Nominal, Periodic, or Effective Annual Rate?

advertisement

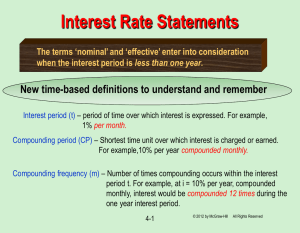

F301_CH6-1 We will deal with 3 different rates: iNom = nominal, or stated, or quoted, rate per year. iPer = periodic rate. effective annual EAR = EFF% = . rate F301_CH6-2 iNom is stated in contracts. Periods per year (m) must also be given. This is also frequently referred to as an Annual Percentage Rate (APR). Examples: 8%; Quarterly 8%, Daily interest (365 days) F301_CH6-3 Periodic rate = iPer = iNom/m, where m is number of compounding periods per year. m = 4 for quarterly, 12 for monthly, and 360 or 365 for daily compounding. Examples: 8% quarterly: iPer = 8%/4 = 2%. 8% daily (365): iPer = 8%/365 = 0.021918%. F301_CH6-4 Effective Annual Rate (EAR = EFF%): Our bank offers a Certificate of Deposit (CD) with a 10% nominal rate, compounded semiannually. What is the true rate of interest that they pay annually (the effective annual rate)? 0 6mo 5% $1 12mo 5% F301_CH6-5 How do we find EFF% for a nominal rate of 10%, compounded semiannually? iNom EFF% = 1 + m m ( ) -1 = (1 + 0.10) - 1.0 2 2 = (1.05)2 - 1.0 = 0.1025 = 10.25%. Any PV would grow to the same FV at 10.25% annually or 10% semiannually. In both instances, our money earns 10.25 percent each year. F301_CH6-6 For a given rate, more frequent compounding increases returns 12 percent compounded annually EARA = 12%. 12 percent compounded semi-annually EARs = (1 + 0.12/2)2 - 1 = 12.36%. 12 percent compounded monthly EARM = (1 + 0.12/12)12 - 1 = 12.68%. 12 percent compounded daily EARD(365) = (1 + 0.12/365)365 - 1 = 12.75%. F301_CH6-7 What is the FV of $100, if you earn 10 percent compounded semi-annually? When using semi-annual periods we use the periodic rate: INPUTS 6 N 5 I/YR 100 PV 0 PMT FV OUTPUT Cpt = 134.01 When using annual periods we use the EAR: 10.25 100 0 3 INPUTS N OUTPUT I/YR PV PMT FV Cpt = 134.01 The nominal rate is never used in calculations! F301_CH6-8 Can the effective rate ever be equal to the nominal rate? Yes, but only if annual compounding is used, i.e., if m = 1. If m > 1, EFF% will always be greater than the nominal rate. F301_CH6-9 When is each rate used? The use of the periodic rate and the effective annual rate is determined by the choice of N. If N is the number of years, the EAR is used. If N is the number of periods (shorter than 1 year), the periodic rate is used. The nominal rate is not used in calculations. As shown later, the choice of N will be determined by the number of payments (PMT). iNom: Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines. F301_CH6-10 Nominal, Periodic, or Effective Annual Rate? We never use the nominal rate calculating future or present values. We always use either the effective annual rate or the periodic rate of return. If PMT is 0, either the periodic rate or the effective rate may be used. Ex: Find the present value of $100 to be received in 5 years. The nominal rate is 6 percent, compounded monthly. 6/12 compute PV= $74.14 Periodic: FV = 100, N = 5*12, I = _______; 6.1678 E.A.R.: FV = 100, N = 5, I = __________; compute PV= $74.14 F301_CH6-11 If PMT has a value, N must equal the number of payments. Since N is determined by the number of payments, we must make I (the interest rate) consistent with how we defined N. Ex: Find the present value of $100 per year for 5 years. The nominal rate is 6 percent, compounded monthly. 6.1678 compute PV = $419.32 PMT = 100, N = 5, I = _________; Ex: Find the present value of $100 per month for 5 years. The nominal rate is 6 percent, compounded monthly. 6/12 PMT = 100, N = 5*12, I = ________; compute PV = $5,172.56 F301_CH6-12 A few other points to note. If the rate is 12% compounded monthly, your EAR is 12.6825%, this is used if the N is in number of years. If the rate is quoted at 12% compounded monthly, the periodic rate would be 1% (12%/12). The 1% is used if the N is in number of months. If the rate is 12% compounded monthly, you cannot divide the 12% by anything besides its number of compounding periods (in this case 12 monthly periods), or you change the interest rate. Example F301_CH6-13 What is the future value of 4 quarterly payments of $100 each, given a nominal rate of 12 percent, compounded monthly. Note that the quarterly payments and monthly compounding are different, so we have to transform the monthly compounded rate to a quarterly compounded rate. This takes some work. First, find the EAR of the monthly rate: EARM = (1 + 0.12/12)12 - 1 = 12.68%. Second, find the nominal rate with quarterly compounding that has an effective annual rate of 12.68% (1 + Inom/4)4 - 1 = 12.68%. Inom = 12.12% Third, compute the future value of the payments N = 4, I = 12.12/4, PV = 0, PMT = 100, cpt FV = $418.55 See the next slide for the Excel Example Excel Calculation Example F301_CH6-14 Input area: Quarterly Payments Nominal Rate # of times compounded Quarter Compounding Periods $100 12.00% 12 4 Output area: Effective Annual Rate 12.68% =+EFFECT(C5,C6) Nominal Rate with 4 periods 12.12% =NOMINAL(C13,C7) Future Value of Quarterly PMTS $418.55 =FV(C15/C7,C7,-C4,0)