Financial Statement Analysis

Chapter 14

McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Financial Statements Are

Designed for Analysis

Classified

Financial

Statements

Comparative

Financial

Statements

Consolidated

Financial

Statements

Items with certain

characteristics are

grouped together.

Amounts from

several years

appear side by side.

Information for the

parent and subsidiary

are presented.

Results

in standardized,

meaningful

subtotals.

Helps identify

significant

changes and

trends.

Presented as if

the two companies

are a single

business unit.

14-2

Tools of Analysis

Dollar &

Trend

Percentage

Percentages

Changes

Component

Percentages

Ratios

14-3

Dollar and Percentage Changes

Dollar Change:

Dollar

Change

=

Analysis Period

Amount

–

Base Period

Amount

Percentage Change:

Percent

Change

=

Dollar Change

÷

Base Period

Amount

14-4

Dollar and Percentage Changes

Evaluating Percentage Changes in

Sales and Earnings

Sales and earnings

should increase at

more than the rate

of inflation.

In measuring quarterly

changes, compare to

the same quarter in

the previous year.

Percentages may be

misleading when the

base amount is small.

14-5

Clover Limited

2008

Comparative2009

Balance Sheets

31 December

Dollar

Change

Percent

Change*

Assets

Property and equipment:

Dollar

Percent

Land

$ 2009

40,000 $2008

40,000 Change

Change*

Buildings and

equipment, net

120,000

85,000

Assets

Total property

and equipment

160,000

125,000

Property

and equipment:

Current

Land assets:

$ 40,000 $ 40,000

Inventoryand equipment, net

80,000

100,000

Buildings

120,000

85,000

Prepaid

expenses

3,000 $ 125,000

1,200

Total property

and equipment $ 160,000

Accounts

receivable, net

60,000

40,000

Current

assets:

$12,000 – $23,500 = $(11,500)

Cash

and

cash

equivalents

12,000

23,500

?

?

Inventory

$ 80,000 $ 100,000

Total current

assets

$ 155,000

$ 164,700

Prepaid

expenses

3,000

1,200

Total

assets

$ 60,000

315,000 $ 40,000

289,700

Accounts

receivable, net

* Cash

Percent

to one decimal point.

androunded

cash equivalents

12,000

23,500

(11,500)

?

Total current assets

$ 155,000 $ 164,700

Total assets

$ 315,000 $ 289,700

* Percent rounded to one decimal point.

14-6

Clover Limited

Comparative Balance Sheets

31 December

2009

Assets

Property and equipment:

Land

$ 40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Current assets:

Inventory

$ 80,000

Prepaid expenses

3,000

Accounts receivable, net

60,000

Cash and cash equivalents

12,000

Total current assets

$ 155,000

Total assets

$ 315,000

* Percent rounded to one decimal point.

2008

Dollar

Change

Percent

Change*

$ 40,000

85,000

$ 125,000

Complete the

analysis for the

other assets.

$ 100,000

1,200

40,000

23,500

$ 164,700

$ 289,700

($11,500 ÷ $23,500) ×

100% = 48.94%

(11,500)

-48.9%

14-7

Clover Limited

Comparative Balance Sheets

31 December

2009

Assets

Property and equipment:

Land

$ 40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Current assets:

Inventory

$ 80,000

Prepaid expenses

3,000

Accounts receivable, net

60,000

Cash and cash equivalents

12,000

Total current assets

$ 155,000

Total assets

$ 315,000

* Percent rounded to one decimal point.

2008

$ 40,000

85,000

$ 125,000

$ 100,000

1,200

40,000

23,500

$ 164,700

$ 289,700 $

Dollar

Change

Percent

Change*

35,000

35,000

0.0%

41.2%

28.0%

(20,000)

1,800

20,000

(11,500)

(9,700)

25,300

-20.0%

150.0%

50.0%

-48.9%

-5.9%

8.7%

14-8

Trend Percentages

Trend analysis is used to reveal patterns in

data covering successive periods.

