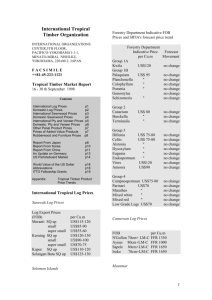

BSF, ¾-Inch - anafata mexico

advertisement

North American Panel Markets: The Pain Continues Presentation Outline • US Woodbased Panel Markets – US Economic and Housing Outlook – Structural Panels (Softwood Plywood and OSB) – Nonstructural Panels (Particleboard and MDF) • Mexico Panel Market Outlook • Brief Comments on South American Markets 2 Sub-Par Recovery in US GDP: Housing A Brake Not a Booster Rocket! Sources: BEA & CFPA 3 US Housing Markets • Demographic Fundamentals Are Solid – Pent-up demand will be a factor … before the decade is over! • But Economic Fundamentals Are Weak – Household formations are being delayed by high unemployment, slow income growth and consumer uncertainty • Elements in Place for Recovery – Sales, production and prices appear to have hit bottom; inventories of unsold homes are in decline – Affordability is great … if you qualify for a mortgage! – Rental demand is strengthening; boost for multifamily construction 4 Post-1990 Surge in Home Ownership is Being Reversed: What is “normal”? 5 New and Existing Home Sales: Have They Bottomed? Thousands, SAAR 8000 1600 7500 Existing 1400 New (Right) 7000 1200 6500 1000 6000 800 5500 600 5000 4500 400 4000 200 3500 0 00 01 02 03 04 05 06 07 08 09 10 6 Unsold Inventory of New Single-Family Homes and Months Supply: Historic Lows 7 Affordability at Very Attractive Levels Mortgage Payment as a % of Average Household Disposable Income 15% 8.5% 13% 7.5% 11% 6.5% 9% Affordability Mortgage Rate (R) Q1 Q2 Q3 7% 5.5% 4.5% 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 10 10 8 US Housing Production: RISI Base Case Outlook Through 2025 2.5 Million Units Mobile Multi Singles 2.0 1.5 1.0 0.5 0.0 95 97 99 01 03 05 07 09 11 13 15 17 19 21 23 25 9 Home Size and Mix Matter!! SINGLE-FAMILY HOMES ARE A LOT LARGER THAN OTHER TYPES OF HOME CONSTRUCTION • Average 2009 US Home Sizes (Square Feet): » SINGLES 2,382 » MULTIS 1,171 » MOBILES 1,594 10 Average Single-Family Home Sizes Thousand SF 11 Single-Family Home Share of Total Conventional Starts Share (%) 12 US Furniture Production Bottomed in 2009/2010: Will It Start to Recover in 2011? US Furniture and Related Production, 2002=1.00 13 What Will Happen to US Furniture Imports as Domestic Markets Recover? Billion, $2009 14 Slow Recovery in Housing Will Be Reflected in North American Structural Panel Demand BSF, 3/8-Inch Basis 15 Higher US OSB Consumption Needs Strong Single-Family Housing Starts BSF, 3/8-Inch 16 How Large is North American OSB Capacity? BSF, 3/8-Inch 17 Will Total NA Structural Panel Capacity Slip Further Before Climbing as Demand Recovers? BSF, 3/8-Inch Basis 18 Recovery in NA D/C Ratios a Matter of Timing of Demand Growth and Capacity Rebound 19 OSB Prices Climbed Above Cost After Mid-2009; Back to Cost Floors by Sep. 2010! $/MSF 20 Plywood More Profitable Than OSB: But Prices Have Recently Collapsed $/MSF 21 OSB Prices: Dependent on Recovery in Housing Demand and Pace/Timing of Capacity Restarts 7/16-Inch OSB in the South (West) $/MSF 22 OSB Will Struggle to Stay Profitable in 2011 Average Mill Realization/Average Total Cost 23 Forecast for SYP Plywood Prices 1/2-Inch, 3-ply CDX (Westside) $/MSF 24 Plywood Profitability Rebounded in 2010, But Levels Will Not Be Sustained in 2011 Average Mill Realization/Average Total Cost 25 Conclusions: Structural Panels • The strength and timing of housing’s recovery will largely determine the forecast outcome for wood products markets. • • • • • • Remainder of 2010 and first half of 2011 will be very difficult for producers as demand generally lags behind year-ago levels. No new total consumption records expected before late in the decade, although OSB should set new records around mid-decade. Effective operating capacity is substantially lower than name-plate. As demand recovers, capacity will come back on-stream in lagged response. Current market conditions will postpone the re-start of capacity. Ramp-up of currently operating mills to full capacity will largely meet the rebound in demand through 2012; mothballed capacity unlikely to be reopened before 2013 at the earliest. Average demand/capacity ratios rebounded in 2010, but are likely to move sideways to lower through much of 2011 before again climbing in 2012. Prices and profitability will be under downward pressure in the first half of 2011 unless production runs consistently below year-ago levels. 