and Fixtures (F/F) – This account title is used in referring to movable items significant value and acquired to improve the workable condition of place such as tables, chairs, electric fans and air conditioners. Tools – Handy, small and usually metallic items used in performing certain functions such as saws, hammers, pliers, scissors, screw drivers, and jacks. Tools in general, have long useful life but do not have significant to peso value. Liabilities Accounts Payable (A/P) – obligations to suppliers for items bought and are not supported by promissory notes. It is often referred to as arising from purchase “on open accounts”. Notes Payable (N/P) – obligations covered by promissory notes. Expenses Payable (Accrued Expenses) – obligations for expenses already incurred but not yet paid. Loans Payable – obligations arising from loans obtained. Owner’s Equity Owner’s Capital – capital of the sole proprietor in his business. If the owner is Jose P. Gonzales, the account becomes Jose P. Golez, Capital. At the end of the accounting period, it is adjusted for withdrawals and net income ( net loss). Owner’s Drawing – this account title is used for withdrawals made by the owner. If the owner’s name is Jose P. Golez, the account title is Jose P. Golez, Drawing or Jose P. Golez, Personal. Revenue Service Income – revenue realized by providing services to customers. Fees Income – revenue realized by providing professionals service to clients. Example: legal , dental, and medical fees. Sales – revenue from sale of goods that were previously acquired for sale. Expenses Taxes and Licenses – cost of permits and taxes incurred. Advertising Expense – incurred in making the public aware of the goods and services being offered by the business. Example: advertisement in the news paper, and through radio and television. Salaries and Wages – the compensation earned by employees for service rendered to the business. Supplies Expense – cost of supplies already used. Light, power and water – cost of light, power and water consumption as indicated on bills presented by utility company. Telephone and Telegram – telephone and telegraph charges as indicated on bills presented by telecommunications companies. Rent Expense – the amount of rentals incurred based on occupy of space or usage of property equipment. Tools Expense – cost of goods treated as expense. Depreciation expense – the portion of property cost allocated to an accounting period. Insurance Expense – Insurance premiums related to current period. Bad Debts – provision for uncollectible receivables. Miscellaneous Expense – the different minor expenses incurred and for which no specific account title has been adopted. . Seatwork. Write in ¼ pad paper Instruction: Classify the following account title according to Assets, Liabilities, Owner’s Equity ASSETS LIABILITES OWNER’S EQUITY CHOICES Furniture, Prepaid Expense, Dental Fees, Supplies Used, Salaries Expense, Loans Payable, Service Income, Cruz Personal, Notes Receivable, Notes Payable, Accounts Payable. Answers ASSETS LIABILITIES OWNER’S EQUITY Furniture Loans Payable Dental Fees Prepaid Expense Notes Payable Salaries Expense Notes Receivable Accounts Payable Service Income Cruz Personal QUIZ Identify the following account titles. Write Asset, Liability, Owner’s Equity and Revenue. ______1. Cash ______2. ______3. ______4. ______5. ______6. ______7. ______8. Service Income Dentals Fees Expenses Payable Accounts Receivables Buildings Notes Payable Cruz, Capital 1. Assets 2. Revenue 3. Revenue 4. Liability 5. Assets 6. Assets Liability 8. Owner’s Equity 7. Assignment: Identify the account titles in the given statements. 1. Cost of placing advertisements is new paper. 2. Rentals incurred for spaces being used. 3. Revenue earned by professionals for service rendered to clients. 4. Receivables covered by promissory notes. 5. Withdrawals by the sole proprietor J. Rizaldy. PRESENTE BY: MS. LOUISSE MARCELINO AREVADA