AP Macro Review

advertisement

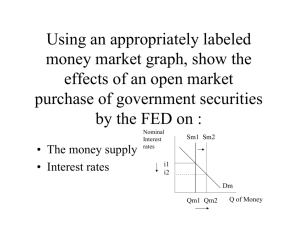

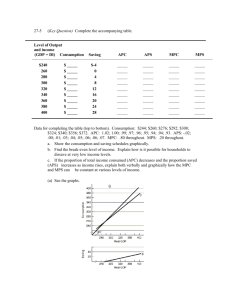

AP Macro Review Fun with formulas! Unemployment EMPLOYED 8000 UNEMPLOYED 1000 NOT IN THE LABOR FORCE (16 -64) 500 According to the chart above, 1. What is the unemployment rate? 2. What is the size of the labor force ? 3. What is the labor force participation rate? Real and nominal interest rates • Jerry decides to loan his friend some money. He would like to see a 5% return on the loan. If the current rate of inflation is 15%, what should he charge as an interest rate? GDP • 1. Suppose GDP is $15 million, where consumer spending is $4 million, investments are $2 million, government spending is $5 million, and exports are $4 million. How much is spent on imports? Rule of 70 • If the US has a 2% annual growth rate, how long will take for real GDP to double? Real v. nominal GDP • Current GDP is $8000 • The GDP deflator is 110 • What is real GDP? • Real GDP in the previous year was $7000 • What was the rate of growth in this economy? Inflation • CPI in 1990 was 115 • CPI in 1991 was 120 • What was the inflation rate between the two years? • If I got a 2% raise between in this time period, what happened to my real income? FRQ PRACTICE • 2011, question B The multiplier • MPC = change in consumption/change in disposable income • MPS= change in savings/change in disposable income • MPC + MPS =1 • Spending multiplier = 1/MPS • Tax multiplier = - MPC/MPS • Balanced budget multiplier =1 (used to offset the multiplier effect on increased spending by increasing taxation by the same amount as the spending increase The multiplier • If the government increases spending by $5 billion and the MPC is .7, what would happen to real GDP? • A. increase by $15 billion • B. Increase by $16.5 billion • C. Decrease by $16.5 billion • D. Decrease by $15 billion • E. Remain the same The multiplier • If the MPC is .6 and spending increases by $10 billion, what will happen to GDP? The multiplier • If the MPC is .6, how much would the government need to spend if it desired an $25 billion increase in national income? The multiplier • MPC = .75 What is the spending multiplier? What is the tax multiplier? What will be the effect on GDP if spending and taxes both increase by $10 billion? The money multiplier • The required reserve ratio (RRR) is 10%. • What is the multiplier? • If a bank receives a cash deposit of $10,000, what is the amount of excess reserves that results from this deposit? • What is the change in loans that results from this deposit? FRQ Practice In Country Z, the required reserve ratio is 10 percent. Assume that the central bank sells $50 million in government securities on the open market. • (a) Calculate each of the following. • (i) The total change in reserves in the banking system • (ii) The maximum possible change in the money supply • (b) Using a correctly labeled graph of the money market, show the impact of the central bank’s bond sale • on the nominal interest rate. • (c) What is the impact of the central bank’s bond sale on the equilibrium price level in the short run? • (d) As a result of the price level change in part (c), are people with fixed incomes better off, worse off, or unaffected? Explain. Assume that the real interest rates in both Canada and India have been 5 percent. Now the real interest rate in India increases to 8 percent. • (a) Using a correctly labeled graph of the foreign exchange market for the Canadian dollar, show the effect of • the higher real interest rate in India on each of the following. • (i) Supply of the Canadian dollar. Explain. • (ii) The value of the Canadian dollar, assuming flexible exchange rates • (b) Using a correctly labeled graph of the loanable funds market in Canada, show how the increase in the real • interest rate in India affects the real interest rate in Canada. T-account Assets : reserves, loans Liabilites : demand deposits/checking accounts Example on whiteboard AS/AD curves • There are three of these that you need to be able to operate. • They work much like regular supply and demand but they look at the entire economy. • P is now PL, and Q is now GDP/Output/Income/Y • EXAMPLES ON BOARD Phillips Curve • Relationship between the EVIL TWINS of economics, inflation and unemployment • In the SHORT RUN, there does seem to be an inverse relationship • In the LONG RUN, there is none---the LRPC is vertical from the point of the natural rate of unemployment. • IT IS THE MIRROR IMAGE OF AGGREGATE SUPPLY • EXAMPLES ON THE BOARD Practice • • • • • • • • • • 1. Assume that the economy of Meekland is in a long-run equilibrium with a balanced government budget. (a) Using a correctly labeled graph of aggregate supply and aggregate demand, show each of the following. (i) Long-run aggregate supply (ii) The output level, labeled YE, and the price level, labeled PLE (b) Assume consumer confidence falls. Show on your graph in part (a) the short-run impact of the change in consumer confidence and label the new equilibrium price level and output Y1 and PL1, respectively. (c) Using a correctly labeled graph of the short-run and long-run Phillips curves, show the effect of the fall in consumer confidence on inflation. Label the initial long-run equilibrium point A and the new short-run equilibrium point B. (d) If the government and the central bank do not pursue any discretionary policy change, how does the fall in consumer confidence affect government transfer payments in Meekland? Explain. (e) Draw a correctly labeled graph of the loanable funds market in Meekland and show the effect of the change in government transfer payments you identified in part (d) on the real interest rate. (f) In the absence of any changes in fiscal and monetary policies, in the long run will the short-run aggregate supply curve shift to the left, Money Market • Relationship between interest rates and the quantity of money • Demand for money is downward-sloping, because we demand less at higher rates, and more at lower rates • Money supply is vertical, because it is manipulated by the Fed • Example on board Loanable funds graph • • • • Supply and demand graph---loanable funds P=interest rate Q= QLF Example on board Laffer curve • Relationship between tax rate and tax revenue • At a certain point, if tax rates are too high, tax revenue will actually decrease because incentive has been removed • Example on board