Ch 4

advertisement

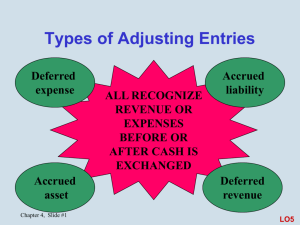

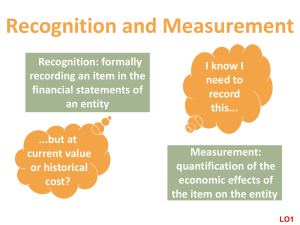

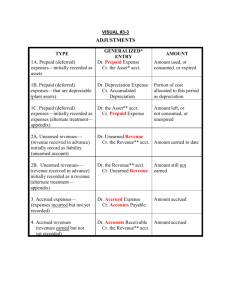

Chapter 4 Introduction Financial Statement Assumptions Economic Entity Cost Principle Time Period Going Concern Monetary Unit Economic Entity Concept • Each entity has its own books, records and financial statements that are separate from owners • No intermingling of personal and business assets and liabilities or income and expenses Business Books & Records Cost Principle • Record assets at cost paid to acquire them – their historical cost • Continue to value assets at historical cost until sold • More objective than market value Going Concern • Assume business will continue indefinitely into the foreseeable future • Justifies use of historical cost Monetary Unit • How we measure (e.g. U.S. dollar, Japanese yen, Mexican peso, etc.) • Assumes economic measure is relatively stable; no adjustment for inflation made in financial statements Time Period Assumption • Assumes it is possible to break up an entity’s earnings in discrete time periods (a month, quarter, year) • Necessary to provide users with financial results on a timely basis • Requires use of estimates 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Cash vs. Accrual Basis Cash basis: revenues and expenses are recorded only when cash is received or paid Accrual basis: revenues are recognized when earned; expenses are recognized when incurred We use the Accrual based approach as required by Generally Accepted Accounting Principles. LO2 Revenue Recognition Principle Revenue is recognized when realized or realizable and earned—when we have provided the goods or services. LO3 Expense Recognition and The Matching Principal Balance Sheet ASSETS: Inventory Supplies Prepaid assets PP&E Intangibles Income Statement EXPENSES: when sold Cost of goods sold as used Supplies expense Insurance expense Rent expense over period they provide benefits Depreciation expense Amortization expense Other expenses (as incurred) LO4 Matching Principle Match expenses with associated revenues Directly Indirectly over period they provide benefits Simultaneously upon their acquisition e.g. Inventory e.g. Buildings e.g. Utilities Types of Adjusting Entries Deferred expense Accrued asset ALL RECOGNIZE REVENUE OR EXPENSES BEFORE OR AFTER CASH IS EXCHANGED Accrued liability Deferred revenue LO5 Deferred Expense Cash paid before expense is incurred Examples: • • • • Prepaid rent Prepaid insurance Office supplies Property and equipment Costs are initially recorded as assets and allocated to expenses in future periods Deferred Expense Example #1 We pay rent for our office space one year in advance on September 1 Initial journal entry: 9/1 Prepaid Rent 2,400 Cash Monthly adjusting journal entry: 9/30 Rent Expense 200 Prepaid Rent 2,400 200 ($2,400 annual × 1/12 = $200 per month for 12 months) Deferred Expense Example #2 Purchase treadmill on January 1 for $5,000. Estimated useful life is 7 years (84 months); estimated salvage value is $800 Initial journal entry: 1/1 Fitness equipment 5,000 Cash Monthly adjusting journal entry: 1/31 Depreciation Expense 50 Accumulated Depreciation ($5,000 – $800) × 1/84 = $50 per month for 84 months) 5,000 50 Deferred Revenue Cash received before revenue is earned Examples: • Insurance collected in advance • Subscriptions collected in advance • Gift certificates Receipts are initially recorded as liabilities (unearned or refundable receipts) and recorded as revenues in future periods when earned Deferred Revenue Example On September 1, we received $2,400 in advance for a 12month subscription to our monthly magazine. Initial journal entry: 9/1 Cash 2,400 Unearned Subscription Revenue (liability) 2,400 Monthly adjusting journal entry: 9/30 Unearned Revenue Subscription Revenue ($2400 * 1/12 = 200 200 200 Accrued Liability Expense incurred before cash is paid Examples: • Payroll • Taxes • Interest Record expense (and corresponding liability) in period incurred; pay for it in a future period No cash flow on recording, only when paid Accrued Liability Example #1 Pay biweekly wages of $28,000 At end of month, between pay periods: Wages Expense 4,000 Wages Payable 4,000 Next payday: Wages Payable Wages Expense Cash 4,000 24,000 28,000 Accrued Liability Example #2 On March 1, assume a 9%, 90-day, $20,000 loan is taken out with a bank Initial journal entry: 3/1 Cash 20,000 Note Payable 20,000 Monthly adjusting journal entry: 3/31 Interest Expense 150 Interest Payable 150 ($20,000 principal × 9% × 3/12 = $450 for 3 months or $450/3 = $150 per month) Accrued Asset Revenue earned before cash is received Examples: Revenue • Rent • Interest Record revenue (and corresponding receivable) in period earned; receive payment in a future period Accrued Asset Example Rent payment of $2,500 due within first 10 days of month First day of the month: Rent Receivable Rent Revenue 2,500 Upon receipt of cash: Cash Rent Receivable 2,500 2,500 2,500