Chris Grose Presentation

advertisement

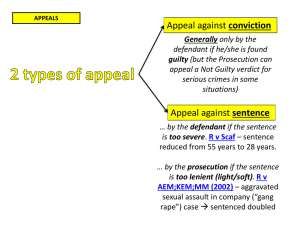

Maintaining the Tax Base – The Billing Authority Role in the Appeal Process Christopher Grose BSc, MRICS, IRRV (Hons) – Divisional Director – Rating – Capita The Background - Definition of Rateable Value Sub-paragraph 2(1) of Schedule 6 to the Local Government Finance Act 1988, as amended by section 1(2) of the Rating (Valuation) Act 1988:“The rateable value of a non-domestic hereditament none of which consists of domestic property and none of which is exempt from local non-domestic rating shall be taken to be an amount equal to the rent at which it is estimated the hereditament might reasonably be expected to let from year to year on these three assumptions – the first assumption is that the begins on the day by reference to which the determination is to be made; the second assumption is that immediately before the tenancy begins the hereditament is in a state of reasonable repair, but excluding from this assumption any repairs which a reasonable landlord would consider uneconomic; the third assumption is that the tenant undertakes to pay all the usual tenant’s rates and taxes and to bear the cost of the repairs and insurance and the other expenses (if any) necessary to maintain the hereditament in state to command the rent mentioned above.” Appeals - The Non-Domestic Rating (Alteration of Lists and Appeals) (England) Regulations 2009 SI No 2268 a) Compiled List b) Material change of circumstances c) Plant and machinery schedule alteration d) VO Notice e) Tribunal/Court Decision f) Effective date alteration, g) New entry h) Deletion; i) Should be composite or part exempt j)Should not be composite or part exempt k) Merger l) Split m) Address change n) Description change o) Section 42 statement omitted Appeals can be made by a) An Interested Person b) In certain circumstances by a Billing Authority c) In cases (c), (d) and (f) by a person who was an interested party at the time the changes had effect Billing Authority Proposals a) Compiled List b) Material change of circumstances c) Plant and machinery schedule alteration d) VO Notice e) Tribunal/Court Decision f) Effective date alteration, g) New entry h) Deletion; i) Should be composite or part exempt j)Should not be composite or part exempt k) Merger l) Split m) Address change n) Description change o) Section 42 statement omitted When can a Proposal be made (Para 5) In general at any time up to the date on which the next list is compiled except:Proposals under grounds (d) (VO Alteration) and (f) (incorrect date) can be made up to next compilation date or within 6 months of the relevant alteration date which ever is the later (subject to change) Proposals made under grounds (e) (Tribunal/Court Decision) can be made up to next compilation date or within 6 months of the relevant decision date which ever is the later However ............ Material Day - The Non-Domestic Rating (Material Day for List Alterations) Regulations 1992 No 556 as amended by The Non-Domestic Rating (Material Day for List Alterations) (Amendment) (England) Regulations 2005 No 658 Material Change proposal – VO Date of event, proposal date served on VO Deletion, Insertion, Split, Recon Date of Event Proposals Form Content (Section 6) Sent to the VO stating i) the proposer, ii) their role, iii) identify the property, iv) how the list should be altered, v) including a statement of the grounds, vi) date of alteration where appropriate, vii) details of Court decision and why applicable where appropriate, vii) the rent payable HOWEVER a rating authority does not need to provide this information, Procedure after making of proposals (Section 9) Within 6 weeks the VO shall send a copy of the proposal to (a) any ratepayer (b) the relevant authority BUT unless the relevant authority is a special authority it has to advise the VO it requires them Withdrawal of proposals Section 11 A proposer can withdraw a proposal at any time but (a) the current ratepayer if different needs to agree in writing (b) an IP who served notice on the VO within 2 months of the proposal date must be notified by the VO of the withdrawal and has 6 weeks to advise the VO they wish to take over the proposal Agreed alterations following proposals Section 12 If all parties to a proposal agree in writing that the List should be altered then the VO shall within 2 weeks alter the List. The parties include:An authority who would have been able to serve the proposal and served Notice on the VO within 2 months of receipt by the VO of the proposal. Disagreement as to proposed alteration Section 13 Within 3 months of receipt of the proposal if there is no agreement then the VO shall refer the proposal to the Valuation Tribunal. The Valuation Tribunal for England (Council Tax and Rating Appeals) (Procedure) Regulations 2009 No 2269 Parties to an Appeal Section 3 Section 3 (d) (i) (aa) Confirms that local authorities are parties to an appeal where their agreement is required to the List alteration. VTE Procedures – Practice Statement A7-1 The Valuation Tribunal Stard Directions state that: No later than 6 weeks prior to the hearing an Appellant shall serve on the Tribunal and all other parties to the appeal (including the respondent) a Statement of Case And No later than 4 weeks prior to the Hearing, the respondent or any party other than the appellant shall serve on the Tribunal and other parties their Statement of Case in response. Not doing so means the party will be barred Consequences If the appellant does not serve a Statement of Case the appeal is struck out, therefore a Billing Authority may require to serve a protective proposal of its own. If a Billing Authority is an Interested Party they must serve a response to the appellants Statement of Case or be barred from the proceedings and therefore have no involvement in the case at the hearing or subsequently. If barred BA’s or any other Interested Party can apply to have the Bar lifted Interested Parties can be parties to any subsequent appeal Practical Effects b) Material Changes e) Tribunal/Court Decisions g) Entries to the List h) Deletions from the List i) Should show part domestic/exempt j) Shouldn’t show part domestic/exempt Rate Retention and Localisation Gives Billing Authorities an ability to be involved on proposals for material change that cause RV loss If the VO no actions a report BA’s could serve a proposal in certain circumstances Prevent wasted High Court Cases? Any Guesses on the Case two of these properties were in? Pall Mall Investments Ltd v Gloucester City Council Going Forward Should Billing Authorities have additional rights? Interested Party to Compiled List appeals? Ability to appeal Compiled List appeals? Effective date change? Address change? If seeking these rights should BA’s make use of their existing rights? Changes to Appeal Regulations Announced as part of Autumn Financial Statement Ratepayer appeals submitted after 1 April 2015 only back dated to 1 April 2015 VO alterations after 1 April 2016 only backdated to 1 April 2015 No reason given for change Rate retention? Stability of Business Rate Income? Clearing decks for 2017 revaluation? Changes to Appeal Regulations - Impact Need to submit appeals by 31 March 2015 Dramatic increase in number of appeals served? However many should be cleared before 1 April 2017 Marketing calls – remember IRRV Marketing Code Marketing Code New Marketing Code: •Applies to IRRV Members from 1 July 2014 •Applies to RSA Members from 1 August 2014 IRRV and RSA Marketing Code No blanket restriction in approaching a ratepayer, even if another agent is instructed but: “those making such approaches should act professionally at all times and should not persistently or in a harassing manner seek instructions after the ratepayer has indicated that he is content with his present advisers or does not wish to use the services of the firm or individual making the approach.” And “A ratepayer may decide to conduct his or her own appeal without representation and such a decision must be respected without repeated attempts to encourage that person to engage outside assistance” IRRV and RSA Marketing Code • Instructions must not be solicited directly from any branch of a national organisation where it is known it would be dealt with by the headquarters . • Proper diligence must be exercised in identifying the appropriate person to approach • if that person declines the approach no other person in the organisation should be approached • Marketing staff should be given appropriate training in the basic principles of rating advice • Marketing should be restricted to describing the services the firm has to offer • Should not include any criticism, direct or implied, of the firm currently instructed by the ratepayer