Trend

=

Percentages

Analysis Period Amount

Base Period Amount

× 100%

14-9

Trend Percentages

Berry Products

Income Information

For the Years Ended 31 December

Item

Revenues

Cost of sales

Gross profit

Item

Revenues

Cost of sales

Gross profit

2009

$ 400,000

285,000

115,000

2008

$ 355,000

250,000

105,000

2007

$ 320,000

225,000

95,000

2006

$ 290,000

198,000

92,000

2009

2008

2007

2006

145%is the129%

116% so 105%

2005

base period

its

150%

132%

118%

104%

amounts124%

will equal

100%.108%

135%

112%

(290,000 275,000)

(198,000 190,000)

(92,000 85,000)

100% = 105%

100% = 104%

100% = 108%

2005

$ 275,000

190,000

85,000

2005

100%

100%

100%

14-10

Component Percentages

Examine the relative size of each item in the financial

statements by computing component

(or common-sized) percentages.

Component

Percentage

=

Analysis Amount

Base Amount

Financial Statement

Balance Sheet

Income Statement

×

100%

Base Amount

Total Assets

Revenues

14-11

Clover Limited

Comparative Balance Sheets

31 December

Complete the common-size analysis for the other

assets.

2009

Assets

Property and equipment:

Land

$ 40,000

Buildings and equipment, net

120,000

Total property and equipment

160,000

Current assets:

Inventory

$ 80,000

Prepaid expenses

3,000

Accounts receivable, net

60,000

Cash and cash equivalents

12,000

Total current assets

$ 155,000

Total assets

$ 315,000

* Percent rounded to first decimal point.

2008

$ 40,000

85,000

125,000

$ 100,000

1,200

40,000

23,500

$ 164,700

$ 289,700

Common-size

Percents*

2009

2008

($23,500 ÷

$289,700) ×

100% = 8.1%

($12,000 ÷

$315,000) ×

100% = 3.8%

3.8%

8.1%

100.0%

100.0%

14-12

Clover Limited

Comparative Balance Sheets

31 December

2009

Assets

Property and equipment:

Land

$ 40,000

Buildings and equipment, net

120,000

Total property and equipment

160,000

Current assets:

Inventory

$ 80,000

Prepaid expenses

3,000

Accounts receivable, net

60,000

Cash and cash equivalents

12,000

Total current assets

$ 155,000

Total assets

$ 315,000

* Percent rounded to first decimal point.

2008

$ 40,000

85,000

125,000

$ 100,000

1,200

40,000

23,500

$ 164,700

$ 289,700

Common-size

Percents*

2009

2008

12.7%

38.1%

50.8%

0.0%

25.4%

1.0%

19.0%

3.8%

49.2%

100.0%

13.8%

29.3%

43.1%

0.0%

34.5%

0.4%

13.8%

8.1%

56.9%

100.0%

14-13

Clover Limited

Comparative Income Statements

For the Years Ended 31 December

Common-size

Percents*

2009

2008

2009

2008

Revenues

$ 520,000 $ 480,000

100.0% 100.0%

Costs and expenses:

Cost of sales

360,000

315,000

69.2%

65.6%

Selling and admin.

128,600

126,000

24.7%

26.3%

Interest expense

6,400

7,000

1.2%

1.5%

Profit before taxes

$ 25,000 $ 32,000

4.8%

6.7%

Income taxes (30%)

7,500

9,600

1.4%

2.0%

Profit for the year

$ 17,500 $ 22,400

3.4%

4.7%

Earnings per share

$

0.79 $

1.01

Avg. # common shares

22,200

22,200

* Rounded to first decimal point.

14-14

Quality of Earnings

Investors are interest in companies that

demonstrate an ability to earn income at a

growing rate each year. Stability of earnings

growth helps investors predict future prospects

for the company.

Financial analyst often speak of the “quality of

earnings” at one company being higher than

another company in the same industry.

14-15

Quality of Assets and the Relative

Amount of Debt

While satisfactory earnings may be a

good indicator of a company’s ability to

pay its debts and dividends, we must also

consider the composition of assets, their

condition and liquidity, the timing of

repayment of liabilities, and the total

amount of debt outstanding

14-16

A Classified Balance Sheet

Matrix, Inc.

