The Term Structure of Interest Rates

advertisement

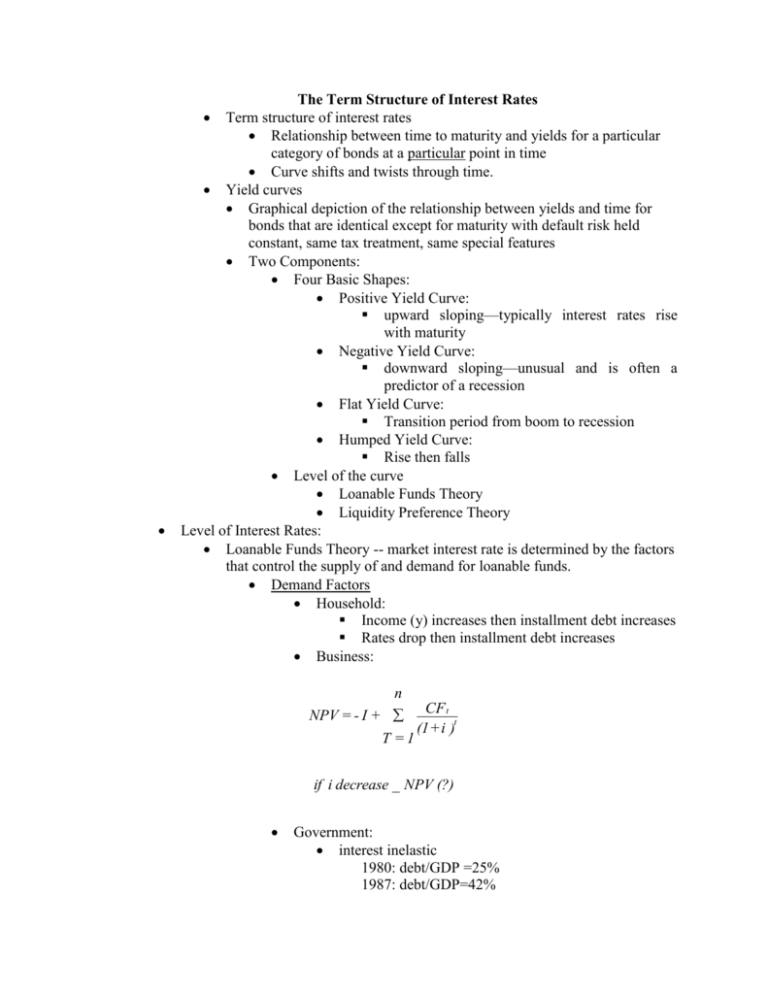

The Term Structure of Interest Rates Term structure of interest rates Relationship between time to maturity and yields for a particular category of bonds at a particular point in time Curve shifts and twists through time. Yield curves Graphical depiction of the relationship between yields and time for bonds that are identical except for maturity with default risk held constant, same tax treatment, same special features Two Components: Four Basic Shapes: Positive Yield Curve: upward sloping—typically interest rates rise with maturity Negative Yield Curve: downward sloping—unusual and is often a predictor of a recession Flat Yield Curve: Transition period from boom to recession Humped Yield Curve: Rise then falls Level of the curve Loanable Funds Theory Liquidity Preference Theory Level of Interest Rates: Loanable Funds Theory -- market interest rate is determined by the factors that control the supply of and demand for loanable funds. Demand Factors Household: Income (y) increases then installment debt increases Rates drop then installment debt increases Business: n CF t NPV = - I + (1 + i )t T =1 if i decrease _ NPV (?) Government: interest inelastic 1980: debt/GDP =25% 1987: debt/GDP=42% 1998: debt/GDP = Foreign Foreign interest rates vs. U.S. rates Supply Households - largest suppliers Very steep slope for supply. Why? What happens if expect higher inflation? Savers – Borrowers Liquidity Preference Theory - Market rate of interest is determined by demand/supply of money balances. Demand of Money Transaction Precautionary Speculative + f(y) + f(y) f(r) Supply of Money Fed basically determines supply Few uncontrollable factors banks lending public's preference for cash Letting D=S then solve for interest rate: - R = ( Y, M, Pe ) Current interest rates reflect expected inflation rates, GDP and expected money supply changes Investors react to expectations of future inflation rather than current actual inflation Expect rates to rise then want a higher return After inflation has peaked, interest rates can continue to increase because investors reacting to the expected future inflation (even if future expectations not based upon actual inflation and current conditions) rather than current inflation Shape of Curve Pure Expectations Theory Long-term rates are an average of current short-term rates and those expected to prevail over the long-term period Average is geometric rather than arithmetic Example: A 2 year security should offer a return that is similar to the anticipated return from investing in 2 consecutive one-year securities. (1+ R2)2 = (1+ R1)( t+1r1) A 3 year security should offer a return that is similar to the anticipated return from investing in 3 consecutive one-year securities. (1+ R3)3 = (1+ R1) ( t+1r1) ( t+2r1) t+1r1 one year interest rate that is anticipated as of time t+1. t+2r1 one year interest rate that is anticipated as of time t+2. R1 } R2 } Known annualized rate on 1 year security, 2 year security, 3 year R3 } security. Eg. if R 2 = .10 R1 = .08 then (1 + .1 ) 2 = (1.08)(1 + t +1 r1) .t+1 r 1 = (1.1 )2 - 1 .12 1.08 Expect interest rates to rise: investor (saver) wants s-t security borrower wants to issue L-T security Borrowers are the suppliers of securities (IOU's) therefore s-t