303t2s97

advertisement

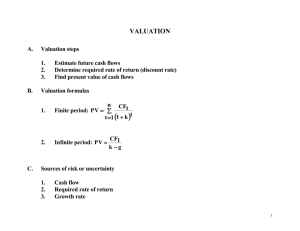

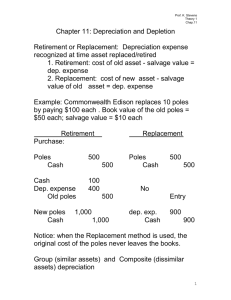

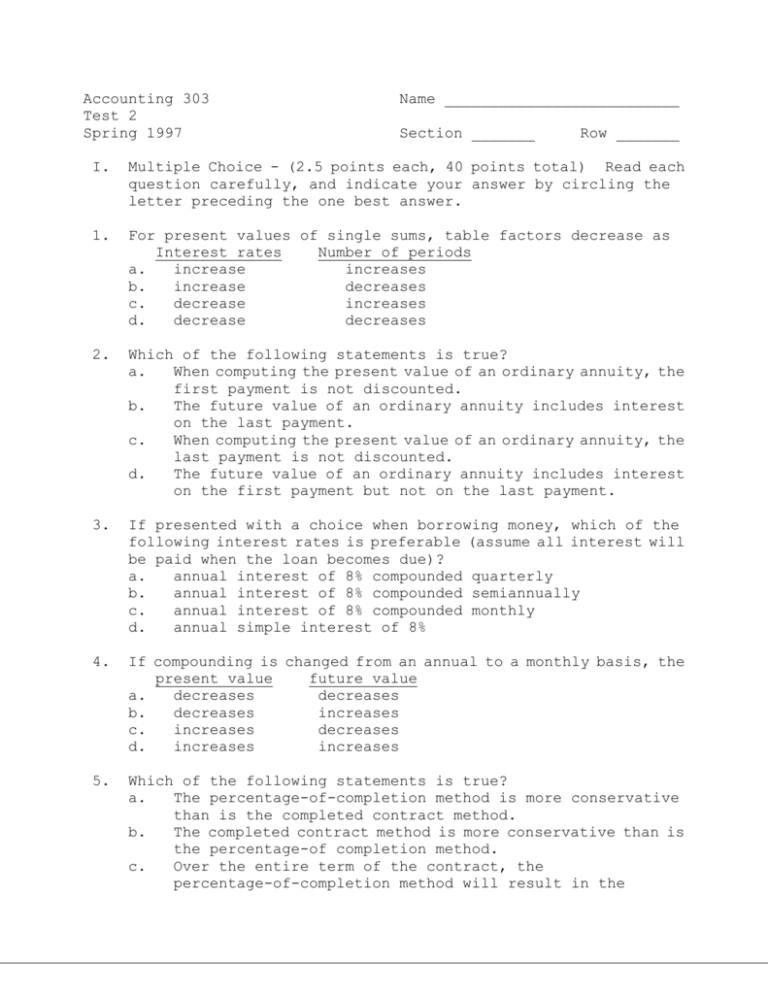

Accounting 303 Test 2 Spring 1997 Name __________________________ Section _______ Row _______ I. Multiple Choice - (2.5 points each, 40 points total) Read each question carefully, and indicate your answer by circling the letter preceding the one best answer. 1. For present values of single sums, table factors decrease as Interest rates Number of periods a. increase increases b. increase decreases c. decrease increases d. decrease decreases 2. Which of the following statements is true? a. When computing the present value of an ordinary annuity, the first payment is not discounted. b. The future value of an ordinary annuity includes interest on the last payment. c. When computing the present value of an ordinary annuity, the last payment is not discounted. d. The future value of an ordinary annuity includes interest on the first payment but not on the last payment. 3. If presented with a choice when borrowing money, which of the following interest rates is preferable (assume all interest will be paid when the loan becomes due)? a. annual interest of 8% compounded quarterly b. annual interest of 8% compounded semiannually c. annual interest of 8% compounded monthly d. annual simple interest of 8% 4. If compounding is changed from an annual to a monthly basis, the present value future value a. decreases decreases b. decreases increases c. increases decreases d. increases increases 5. Which of the following statements is true? a. The percentage-of-completion method is more conservative than is the completed contract method. b. The completed contract method is more conservative than is the percentage-of completion method. c. Over the entire term of the contract, the percentage-of-completion method will result in the d. recognition of more revenue than will the completed contract method. Over the entire term of the contract, the completed contract method will result in the recognition of more revenue than will the percentage-of-completion method. 6. Alexander Corporation is building a 100-mile highway. The project will take four years to complete. Alexander can make reasonable estimates of future costs to be incurred. When should they recognize revenue? a. During production. b. At completion of production. c. At the point of sale. d. When cash is collected. e. Over the passage of time. 7. Ball Mining Company extracts precious minerals from its mines. The minerals are sold at the current market price which fluctuates every day. When should they recognize revenue? a. During production. b. At completion of production. c. At the point of sale. d. When cash is collected. e. Over the passage of time. 8. Delta Copiers, Inc. rents copying machines on multi-year leases. Delta requires its customers to pay for a year in advance each year. When should they recognize revenue? a. During production. b. At completion of production. c. At the point of sale. d. When cash is collected. e. Over the passage of time. 9. The predominant method of depreciation in use in the U.S. today is a. accelerated. b. decelerated. c. straight-line. d. units-of-production. 10. Which costs become part of inventory costs? a. period b. product c. neither period nor product d. both period and product 11. Costs of internally developed intangibles a. b. c. d. are are are are 12. What a. b. c. d. is the maximum amortization period for capitalized goodwill? its economic life 40 years the shorter of its economic life or 40 years the longer of its economic life or 40 years 13. Depreciation of a plant asset is the process of a. asset valuation for balance sheet purposes. b. allocating the cost of the asset to the periods of use. c. accumulating a fund for the replacement of the asset. d. asset valuation based on current replacement cost data. 14. If the sum-of-the-years'-digits method of depreciation is being used for a machine with a 12-year life, what would be the fraction applied to the cost to be depreciated in the second year? a. 11/12 b. 11/66 c. 11/72 d. 11/78 e. Some other fraction. 15. Nella Corporation computes depreciation to the nearest whole month. A new piece of equipment was purchased and placed in operation on September 1, 1997, and it was expected to produce 400,000 units of product in its estimated useful life of 8 years. Total purchase cost was $300,000, and salvage value was estimated to be $30,000. Nella employs a calendar year for financial reporting purposes. If Nella uses the 200% declining-balance method of depreciation, the amount of depreciation computed for this equipment for book purposes in the year 1999 would be a. $37,134. b. $38,672. c. $42,188. d. $51,563. e. Some other amount. 