Engineering Economy Module 2

advertisement

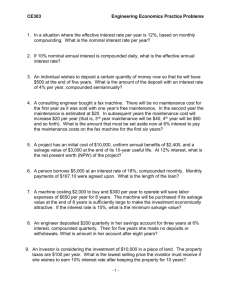

Module 2 INTEREST & MONEY – TIME RELATIONSHIPS Engr. Gerard Ang School of EECE Simple Interest Interest – is the return on capital or cost of using capital. It is the amount of money paid for the use of borrowed capital or the income produced by money, which has been loaned. Simple Interest – is calculated using the principal only, ignoring any interest that had been accrued in preceding period. 𝐈 = 𝐏𝐢𝐧 𝐅=𝐏+𝐈 𝐅 = 𝐏(𝟏 + 𝐢𝐧) Where: I = interest i = rate of interest n = number of interest period P = principal or present worth F = accumulated amount or future worth Types of Simple Interest 1. Ordinary Simple Interest – simple interest in which it is assumed that each month contains 30 days and consequently each year has 360 days. 1 month = 30 days 1 year = 360 days (banker’s year) 2. Exact Simple Interest – simple interest in which the exact number of days per month is used. 1 ordinary year = 365 days 1 leap year = 366 days Sample Problems on Simple Interest 1. 2. 3. 4. 5. A loan of Php50,000 is made for a period of 13 months, from April 1 to April 30 of the following year, at a simple interest rate of 20%. What future amount is due at the end of the loan period? What is the principal amount if the amount of interest at the end of 2 ½ years is Php450 for a simple interest rate of 6% per annum? Determine the exact simple interest of Php25,000 for the period of December 27, 2002 to March 23, 2003, if the rate of interest is 10%. What is the interest due on a Php1,500 loan for 4 years and three months if it bears 12% ordinary simple interest? Determine the exact simple interest of Php4,000 for the period of Feb. 14, 1984 to November 30, 1984, if the rate of interest is 18%. Compound Interest Compound Interest – the interest for an interest period is calculate on the principal plus total amount of interest accumulated in the previous period. Compound interest means “the interest on top of interest.” 𝐅 = 𝐏(𝟏 + 𝐢)𝐧 𝐏 = 𝐅(𝟏 + 𝐢)−𝐧 𝐫 𝐢= 𝐦 𝐧=𝐦×𝐭 Where: I = interest i = rate of interest n = number of interest periods m = number of compounding periods t = time P = present worth F = future worth Rates of Interest Rate of Interest – it is the cost of borrowing money. Nominal Rate of Interest – it specifies the rate of interest and a number of interest periods in one year. Where: i = interest rate per interest period r = nominal interest rate m = number of compounding periods 𝐫 𝐢= 𝐦 Effective Rate of Interest – it is the actual or exact rate of interest on the principal during one year. 𝐄𝐑 = (𝟏 + 𝐢)𝐦 −𝟏 𝐫 𝐄𝐑 = 𝟏 + 𝐦 𝐦 −𝟏 Where: ER = effective rate i = interest rate per interest period r = nominal interest rate m = number of compounding periods Values of “m” m = 1 for compounded annually (every 12 months) m = 2 for compounded semi-annually (every 6 months) m = 4 for compounded quarterly (every 3 months) m = 6 for compounded bi-monthly (every 2 months) m = 8 for compounded semi-quarterly (every 1 1/2 months) m = 12 for compounded monthly (every month) m = 24 for compounded semi-monthly (every 1/2 month) F/P and P/F Factors: Notation and Equations Find/Given Standard Notation Equation Equation with Factor Formula Excel Functions (F/P,i,n) Singlepayment compound amount F/P F = P(F/P,i,n) F = P(1 + i)n FV(i%,n,,P) (P/F,i,n) Singlepayment present worth P/F P = F(P/F,i,n) P = F(1 + i)-n PV(i%,n,,F) Factor Notation Factor Name Sample Problems on Compound Interest 1. 2. 3. 4. 5. What rate of interest compounded annually must be received if an investment of Php5,400 made now will result in a receipt of Php7,200 5 years hence? What amount will be accumulated by Php4,100 in 10 years at 6% compounded annually? What effective annual interest rate corresponds to the following situations? a.nominal interest rate of 10% compounded semi-annually b.nominal interest rate of 6% compounded monthly c.nominal interest rate of 8% compounded quarterly How much should Engr. Cruz deposit now, if after 10 years, this will amount to Php100,000. Interest rate is 12% compounded semiannually? If Php1,000 becomes Php5,734 