Monetary Policy Part 2

advertisement

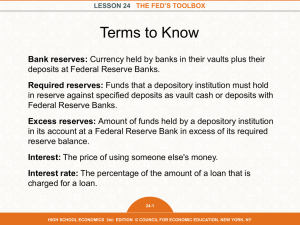

CHAPTER 15 MONETARY POLICY Tools 2 and 3 2nd Tool: Reserve Ratio Manipulation of the Reserve Ratio can influence the ability of commercial banks to lend money. TOOLS OF MONETARY POLICY The Reserve Ratio Raising the Reserve Ratio • Banks must hold more reserves • Banks decrease lending • Money supply decreases Lowering the Reserve Ratio • Banks may hold less reserves • Banks increase lending • Money supply increases Raising the Reserve Ratio: When the reserve ratio is raised, banks are required to have larger reserves. This diminishes their ability to create money by lending. They have to hold more in reserves and there have less to lend. Banks could have lower checkable deposits and at the same time, increase reserves. To reduce checkable deposits, the bank could let outstanding loans mature and be repaid, and not extend new credit. Also, to increase reserves, the bank might sell some of its bonds. This would increase the banks reserves This reduces the supply of money. Lowering the Reserve Ratio: When the reserve ratio is lowered, banks lending ability increases. Lowering the reserve ratio, transforms required reserves into excess reserves, and enhances the ability of banks to create new money by lending. Changing the reserve ratio affects the money creating ability in two ways: Changes the amount of excess reserves. It changes the size of the monetary multiplier. Raising the reserve ration forces banks to reduce the amount of checkable deposits they create through lending. Reserve Ratio Key Points A powerful technique of monetary control It is infrequently used Last such change was in 1992 (the Fed lowered the reserve ratio from 12% to 10%) 3rd Tool of Fed: Discount Rate Commercial Banks sometimes must borrow money from the Federal Reserve Bank (e.g. unexpected and immediate needs for funds). When a commercial bank borrows from the Fed, it gives the Fed a promissory note (an IOU) drawn against itself and secured by acceptable collateral (typically U.S. Government Securities). The Fed charges interest on the loans it makes to Commercial banks The interest rate the Fed charges is called the Discount Rate. The Promissory note is an asset to the Fed and a Liability to the Commercial Bank. 3rd Tool of Fed: Discount Rate A loan to a commercial bank from the Fed, increases the borrowing bank’s reserves. Since no required reserves need be kept against loan from the Fed, all new reserves acquired by borrowing from the Fed, are excess Reserves. Discount Rate Key Points: Borrowing from the Fed by Commercial banks, increases the reserves of the Commercial Banks and enhances their ability to extend credit. The Fed has the power to set the Discount Rate that it charges banks. From the viewpoint of the Commercial Bank, the discount rate is a cost of acquiring reserves. Lowering the discount rate encourages commercial banks to obtain additional reserves from the Fed. Discount Rate Key Points (cont.): When the commercial banks lend the money obtained from the loan from the Fed, it increases the money supply. When the Fed increases the discount rate, it discourages commercial banks from borrowing from the fed. The Fed may raise the discount rate when it wants to restrict the money supply. TOOLS OF MONETARY POLICY Easy Money Policy • Buy Securities • Decrease Reserve Ratio • Lower Discount Rate TOOLS OF MONETARY POLICY Tight Money Policy • Sell Securities • Increase Reserve Ratio • Raise Discount Rate Expansionary or Easy Money Policy The Fed takes steps to increase excess reserves, which lowers the interest rate and increases investment which, in turn, increases GDP by a multiple amount Contractionary or Tight Money Policy Excess reserves fall, which raises interest rate, which decreases investment, which, in turn, decreases GDP by a multiple amount of the change in investment