MathFinLec2

advertisement

LOGO

MATH 2040

Introduction to

Mathematical Finance

Instructor: Dr. Ken Tsang

1

Chapter 2: Solution of problems in interest

Introduction: the basic problem

Equations of value

Unknown time & interest rate

Determining time periods

Examples

2

Introduction

• How to solve an interest problem?

–Use basic principle

– Develop a systematic approach

3

Obtaining numerical results

• Use a calculator with exponential functions.

• Use the table of compound interest functions.

• Series expansion could also be used.

• Use software like MatLab or R

4

A common problem

• A common problem is to determine a(t), where t

is not an integer.

• Use compound interest for integral periods of time

and simple interest for fractional periods.

• This method is equivalent to the method of using

the first two terms of the binomial expansion

assuming that 0 < k < 1.

5

Linear interpolation

• The use of simple interest for a fractional period is

equivalent to performing a linear interpolation

between (1 + i)n and (1 + i)n+1, where n is the

integral part of the period.

• (1 + i) n+k (1 k)(1 + i)n + k (1 + i) n+1

= (1 + i)n(1 + k i)

• (1 – d) n+k (1 k)(1 d )n + k (1 – d) n+1

= (1 – d)n(1 – k d)

6

Example

• Find the accumulated value of $5000 at the end of

30 years and 4 months at 6% p.a. converted

semiannually: (1) assuming compound interest

throughout, and (2) assuming simple interest during

the final fractional period.

• (1) By direct calculation,

5000(1.03)60.667 = 30044.27

• (2) By assuming simple interest in the final

fractional period, we have

5000(1.03)60(1.02) = 30047.18

7

Exact simple interest

• There are three commonly used methods to count

the number of days for the period of investment.

• The first one is called the exact simple interest

method.

• In this method, the exact number of days are

counted, and a year contains 365 days.

• This method is often denoted by “actual/actual”.

8

Ordinary simple interest

• The second one is called the ordinary simple

interest method.

• In this method, it is assumed that there are 30

days in each month and 360 days in a year.

• This method is often denoted by “30/360”.

• For simplicity, a formula for calculating the days in

the “30/360” method is:

360(Y2 – Y1) + 30(M2 – M1) + (D2 – D1)

9

The banker’s rule

• The third one is called the banker’s rule.

• This method is a hybrid of the previous two.

• It used the exact number of days in each month

and 360 days in a year.

• This method is often denoted by “actual/360”.

• Bankers use this rule to charge interest for loans to

their clients, and the rule is more favorable to the

bankers.

10

Remarks on Determining time periods

•

Leap years lead to complications.

– February 29 counted as one day and 366 days for the

year.

– February 29 counted as one day and 365 days for the

year.

– February 29 is not counted and 365 days for the year.

•

•

In counting the number of days, either the first

day or the final day is counted, but not both.

The above methods are also used for compound

interest calculation.

11

Example

•

Find the amount of interest that $2000 deposited From June

17 to September 10 of the same year will earn, if the rate of

interest is 8%, on the following:

–

–

–

•

Exact simple interest (actual/actual)

Ordinary simple interest (30/360)

Banker’s rule (actual/360)

Answers for the three methods are:

–

–

–

85 days. Interest = 2000(0.08)(85/365) = 37.26

Number of days = 360(0) + 30(9 – 6) + (10 – 17) = 83.

therefore interest = 2000(0.08)(83/360) = 36.89

85 days. Interest = 2000(0.08)(85/360) = 37.78.

12

The basic problem

• A typical problem on interest involves four

basic quantities:

–

–

–

–

The original investment – principal

The length of the investment period – the period

The rate of interest

The accumulated value at the end of the period

• In principle, if three of the four quantities are

known, the fourth can be determined.

13

A fundamental principle in the theory of interest

• Value of an amount of money depends on the

time when it is payable.

• This time value of money reflects the effect of

interest.

• Two or more amounts of money payable at

different time cannot be compared directly.

14

Equation of value

• The time value of money at any given point in time, t,

will be either a present value or a future value from the

payment time.

• To compare two or more amounts of money payable at

different time, they have to be accumulated or discounted

to a common date, the comparision date.