after 15 years, when invested at an unknown rate of interest compounded semi-annually, determine the unknown nominal rate and corresponding effective rate. Cash Flow Diagram Cash Flow Diagram – depicts the timing and amount of expenses (negative, downward) and revenues (positive, upward) for engineering projects. Receipt (positive cash flow or cash inflow Disbursement (negative cash flow or cash outflow Types of Cash Flow Diagrams P-Pattern F-Pattern A-Pattern G-Pattern “present” 1 2 3 n “future” 1 2 3 n “annual” 1 2 3 n “gradient” 1 2 3 n Equation of Value An equation of value is obtained by setting the sum of the values on a certain comparison or local date (or focal date) of one set of obligations equal to the sum of the values on the same date of another set of obligations. Sample Problems on Equation of Value 1. 2. Jay wishes his son, Jason, to receive Php1,000,000 twenty years from now. What amount should he invest now, if it will earn interest of 12% compounded annually during the first five years and 10% compounded monthly for the remaining years. Find the present worth of a future payment of Php300,000 to be made in 10 years with an interest rate of 10% compounded annually. What will be the amount if it will be paid 5 years later (on the 15th year)? Discrete Payments The solution of discrete payments or number of transactions occurring at different periods is taking each transaction to the base year and equating each value. Steps in Solving Discrete Payments: 1. Draw the cash flow diagram. 2. Select any convenient focal date. 3. Years on the left of the focal date have a positive sign while years on the right of the focal date have a negative sign. 4. Use the principle: Cash Inflow = Cash Outflow Sample Problems on Discrete Payments 1. 2. 3. Acosta Holdings borrowed Php9,000 from Smith Corporation on January 1, 1998 and Php12,000 on January 1, 2000. Acosta Holdings made a partial payment of Php7,000 on January 1, 2001. It was agreed that the balance of the loan would be amortized by two payments, one on January 1, 2002 and one on January 1, 2003, the second being 50% larger than the first. If the interest rate is 12%, what is the amount of each payment? A contract has been signed to lease a restaurant at Php20,000 per year with annual increase of Php1,500 for 8 years. Payments are to be made at the end of each year, starting one year from now. The prevailing rate is 7%. What lump sum paid today would be equivalent to the 8 year lease program? Mr. Cruz buys a second hand car worth Php150,000 if paid in cash. On installment basis, he pays Php50,000 downpayment, Php30,000 at the end of one year, Php40,000 at the end of two years and a final payment at the end of four years. Find the final payment if interest is 14%. Continuous Compounding Interest The solution for interest compounded continuously can be derived thru differential equations and can be found as: 𝐝𝐏 = 𝐢𝐏 𝐝𝐭 Where: i = interest rate compounded continuously P = present worth t = time Sample Problems on Continuous Compounding Interest 1. 2. Philip invested $100 on a bank. The bank offers 5% interest compounded continuously in a savings account. Determine (a) how long will it require for him to earn $5 (b) the equivalent simple interest rate for 1 year of the bank. Which is more advisable to invest Php5,000 for five (5) years, to bank A that offers 5% compounded continuously or to bank B that offers 10% simple interest? Banker’s Discount Certain banks lend money in such a way that they deduct the interest on the money. They actually don’t lend you money you asked for. This type of computing money is called banker’s discount. The money received by the borrower after the discount has been deducted is called proceeds. 𝟏 − (𝟏 + 𝐧𝐢)−𝐧 𝐝= 𝐧 Where: i = rate of interest d = rate of discount n = number of interest period Sample Problems on Banker’s Discount 1. Ms. Glydel Marquez borrowed money from a bank. She received from the bank Php1,342 and promised to repay Php1,500 at the end of 9 months. Determine the following: (a) simple interest rate (b) discount rate or often referred as Banker’s discount.