Chapter 14: The Federal Reserve and Monetary Policy

advertisement

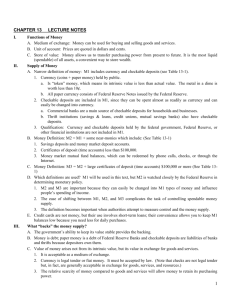

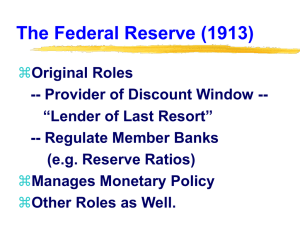

Chapter 16: The Federal Reserve and Monetary Policy Economics How did the Panic of 1907 affect U.S banking? • The panic of 1907 had two causes. First, the nation’s monetary system at the time had no mechanism for expanding the amount of money in circulation. This meant that business expansion was restricted because consumers and businesses competed for a fixed supply of loanable funds. • Second, the system of pyramided reserve failed. In a system of pyramided reserve, virtually all smaller, local banks deposit some of their reserves at a larger city banks. These larger city banks, in turn, deposit some of their own cash reserves in the largest commercial banks in a nation’s financial center suck as New York or Chicago in the United states. What are the purposes and characteristics of the Federal Reserve system? • The Federal Reserve system is a central banking system for nations such as United Kingdom, Japan, Canada. However the U.S Federal Reserve System has several features that distinguish it: • Lack of a single central bank • Ownership and control by member banks • Optional membership in the Fed of some banks • The Federal Reserve relies on district banks to carry out the banking policies developed at the national level. Stocks are owned by the bank members, not the Government. In most countries all banks are required to join the central banks, however, in the U.S only nationally chartered banks are required to join the Fed. How is the Fed organized? • The Federal Reserve System was designed to oversee banking practices throughout the U.S caused many people to be concerned that a single central bank would hold too much power over the nations economy. To avoid this problem the Fed is organized on two levels: National and District • The main decision on the national level are done by the board of governors and Federal Open Market Committee(FOMC) the president appoints each of the board of governors. Each governor is appointed for 14year terms.There are 12 district levels each of these districts serves as a designated geographic region of the U.S. What services does the Fed provide to the banks? • The Fed oversees the flow of money among member banks and its district banks – It does so mainly through check clearing and by making loans to commercial banks – Check clearing is the method the Fed uses to keep track of the billions of monetary transfers using a method of crediting and debiting banks’ reserve accounts—and, in turn, checking accounts How does the Fed serve the federal government? • The Fed manages the U.S. government’s financial activities by serving as the – Government’s bank – Supervising member banks – Regulating the money supply How do economists measure the U.S. money supply? • Economists measure money supply in many ways – These measures are known as M1. M2, M3, and L – M1 includes the most limited amount of funds – L includes the widest among – Each fund is distinguished by how it identifies “readily available” money Why does the Fed rely on either an easymoney policy or a tight-money policy? • Through it’s monetary policy, the Fed attempts to promote economic growth and stability as well as to avoid recessions • To reach these goals, the Fed pursues either an easy-money policy or a tight-money policy Why does the Fed rely on either an easymoney policy or a tight-money policy? • Easy-money policy – Low interest rates – Used in times of recession to expand the money supply, increase aggregate demand, create jobs and reduce unemployment, and promote economic growth • Tight-money policy – Higher interest rates – Contracting money supply – Used during period of inflation to slow business activity and stabilize prices What are the three major tools the Fed’s use to determine monetary policy? • Open-market operations • Discount rate – The prime rate is the interest rate that commercial banks charge on loans to their most reliable business customers – It is used to determine the bank’s general interest rate • • • • Reserve requirements Margin requirements Credit regulations Moral suasion What are challenges associated with determining monetary policy? • The Fed’s actions are limited by several factors, including: – Economic forecasts – Time lags in developing and carrying out monetary policy – Priorities – Trade-offs – Lack of coordination among government agencies in forming economic policies – Conflicting opinions about monetary policy