Fact Sheet - Direxion

advertisement

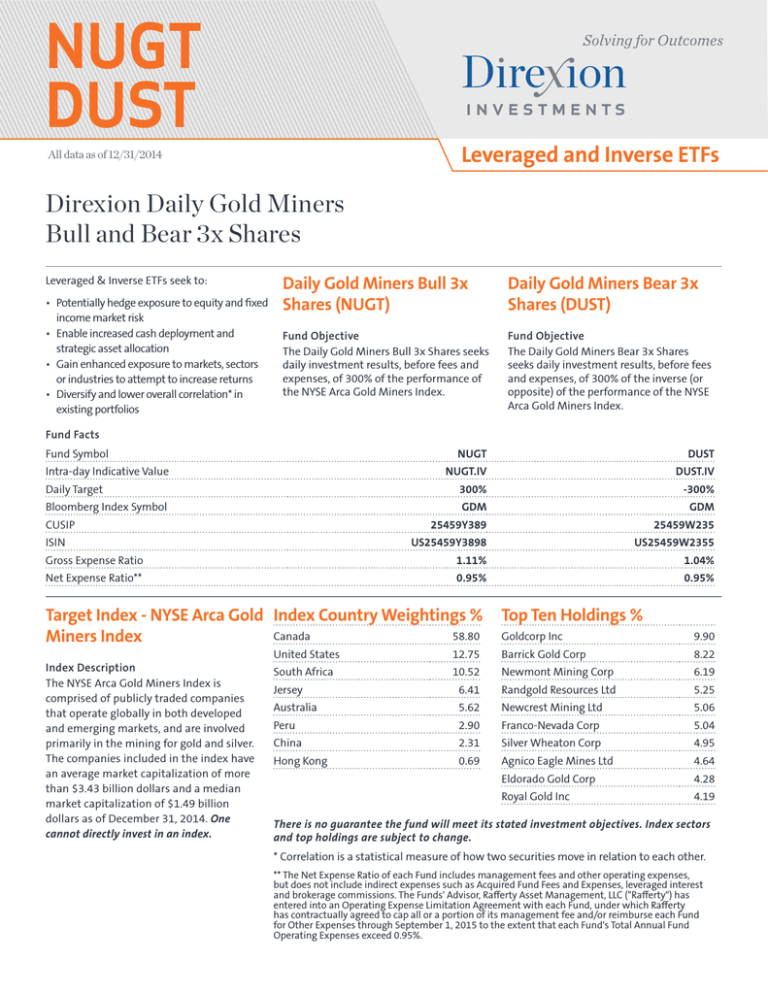

NUGT DUST Leveraged and Inverse ETFs All data as of 12/31/2014 Direxion Daily Gold Miners Bull and Bear 3x Shares Leveraged & Inverse ETFs seek to: • Potentially hedge exposure to equity and fixed income market risk • Enable increased cash deployment and strategic asset allocation • Gain enhanced exposure to markets, sectors or industries to attempt to increase returns • Diversify and lower overall correlation* in existing portfolios Daily Gold Miners Bull 3x Shares (NUGT) Daily Gold Miners Bear 3x Shares (DUST) Fund Objective The Daily Gold Miners Bull 3x Shares seeks daily investment results, before fees and expenses, of 300% of the performance of the NYSE Arca Gold Miners Index. Fund Objective The Daily Gold Miners Bear 3x Shares seeks daily investment results, before fees and expenses, of 300% of the inverse (or opposite) of the performance of the NYSE Arca Gold Miners Index. Fund Facts Fund Symbol NUGT DUST NUGT.IV DUST.IV Daily Target 300% -300% Bloomberg Index Symbol GDM GDM Intra-day Indicative Value CUSIP 25459Y389 25459W235 US25459Y3898 US25459W2355 Gross Expense Ratio 1.11% 1.04% Net Expense Ratio** 0.95% 0.95% ISIN Target Index - NYSE Arca Gold Index Country Weightings % Canada 58.80 Miners Index Top Ten Holdings % Index Description The NYSE Arca Gold Miners Index is comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in the mining for gold and silver. The companies included in the index have an average market capitalization of more than $3.43 billion dollars and a median market capitalization of $1.49 billion dollars as of December 31, 2014. One cannot directly invest in an index. Goldcorp Inc 9.90 United States 12.75 Barrick Gold Corp 8.22 South Africa 10.52 Newmont Mining Corp 6.19 Jersey 6.41 Randgold Resources Ltd 5.25 Australia 5.62 Newcrest Mining Ltd 5.06 Peru 2.90 Franco-Nevada Corp 5.04 China 2.31 Silver Wheaton Corp 4.95 Hong Kong 0.69 Agnico Eagle Mines Ltd 4.64 Eldorado Gold Corp 4.28 Royal Gold Inc 4.19 There is no guarantee the fund will meet its stated investment objectives. Index sectors and top holdings are subject to change. * Correlation is a statistical measure of how two securities move in relation to each other. ** The Net Expense Ratio of each Fund includes management fees and other operating expenses, but does not include indirect expenses such as Acquired Fund Fees and Expenses, leveraged interest and brokerage commissions. The Funds' Advisor, Rafferty Asset Management, LLC ("Rafferty") has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contractually agreed to cap all or a portion of its management fee and/or reimburse each Fund for Other Expenses through September 1, 2015 to the extent that each Fund's Total Annual Fund Operating Expenses exceed 0.95%. Daily Return During Q4 2014 NYSE Arca Gold Miners Index Daily Gold Miners Bull 3x Shares (NUGT) Daily Gold Miners Bear 3x Shares (DUST) 30.00 20.00 10.00 0.00 -10.00 -20.00 09/30/2014 10/01/2014 10/02/2014 10/03/2014 10/06/2014 10/07/2014 10/08/2014 10/09/2014 