26 Structural and Cyclical Pressures Persist in North American PB & MDF Panel Markets BSF, ¾-Inch 27 Furniture and Residential Construction Dominate North American Particleboard Consumption BSF, ¾-Inch 28 Furniture and Residential Construction Also Key to N. American MDF/HDF Consumption (94%-95% of Total Domestic Consumption) BSF, ¾-Inch 29 Will MDF/HDF Consumption Overtake PB? Largely Depends on Furniture … BSF, ¾-Inch Basis 30 How Should We Measure North American Particleboard Capacity? BSF, 3/4-Inch 31 Forecast for PB Effective Operating Capacity NA Particleboard Capacity Still Too High Even With These Lower Estimates? BSF, ¾-Inch 32 PB Demand/Capacity Ratios Will Remain Very Low; MDF/HDF Ratios Average Higher (Depends on Import Levels) 33 Weak Dollar and Increased North American HDF Capacity Have Reduced MDF/HDF Imports: How Far Will They Rebound? BSF, ¾-Inch – Offshore Imports 34 N. American Particleboard Inflation-Adjusted Prices: The 1990s Were the Golden Years! $2009/MSF, ¾-Inch Industrial Prices 35 Particleboard Profitability Will Be Hard to Detect Over the Next Few Years Mill Realization/Avg. Total Cost 36 North American MDF Inflation-Adjusted Prices: Nothing Like the Early to Mid-1990s Again! $2009/MSF, ¾-Inch Prices 37 MDF Profitability Recovered in 2010, But Uncertainty Surrounds 2011 Mill Realization/Avg. Total Cost 38 Conclusions: Nonstructural Panel Markets March to Different Drummers • Particleboard’s outlook is a lot less positive than that for MDF/HDF – Even with an optimistic forecast for North American furniture production, in-place particleboard capacity is excessive – Without aggressive capacity closures, it will be difficult for particleboard producers to gain pricing power over the next few years – Production costs are worrisomely high relative to history, especially outside the South; this could threaten industry’s competitive position • MDF/HDF seem better positioned than particleboard but with 30%+ of that market served by off-shore imports, North American producers are vulnerable to added off-shore competition particularly if North American pricing proves attractive enough to offset a weak US dollar. 39 Mexico’s Wood Panel Markets 40 Mexico’s Panel Markets Tumbled in 2009, But Rebounded in 2010 • Strong growth in fiberboard consumption has offset weakness in particleboard • 2011 – Prognosis is positive providing Mexico’s domestic economic growth remains healthy – Export opportunities will be limited by slow US recovery and weakening US dollar – Mexico’s plywood and particleboard producers most at risk; growing import threats and loss of market share (also to other types of panels)? – Fiberboard and OSB imports represent major growth opportunities – Will Mexican particleboard production recover to match past peaks? 41 Mexico and ABC Countries: A Generally Short and Shallow Recession … Except for Mexico Sources: IMF & CFPA 42 Mexico: Recovery in 2010 Supported By Healthy Domestic Markets Even as US Languishes 2006 2007 2008 2009 2010 2011 2012 GDP 4.9 3.3 1.5 -6.5 4.8 3.8 4.2 Industrial Production 5.9 1.7 -0.6 -10.2 8.3 4.8 5.0 Consumer Prices 4.1 3.8 6.5 3.6 4.4 3.8 3.7 % Change 43 Mexican Panel Consumption Rebounded in 2010: New Records in 2011-2012? Thousand M3 44 Mexico’s Plywood Market Remains an Import Story Thousand M3 45 Mexico’s Fiberboard Markets Shrugged Off the Recession: Further New Records To Be Set Thousand M3 46 Mexico’s Particleboard Producers Struggle to Recover As Market Share is Lost to MDF Thousand M3 47 Panel Consumption in Mexico Thousand M3 2006 2007 2008 2009 2010 2011 2012 660 668 713 578 653 689 711 Particleboard 641 691 523 386 489 566 619 Fiberboard 347 351 331 312 373 412 450 67 35 85 74 86 94 101 Plywood OSB TOTAL 1,715 1,745 1,652 1,350 1,601 1,761 1,881 48 Miscellaneous Considerations: Brazil and Chile 49 Brazil and Chile Have Enjoyed Healthy Growth Despite Recession and Earthquakes … • Fiscal stimulus and the run-up to an election boosted Brazil’s economy strongly, especially in the first half of 2010 • Chile has been quick to recover from the February earthquake; growth in 2011 will outpace 2010 as rebuilding provides significant economic stimulus to the whole economy • Ramp-up of new MDP and MDF capacity in Brazil has been controlled; consequently pricing held up well, at least through mid-year – Further industry shakeout and consolidation? Slower economic growth in 2011 could result in another wave of M&A 50 Brazil’s Panel Production Recovered in 2010 Million M3 Total = 7.55 51 Chile’s Rebound Initially Held Back by February Earthquake Million M3 Total = 2.04 52 Climbing Out of the Chasm: Global Lumber Markets Still Need North America and Europe … Million M3 53 … But Global Panel Markets Will Recover Sooner and Faster Because of China’s Strength Million M3 54 Conclusions: Latin America • The Great Recession so far has done surprisingly minimal damage to Latin America’s wood panel markets • MEXICO’s panel markets have been hurt more than most but are in a healthy recovery which should persist at least through 2011 • Domestic market growth will be key to sustained increases in panel consumption in Mexico, Brazil and elsewhere in Latin America • Fastest growth in panel markets will be in MDF/HDF and OSB • Chilean producers will buck the weak overall trend in plywood output as capacity expands further 55