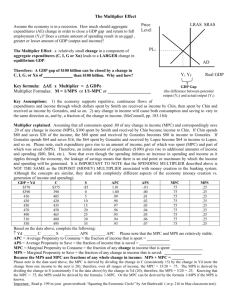

Multipliers

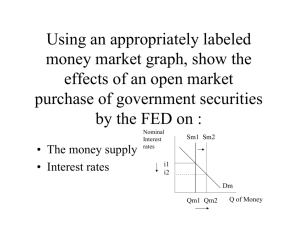

advertisement

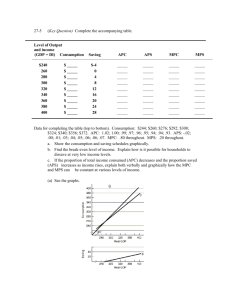

Multipliers & Fiscal Policy MPC, MPS & Multiplier Analysis MPC + MPS = 1 • MPC + MPS = 1 Group 1: MPC = .90 Group 2: MPC = .60 If taxes were reduced, which MPC would shift AD more? LRAS1 Price Level SRAS1 AD ↑ more with higher MPC ----------- Because, in short run, C↑ more E1 --------- P1 Y1 MPC = .60 MPS = .40 AD1 Y* Real GDP Multipliers & Fiscal Policy • Fiscal Policy has a multiplier affect on AD – If G↑ 1 billion => Real GDP ↑ by more than 1 billion! • Size of MPC/MPS determines how far AD shifts – Larger the MPC => the bigger the shift! LRAS1 Price Level ----------- E1 --------- P1 SRAS1 Y1 AD1 Y* Real GDP Gov’t Spending & Investment Multiplier • Multiplier = ∆GDP / ∆ Gov’t Spending – GDP increases more than Gov’t spending rises • 2-ways to calculate multiplier: 1/(1-MPC) Example: If MPC = .80 or (you need to know MPC or MPS) 1/MPS 1/(1-.80) = 5 or 1/.20 = 5 Multiplier & GDP • Gov’t Spending & investment have “multiple” affect on GDP Government raises spending $100 PRODUCT Market If MPC = .80 FIRMS HOUSEHOLDS Change in GDP: FACTOR Market Multiplier = 5 i.e. 1/MPS => 1/.20 = 5 Round 1 $100.0 Round 2 $80.0 Round 3 $64.0 Round 4 $51.2 Etc….. So a $100 ↑ => causes Real GDP ↑ $500 The Tax Multiplier • Multiplier = ∆GDP / ∆ Taxes • Is always smaller by 1 than spending/investment multiplier – spending multiplier = 5 => then tax multiplier = 4 • TM = -MPC/MPS or -MPC x (spending multiplier) • Example: $200 tax cut Example: MPC = .80 MPC = .80 TM = -.80 * 5 = -4 1/(1-.80) = 5 Balanced Budget Multiplier • Always equal to 1 (regardless of size of MPC) • Example: Government ↑ Taxes & ↑ Spending Example: Spending Multiplier = 10 Tax Multiplier = 9 by 1 billion Always a difference of 1 G ↑ 1 billion = > Real GDP ↑ 10 billion Tax ↑ 1 billion => Real GDP ↓ 9 billion Net Effect: Real GDP ↑ 1 billion Multipliers & Fiscal Policy Worksheet Price Level LRAS1 AD1 Real GDP SRAS1