demand > supply--- Price increases for s-t securities and their return decreases have an upward sloping curve. Theory assumes the investor is risk neutral If expectations change, the shape of the yield curve will change Liquidity Premium Theory Rates reflect current and expected short rates, plus liquidity risk premiums Liquidity premium to induce long term lending Implies long-term bonds should offer higher yields Interest rate expectations are uncertain Investors are risk averse Segmented Markets Unlike first 2 theories that treat market as a whole - this theory treats market as if made up of segments. Institutional investors/borrowers choose security with maturities that satisfy their forecasted cash needs. Institutional investors are usually not willing to shift from one maturity sector to another to take advantage of any opportunities that may arise Therefore, need rather than expectations of s-t rates determine where a person invests. Demand/Supply within segments drive rates. │ rate│ │ Upward │ Pension Life Ins. │ Thrifts │ │ Bank └────────────────────────────────────────────── Time │ │ │ │ Downward │ Bank │ Thrifts │ Pension │ └────────────────────────────────────────────── Demand for L-T D>S P r for L-T Preferred Habitat Theory Combines expectation and segmentation theory Investors have preferred maturities Borrowers and lenders move within their habitats based on their expectations Borrowers and lenders can be induced to shift maturities with appropriate risk premium compensation Shape of yield curve reflects relative supplies of securities in each sector Most market observers are not firm believers in any one theory Which Theory is Correct? Research by Meiselman on interest rate expectations found they strongly influence on the term structure-- they have looked at how accurate forward rates are--not very accurate--therefore other factors also influence interest rates Kessel found that liquidity premium caused forward rates to have a positive bias Other research on liquidity premium have found that the size of the premium varies inversely with interest rate levels and yet others have found the opposite to be true Elliot and Echols have examined the segmented market idea--they found discontinuities in the yield maturity relationship--may be due to supply and demand of segments All of the theories have some evidence on their validity Integrating the theories Example: Borrowers and investors expect rates to rise they invest (expectation theory) Borrowers need long term funds while investors prefer short-term (segmentation theory) Investors prefer more liquidity than less (liquidity premium theory) In this example, all theories suggest an upward sloping curve ---domination of the views would determine the slope--ie. If #1 was dominate but the expectation was for declining rates then might have a slightly downward sloping curve Use of Yield Curves Yield Curves are good predictor of changes in economic activity in 12-18 months Predictor of economic growth Upward sloping-expanding economy Downward sloping- recession Other factors that affect yield on Sec. Default risk Liquidity Tax Status Term-to-Maturity Special Provisions Call Convertibility Yield on Sec r = R + DP + LP + Special Provision Risk and Yield Curves Yield spreads Relationship between yields and the particular features on various bonds