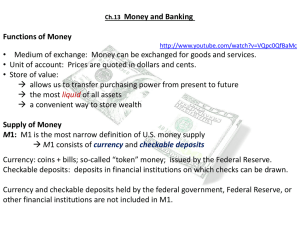

Money and Banking

advertisement

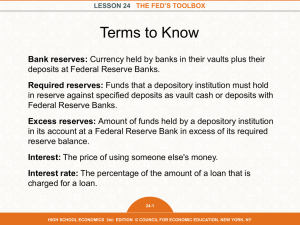

Chapter 5 Money and the Federal Reserve These slides supplement the textbook, but should not replace reading the textbook 1 What is barter? The practice of trading one good or service for another 2 What is a double coincidence of wants? A situation in which two traders are willing to exchange their products directly 3 What is currency? Anything that can be used to signify someone’s credit and someone’s debit in a financial transaction 4 What are the 4 basic functions of money? Medium of exchange Unit of account Store of value Standard deferred payment 5 What is a medium of exchange? Money is accepted in exchange for a good or service 6 What a unit of account? Money is used to compare the relative value of different goods and services 7 What is a store of value? Money is used as a means of saving 8 What is a standard of deferred payment? Money is used to keep track of the method and the amount of money is to be paid back in the future 9 What are the properties of money? Scarcity Portability Divisibility 10 What is commodity money? Anything that serves both as money and as a commodity 11 What is token money? Money that exceeds the value from which it was made, for example, quarters 12 What are examples of money? Federal Reserve Notes Coins Checks Travelers checks 13 What does the term liquidity mean? The easier something is to spend the more liquid it is, the more difficult it is to spend the less liquid it is 14 Which form of money is most liquid? It all depends on the circumstances 15 What is fiat money? Money not redeemable for any commodity; its status as money is conferred by the government 16 What is legal tender? Currency that constitutes a valid and legal offer of payment for debts 17 Does gold or silver back up our money? No, our money is not backed up by anything 18 What happened in 1968? U.S and a number of European nations stopped selling gold on the London market, allowing the market to freely determine the price of gold 19 What happened in 1971? From 1968 to 1971, only central banks could trade with the U.S. at $35/oz. Finally, in 1971, even this bit of gold convertibility died 20 Why does money have value? It is useful and relatively scarce 21 What determines the value of money? The general price level 22 Why are banks called depository institutions? Because they accept deposits from the public 23 What are commercial banks? Depository institutions that make loans to the public 24 What are demand deposits? Accounts at financial institutions that pay no interest and on which depositors can write checks to obtain their deposits 25 How do banks make profit? After interest paid or services rendered minus costs equals bank’s profit 26 Who were the first bankers? Goldsmiths in the middle ages 27 What is the Federal Reserve System? The central bank and monetary authority of the United States; known as “the Fed” 28 What is the function of the Fed? To ensure the availability of enough money and credit in the banking system to support a growing economy 29 When was the federal reserve system established? The Federal Reserve Act of 1913 30 Does the Fed loan money to private companies? No, they only do business with financial institutions 31 Why would the Fed want to decrease the money supply? To lower inflation 32 Why would the Fed want to increase the money supply? To stimulate employment 33 How many Federal Reserve banks are there? The U. S. is divided into 12 Federal Reserve districts, each district has a Federal Reserve Bank 34 Who makes the decisions for the Federal Reserve? The Board of Governors and the Open Market Committee 35 How long do most board members serve? 14 years, after which they cannot serve again 36 How long does the chairman of the board serve? The Chairman serves 4 years, but can serve again 37 What is the Federal Open Market Committee? Made up of the 7 board members and 5 presidents of Federal Reserve Banks 38 What is the role of the Federal Open Market Committee? The FOMC makes decisions as to the buying and selling of government securities 39 Member Banks owns stock in Federal Reserve only national banks are required to be members 40 What do the letters FDIC stand for? The Federal Deposit Insurance Corporation 41 When was the FDIC established? 