The Power of Compounding

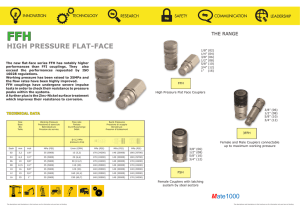

advertisement

What new money is created on €5000, if 8% is earned? €5000 (1 + 0.08) = €5400 €5000 Original Lump Sum €400 New Money What new money is created on €5400, if 8% is earned? €5400 (1 + 0.08) = €5832 €832 €5000 Original Lump Sum €400 (Yr 1) €432 (Yr 2) €5000 ( 1 + 0.08) = €5400 €5400 ( 1 + 0.08) = €5832 €5832 ( 1 + 0.08) = €6298 €6298 ( 1 + 0.08) = €6802 €6298 ( 1 + 0.08) = €7346 Rule of 72 72 Interest Rate 72 8 = How many years it takes to double your money = 9 years €5000 ( 1 + 0.08) = €5400 €5400 ( 1 + 0.08) = €5832 €5832 ( 1 + 0.08) = €6298 €6298 ( 1 + 0.08) = €6802 €6802 ( 1 + 0.08) = €7346 ……………………. no of years Principal (1 + interest rate/100)^ (One plus the interest rate) to the power of (the number of years) multiplied by (the principal) The long way… €6802 ( 1 + 0.08) = €7346 The short way… €5000 * (1.08)^5 = €7346 Take a person who starts saving €3000 per year from the ago of 22. She puts away the money into a high interest account earning 6% How much does she have when she turns 65? €674,186.99!!! In 1626, the natives in New York traded Manhattan for $24 worth of glass beads. Do you think that was a good deal? Who got the better deal? If the Americans had put that $24 on deposit at 6% interest in 1626… They could buy Manhattan today… TWICE OVER… SKYSCRAPERS AND ALL… AND have $1 billion left over in spare “change” Transaction Costs and Taxes Imagine, if each year, 5% of her portfolio was taken away in transaction costs. By the time she would have arrived to 65, 5% of the portfolio was worth… €674,186.99 * 5% = €33709 €26968 The price of a VERY NICE new car… Currently, the government charge 25% of any gains over and above €1270. The impact of transaction costs is enough to prove to you the difference expenses can make over time What if you could legally avoid paying tax? Put All the money into a pension! a pension does is put a wrapper around your investments that prevents the tax office from taking some out of it. Also, it stops you from going on a spending spree, as it is tied up there until you retire Not at all, instead of spending all your money now, you simply put some away, let it grow and live more comfortably and enjoy life all the more when you do retire. Carry out these three exercises to find the answers using the “short cut” formula. no of years Principal (1 + interest rate/100)^