• The equation which accumulates or discountes each

payment to the comparision date is called the equation

of value.

15

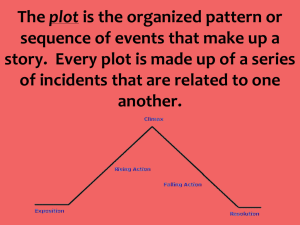

Time diagram

• It helps to draw out a time line and plot

the payments and withdrawals accordingly.

16

Example

• A $600 payment due in 8 years is equivalent to

receive $100 now, $200 in 5 years and $ X

in 10 years. If i = 8% p.a., find $ X.

• The line diagram is

17

Example – solution 1

• Compare the values at t = 0.

18

Example – solution 2

• Compare the values at t = 5.

19

Example – solution 3

• Compare the values at t = 10.

• All three solutions leads to the same answer, because

they all treat the values of the payments consistently at a

given point of time t.

20

Unknown time

• As discussed before, if any of the four basic

quantities are known, then the fourth can be

determined.

• Consider the situation where the length of

investment is not known.

• The easiest approach is to use logarithm.

21

Example - logarithm

• How long does it take money to double if

the interest rate i = 6%?.

Very simple evaluation using MATLAB

22

Example – interest table + interpolation

• If logarithms are not available, then use

interest tables and perform a linear

interpolation.

• Using interest tables, we have

and

23

Doubling a payment – rule of 72

• For doubling a single payment we have the rule

of 72

• This rule gives a good approximation for the

period to double the principal over a wide range

of interest rates.

24

Comparing rule of 72 with exact values

Rate of interest Rule of 72 Exact value Error

4%

18

17.67

+2%

6

12

11.90

+1%

8

9

9.01 0.1%

10

7.2

7.27

1%

12

6

6.12

2%

18

4

4.19

5%

25

Tripling a payment – rule of 114

• For tripling a single payment, we have the

approximate rule of 114.

26

Multiple payments

• Let St represent a sequence of payments made at time

t for t = 0, 1, …, n.

• How to replace the multiple payments with a single

payment S, equal to the sum of all St, such that the

present value of S at time t is equal to the present

value of the multiple payments?

• Determine the value of t.

27

Multiple payments - solution

• To find the true value of t, we form the

equation:

• Taking logarithm on both sides, we have

28

Multiple payments – approximate solution

• Suppose we use t , the weighted average of time for the

multiple payments, to approximate the value of t.

• This method is called the method of equated time.

• If we can prove that t t , then the present value using

the method of equated time will be less than the present

value using exact t.

29

Weighted average of time > exact time 1

• The present value of the payment at time tk is

.

• So the arithmetic weighted mean of present values is

• And the geometric weighted mean of present values is

30

Weighted average of time > exact time 2

• Since the geometric means are less than

arithmetic mean

• Method of equated time > exact t

31

Example

• Find the length of time necessary for $1000 to

accumulate to $1500 if invested at 6% per annum

compounded semiannually: (1) by use of logarithm,

and (2) by interpolating in the interest table.

• Let n be the number of half-years required. The

equation of time is

1000(1.03)n = 1500.

(1.03)n = 1.5

32

Example – cont’d

• Using logarithm, we have

n loge 1.03 = loge 1.5.

• Because loge 1.03 = 0.405465 and loge 1.5 =

0.029559, we can determine n to be 13.717.

• So the number of years is 6.859

Using MATLAB

33

Example – cont’d

• From the interest table, we have

(1.03)13 = 1.46853 and

(1.03)14 = 1.51259

• Performing a linear interpolation,

1.50000 1.46853

n 13

13.714

1.51259 1.46853

• So the number of years is 6.857. Note that

the two answers are very close.

34

Another example

• Payments of $100, $200 and $500 are due at the ends

of years 2, 3 and 8 respectively. Assuming an

effective rate of interest of 5% per annum, find the

point in time at which a payment of $800 would be

equivalent: (1) by an exact method, and (2) by the

method of equated time.

• The exact time equation is:

800 vt = 100 v2 + 200 v3 + 500 v8,

which can be solved for t = 5.832.

