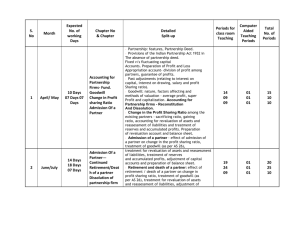

Share Capital and Debentures - Ludhiana

advertisement

Share Capital and Debentures Presentation By CA Anil Sharma Share Capital and Debentures • Chapter IV • Sections 43 to 72 • the Companies (Share Capital and Debentures) Rules, 2014. • All sections are effective from 1.4.2014 except Section 57 which was effective from 12.9.2013 and section 66 which is not yet effective.) • Corresponding to: • Part IV – Share Capital and Debentures • Sections 82 to 123 of the CA, 1956. Section 52- Securities Premium Account • Corresponding to section 78 of CA, 1956 which permitted utilisation of securities premium account for : – 1) issue of unissued shares to the members as bonus shares – 2)writing off preliminary expenses, – 3)commission paid or discount allowed on issue of shares or debentures or – 4)premium payable on redemption of preference shares or debentures • Section 52 adds for the purchase of its own securities • However, for the purpose referred in (1), (3) and the fifth one, it shall be available to prescribed companies only. Rules does not provide anything yet. Sec. 53- Issue of shares at discount • Prohibits issue of shares at discount except issue of sweat equity shares under section 54. • Earlier section 79 of CA, 1956 permitted issue of shares at discount subject to certain conditions. Sec. 54-Issue of Sweat Equity Shares • Corresponding to section 79A of CA, 1956 which contained an explanation II that for the purpose of the section ‘company’ means a company formed and registered under this Act and its subsidiary incorporated outside India. • This explanation is not there in Section 54 and therefore, conditions in the section shall not be applicable on issue of sweat equity shares issued by overseas subsidiaries of the company. Rule 8-Issue of Sweat Equity Shares by unlisted companies • Conditions are similar to Unlisted Companies( Issue of Sweat Equity Shares) rules, 2003 except that Rule provides for valuation of sweat equity as well as know how/IPR to be done by Registered Valuer. • For the purposes of Rule 8 ‘‘Employee’’ means– (a) a permanent employee of the company who has been working in India or outside India, for at least last one year; or – (b) a director of the company, whether a whole time director or not or – (c) an employee or a director as defined in sub-clauses (a) or (b) above of a subsidiary, in India or outside India, or of a holding company of the company. Sec 55- Issue and Redemption of Preference Shares • Corresponding to section 80 of the CA, 1956. • However, the section, read with Rule 10, permits a company engaged in the setting up and dealing with of infrastructural projects to issue preference shares for a period exceeding twenty years but not exceeding thirty years, subject to the redemption of a minimum ten percent of such preference shares per year from the twenty first year onwards or earlier, on proportionate basis, at the option of the preference shareholders. Sec 56- Transfer and Transmission • Corresponding to sections 108,109,110 and 113 of the CA, 1956. • No change except that the CA, 1956 did not provide any procedure or mechanism for transfer of a member in a company having no share capital. The same was transferable under the Transfer of Property Act ,1882. • Now section 56 provides for transfer of interest of the member in the company on the same lines as transfer of securities. Rule 11 prescribes Form SH-4 for both the cases of transfer. Sec. 57- Punishment for personation of shareholder • Corresponding to Section 116 of the CA, 1956. • Applicable w.e.f. 12.9.2013 itself. • Section 116 of CA, 1956 did not specify any fine that could be imposed for personation of shareholder. • Section 57 specify that fine shall not be less than Rs. 1,00,000 /-but which may extend to Rs. 5,00,000/-. Sec 62- Further Issue of Share Capital • Corresponding to Sections 81 and 94A of the CA, 1956. • Section 81 was not applicable to private companies whereas Section 62 in now applicable to them also. • Rule of pre-emptive right of existing shareholders to further shares under CA, 1956 was available only in respect of issues made after 2 years of it incorporation or after one year from the first allotment , no such condition in Section 62 now. • Option to make preferential allotment with ordinary resolution and permission of the Central Government is not available in Section 62 now. Rule 13- Further Issue of Share Capital • Where the preferential offer of shares or other securities is made by a company whose share or other securities are listed on a recognized stock exchange, such preferential offer shall be made in accordance with the provisions of the Act and regulations made by the Securities and Exchange Board . • In case of unlisted companies, the price of the shares or other securities to be issued on a preferential basis, either for cash or for consideration other than cash, shall be determined on the basis of valuation report of a registered valuer only. • where convertible securities are offered on a preferential basis with an option to apply for and get equity shares allotted, the price of the resultant shares shall be determined beforehand on the basis of a valuation report of a registered valuer. Sec 63- Issue of Bonus Shares • There was no corresponding provision in the CA, 1956. • However, section 205(3) of the CA, 1956 provided that a company can utilise profit or reserves of the company for issue of fully paid up bonus shares. • Section 205 was interpreted as allowing issue of bonus shares out of reserves created from revaluation of shares also. But SEBI (ICDR) Regulations, 2009 prohibits such issue but unlisted companies were doing that. • Now section restrict all companies not to utilise revaluation reserve for issue of bonus shares. • The bonus shares shall not be issued in lieu of dividend. • Rule 14 provides that the company which has once announced the decision of its Board recommending a bonus issue, shall not subsequently withdraw the same. Sec 66- Reduction of share capital • Corresponding to sections 100 to 105 of the CA, 1956. Not yet notified. • Section specifically provides that the provisions of reduction of capital shall not apply to buy-back of its own shares under section 68. Earlier section 100 did not have such provisions and was being interpreted differently by courts. • Reduction of capital not permitted id deposit and/or interest thereon are in arrears. There was no such bar in section 100 earlier. Sec 68- Power of company to purchase its own shares • Corresponding to Section 77A of the CA, 1956. • No changes in the provisions except: – ‘No offer to buy back within a period of 365 days from the date of preceding offer of buy back’ has been replaced with ‘ No offer to buy back within a period of one year from the date of closure of the preceding offer of buy back’. • Rule 17 contained detailed procedure to be followed. Section 70- Prohibition for buy-back in certain circumstances • Corresponding to section 77B of the CA, 1956. • Under Section 77B default in repayment of deposit and/or interest there on , redemption of debentures or preference shares, payment of dividend, repayment of any term loan or interest to banks and financial institutions prohibited companies to buy back till the default continued. • Section 70 is more strict on this issue, the company can not buy back for next three years from the date when default ceased to subsist. Sec 71 - Debentures • Corresponding to Sections 117, 117A, 117B, 117C, 118, 119 and 122 of the CA, 1956. • Section 71 makes clear reference to secured debentures and optionally convertible debentures in to shares. – It requires a company to pass special resolution for optionally convertible debenture. – It also make provision for providing terms and conditions for issue of secured debentures. These provisions were not there earlier. • Section requires appointment of debenture trustee mandatorily only when prospect is issued to more than 500 persons for subscription.