Lecture No. 3: AGREGATE DEMAND

advertisement

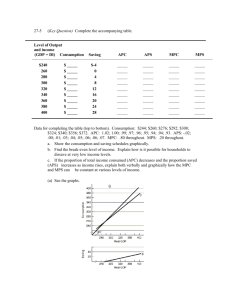

AGREGATE DEMAND AND BUSINESS CYCLES dr. Aleksandar Kešeljević Faculty of Economics University of Ljubljana Assistant professor THREE MAIN TOPICS A. AD, CONSUMPTION AND INVESTMENT (Ch. 21) B. BUSINESS CYCLES AND AGGREGATE DEMAND (Ch. 22) C. TODAY’S CRISIS A. AGREGATE DEMAND 1. CONSUMPTION (C) 2. INVESTMENT (I) 3. GOVERNMENT EXPENDITURES (G) 4. NET EXPORTS (NX) 1. CONSUMPTION • • • • • • • • • AD= C+I+G+NX Y= C + S → C = f (Y) C = 55% GDP Family budget expenditures (P) Consumption function (P) Marginal propensity to consume (MPC) (P) MPC + MPS = 1 Hypothesis (classical, Friedman, Modigliani) Determinants of consumption (DI, weath, live cycle,…) P: Family budget expenditures P: Consumption function P: Consumption function P: MPC P: MPC Saving • • • • Y= C + S The saving function (P4) MPS = 1 – MPC Paradoks of saving (S↑→C↓→AD↓→Y↓→S↓) • S = f (Y, i, T, social security system, financial markets, inflation…..) P: The saving function 2. INVESTMENT • Double role of I (AD= C+I+G+NX; AS) • The investment demand curve (P) • Determinants of investments (revenues, costs, expectations) (P) • Investments and saving S= I P: The investment demand curve P: The investment demand curve P: Determinants of ivestments 3. GOVERNMENT EXPENDITURES • AD= C + I + G + NX • Comparasion: G/BDP, T/BDP (P7) • G<T, G=T, G>T P: Governement spending P: Governement taxation • Functions of the governement (improving economic efficiency, reducing economic inequality, stabilizing through macroeconomic policies, international economic policy) • Social state and governement expenditures → no such a thing as a free lunch! • Governement expenditures (state, local) • Today’s crisis and the role of the government 4. NET EXPORTS • • • • • AD= C + I + G +NX EX- IM =NX X = f (Y , e) M = f (Y , e) e = exchange rate (mechanism,…) F D P: AD = C + I + G + NX B. BUSINESS CYCLES AND AGGREGATE DEMAND 1. BUSINESS CYCLES 2. ANTICYCLICAL POLICY 3. THE MULTIPLIER MODEL 1. BUSINESS CYCLES • Business cycles are fluctuations in output, income, employment, inventiries usually lasting 2 to 10 years • Four phases (peak, contraction or recession, trough, expansion) (P) • Recession occurs when real GDP has declined for two consecutive calendar quaters P: Four phases of business cycle P: Business activity since 1919 • Internal theories (multiplicator theory, monetary theory, political theories, real cycle theory,….) • External reasons (wars, oil shocks, revolutions, elections, gold expeditions, migrations, new world,.....) 2. ANTICYCLICAL POLICY • • • • • Business cycles forecasting Discretionary policy versus rules Anti-cyclical policy Automatic (or built in) stabilizers EU, EMU 3. THE MULTIPLIER MODEL • How output is determined in the short run? • How changes in spending (AD) get translated into changes in output and employment? ∆ GDP = m * ∆ AD • Three approaches: AS-AD, I=S, Keynesian cross • Advantages/disadavantages Multiplier: I↑ → GDP↑ AS-AD APPROACH: AD↓→ GDP↓ KEYNESIAN CROSS APPROACH NUMERICAL ANALYSIS • ∆ GDP = m * ∆ AD • GDP = C +I+G+NX; I, G, NX=0 → ∆GDP=∆C • ∆Y=1000 (Y=C+S) • 1000+666+444+296+……= 3000 • 1 + r + r2 + ...