Asset Section: Classified Balance Sheet

31 December 2009

Noncurrent assets:

Property, plant and equipment:

Land

Building

Less: Accumulated depreciation

Equipment and Fixtures

Less: Accumulated depreciation

Total plant and equipment

Patents

Total noncurrent assets

Current assets:

Cash

Notes receivable

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Total assets

$

$

121,000

(10,000)

46,000

(27,000)

150,000

111,000

19,000

$

$

280,000

170,000

450,000

30,000

16,000

60,000

70,000

4,000

180,000

630,000

14-17

Ratios

A ratio is a simple mathematical expression

of the relationship between one item and another.

Along with dollar and percentage changes,

trend percentages, and component percentages,

ratios can be used to compare:

Past performance to

present performance.

Other companies to

your company.

14-18

Use this information to calculate the liquidity

ratios for Babson Builders.

Babson Builders Limited

2009

Cash

$ 30,000

Accounts receivable, net

Beginning of year

17,000

End of year

20,000

Inventory

Beginning of year

10,000

End of year

15,000

Total current assets

65,000

Total current liabilities

42,000

Total liabilities

103,917

Total assets

Beginning of year

300,000

End of year

346,390

Revenues

494,000

14-19

Working Capital

Working capital is the excess of current

assets over current liabilities.

31/12/09

Current assets

Current liabilities

Working capital

$ 65,000

(42,000)

$ 23,000

14-20

Current Ratio

This ratio measures the

short-term debt-paying

ability of the company.

Current

=

Ratio

Current

=

Ratio

Current Assets

Current Liabilities

$65,000

$42,000

= 1.55 : 1

14-21

Quick Ratio

Quick

Ratio

Quick Assets

=

Current Liabilities

Quick assets are cash, marketable

securities, and receivables.

This ratio is like the current

ratio but excludes current assets

such as inventories that may be

difficult to quickly convert into cash.

14-22

Quick Ratio

Quick Assets

=

Current Liabilities

Quick

Ratio

Quick

Ratio

=

$50,000

$42,000

= 1.19 : 1

14-23

Uses and Limitations of Financial

Ratios

Uses

Limitations

Ratios help users

understand

financial relationships.

Management may enter

into transactions merely

to improve the ratios.

Ratios provide for

quick comparison

of companies.

Ratios do not help with

analysis of the company's

progress toward

nonfinancial goals.

14-24

Measures of Profitability

An income statement can be prepared in either a

multiple-step or single-step format.

The single-step format

is simpler. The multiple-step

format provides more detailed

information.

14-25

Income Statement (Multiple-Step)

Proper Heading

Gross Margin

Operating Expenses

Non-operating Items

Remember

to compute

EPS.

Babson Builders Limited

Income Statement

For the Year Ended 31/12/09

Sales

Cost of goods sold

Gross margin

Operating expenses:

Selling expenses

General & Admin.

Depreciation

Profit from Operations

Other revenues & gains:

Interest income

Gain

Other expenses:

Interest

Loss

Profit before taxes

Income taxes

Profit for the year

$

$

$

$

$

785,250

351,800

433,450

$

293,350

140,100

197,350

78,500

17,500

62,187

24,600

86,787

27,000

9,000

$

$

(36,000)

190,887

62,500

128,387

14-26

Income Statement (Single-Step)

Proper Heading

Revenues

& Gains

Expenses

& Losses

Remember

to compute

EPS.

Babson Builders Limited

Income Statement

For the Year Ended 31/12/09

Revenues and gains:

Sales

Interest income

Gain on sale of plant assets

Total revenues and gains

Expenses and losses:

Cost of goods sold

Selling Expenses

General and Admin. Exp.

Depreciation

Interest

Income taxes

Loss: sale of investment

Total expenses & losses

Operating profit

$

$

$

785,250

62,187

24,600

872,037

$

743,650

128,387

351,800

197,350

78,500

17,500

27,000

62,500

9,000

14-27

Use this information to calculate the

profitability ratios for Babson Builders

Limited

Babson Builders Limited

2009

Ending market price per share

Number of common shares

outstanding all of 2007

Profit

Total shareholders' equity

Beginning of year

End of year

Revenues

Cost of sales

Total assets

Beginning of year

End of year

$

15.25

$

27,400

53,690

180,000

234,390

494,000

140,000

300,000

346,390

14-28

Earning Per Share

Profit for the year

= EPS

Average No. of Ordinary Shares Outstanding

Look back at the information from Babson and get the

values we need to calculate earning per share.

