Jessica Phung

MSM 630-T302

Bellevue University

Baseline profits for 1986-1988

Gas Accounts in 1990

Salary Discrimination

Hedge Funds

Senior Management

Accounting Practices

Profit Structure

Lines of Communication

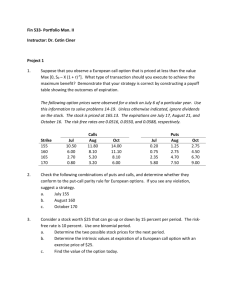

What was the corporation’s baseline profits

for 1986-1988?

400

300

Q1

Q2

200

Q3

100

Q4

0

1986

1987

Cumulative Total: $1,890 million

Mean: $236.25 million

Standard Deviation: $115.43 million

According

to Resources Unlimited,

in 1988 there were:

◦ 32 Gas Accounts

◦ 64 Oil Accounts

Internal analysis projected 86 oil

accounts for 1990

What was their number of gas

accounts in 1990?

140

120

100

Natural Gas

80

Accounts

60

Oil Accounts

40

20

0

1988

1990

Gender discrimination in Accounting dept.

Previous salaries of employees performing

the same job title:

◦ (3) males

$50,000; $55,000; $52,000

◦ (1) female

$32,000

To avoid lawsuit, the appropriate raise for the

female accountant would be $20,000.

500 gas accounts to sustain for 30-days

CEO transfers gas accounts to a dummy-fund

to lessen cash demands

16.6 percent or 100 gas accounts were

transferred to the Hedge Fund

New CEO’s vision to take advantage of daily

changes in supply/demand was too risky.

No technically trained personnel to monitor

hedge funds.

Accounts sent a memo, no action was taken.

CEO transfers funds in an attempt to avoid

bankruptcy, insufficient planning.

CEO’s decision to use complex financial

instruments without technical advisors.

Accountants suspected skewed data.

Incomplete data sent to New York analysts.

Inability to provide accurate data on gas

accounts when requested.

Utilized derivatives and hedge funds,

complex financial instruments without

technical personnel.

Inaccurate forecasting, IE. 500 accounts to

sustain a company workflow for 30-days

Current structure produced insufficient data

and flawed reports

CEO ignored memo from accountants.

Incomplete data sent to Wall Street analysts

CEO transfers a number of gas accounts to a

dummy hedge fund but did not communicate

with accountants or strategic planning

division

Average baseline profits for 1986-1988 was

$236 million

Gas Accounts in 1990 was 43.

To settle the salary discrimination, a raise of

$20,000.

100 gas accounts moved to Hedge Fund.

CEO did not use technical advisors for derivatives

and hedge funds

Accounting wary of skewed data given to analysts

Profit structure produced incorrect forecasts.

Lack of communication in the organization, CEOs

to the bottom-line.