= 1 ∕ (1-r) = 1 ∕ (1- MNP)= 1∕MPS • ∆GDP = 1 ∕ (1-MPC) * ∆ AD = (1 / MPS) * ∆ AD MULTIPLIERS • Investment multiplier • Government expenditures multiplier • Tax multiplier Investment and government expenditures multipliers • ∆ GDP = 1/MPS * ∆I investment multiplier • ∆ GDP = 1/MPS * ∆G government expenditure multiplier Tax multiplier • T↑ → AD↓ → GDP↓ • T↓ → AD↑ → GDP↑ • ∆ GDP = MPC/MPS * ∆T tax multiplier Tax multiplier FISCAL POLICY IN THE MULTIPLIER MODEL • ∆ GDP = 1/MPS * ∆G r • ∆ GDP = MPC/MPS * ∆T • • • • mt = mg * MPC mt < mg Tax mupliplier= MPC * expenditure multiplier Consequences for fiscal policy and its affect on output AD vs. AS - Supply side economics AS (not AD) in the center of interest Laffer curve Privatization, deregulation, liberalisation USA, GB in the 1980’s Effect of moving AS curve C. TODAY’S CRISIS • Crisis is like pretty woman: Hard to define but recognizable when encountered (Goldsmith) • Crisis: financial, economic, social, political, sistemic aspect Main reasons • too expansive monetary policy • fast liberalization of capital markets and inovative financial instruments • booms and baloons • bad regulation in the financial sector (grey banking) • structural reasons (w/GDB↓) • bad corporate governance WALL STREET-MAIN STREET (“We are 99”) SOLUTIONS AND COSTS • Screenplay for the movie Apokalipsa • Restoring the confidence and trust among population and banks (government guarantees of bank deposits, recapitalization of banks,…) • Coordinated action of CB (↓i, liquidity trap, QE3) • Fiscal policy stimulus packages • Fiscal measures: government debt guarantees, injection of capital, purchases of assets, take-overs by the government (state ownership), • Funding: IMF, WB, the role of rising China • ESFS, EFSM (2013), ESM (2013→) • Fiscal deficits and public debt (P) P: Public debt/GDP (%) 2007 2011 Germany 64,9 82,4 Irland 25,0 112,0 France 63,9 84,7 Italy 103,6 120,3 Belgium 84,2 97,0 Greece 105,4 158 Spain 36,1 68,1 Slovenia 23,1 42,8 Czech Republik 29,0 41,3 Croatia 33,2 40,4 EMU-17 66,2 87,8 EU27 59,0 82,3 • Not every country in the same position (crisis on crisis, free rider) • Different approaches: In EU not enough manoeuvring space for economic policy, EU is not a federal state as USA, EU27 more modest (3% GDP) than USA (different ES), differences regarding FED and ECB • American elections (Obama, Romney) Dilemmas • Dilemma 1: to much from taxpayers viewpoint or to little to solve the problem (P) • Dilemma 2: moral solution and deep recession or vice versa • Dilemma 3: exit or relying on others (PIGS) • Dilemma 4: market or the state • Dilema 5: socialist instruments or more market • Dilemma 6: austerity measures or higher spending. Are austerity measures effective? Implications for the Capitalism? • Is capitalism dead, We are 99 • Enormous creation of well being until today by capitalism (1980-2008 GDP↑ 145%, 3,4% annually) • Is socialism an alternative? (not hamper the markets, not all regulation will be wise) • Capitalism will not be the same afterwards → today market the only game and enemy in town • Regulation: Institutional reforms, corporate responsibility, business ethics, corporate governance, living within the personal limits,… Better days • It is not as bad, as it sounds… (M. Twain) Gini Coefficient World 2011 HDI World in 2011