Compound Interest Presentation w

advertisement

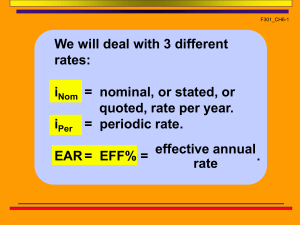

3/9/12 Section 3.6/3.2 Obj: SWBAT solve real world applications using exponential growth and decay functions. Bell Ringer: Get Compound Interest Packet Part 2 HW Requests: pg 296 # 1-16 (3’s) 15, 32, 33 pg 342 #1-9 odds Homework: pg 342 11-26 (3’s), 47, 50, 53, 55 Announcements: Tuesday -Quiz Log and Exponential Equations, Exponential Growth and Decay Function for compound interest, compounding continuously: A(t) = Pert P = the principal amount r = the interest rate t = the number of years Problem One thousand dollars is invested at 5% interest compounded continuously. a. Give the formula for A(t), the compounded amount after t years. b. How much will be in the account after 6 years? c. How long is required to double the initial investment? Problem One thousand dollars is invested at 5% interest compounded continuously. a. Give the formula for A(t), the compounded amount after t years. A(t) = P𝑒 0.05𝑡 b. How much will be in the account after 6 years? c. How long is required to double the initial investment? Problem One thousand dollars is invested at 5% interest compounded continuously. a. Give the formula for A(t), the compounded amount after t years. A(t) = P𝑒 0.05𝑡 b. How much will be in the account after 6 years? A(t) = 1000𝑒 0.05 (6) = $1349.86 a. How long is required to double the initial investment? Problem One thousand dollars is invested at 5% interest compounded continuously. a. Give the formula for A(t), the compounded amount after t years. A(t) = P𝑒 0.05𝑡 b. How much will be in the account after 6 years? A(t) = 1000𝑒 0.05 (6) = $1349.86 a. How long is required to double the initial investment? 2000 = 1000 𝑒 0.05 (𝑡) 2 = 𝑒 0.05 (𝑡) ln(2) = ln(𝑒 0.05 (𝑡) ) ln(2) = 0.05t ln(e) ln(2) = 0.05t ln(2) = t .05 t = 13.86 years (0.5)(12) (0.5)(12) (0.5)(12) An annuity is a sequence of equal periodic payments. We will be working with ordinary annuities. The deposits are made at the end of each period and at the same time the interest is posted or added to the account. Calculator http://iris.nyit.edu/appack/pdf/FINC201_4.pdf We can calculate the total of our periodic payments and the interest accrued. This value is called the Future Value of the annuity. The net amount of money returned from the annuity is its future value. We make payments today and get the money some time in the future. (IRA’s, 401 k, mutual funds) Future Value Equation: (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding period) R = payment amount 𝑟 i = interest rate ( ) 𝑘 I C/Y P/Y PMT Future Value Equation: (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Geno contributes $50 per month into Morgan Park Mutual Fund that earns 7.26 APR. What is the value of Geno’s investment after he retires in 25 years? R = $50, k = 12, r = 0.0726, n = 25*12, i = 0.0726/12 (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 Geno contributes $50 per month into Morgan Park Mutual Fund that earns 7.26 annual interest rate. What is the value of Geno’s investment after he retires in 25 years? R = $50, k = 12, r = 0.0726, n = 25*12, I = 0.0726/12 𝐹𝑉 = (1+.00605)300 −1 50 0.00605 FV= $42211.46 How much money will he need to invest to make .5 million dollars? FV = .5 million, R = ? (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 Geno contributes $50 per month into Morgan Park Mutual Fund that earns 7.26 annual interest rate. What is the value of Geno’s investment after he retires in 25 years? R = $50, k = 12, r = 0.0726, n = 25*12, I = 0.0726/12 𝐹𝑉 = (1+.00605)300 −1 50 0.00605 FV= $42211.46 Geno will have $42, 211,46 for his retirement. How much money will he need to invest to make .5 million dollars? FV = .5 million, R = ? (1+.00605)300 −1 𝑅 0.00605 500,000 = R = $592.26 Geno needs to pay $592.26 monthly to have .5 million dollars for retirement. Loans and Mortgages We want to get a loan or mortgage. We want to get the money today (present) and pay it back over time. The net amount of money put into an annuity is its present value. This value is called the Present Value of the Annuity. (Annual Percentage Rate – APR- the annual interest Rate charged on consumer loans.) We can calculate our monthly payments needed to pay back the loan using the Present Value Equation: P𝑉 = where 1−(1+𝑖)−𝑛 𝑅 𝑖 r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding period) R = payment amount 𝑟 i = interest rate ( ) 𝑘 Future Value Equation: 1− 1+𝑖 𝑃𝑉 = 𝑅 𝑖 −𝑛 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Genae buys a black C Class Mercedes Benz Coupe for $40,000. She gets financing and puts $5000 down for the car. The APR is 6%. What will be her monthly payments if she finances the car for 60 months? Future Value Equation: 1− 1+𝑖 𝑃𝑉 = 𝑅 𝑖 −𝑛 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Genae buys a C Class Mercedes Benz for $40,000. She gets financing. and puts $5000 down for the car. The APR is 6%. What will be her monthly payments if she finances the car for 60 months? PV = 35000, k = 12, r = 0.06, n =5*12 =60, i = 0.06/12 P𝑉 = 1−(1+𝑖)−𝑛 𝑅 𝑖 Genae buys a C Class Mercedes Benz for $40,000. She gets financing and puts $5000 down for the car. The APR is 6%. What will be her monthly payments if she finances the car for 60 months? PV = 35000, k = 12, r = 0.06, n =5*12 =60, i = 0.06/12 35000= 1−(1+.005)−60 𝑅 0.005 R= $676.65 Genae’s monthly bill