Chapter 4

advertisement

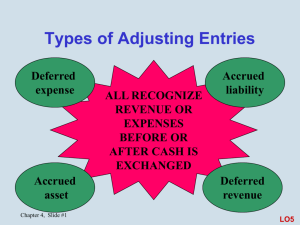

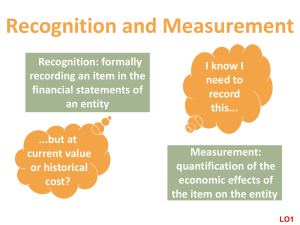

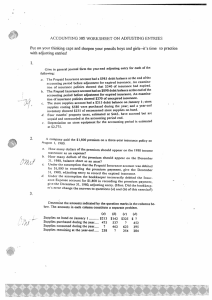

Ch.4 Income Measurement & Accrual Accounting Chapter 4, Slide #1 Recognition and Measurement Recognition: formally recording an item in the financial statements of an entity ...but at current value or historical cost? Chapter 4, Slide #2 I know I need to record this... Measurement: quantification of the economic effects of the item on the entity LO1 Cash vs. Accrual Basis Cash basis: revenues and expenses are recorded only when cash is received or paid Accrual basis: revenues are recognized when earned; expenses are recognized when incurred Chapter 4, Slide #3 LO2 Cash basis statement Accrual basis statement Statement of Cash Flows Income Statement Cash flows from operating activities: $(4,000) Net income: $ 7,000 What accounts for the difference? Chapter 4, Slide #4 Revenue Recognition Principle Revenue is recognized when realized and earned—usually at point of sale Chapter 4, Slide #5 LO3 Expense Recognition Balance Sheet ASSETS: Inventory Supplies Prepaid assets PP&E Intangibles Income Statement EXPENSES: when sold Cost of goods sold as used Supplies expense Insurance expense Rent expense over period they provide benefits Depreciation expense Amortization expense Other expenses (as incurred) Chapter 4, Slide #6 LO4 Matching Principle Match expenses with associated revenues Directly Indirectly over period they provide benefits Simultaneously upon their acquisition e.g. Inventory e.g. Buildings e.g. Utilities Chapter 4, Slide #7 Types of Adjusting Entries Deferred expense Accrued asset Chapter 4, Slide #8 ALL RECOGNIZE REVENUE OR EXPENSES BEFORE OR AFTER CASH IS EXCHANGED Accrued liability Deferred revenue LO5 Deferred Expense Cash paid before expense is incurred Examples: • Prepaid rent • Prepaid insurance • Office supplies • Property and equipment Costs are initially recorded as assets and allocated to expenses in future periods Chapter 4, Slide #9 Deferred Expense Example #1 Prepay rent on office space for one year on September 1 Initial journal entry: 9/1 Prepaid Rent 2,400 Cash 2,400 Monthly adjusting journal entry: 9/30 Rent Expense 200 Prepaid Rent 200 ($2,400 annual × 1/12 = $200 per month for 12 months) Chapter 4, Slide #10 Deferred Expense Example #2 Purchase treadmill on January 1 for $5,000. Estimated useful life is 7 years (84 months); estimated salvage value is $800 Initial journal entry: 1/1 Fitness equipment 5,000 Cash 5,000 Monthly adjusting journal entry: 1/31 Depreciation Expense 50 Accumulated Depreciation 50 ($5,000 – $800) × 1/84 = $50 per month for 84 months) Chapter 4, Slide #11 Deferred Revenue Cash received before revenue is earned Examples: • Insurance collected in advance • Subscriptions collected in advance • Gift certificates Receipts are initially recorded as liabilities (unearned or refundable receipts) and recorded as revenues in future periods when earned Chapter 4, Slide #12 Deferred Revenue Example Received $2,400 for an insurance policy in advance on September 1 Initial journal entry: 9/1 Cash 2,400 Insurance Collected in Advance 2,400 Monthly adjusting journal entry: 9/30 Insurance Collected in Advance 200 Rent Revenue 200 ($2,400 annual × 1/12 = $200 per month for 12 months) Chapter 4, Slide #13 Accrued Liability Expense incurred before cash is paid Examples: • Payroll • Taxes • Interest Record expense (and corresponding liability) in period incurred; pay for it in a future period No cash flow on recording, only when paid Chapter 4, Slide #14 Accrued Liability Example #1 Pay biweekly wages of $28,000 At end of month, between pay periods: Wages Expense 4,000 Wages Payable 4,000 Next payday: Wages Payable Wages Expense Cash 28,000 Chapter 4, Slide #15 4,000 24,000 Accrued Liability Example #2 On March 1, assume a 9%, 90-day, $20,000 loan is taken out with a bank Initial journal entry: 3/1 Cash 20,000 Note Payable 20,000 Monthly adjusting journal entry: 3/31 Interest Expense 150 Interest Payable 150 ($20,000 principal × 9% × 3/12 = $450 for 3 months or $450/3 = $150 per month) Chapter 4, Slide #16 Accrued Asset Revenue earned before cash is received Examples: Revenue • Rent • Interest Record revenue (and corresponding receivable) in period earned; receive payment in a future period Chapter 4, Slide #17 Accrued Asset Example Rent payment of $2,500 due within first 10 days of month First day of the month: Rent Receivable Rent Revenue 2,500 Upon receipt of cash: Cash Rent Receivable 2,500 Chapter 4, Slide #18 2,500 2,500