16. When a fixed plant asset with a 5-year estimated useful life is sold during the second year, how would the use of a decreasing charge method of depreciation instead of the straight-line method affect the gain or loss on the sale of the fixed asset? a. expensed as incurred. amortized over the legal life of the asset. amortized over the useful life of the asset. amortized over 40 years. Gain Increase Loss Increase b. c. d. Increase Decrease Decrease Decrease Increase Decrease II. Problems - Show your work as appropriate. 1. (14 points) This problem consists of three unrelated parts. a. Assume you take out a three-year loan in the amount of $3,000 and it has a 12% interest rate compounded quarterly. The total amount of principal and interest is to be repaid in one lump sum at the end of three years. How much interest will be paid on this loan? b. Assume that you have just won the $10,000,000 grand prize in the Printer's Sweepstakes. Your earnings will be paid as $500,000 per year for the next 20 years, with the first payment made today. Assuming an 8% interest rate compounded annually, what is the present value of your winnings? c. Sean's grandparents want to help him pay for his college education. Therefore, they deposited $10,000 on September 1, 1997, in a savings account that pays 6% interest compounded annually. Sean plans to start college on September 1, 1998, and to withdraw four equal amounts at one-year intervals with the first withdrawal on September 1, 1998. How much can Sean withdraw each time? 2. (20 points) On June 1, 1997, TuffCo, Inc. began constructing a new outdoor track and field stadium for the University of Nebraska. The total contract price was $7,000,000 and completion was expected by March 15, 1999. Information for 1997 was as follows: Material $ 1,100,000 Labor 950,000 Overhead 350,000 Total Costs $ 2,400,000 Estimated Remaining Costs (as of 12-31-97) Amounts Billed by TuffCo Cash Received by TuffCo $ 3,550,000 1,000,000 850,000 a. Assuming that TuffCo used the percentage-of-completion method to account for this contract, give the four entries made in 1997. b. What amount of revenue was recognized in 1997 under the percentage-of-completion method? c. What amount of revenue would have been recognized if the completed-contract method had been used? 3. (15 points) On January 1, 1997, MCD Farms, Inc. sold 1,000 acres of prime farm land to Brad Snyder. Snyder paid for the land by issuing a $900,000, 10-year, 6% interest-bearing note. The note calls for interest in the amount of $54,000 to be paid each December 31, and the principal to be paid at maturity. MCD Farms is unable to determine the fair market value of the land, and decides to value this transaction at the present value of the note, discounted at 10%, which is the current market interest rate for this type of loan. The land cost MCD Farms $375,000 when they acquired it. a. Make the entries for MCD Farms required by this transaction on January 1, 1997, and December 31, 1997. b. How much interest revenue will MCD Farms recognize in 1998? 4. (11 points) Sparks County Rural Electric Company (SCREC) replaces approximately 5% of its utility poles each year. During 1996, SCREC replaced 525 utility poles. The replacement poles had a total cost of $51,000, and the old poles being replaced had originally cost $42,000. a. Give the journal entry to record depreciation expense if SCREC uses the retirement (like FIFO) depreciation method. b. Give the journal entry to record depreciation expense if SCREC uses the replacement (like LIFO) depreciation method. Answers Multiple Choice 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. a d d b b a c e c b a c b d d b Problems 1. a. FV = 3,000 x 1.4258 = 4277 b. PV(a-due) = 500,000 x 10.6036 = 5,301,800 c. PV(a-ord) = Pmt x PVIF(6%, 4) 10,000 = Pmt x 3.4651 Pmt = 2,886 2. a. Percentage of Completion: Revenue Recognized: Interest = 1,277 2,400,000/5,950,000 = 40.3% 7,000,000 x .403 = 2,821,000 Construction in Progress Cash 2,400,000 Accounts Receivable Progress Billings 1,000,000 Cash 2,400,000 1,000,000 850,000 Accounts Receivable Construction Expense 850,000 2,400,000 Construction in Progress Construction Revenue b. c. 3. a. $0 PV: 12-31-97 4. a. b. 2,821,000 $2,821,000 1-1-97 b. 421,000 900,000 54,000 x x .3855 6.1446 = = Notes Receivable Gain on Sale Land Cash Notes Receivable Interest Revenue (678,758 x .10 = 67,876) 678,758 + 13,876 = 692,634; 346,950 331,808 678,758 678,758 303,758 375,000 54,000 13,876 67,876 692,634 x .10 = $69,263 Depreciation Expense Equipment 42,000 Depreciation Expense Cash 51,000 42,000 51,000