will be $676.65 for 5 years to pay for her car. How much interest will Genae pay in total? How much interest will Genae pay? First how much is she paying total? $676.65 * 60 = $40,598.88 Interest Paid: $40,598.88- $35000 = $5598.88 Simple Interest Simple interest is calculated on the original principal only. Accumulated interest from prior periods is not used in calculations for the following periods. Simple interest is normally used for a single period of less than a year, such as 30 or 60 days. where: Simple Interest I = P*r*n p = principal (original amount borrowed or loaned) i = interest rate for one period n = number of periods Compound Interest Compound interest is calculated each period on the original principal and all interest accumulated during past periods. Although the interest may be stated as a yearly rate, the compounding periods can be yearly, semiannually, quarterly, or even continuously. Compound Interest Compound interest is calculated each period on the original principal and all interest accumulated during past periods. Although the interest may be stated as a yearly rate, the compounding periods can be yearly, semiannually, quarterly, or even continuously. The power of compounding can have an astonishing effect on the accumulation of wealth. This table shows the results of making a one-time investment of $10,000 for 30 years using 12% simple interest, and 12% interest compounded yearly and quarterly. Type of Interest Simple Principal Plus Interest Earned 46,000.00 Compounded Yearly 299,599.22 Compounded Quarterly 347,109.87 10) The Fresh and Green Company has a savings plan for employees. If an employee makes an initial deposit of $1000, the company pays 8% interest compounded quarterly. If an employee withdraws the money after five years, how much is in the account? 11) Using the information in the question above, find the interest earned if the money is withdrawn after 35 years. 12) Determine the amount of interest earned if $500 is invested at an interest rate of 4.25% compounded quarterly for 12 years. 10) The Fresh and Green Company has a savings plan for employees. If an employee makes an initial deposit of $1000, the company pays 8% interest compounded quarterly. If an employee withdraws the money after five years, how much is in the account? A = $1485.95 11) Using the information in the question above, find the interest earned. Simple Interest Compound Interest 12) Determine the amount of interest earned if $500 is invested at an interest rate of 4.25% compounded quarterly for 12 years. 10) The Fresh and Green Company has a savings plan for employees. If an employee makes an initial deposit of $1000, the company pays 8% interest compounded quarterly. If an employee withdraws the money after five years, how much is in the account? A = $1485.95 11) Using the information in the question above, find the interest earned. Simple Interest I = prt I = 1000*.08* 5 = $400 Compound Interest = $1485.95 - $1000 = $485.95 12) Determine the amount of interest earned if $500 is invested at an interest rate of 4.25% compounded quarterly for 12 years. Simple Interest Compound Interest 10) The Fresh and Green Company has a savings plan for employees. If an employee makes an initial deposit of $1000, the company pays 8% interest compounded quarterly. If an employee withdraws the money after five years, how much is in the account? A = $1485.95 11) Using the information in the question above, find the interest earned. Simple Interest I = prt I = 1000*.08* 5 = $400 Compound Interest = $1485.95 - $1000 = $485.95 12) Determine the amount of interest earned if $500 is invested at an interest rate of 4.25% compounded quarterly for 12 years. Simple Interest $255 Compound Interest $830.41 Future Value Equation: http://www.bugatti.com/en/veyron-16.4.html (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Genae and Lucky want a Bugatti Veyron sports car. This car costs $1,700,000. Genae and Lucky are going to use the money Genae was paying for the Mercedes to save up for the Bugatti. This means Genae contributes $680 per month @ 7.26 interest rate into the Genae/Lucky Bugatti fund. How long before Genae and Lucky will get their car? Future Value Equation: http://www.bugatti.com/en/veyron-16.4.html (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Genae and Lucky want a Buggatti Veyron sports car. This car costs $1,700,000. Genae and Lucky are going to use the money Genae was paying for the Mercedes to save up for the Bugatti. This means Genae contributes $680 per month @ 7.26 interest rate into the Genae/Lucky Bugatti fund. How long before Genae and Lucky will get their car? R = $680, k = 12, r = 0.0726, n = ?, i = 0.0726/12 Future Value Equation: http://www.bugatti.com/en/veyron-16.4.html (1 + 𝑖)𝑛 −1 𝐹𝑉 = 𝑅 𝑖 where r = the annual interest rate k = number of times interest is compounded per year n = number of equal periodic payments (number of years * compounding periods (k)) R = payment amount 𝑟 i = interest rate (𝑘) Genae and Lucky want a Buggatti Veyron sports car. This car costs $1,700,000. Genae and Lucky are going to use the money Genae was paying for the Mercedes to save up for the Bugatti. This means Genae contributes $680 per month @ 7.26 interest rate into the Genae/Lucky Bugatti fund. How long before Genae and Lucky will get their car? R = $680, k = 12, r = 0.0726, n = ?, i = 0.0726/12