$53,690

= $1.96

27,400

14-29

Price-Earnings Ratio

Current Market Price of one Share

Earnings Per Share

= P/E

$15.25

= 7.78

$1.96

The measure shows us the relationship between earning

of the company and the market price of its share.

14-30

Return On Investment (ROI)

This ratio is a good measure of

the efficiency of utilization of

assets by the business.

ROI

=

Annual return (profit) from and investment

Average amount invested

14-31

Return On Assets (ROA)

This ratio is generally considered

the best overall measure of a

company’s profitability.

ROA

Operating

=

÷ Average total assets

profit

Income

= $ 53,690 ÷ ($300,000 + $346,390) ÷ 2

=

16.61%

14-32

Return On Equity (ROE)

This measure indicates how well the

company employed the owners’

investments to earn income.

ROA

=

Profit

÷ Average total equity

= $ 53,690 ÷ ($180,000 + $234,390) ÷ 2

=

25.91%

14-33

Dividend Yield

Dividend

Yield Ratio

=

Dividends Per Share

Market Price Per Share

Babson Builders pays an annual dividend of

$1.50Dividend

per share. The $1.50

market price of the

=

= 9.84%

Yield Ratio

company’s

share was$15.25

$15.25 at the end of

2009.

This ratio identifies the return, in

terms of cash dividends, on the

current market price of the share.

14-34

Analysis by Long-Term Creditors

Use this information to calculate ratios to

measure the well-being of the long-term

creditors for Babson Builders.

Babson Builders Limited

2009

Earnings before interest

expense and income taxes

This is also

referred to as

net operating

profit.

Interest expense

$

84,000

7,300

Total assets

346,390

Total shareholders' equity

234,390

Total liabilities

112,000

14-35

Interest Coverage Ratio

Times

Interest

Earned

Operating Profit before Interest

and Income Taxes

Annual Interest Expense

=

Times

Interest

Earned

=

$84,000

7,300

=

11.5 times

This is the most common

measure of the ability of a firm’s

operations to provide protection

to the long-term creditor.

14-36

Debt Ratio

A measure of creditor’s long-term risk.

The smaller the percentage of assets

that are financed by debt, the smaller

the risk for creditors.

Debt

Ratio

=

Total

Liabilities

÷ Total Assets

=

$112,000 ÷

=

32.33%

$346,390

14-37

Analysis by Short-Term Creditors

Babson Builders Limited

Use this

information to

calculate ratios

to measure the

well-being of

the short-term

creditors for

Babson

Builders

Limited

2009

Cash

$

30,000

Accounts receivable, net

Beginning of year

17,000

End of year

20,000

Inventory

Beginning of year

10,000

End of year

12,000

Total current assets

65,000

Total current liabilities

42,000

Sales on account

500,000

Cost of goods sold

140,000

14-38

Accounts Receivable Turnover

Rate

Accounts

Receivable

Turnover

=

Net Sales

Average Accounts Receivable

Accounts

$500,000

= 27.03 times

Receivable =

($17,000 + $20,000) ÷ 2

Turnover

This ratio measures how many

times a company converts its

receivables into cash each year.

14-39

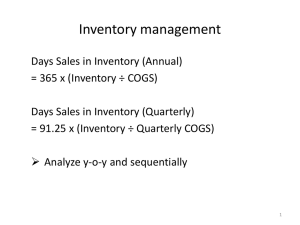

Inventory Turnover Rate

Inventory

Turnover

Inventory

Turnover

=

Cost of Goods Sold

Average Inventory

$140,000

=

= 12.73 times

($10,000 + $12,000) ÷ 2

This ratio measures the

number of times merchandise

inventory is sold and replaced

during the year.

14-40

Operating Cycle

Cash

Accounts

Receivable

Inventory

2. Sale of merchandise on account

14-41

End of Chapter 14

14-42