• By method of equated time, we have

100 2 200 3 500 8

t

6.

100 200 500

• As expected, the true value t is less.

35

Unknown rate of interest – single payment

• It is quite common to have a financial transaction

where the rate of return needs to be determined.

• For example, suppose $1000 investment triples in

10 years at nominal rate of interest convertible

quarterly. Find i(4).

Using MATLAB

36

Unknown rate of interest – multiple payments

• Interest can also be determined if there are only a small

number of payments and the equation of value can be

reduced to a polynomial that is not too difficult to solve.

• For example, at what effective interest rate will the present

value of $130 at the end of 5 years and $300 at the end of

10 years be equal to $360?

• The equation of value is

130 v5 + 300 v10 = 360.

• If we put y = v5, the equation becomes a quadratic equation

in y, which can be solved, and consequently i can be

determined, giving y = 0.9 and i = (0.9)0.2 1.

37

Linear interpolation

• Unfortunately, most of the times, a quadratic

equation or low degree polynomial equation is not

available.

• In this case we can use linear interpolation.

• For example, at what effective interest rate will an

investment of $100 immediately and $500 at the

end of the 3rd year from now accumulate to

$1000 at the end of the 10th year from now?

38

Linear interpolation – cont’d

• The equation to solve is 100(1 + i)10 + 500(1 + i)7 = 1000.

• Put f (i) = (1 + i)10 + 5(1 + i)7. The problem is solved if we

can determine what value of i will lead to f (i) = 10.

• By trial and error, we find that f (9%) = 9.68 and that

f

(10%) = 10.39. So by linear interpolation, we have

• The actual answer is 9.46%.

• The linear interpolation can be repeated until the desired

level of accuracy is attained.

39

Worked example 1

• At what interest rate convertible quarterly

would $1000 accumulate to $1600 in six

years?

• We need to determine x = i(4)/4. So the

equation of value is 1000(1 + x)24 = 1600.

• Solving the equation, we get x = 0.019776.

• The answer is i(4) = 4 x = 7.91%

40

Worked example 2

• At what effective rate of interest will sum of the

present value of $2000 at the end of the 2nd year

from now and $3000 at the end the 4th year from

now be equal to $4000?

• The equation of value is 2000v2 + 3000v4 = 4000.

• That is simplified and re-written as 2v2 + 3v4 4 =

0.

• Solving it as a quadratic equation in v2, we get the

meaningful root 9 v2 = 0.868517, which gives the

answer i = 7.30%.

41

Worked example 3

• Suppose an investment of $1000 now plus another

investment of $2000 at the end of 3 years from now will

accumulate to $5000 at the end of 10 years from now.

What is the nominal interest rate convertible semiannually?

• We need to determine j = i(2) /2.

• So the equation of value is:

1000(1 + j)20 + 2000(1 + j)14 = 5000

• We cannot solve this equation easily, so we use linear

interpolation.

• We may also use the graphic capability of MATLAB to help.

42

Worked example 4 – cont’d

• Put f (j) = 1000(1 + j)20 + 2000(1 + j)14 5000

• Then we need to find j so that f (j) = 0.

• By trial and error, we get

f (0.030) = 168.71 and f (0.035) = 227.17

• Performing one linear interpolation, we get

168 .71

j 0.0300 0.0050

0.0321 .

227 .17 168 .71

• This implies that i (2) = 2 (0.321) = 0.0642, or 6.42%.

• A higher level of accuracy can be achieved if the linear

interpolation is repeated until the desired accuracy is

attained.

43

A simple MATLAB plot routine

• Use the following command lines in MATLAB

–

–

–

–

x = 1:0.005:1.2

y = x.^20 + 2*x.^14 – 5

Z=0

plot(x,y,x,z)

• and we get the plot

44

A simple plot by MATLAB

45

A fancier MATLAB plot routine

x=1:0.005:1.2;

y=x.^20 + 2*x.^14-5;

z=0

plot(x,y,x,z);

title('y=(1+j)^2^0+2(1+j)^1^4-5');

xlabel('1+j');

ylabel('y')

46

A fancier MATLAB plot

From this plot we can determine j approximately.

47