The Multiplier

advertisement

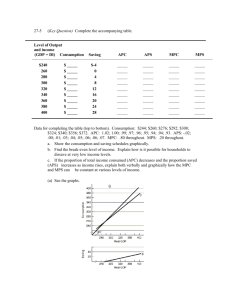

The Multiplier Effect Assume the economy is in a recession. How much should aggregate expenditures (AE) change in order to close a GDP gap and return to full employment (YF)? Does a certain amount of spending result in an equal , greater or lesser amount of GDP (output and income)? LRAS SRAS Price Level PL1 The Multiplier Effect: a relatively small change in a component of aggregate expenditures (C, I, G or Xn) leads to a LARGER change in equilibrium GDP. AD Therefore: A GDP gap of $100 billion can be closed by a change in C, I, G, or Xn of ______________ than $100 billion. Why and how? Y1 YF Key formula: ΔAE x Multiplier = Δ GDPe Multiplier Formulas: M = 1/MPS or 1/1-MPC or ___________________ Real GDP GDP Gap (the difference between potential output (YF) and actual output (Y1) Key Assumptions: 1) the economy supports repetitive, continuous flows of expenditures and income through which dollars spent by Smith are received as income by Chin, then spent by Chin and received as income by Gonzales, and so on. 2) any change in income will cause both consumption and saving to vary in the same direction as, and by, a fraction of, the change in income. (McConnell, pp. 183-184) Multiplier explained: Assuming that all consumers spend .80 of any change in income (MPC) and correspondingly save .20 of any change in income (MPS), $100 spent by Smith and received by Chin become income to Chin. If Chin spends $80 and saves $20 of the income, the $80 spent and received by Gonzales becomes $80 in income to Gonzales. If Gonzales spends $64 and saves $16, the $64 spent by Gonzales and received by Lopez become $64 in income to Lopez, and so on. Please note, each expenditure gave rise to an amount of income, part of which was spent (MPC) and part of which was saved (MPS). Therefore, an initial amount of expenditure ($100) gives rise to additional amounts of income and spending ($80, $64, etc.). Note that even though the spending initiates an increase in spending and income as it ripples through the economy, the leakage of savings means that there is an end point or maximum by which the income and spending will be generated. It is IMPORTANT TO NOTE that the SPENDING MULTIPLIER described above is NOT THE SAME as the DEPOSIT (MONEY) MULTIPLIER associated with money creation in the banking system. Although the concepts are similar, they deal with completely different aspects of the economy (money creation vs. generation of income and spending). GDP = Yd $370 $390 410 430 450 470 490 510 530 C $375 390 405 420 435 450 465 480 495 S -$5 0 5 10 15 20 25 30 35 APC 1.01 1.00 .99 .98 .97 .96 .95 .94 .93 APS -.01 .00 .01 .02 .03 .04 .05 .06 .07 MPC .75 .75 .75 .75 .75 .75 .75 .75 .75 MPS .25 .25 .25 .25 .25 .25 .25 .25 .25 Based on the data above, complete the following: ↑ Yd ______ C ______ S _______ APS _______ APC Please note that the MPC and MPS are relatively stable. APC = Average Propensity to Consume = the fraction of income that is spent = ___________ APS = Average Propensity to Save = the fraction of income that is saved = _______________ MPC = Marginal Propensity to Consume = the fraction of any change in income that is spent: _______________ MPS = Marginal Propensity to Save = the fraction of any change in income that is saved: __________________ Because the MPS and MPC are fractions of any whole change in income: MPS + MPC = ______ Please note in the data used above, the MPC is derived by dividing the change in C (consistently 15) by the change in Yd (note the change from one income to the next is 20); therefore, over all ranges of income, the MPC = 15/20 = .75. The MPS is derived by dividing the change in S (consistently 5 in the data above) by the change in Yd (20); therefore, the MPS = 5/20 = .25. Knowing that the MPC = .75, the MPS could be derived by the formula: 1-MPC. Or the MPC can be derived by the formula 1-MPS if the MPS is known. Important: Read p. 199 in your green textbook “Squaring the Economic Circle” by Art Buchwald ( or p. 216 in blue classroom text). Multiplier Formulas: M = 1/MPS or 1/1-MPC or ΔGDPe/ΔAE 1. 2. 3. 4. If the MPS = .20 the MPC = _____ the Multiplier = _____ If the MPC = .75 the MPS = _____ the Multiplier = _____ If the MPC = .90 the MPS = _____ the Multiplier = _____ If the change in GDPe = $20 billion and the change in AE = $5 billion, then the multiplier = _____ and the MPC = _____ and the MPS = _____. Use the multiplier to determine the amount of spending needed to close a GDP gap and return the economy to full employment. Key formula: ΔAE x Multiplier = Δ GDPe 5. If the GDP gap is $100 billion, how much must AE (C, I, G, or Xn) increase to return the economy to full employment if the MPC = .80? 6. If the GDP gap is $40 billion and the MPS = .25, what amount must AE increase to close the GDP gap? 7. If the economy is in recession and has a GDP gap of $50 billion, how much must government increase G to close the GDP gap and return to full employment, assuming an MPS of .20? 8. If actual output exceeds potential output (YF) by $80 billion, how much must AE decrease in order to dissipate the inflationary gap assuming the MPS = .25? Does a change in G have the same effect as a change in T? No, a change in G can directly affect the economy. A change in T results in a change in disposable income (Yd), but Yd can be either spent (C) or saved (S); therefore, a change in T affects the economy only by a multiple of the amount that it changes C. 8. Determine the effect on GDP of an increase in G of $20 billion if the MPC = .80 and the effect of a decrease in T of $20 billion. $20 x 5 = $100 billion $20 billion in T → $20 billion in Yd. With an MPC of .80, C = $16 billion; therefore, the change in GDP = $16 billion x 5 = $80 billion. Therefore, an increase in G of $20 billion has a greater impact ($100 billion) on the economy than a decrease in taxes of $20 billion ($80). This is due to the leakage of savings in the case of taxes. 9. What would be the effect on the economy (GDPe) of a decrease of $100 billion in G (or C, I or Xn) if the MPS were .25? What would be the impact on GDPe of an increase in taxes of $100 billion? 10. Determine the effect on GDP of equal increases in both G and T of $50 billion given an MPC of .80? How would this approach affect the government’s budget versus the effect on the economy? Key idea: The balanced budget multiplier = 1. Therefore, 1 x the ΔG = the ΔGDPe if taxes and G are changed by the same amount. 11. 12. An increase in G and T of $50 billion would change GDPe how much? ______ A decrease in G and T of $30 billion would change GDPe how much? ______ Conclusion: A balanced budget has a(n) ____________________________ effect on the economy. (expansionary/contractionary?)