1933 42 What is the function of the FDIC? To ensure deposits in any banking institution that purchases FDIC insurance 43 How much are deposits insured for? Each account in a bank is insured up to $250,000 per depositor per bank 44 What is the name of the market where money is bought and sold? The loanable funds market 45 Why would the Fed want to expand the money supply? If we have unemployment the Fed wants to increase the money supply to stimulate employment 46 Why would the Fed want to contract the money supply? If we have inflation the Fed wants to decrease the money supply to bring down prices 47 What does the term liquidity mean? A measure of the ease with which an asset can be converted into money without significant loss in its value 48 What does liquidity have to do with the money supply? With inflation the Fed wants banks to be less liquid With unemployment the Fed wants banks to be more liquid 49 What makes a bank more or less liquid? A lot of cash in excess reserves - very liquid Little cash in excess reserves - less liquid 50 What is a required reserve ratio? The ratio of reserves to deposits that banks are required to hold 51 What are required reserves? The dollar amount of reserves a bank is legally required to hold 52 Where are bank’s reserves held? Deposits with the Fed and cash in the bank’s vault 53 What are excess reserves? Bank reserves in excess of required reserves 54 What money do banks lend out? Excess reserves 55 If a bank has $6,000 in checkable deposits with a reserve ratio of .2 how much can the bank lend? No more than $4,800 56 How does the Fed influence the money supply? Change reserve requirements Change discount rate Change federal funds rate Buy/sell govt. securities 57 What are reserve requirements? The percentage of a bank’s assets that must be kept in cash and therefore cannot be lent out 58 Who sets reserve requirements? Reserves are determined by the Fed for all financial institutions 59 If we have inflation what will the Fed do to reserve requirements? Raise reserve requirements thereby decreasing bank’s excess reserves 60 If we have unemployment what will the Fed do to reserve requirements? Lower reserve requirements thereby increasing bank’s excess reserves 61 What is the discount rate? The interest that banks pay when they borrow money from the Fed 62 What will the Fed do to the discount rate during periods of inflation? The Fed will raise the discount rate to discourage borrowing and thus spending 63 What will the Fed do to the discount rate during periods of unemployment? The Fed will lower the discount rate to encourage borrowing and thus spending 64 What is the federal funds rate? The interest rate that banks pay to borrow excess reserves from another bank 65 What will the Fed do to the federal funds rate during periods of inflation? The Fed will raise the federal funds rate to discourage borrowing and thus spending 66 What will the Fed do to the federal funds rate during periods of unemployment? The Fed will lower the federal funds rate to encourage borrowing and thus spending 67 What is the prime interest rate? The interest rate that big banks charge their best and most credit worthy customers 68 What is a government security? A short term bond that the federal government sells 69 What is the open market? A place where bonds are bought and sold 70 What are open market operations? The act of the Fed buying or selling government securities at the open market 71 Why does the government sell securities? This is its way of borrowing money 72 What will the Fed do if we have unemployment? The Fed will buy government securities making banks more liquid so they can lend out more money 73 What will the Fed do if we have inflation? The Fed will sell securities making banks less liquid so they will have less money to lend 74 Which monetary tool is most often used? Open-market operations 75 What is moral suasion? A host of different measures that the Fed uses to influence the activities of banks in one way or another 76 What is the largest component of assets of the Fed? U.S. government securities 77 What is the largest component of the Fed’s liabilities? Federal Reserve notes 78 Why is the Fed so profitable? Because it pays no interest on its liabilities but earns interest on its assets 79 If the Fed wants to increase the money supply by $1,000 million, what should it do? With a reserve requirement of 10% it should increase the money supply by $100 million 80 What is the money multiplier with a reserve requirement of 1/10? 10 81 What is the Money Multiplier formula? 1/Required reserve ratio 82 If the required reserve ratio is 1/10 and all banks are exactly meeting their reserve requirement - how do we calculate the money multiplier? 83 One divided by one tenth equals 10 . 1 . 1 X 1 10 10 = 1 Multiplier = 10 84 $100 $90 $81 original deposit $74 $63 total money ... $1,000 85 If the Fed wants to decrease the money supply by $1,000 million, what should it do? With a reserve requirement of 10% it should decrease the money supply by $100 million 86 Why is the Fed better at fighting inflation than unemployment? The Fed can’t force people to borrow more money 87 What things will cause interest rates to rise? Demand for money increases The Fed raises the Discount or Federal Funds Rate The Fed sells government securities 88 What things will cause interest rates to fall? Demand for money decreases The Fed lowers the Discount or Federal Funds Rate The Fed buys government securities 89 What is Quantitative Easing? A politically polite term for monetizing the debt, the Fed creates money to buy bonds 90 END 91