10/10/2014 10/13/2014 10/14/2014 10/15/2014 10/16/2014 10/17/2014 10/20/2014 10/21/2014 10/22/2014 10/23/2014 10/24/2014 10/27/2014 10/28/2014 10/29/2014 10/30/2014 10/31/2014 11/03/2014 11/04/2014 11/05/2014 11/06/2014 11/07/2014 11/10/2014 11/11/2014 11/12/2014 11/13/2014 11/14/2014 11/17/2014 11/18/2014 11/19/2014 11/20/2014 11/21/2014 11/24/2014 11/25/2014 11/26/2014 11/28/2014 12/01/2014 12/02/2014 12/03/2014 12/04/2014 12/05/2014 12/08/2014 12/09/2014 12/10/2014 12/11/2014 12/12/2014 12/15/2014 12/16/2014 12/17/2014 12/18/2014 12/19/2014 12/22/2014 12/23/2014 12/24/2014 12/26/2014 12/29/2014 12/30/2014 12/31/2014 -30.00 Source: Bloomberg (09/30/2014-12/31/2014) Performance (as of 12/31/2014) 1 Month % 3 Month % NUGT DUST GDM YTD % 1 Year % 3 Year % 5 Year % S/I of the NAV -5.44 -51.44 -59.53 -59.53 -77.48 — fund % -71.81 Mkt Close -6.45 -51.22 -59.28 -59.28 -77.49 — -71.77 NAV -18.12 -12.87 -43.98 -43.98 4.97 — 6.65 Mkt Close -18.24 -13.11 -44.02 -44.02 5.00 — 6.54 0.35 -13.23 -11.76 -11.76 -27.87 -15.64 -24.74 Inception Date 12/08/2010 12/08/2010 The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. For the most recent month end performance please visit the funds website at www.direxioninvestments.com. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus or summary prospectus. Index performance does not include any fees or expenses, are unmanaged and cannot be invested in directly. For Information: 866-476-7523 | info@direxioninvestments.com | direxioninvestments.com Disclosures Shares of Direxion Shares are bought and sold at the market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally determined) and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable. An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion Shares. Click here to obtain a prospectus and summary prospectus or visit our website at www.direxioninvestments.com. The prospectus and summary prospectus should be read carefully before investing. Investing in each Fund may be more volatile than investing in a broadly diversified fund. The use of leverage by each Fund increases the risk to the Fund. The Funds are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment. The Funds are not designed to track their underlying index over a longer period of time. Risks: An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds' concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts, forward contracts, options and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are a multiple of the return of their underlying index for periods other than a single day. Risks of each Fund include Daily Index Correlation Risk, Leverage Risk, Compounding and Market Volatility Risk and risks specific to the Mining Industry, such as Emerging Markets Risk, Foreign Securities Risk, Gold Related Companies Risk and Mining and Metal Industry Risk, and for the Direxion Daily Gold Miners Bear 3X Shares risks related to shorting. Please see the Summary and full Prospectuses for a more complete description of these and other risks of each Fund. Distributor: Foreside Fund Services, LLC.