c81e7-PRESENTATION ON DEPRECIATION ACCOUNTING

advertisement

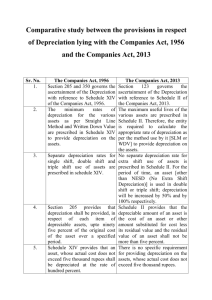

AS – 6 DEPRECIATION ACCOUNTING Depreciation is loss of value of an asset It is a measure of wearing out, consumption or other loss of value of depreciable asset arising from use and passes of time Depreciable Assets • Are expected to be used for more than one accounting period • Have a limited useful life • Are held for use in production of goods & services Applicability of AS-6 Except the followings: • Forests, Plantations • Wasting assets, Minerals & Natural Gas • Expenditure on research & development • Goodwill • Live Stock – Cattle, Animal husbandry Calculation of Depreciation • Historical cost or other amount in place of historical cost • Estimate useful life of depreciable assets • Estimated residual/scrap value Cost of Depreciable Asset • Increase/decrease in long-term liability • Price adjustments • Changes in duties • Revaluation of depreciable assets • Other similar reasons Estimated useful life of Depreciable Asset • Pre-determined by legal or contractual limits • Depends upon the number of shifts for which the asset is to be used • Repair & maintenance policy • Other similar reasons Estimated useful life of Depreciable Asset • Technological obsolescence • Innovation/improvements • Legal or other restrictions Estimated residual /scrap value of depreciable asset It is estimated value of depreciable assets at the end of its useful life Depreciable amount Historical Cost Less Residual Value Method of Depreciation • Straight Line Method (SLM) • Written Down (WDVM) Value Method Selection of appropriate method • Type of assets • Nature of the use of such asset • Circumstances prevailing in the business • A combination of more than one method may be used Change in depreciation method • For compliance of statute • For compliance standards of accounting • For more appropriate presentation of the financial statement Procedure to be followed in case of change in depreciation method Change of depreciation method should be treated as change in accounting policy and its effect should be quantified and disclosed Change in estimated useful life Should be allocated over the revised remaining useful life of assets Change in historical cost Provided prospectively over remaining useful life of the assets the Change in historical cost due to revaluation Estimate of the remaining useful lives of the such assets Depreciation charge on addition/extension to an existing asset • Addition/extension is an integral part of existing asset Remaining useful life of the asset Depreciation charge on addition/extension to an existing asset • Addition/extension is not an integral part of existing assets Estimated useful life of additional assets Depreciable asset is disposed of, discarded, demolished or destroyed Disclosure • Total cost of each class of assets • Total depreciation • Accumulated depreciation • Depreciation method Disclosure • Depreciation rate, useful life of assets, if they are different than the rate specified in governing statute • A change in method of depreciation • Effect of the revaluation Significant differences with IAS/IFRS & US GAAP • AS-6 allows the depreciation on revalued value however, US GAAP prohibits revaluation. IAS-16 allows fair value accounting. Significant differences with IAS/IFRS & US GAAP • Change in depreciation method under AS-6 is treated as a change in accounting policy; whereas IAS-16 and US GAAP it is change in estimate. Issues • Depreciation on fixed assets where title not clear • Depreciation on the assets not own by the company • Depreciation on live stock held as fixed assets Issues • Income-tax rate Vs. Companies Act Vs. AS-6 • Depreciation on Addition to Building with Nil WDV • Continuous Vs. Non-continuous process plant • Depreciation in case of electricity company Issues • Depreciation on investment property • Useful life of asset acquired under amalgamation THANK YOU D.S. Rawat, FCA Partner, Basal & Co.