file pdf - Borsa Italiana

advertisement

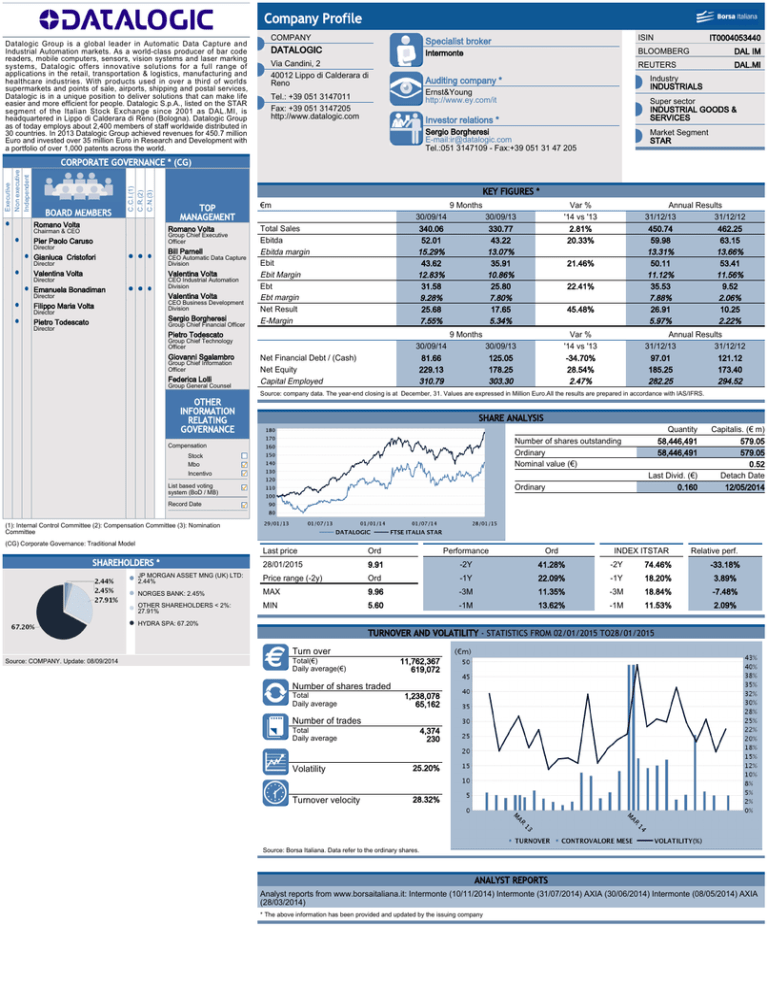

Company Profile Datalogic Group is a global leader in Automatic Data Capture and Industrial Automation markets. As a world-class producer of bar code readers, mobile computers, sensors, vision systems and laser marking systems, Datalogic offers innovative solutions for a full range of applications in the retail, transportation & logistics, manufacturing and healthcare industries. With products used in over a third of worlds supermarkets and points of sale, airports, shipping and postal services, Datalogic is in a unique position to deliver solutions that can make life easier and more efficient for people. Datalogic S.p.A., listed on the STAR segment of the Italian Stock Exchange since 2001 as DAL.MI, is headquartered in Lippo di Calderara di Reno (Bologna). Datalogic Group as of today employs about 2,400 members of staff worldwide distributed in 30 countries. In 2013 Datalogic Group achieved revenues for 450.7 million Euro and invested over 35 million Euro in Research and Development with a portfolio of over 1,000 patents across the world. COMPANY Specialist broker ISIN DATALOGIC Intermonte BLOOMBERG DAL IM REUTERS DAL.MI Via Candini, 2 40012 Lippo di Calderara di Reno Industry INDUSTRIALS Auditing company * Ernst&Young http://www.ey.com/it Tel.: +39 051 3147011 Fax: +39 051 3147205 http://www.datalogic.com IT0004053440 Super sector INDUSTRIAL GOODS & SERVICES Investor relations * Sergio Borgheresi E-mail:ir@datalogic.com Tel.:051 3147109 - Fax:+39 051 31 47 205 Market Segment STAR BOARD MEMBERS C.C.I.(1) C.R.(2) C.N.(3) Executive Non executive Independent CORPORATE GOVERNANCE * (CG) Romano Volta KEY FIGURES * TOP MANAGEMENT Romano Volta Chairman & CEO Group Chief Executive Officer Pier Paolo Caruso Director Bill Parnell Gianluca Cristofori Director CEO Automatic Data Capture Division Valentina Volta Valentina Volta Director CEO Industrial Automation Division Emanuela Bonadiman Director Valentina Volta Filippo Maria Volta CEO Business Development Division Director Sergio Borgheresi Pietro Todescato Group Chief Financial Officer Director €m 9 Months Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin 30/09/14 340.06 52.01 15.29% 43.62 12.83% 31.58 9.28% 25.68 7.55% Net Financial Debt / (Cash) Net Equity Capital Employed 30/09/14 81.66 229.13 310.79 Group Chief Technology Officer Group Chief Information Officer Federica Lolli Group General Counsel Annual Results 31/12/13 31/12/12 450.74 462.25 59.98 63.15 13.31% 13.66% 50.11 53.41 11.12% 11.56% 35.53 9.52 7.88% 2.06% 26.91 10.25 5.97% 2.22% 21.46% 22.41% 45.48% 9 Months Pietro Todescato Giovanni Sgalambro Var % '14 vs '13 2.81% 20.33% 30/09/13 330.77 43.22 13.07% 35.91 10.86% 25.80 7.80% 17.65 5.34% Var % '14 vs '13 -34.70% 28.54% 2.47% 30/09/13 125.05 178.25 303.30 Annual Results 31/12/13 31/12/12 97.01 121.12 185.25 173.40 282.25 294.52 Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.All the results are prepared in accordance with IAS/IFRS. OTHER INFORMATION RELATING GOVERNANCE SHARE ANALYSIS Quantity 58,446,491 58,446,491 Number of shares outstanding Ordinary Nominal value (€) Compensation Stock Mbo Incentivo List based voting system (BoD / MB) Last Divid. (€) 0.160 Ordinary Capitalis. (€ m) 579.05 579.05 0.52 Detach Date 12/05/2014 Record Date (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model Last price Ord Performance Ord 28/01/2015 9.91 -2Y 41.28% -2Y 74.46% JP MORGAN ASSET MNG (UK) LTD: 2.44% Price range (-2y) Ord -1Y 22.09% -1Y 18.20% 3.89% NORGES BANK: 2.45% MAX 9.96 -3M 11.35% -3M 18.84% -7.48% OTHER SHAREHOLDERS < 2%: 27.91% MIN 5.60 -1M 13.62% -1M 11.53% 2.09% SHAREHOLDERS * INDEX ITSTAR Relative perf. -33.18% HYDRA SPA: 67.20% TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO28/01/2015 Turn over Source: COMPANY. Update: 08/09/2014 Total(€) Daily average(€) 11,762,367 619,072 Number of shares traded Total Daily average 1,238,078 65,162 Number of trades Total Daily average 4,374 230 A Volatility 25.20% A Turnover velocity 28.32% Source: Borsa Italiana. Data refer to the ordinary shares. ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Intermonte (10/11/2014) Intermonte (31/07/2014) AXIA (30/06/2014) Intermonte (08/05/2014) AXIA (28/03/2014) * The above information has been provided and updated by the issuing company